Several predictions have emerged that the altcoin season will approach in 2025. However, it has not yet been realized. Some market observers are hopeful for a revival, while others are increasingly skeptical.

BeInCrypto consulted with several experts to discuss the possibility of an altcoin season in this cycle. They agree that the altcoin season has been delayed but has not completely disappeared.

What is Blocking the 2025 Altcoin Season?

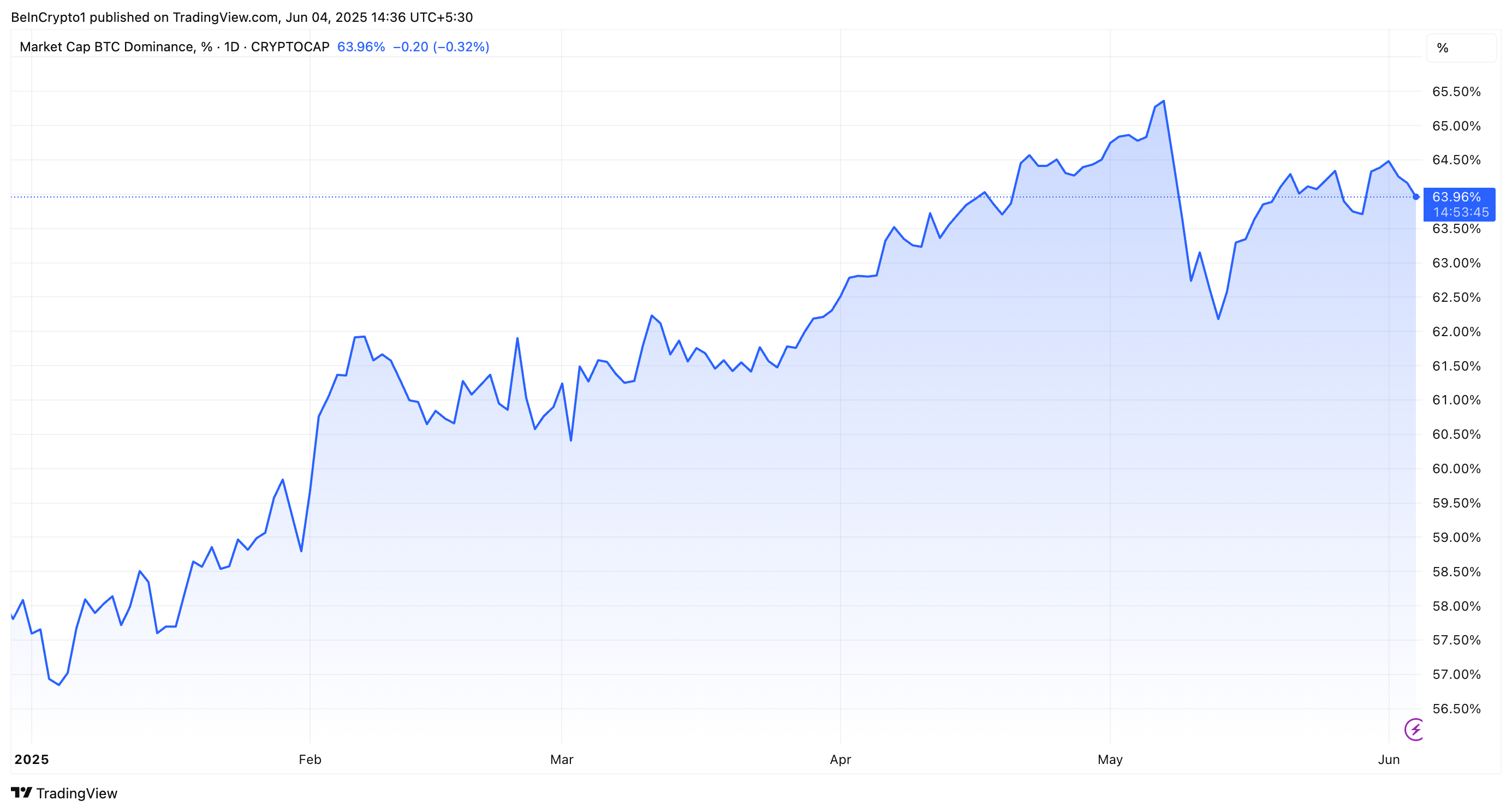

Bitcoin (BTC) is currently leading the cryptocurrency cycle, with its market dominance steadily rising. In May, it reached 65.3%, the highest level since 2021. BTC.D briefly declined in the middle but rebounded to 63.9% at the time of reporting.

