Author: Arnav Pagidyala Source: Bankless Translation: Shan Ouba, Jinse Finance

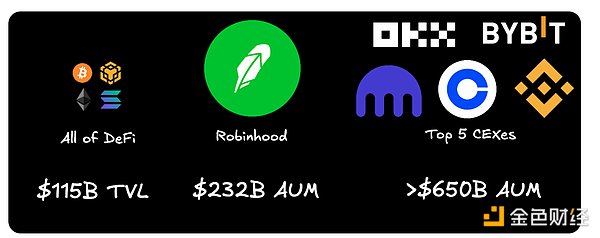

Despite the total value locked on-chain reaching billions of dollars, and significant progress in wallets, interoperability, and blockchain performance, DeFi is still far from reaching its potential massive user base. In contrast, centralized exchanges (CEX) are rapidly growing users and assets - not because they are superior, but because they are more convenient.

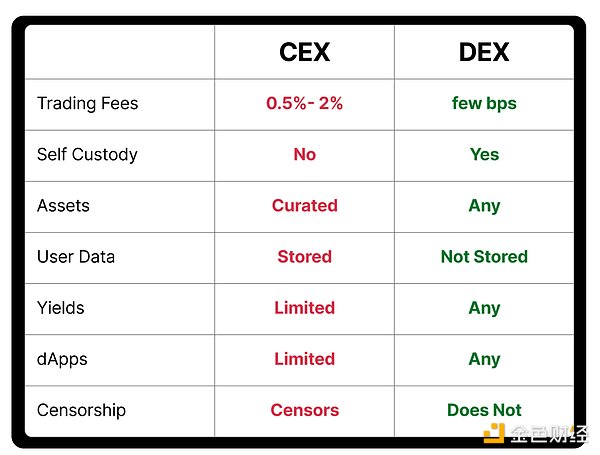

Applications like Infinex, Defi App, and Definitive have already preliminarily showcased what a smoother on-chain experience might look like: lower fees, smaller spreads, access to more assets and yields, etc.

But as long as fiat on-ramps remain slow, expensive, and error-prone, DeFi will remain a niche tool for crypto-native users.

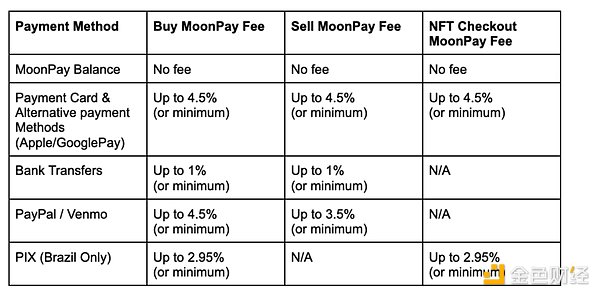

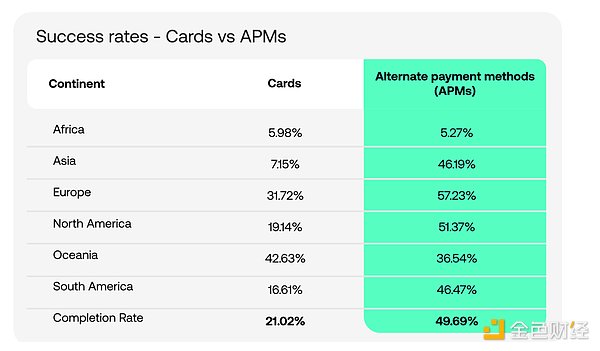

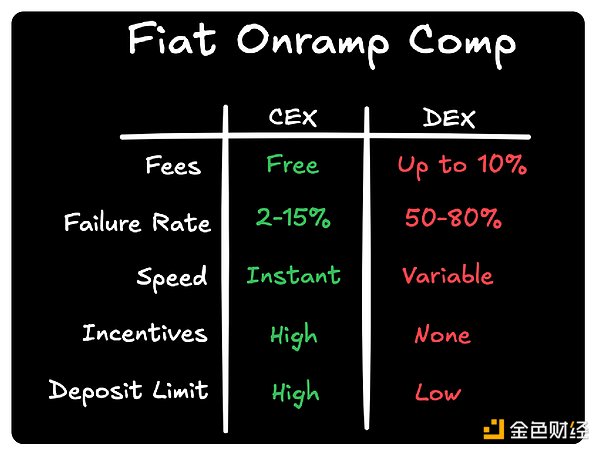

Ordinary users can buy meme stocks on Robinhood or trade tokens on Coinbase, with funds instantly available and almost no barriers. However, if you try to do the same on-chain through MoonPay or Transak, you'll face 3-6% transaction fees, over 50% failure rates, and even wait days to complete.

