I just checked the market value of the main stablecoins and looked at recent events and yesterday's Chuan Ma battle to see if they would impact the market. From USDT's data, there seems to be no impact, and the market value is even rising. This is not surprising, as USDT is still primarily used by Asian users, and its application in cryptocurrency trading has been decreasing.

Then there's USDC, which has experienced slight fluctuations recently but hasn't significantly decreased. In fact, since the end of April, USDC's market value has stopped increasing, reflecting that European and American investors' enthusiasm for cryptocurrencies may have reached its peak and is now slowly cooling down. The feedback from trading volume data is similar, with investor buying and selling sentiment being at its lowest point in the past year. (Except for yesterday)

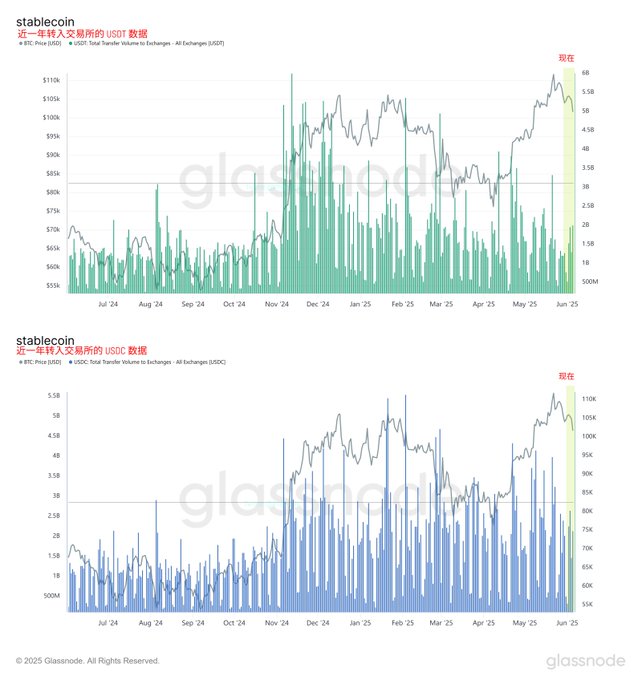

Of course, stablecoin market value doesn't equate to purchasing power, so we also need to look at the data of main stablecoins transferred to exchanges to get a more accurate picture of user sentiment.

From the data, it's clear that both USDT and USDC have seen lower fund transfers to exchanges in the past two weeks compared to before. USDT's inflow last week was almost at its lowest level in the past year, while USDC has seen declining transfer amounts for two consecutive weeks, indicating that investors are indeed in a buying slump.

Of course, some might say that these funds might be transferred to exchanges for financial gains, so the exchange's fund reserves remain a key focus.

USDT's fund reserves have been declining since the end of last year. One explanation is that some funds have left exchanges, and another is that after BTC's price touched its peak twice in late 2024, Asian investors began reducing their investments, and even when it broke the historical high again in May 2025, Asian investors continued to reduce their exchange fund volumes.

USDC's exchange reserves highly correlate with Bitcoin's price trend - fund reserves increase when prices rise and decrease when prices fall, indicating that European and American investors are more sensitive to price and excel at chasing trends.

Overall, investor sentiment is not very positive. Although the total stablecoin market value remains high, the purchasing power doesn't show FOMO sentiment. Asian investors are gradually reducing their investment willingness, while European and American investors seem to prefer trading on the right side.

Bitcoin's overall trading volume in the past two weeks has also reached a recent low point. Except for events causing increased volatility, the purchasing power suggests that investors are tired of the current trend and may enter a "garbage time" after prices stabilize.

PS: From the exchange reserve data, I noticed another key data point. As of 8 am today, the total main stablecoin reserves across exchanges are 36.57 billion USDT and 6.28 billion USDC. Among them, #Binance's USDT reserves reached 22.26 billion USD, and USDC reserves are 3.89 billion USD, accounting for 60.87% and 61.94% of total reserves.

The second place is #OKX, with total USDT reserves of 6.69 billion USD and USDC reserves of 619 million USD.