Simultaneously, BTC's price has significantly increased, surpassing the all-time high of $111,800 last month. Historically, the altcoin season follows Bitcoin's rally as capital rotates into smaller coins.

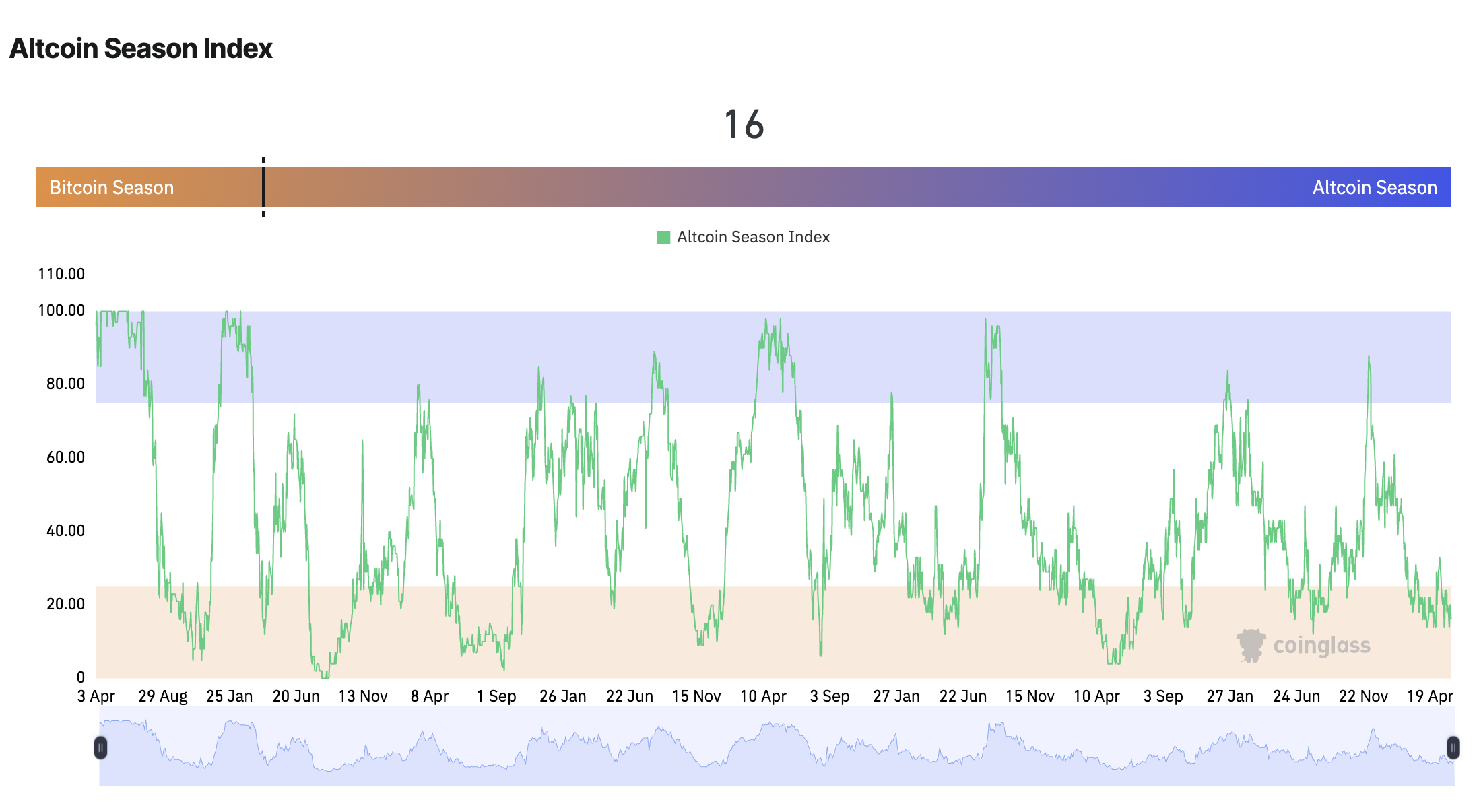

Some coins have shown strong recent gains, but these are isolated cases. Additionally, according to Coinglass data, the altcoin season index was only 16 at the time of reporting.

