The cryptocurrency market was thrown into chaos due to the public conflict between US President Donald Trump and Tesla CEO Elon Musk. The total liquidation amount surged to nearly $1 billion in the past 24 hours.

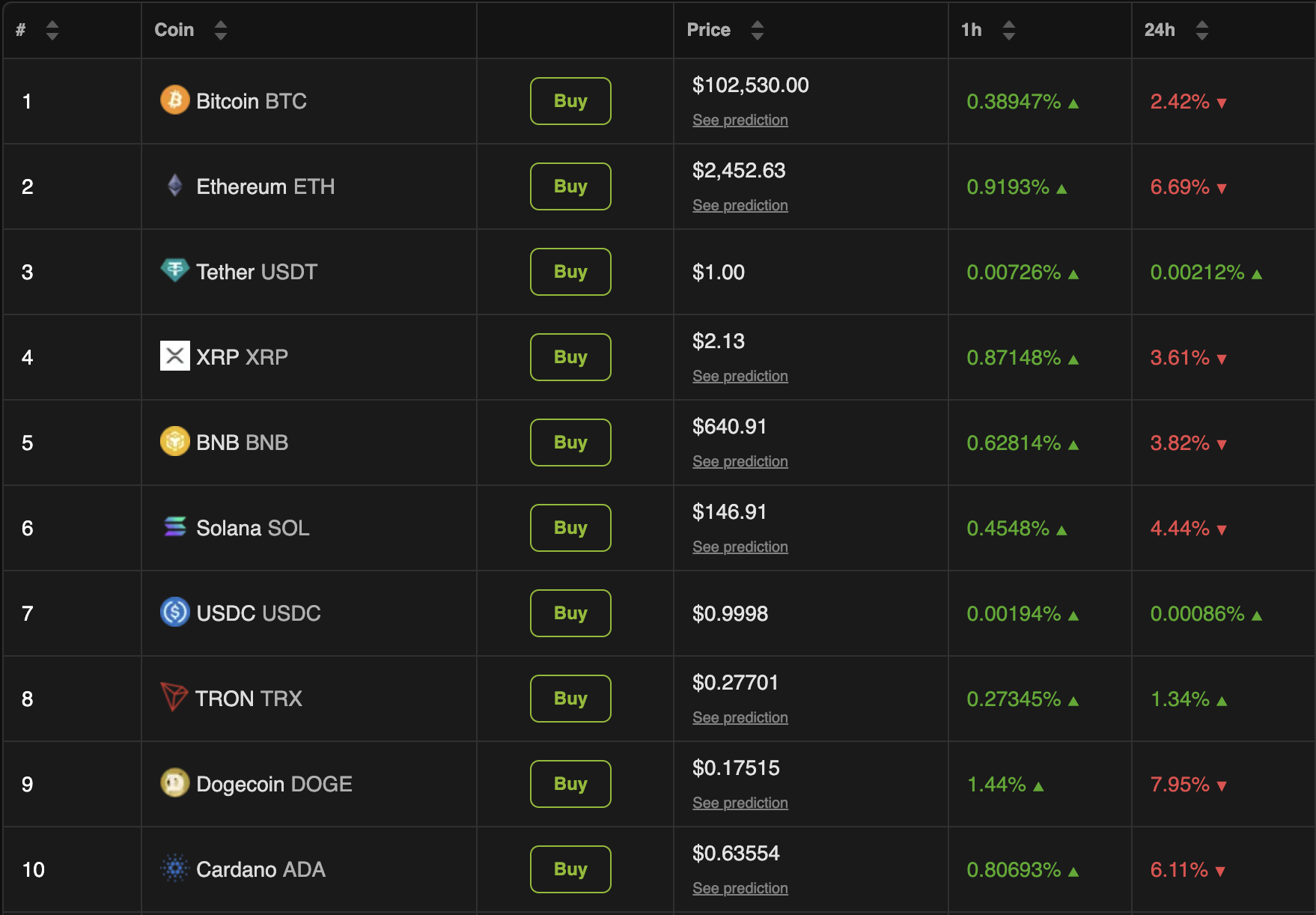

Additionally, the total market capitalization declined, with 7 out of the top 10 cryptocurrencies recording losses today.

Trump-Musk Conflict, What Impact on the Coin Market?

Tension between Trump and Musk erupted with the latter criticizing the president's tax and spending bill.

"This massive, ridiculous, pork-filled congressional spending bill is a disgusting monster. Those who voted for it should be ashamed: you know you were wrong. You know it." Musk posted on X.

The conflict escalated when Trump dismissed Musk's criticism, accusing him of suffering from "Trump derangement syndrome". Trump also threatened to revoke government subsidies and contracts for Musk's businesses.

This argument is playing out publicly on X, introducing unpredictable variables to the market, including personal scandals and policy disagreements.

Time to drop the really big bomb:@realDonaldTrump is in the Epstein files. That is the real reason they have not been made public.

— Elon Musk (@elonmusk) June 5, 2025

Have a nice day, DJT!

It also put significant downward pressure on the market, shaking investor confidence. According to BeInCrypto data, the total cryptocurrency market capitalization dropped by 5.1% in the past 24 hours.

