Welcome to the US Cryptocurrency Morning Briefing. We will comprehensively summarize today's key cryptocurrency developments.

Prepare your coffee to read experts' opinions on BTC adoption. The pioneering cryptocurrency's influence in mainstream finance is growing. Meanwhile, the surging US debt continues to weaken confidence in fiat currency. This strengthens Bitcoin's position as a powerful, decentralized alternative and potential global reserve asset.

Today's Cryptocurrency News: Kaiser Predicts Tesla and Coinbase Executives Shifting to Bitcoin Maximalism

Max Kaiser, a Bitcoin advocate and financial commentator appearing in various US cryptocurrency news publications, shared more insights with BeInCrypto.

The Bitcoin pioneer believes that two of the world's most powerful tech leaders, Elon Musk and Brian Armstrong, will make a decisive ideological shift towards Bitcoin maximalism.

In an exclusive opinion to BeInCrypto, Kaiser suggested that the Tesla CEO and Coinbase founder may soon abandon their relatively cautious stance for full support of Bitcoin as a world reserve asset.

"Elon and Brian are transitioning from Bitcoin agnostics to full Bitcoin maximalist mode," Kaiser told BeInCrypto.

Kaiser's outlook is rooted in deep concerns about fiat currency's vulnerability. He argued that the fundamental flaw in today's monetary system is using "worthless paper money" as the denominator for global commerce. In his view, Bitcoin solves this problem.

"The problem has always been the denominator. You cannot build an economy with worthless paper money that is not backed by anything and can be printed infinitely. Making Bitcoin the denominator of the global economy solves this problem," he added.

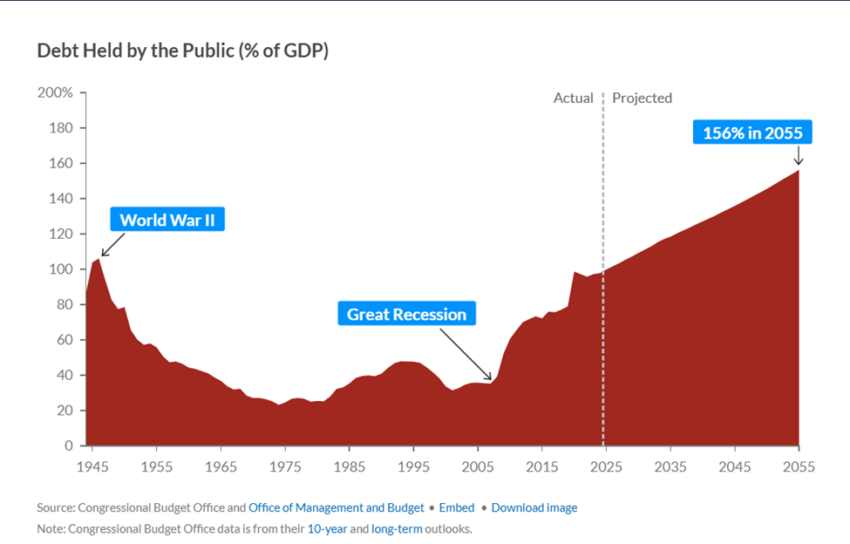

Kaiser's statements came amid heightened anxiety about the US fiscal trajectory. The "big and beautiful bill" proposed by Donald Trump includes massive spending increases and has been criticized for potentially expanding national debt to unsustainable levels.

Coinbase CEO Brian Armstrong shared his views in an X (Twitter) post. He warned that Bitcoin could naturally emerge as a global reserve currency if Congress does not begin reducing deficits and repaying debt.

"If Congress is not held accountable to have voters reduce deficits and start paying down debt, Bitcoin will establish itself as the reserve currency," Armstrong wrote.

Increasing Fiscal Pressure Stimulates Bitcoin Sentiment

Tesla CEO Elon Musk also warned in another post that the US government risks being financially exhausted due to debt service.

"Interest payments already consume 25% of all government revenue. With continued massive deficit spending, there will be no money except for interest payments," Musk warned.

The total accumulated US debt currently stands at $37.5 trillion, with the official limit expected to be raised from $36.2 trillion to $40 trillion by September.

Musk referred to the new bill as the "Debt Slavery Bill", claiming it represents the largest debt ceiling increase in US history.

[The rest of the translation continues in the same manner, maintaining the specified translations for specific terms and preserving the original HTML structure.]