This has raised concerns about why capital rotation patterns are not repeating. Willy Chang, co-founder of Truenos, explained the background factors for the delay. He mentioned that institutional investors are currently driving the Bitcoin rally and have little interest in altcoins.

"BTC is still the consensus trade. As long as Bitcoin is preferred as the 'safe choice', capital rotation to altcoins will be limited. Additionally, structural risks such as smart contract vulnerabilities, regulatory uncertainty, and operational failures make altcoins less attractive to waiting capital," Chang told BeInCrypto.

Management also acknowledged the isolated performance during meme coin short-term pumps. However, he argued that macroeconomic uncertainty, reduced liquidity, and a tendency to prefer short-term trading over long-term altcoin holding are hindering market rotation.

According to him, many people see the traditional altcoin model as structurally flawed, with high centralization and team-driven execution risks.

Gustavo H., Senior Business Development at Chiron Labs, shared a similar view. He emphasized that Bitcoin's growth is primarily driven by institutional investment inflows and clear regulatory clarity for spot ETFs.

Gustavo explained that ETF volumes are injecting liquidity into Bitcoin. This increases Bitcoin's proportion in the overall market depth and reduces altcoin liquidity. This widens the bid-sell spread, making large investments in small assets less attractive and further strengthening Bitcoin's dominance.

"Spot ETFs provide direct BTC exposure to investors. In previous cycles, altcoins played a proxy role. With institutions still building BTC positions, the rotation clock has essentially been reset. Meanwhile, retail investors remain cautious after the 2022-23 deleveraging," Gustavo said.

Both experts pointed to the surge of new tokens as a crucial factor. Chang emphasized that this disperses capital and investor attention.

"Liquidity is now thinly spread, but 98% of total market cap is still locked in the top 100 coins. This highlights how little capital reaches new projects. Low conversion costs drive traders to chase short-term narratives, and many founders optimize for quick token price spikes over sustainable utility conditions," Gustavo added.

Altcoin Season 2025, Possibility of Reality?

Despite these factors, experts still believe there is a possibility of an upcoming altcoin season.

"Conditions are pointing to a delayed altcoin season," Chang noted.

He believes Bitcoin's current performance is likely to continue in the short term. However, Chang anticipates an altcoin revival after the potential end of quantitative tightening (QT) and the start of a new quantitative easing (QE) cycle.

"Delay is more likely. Once BTC sets a range, risk appetite historically moves outward," Gustavo mentioned.

He suggests that the altcoin season is more likely to be delayed rather than completely ruled out until the growth of new token supply slows or new liquidity catches up. Gustavo believes this market consolidation will reward teams that achieve genuine product-market fit over time.

Management also confirmed that once ETF demand stabilizes and Bitcoin's volatility compresses, capital typically moves to high-beta assets.

"Therefore, there's a possibility of an alt season in late 2025 or early 2026, which is not predetermined," he predicted.

Notably, Tracy Jin, COO of MEXC, stated that signs are already beginning to appear.

"The stark contrast in ETF flows is one of the clearest signs that capital rotation is beginning in the market. Ethereum's ETF has recorded over $630 million in inflows for 11 consecutive days, while Bitcoin ETF has seen over $1.2 billion in outflows for three consecutive days," Jin told BeInCrypto.

She also mentioned the increase in altcoin ETF applications and companies adopting altcoin financial strategies. Jin emphasized that this indicates growing institutional interest in Bitcoin alternatives.

MEXC's COO noted that while the recent altcoin rally is encouraging, the true alt season begins when Bitcoin's dominance decreases more significantly. Currently, risk appetite is recovering, but Bitcoin still maintains a large market share, and its dominance appears to be weakening.

"Ethereum is currently leading the transition to altcoins and capital rotation in this market cycle, and other coins like XMR, ENA, HYPE, Abe, and Arbitrum are also recording over 5% increases compared to Bitcoin's 0.6% rise," she said.

Additionally, Jin argued that when Bitcoin consolidates at high levels, especially as risk appetite increases and investors seek higher beta opportunities, space is created for altcoins to perform. After Bitcoin stabilized for 25 consecutive days above $100,000, she suggested that the start of a true alt season is near.

"If the current altcoin momentum continues and institutional interest grows further, we could witness explosive movements in high-potential altcoins in the coming weeks," Jin predicted.

While the alt season has not yet fully begun, Jin emphasized that conditions are aligning. She noted that this time, institutional capital is joining this journey.