Several key indicators of the US economy are showing weakness, signaling new opportunities for American individuals and businesses to invest in Bitcoin. Major corporations are already joining this trend.

Nick Purkrin, a cryptocurrency analyst and founder of The Coin Bureau, exclusively shared his observations on this trend with BeInCrypto.

US Recession, Benefit for Bitcoin?

Recent concerns about a US economic recession seemed to have eased. The Atlanta Fed released a positive GDP report, and trade threats have significantly diminished.

However, two important indicators of US economic health were pessimistic today, suggesting issues with the dollar and potential opportunities for Bitcoin.

Specifically, these two indicators are the OECD's economic outlook and ADP's employment report. The latter claims private sector employment is at its lowest level in over two years, with President Trump pressuring Jerome Powell to lower interest rates.

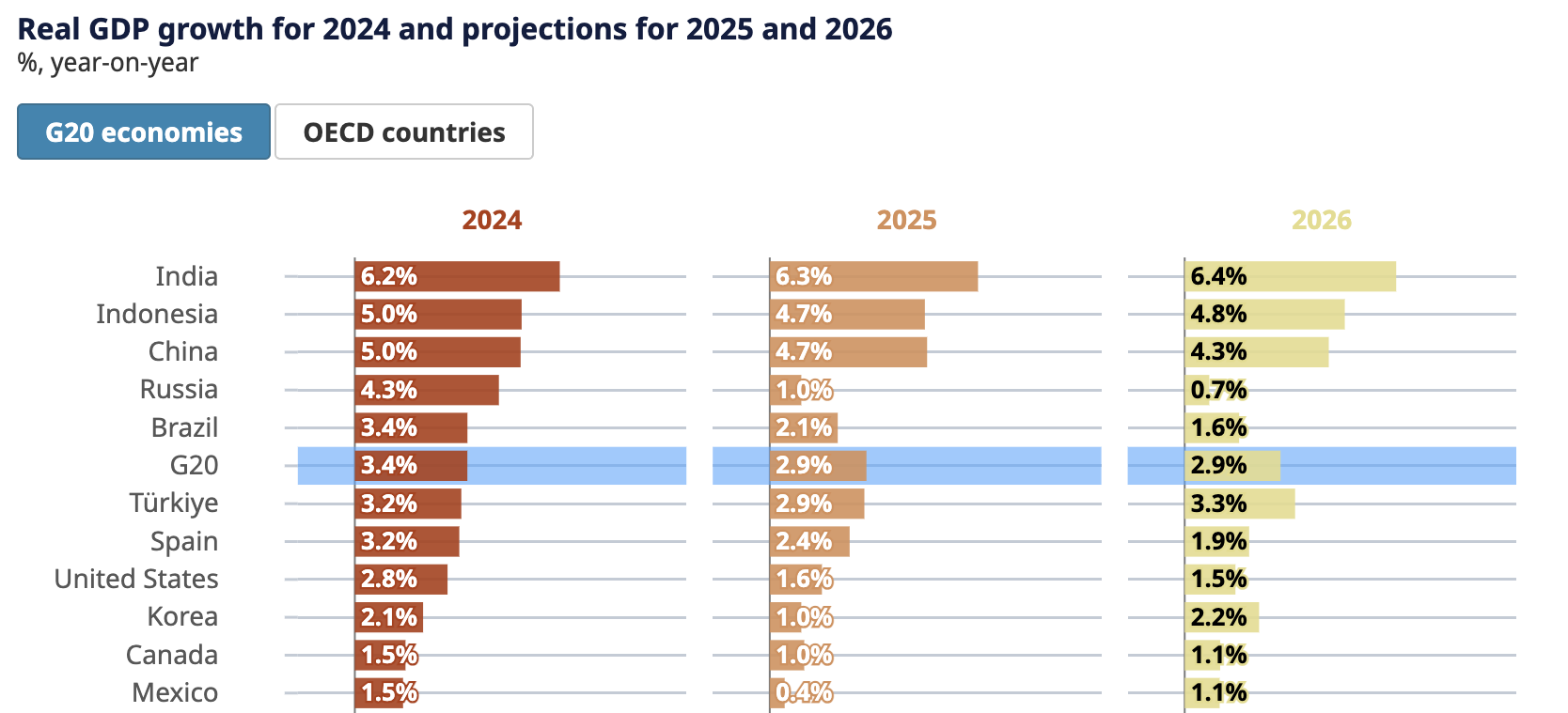

Meanwhile, the OECD was even more severe. It predicted the US GDP growth rate would drop from 2.8% in 2024 to 1.6% in 2025, with further decline expected in 2026.

A recession is defined as consecutive quarterly growth declines, and two years could be fatal. Global GDP growth is low, but the US is lower. The OECD also predicted disproportionately high inflation.

Additionally, new tariffs on the EU and technology sanctions on China could further exacerbate the crisis. While nothing is certain, various potential recession indicators are currently affecting the market.

Nick Purkrin explained the US situation and how it could benefit Bitcoin:

"The OECD has now assigned numbers to the growth outlook, one of the biggest fears for investors in the US. They predict it will be sluggish at best over the next two years. If anyone was hoping for a US dollar rebound, the OECD's critical report has finally signaled its end." – Nick Purkrin, Founder of The Coin Bureau

Purkrin further noted that the US Dollar Index (DXY) has fallen 9.3% year-to-date, and Morgan Stanley predicts an additional 9% drop next year.

Bitcoin has long been considered a potential recession hedge, and non-US investors are already moving to Bitcoin. This trend explains why US corporations are making the same choice.

Most importantly, BTC has recently been less volatile than usual. This is encouraging US corporations to make large-scale investments. Corporate whales like MicroStrategy are making new promises, and significant ETF inflows show a meaningful picture.

This morning, JP Morgan even opened a new service to promote cryptocurrency exposure for institutional clients. These various data points lead to one conclusion.

"Corporations are rushing to support their finances with Bitcoin. As the US dollar continues to depreciate, more changes will occur to protect assets. With Bitcoin maintaining over $100,000 for more than 20 days, it's quickly establishing itself as a new safe asset." – Nick Purkrin, Founder of The Coin Bureau

However, as Russia recently demonstrated, Bitcoin investments by US corporations are not necessarily beneficial for everyday users or the DeFi ecosystem.

Nevertheless, this increased demand could raise BTC's value and guarantee higher returns for current holders. As a potential recession approaches, wise cryptocurrency investors can secure stability and long-term growth opportunities.