Seven out of the top 10 coins saw value declines over the past day. Doge, a favorite of Musk, recorded the largest drop at 7.9%, while ETH fell by 6.6%.

BTC dropped by 2.4%, falling below $105,000. The president's meme coin was also negatively impacted. Latest data shows the official Trump (TRUMP) declined by 10.8%.

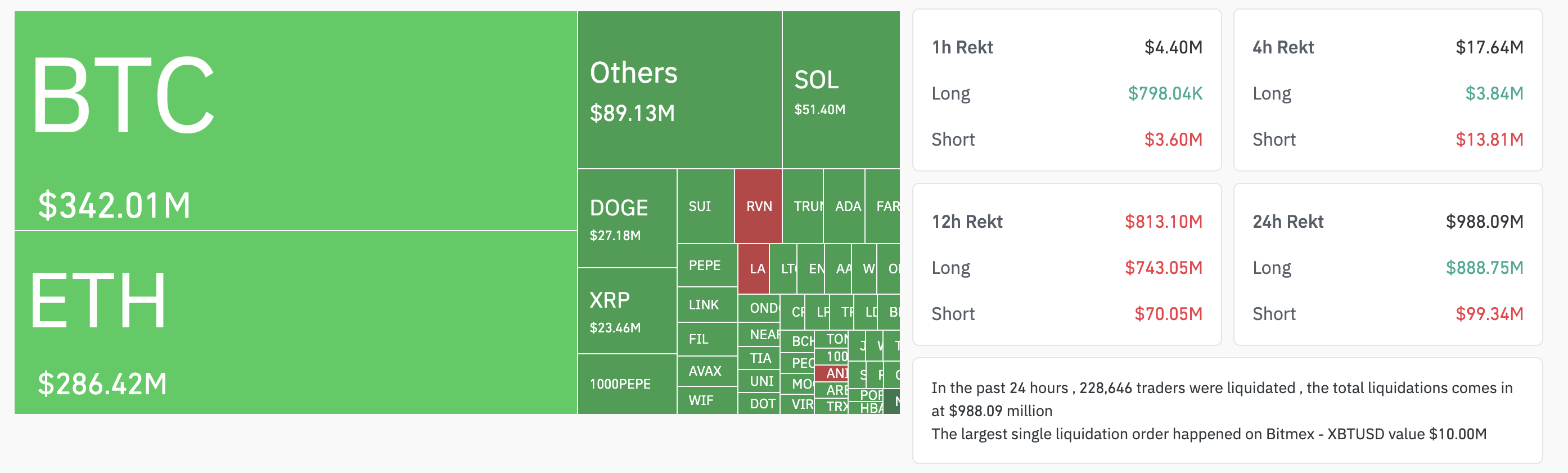

This price drop amplified volatility as many leveraged positions were forcibly liquidated. According to Coinglass data, total liquidations in the past 24 hours reached $987.09 million.

During this period, 228,646 traders were liquidated, emphasizing the scale of market reaction. Bitcoin was at the center of selling pressure, with long position liquidations at $308.10 million and short positions at $33.80 million. Ethereum followed with long liquidations of $260.10 million and short liquidations of $26.30 million.

Long positions accounted for $888.70 million of total liquidations, while short positions contributed $99.30 million, reflecting the intensity of risk-averse sentiment.

That's not all. The Bitcoin Coinbase Prime Index, a key indicator of US institutional investor sentiment, also turned negative.

'The Coinbase Prime Index just turned negative, showing US institutional investors and whales suddenly turning bearish. We'll see how it plays out short-term, but a new story is unfolding now. It's when the "trade war" theme starts losing its impact,' an analyst wrote.

Meanwhile, some suspect this conflict is part of a larger plan to manipulate the market.

"Elon Musk and Donald Trump have created a fake 'conflict' to drive the market down. This is manipulation at the highest level. It's crazy to think they would do something like this," a market observer said.

Bitcoin, Benefit from Trump-Musk Conflict?

Beyond short-term volatility, this fallout raised concerns about long-term economic impacts. Musk publicly warned about the possibility of a US recession in the second half of 2025, attributing it to Trump's tariff policies.

"Trump tariffs will cause a recession in the second half of this year," it was written in a post.

This warning aligns with broader market fears, similar to how Trump's trade policies contributed to market instability earlier this year. Nevertheless, some speculate that the breakdown of Trump and Musk's relationship could benefit Bitcoin.

"The breakdown of Elon Musk and Trump's relationship will be marked by money printing we've never seen. Bitcoin will explode. Get ready," a user claimed.

Bitning founder Kashif Raja explained that this dispute could impact Bitcoin in various ways. His post explored scenarios such as Trump imposing sanctions on Musk's companies or withdrawing subsidies, the possibility of Musk being expelled, or Musk potentially choosing Bitcoin to circumvent restrictions. He also considers the possibility of Musk receiving Bitcoin donations if he runs for public office.

"Bitcoin is winning because it is one of the features with strong censorship resistance in all possible scenarios," Raza [mentioned](https://x.com/simplykashif/status/1930735941804511458).

While it is uncertain whether these scenarios will be realized, one thing is certain: as the discord between Trump and Musk continues, there is a high possibility that its aftermath will create tension in the cryptocurrency market.