Even worse, payment via credit card has a failure rate of around 80%.

But we have also seen the massive potential when on-ramp barriers disappear:

Moonshot has successfully guided over 1.5 million users on-chain through a no-KYC Apple Pay on-ramp

Opera Minipay has successfully imported 8 million users with a no-KYC on-ramp system integrated with local payment methods

Other similar examples exist, but of course, no-KYC mechanisms typically only apply to transactions under $500

In one sentence: On-ramps are the current biggest bottleneck for DeFi.

This article will explore: Why Web2 on-ramps work effectively, why crypto on-ramps are still in a primitive stage, and how the new generation of integrated DeFi applications will close this final loop.

Web2 Fiat On-Ramp Mechanisms

If you've ever tried to open an account and deposit funds on Robinhood, Coinbase, or any new-age online bank, you've almost certainly experienced a seamless ACH (Automated Clearing House) or debit card deposit process.

The user experience (UX) of depositing can be broken down into three core elements: transaction fees, deposit failure rates, and speed. Most CEXs' deposits are almost free, with extremely low failure rates, and funds are instantly available for trading, providing an almost perfect user experience. Moreover, with fintech companies and CEXs actively conducting deposit incentive activities to encourage users to deposit as much as possible, CEXs have effectively monopolized the deposit entry, "pricing out" other competitors.

In summary, the operational strategy of CEX is to find a balance between "loosening risk parameters to drive revenue growth" and "tightening risk control to avoid users with negative expected value". The profitability of top CEXs is extremely strong, making them more willing to take risks and tend to aggressively pursue revenue growth.

Ultimate Concept

DeFi's competitive advantage lies in its structurally low costs, giving it the potential to surpass centralized exchanges in some aspects. It's worth noting that CEXs spend millions or even tens of millions of dollars annually on employees, compliance, and legal expenses; while small DeFi protocol teams like Hyperliquid, Pump, and Axiom can achieve hundreds of millions of dollars in profits with fewer than 20 team members.

The key breakthrough in the next stage will be these already profitable DeFi protocols investing part of their income into **user acquisition (top-of-funnel)**, thereby achieving parity with CEXs in market marketing and brand credibility. The core behind this still remains product usability.

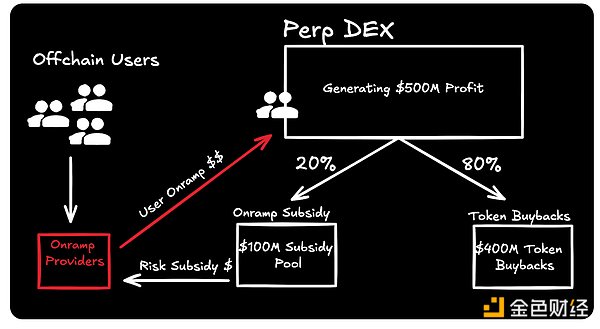

Let's look at a simple example: a Brazilian user wants to deposit funds on xDEX using a debit card:

User initiates deposit with debit card → onramp service provider sends USDC to user's DEX wallet → smart contract verifies the deposit → smart contract rewards service provider with a certain percentage of deposit TVL (e.g., $5 for every $100 deposited)For users, this greatly reduces deposit failure rates, makes funds instantly tradable, and brings fees down to zero. In essence, this achieves the same level of deposit experience as a CEX.

If a protocol pays a 5% subsidy for every $100 of TVL deposit, and it can earn more than 5% annually on these TVLs, then such a subsidy is worthwhile. Our internal models show that synthetic asset or perpetual contract DEXs often generate annual yields exceeding 20% on onramp funds.

Ultimately, onramp subsidies are key to expanding DeFi beyond crypto natives. Introducing "productive" TVL is far more valuable than simple token buybacks: it brings sustained revenue growth and ultimately drives the long-term token value increase. This is the true path to driving on-chain price discovery.