When expressed in Korean won, the total trading volume on Upbit from midnight to 5:06 PM on June 5th was 1.27 trillion won, with a cumulative 24-hour trading volume of 2.39 trillion won. The 24-hour trading volume increased by 11.09% compared to the previous day.

In terms of thematic trading trends, trading volume was concentrated in the 'Smart Contract Platform' and 'Infrastructure' areas.

In the Smart Contract Platform, RVN (+116.48%) recorded a massive surge and showed the highest yield. Aergo (AERGO, +8.24%) and Ardr (ARDR, +3.46%) also demonstrated a solid upward trend, while ETH (–0.52%) and SOL (–1.08%) slightly declined. Overall, individual stocks showed mixed performance, but stocks with high growth rates drew attention.

In the Infrastructure theme, major coins like BTC (–0.48%) and XRP (–0.75%) showed adjustments. LPT (–20.16%) displayed the largest decline among single stocks, while POKT (–6.21%) and WCT (–4.18%) also recorded poor performance.

In the DeFi sector, most stocks like COMP (–3.86%), ONDO (–1.29%), and G (–6.30%) showed weakness, limiting upward momentum.

In the Culture/Entertainment theme, most stocks like STMX (–9.70%) and ME (–6.48%) declined, and SOPH (–2.98%) in the unclassified theme also showed weakness. The Meme theme remained relatively stable, with Doge (DOGE, +0.07%) showing a slight increase.

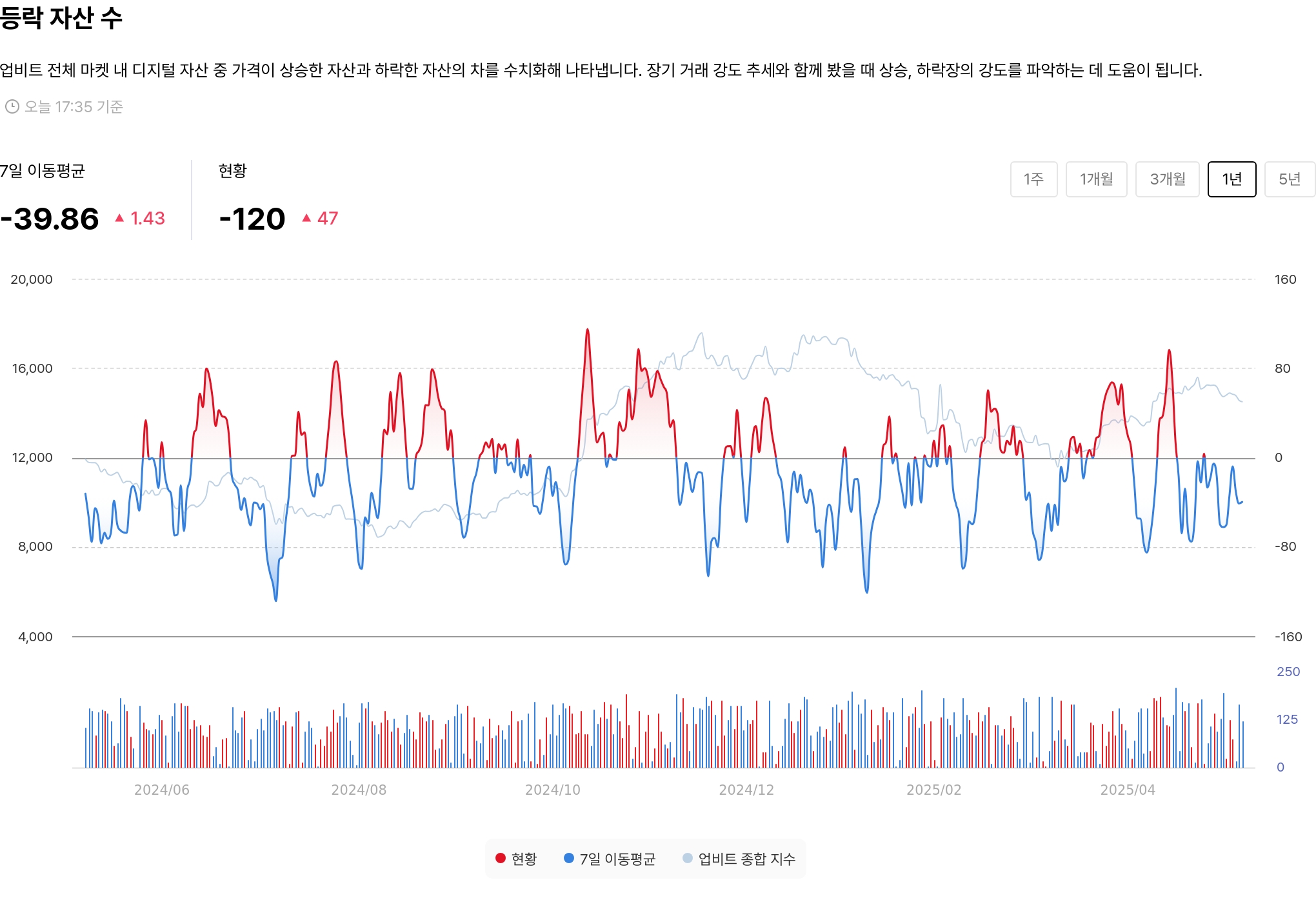

In the Upbit market, the number of declining stocks continues to exceed the number of rising stocks. As of June 5th, the number of rising and falling assets was –120, meaning 120 more assets declined than rose.

The 7-day moving average was recorded at –39.86. This suggests that while short-term decline has somewhat eased, overall investment sentiment remains constrained.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>