XRP recently experienced a significant drop, falling to $2.07. It is now attempting a slight recovery. Currently, altcoins are showing signs of recovery, but they may struggle to break out of the three-week downtrend.

However, major holders, especially long-term holders (LTH), can play a crucial role in supporting a potential breakthrough.

XRP Investors Selling

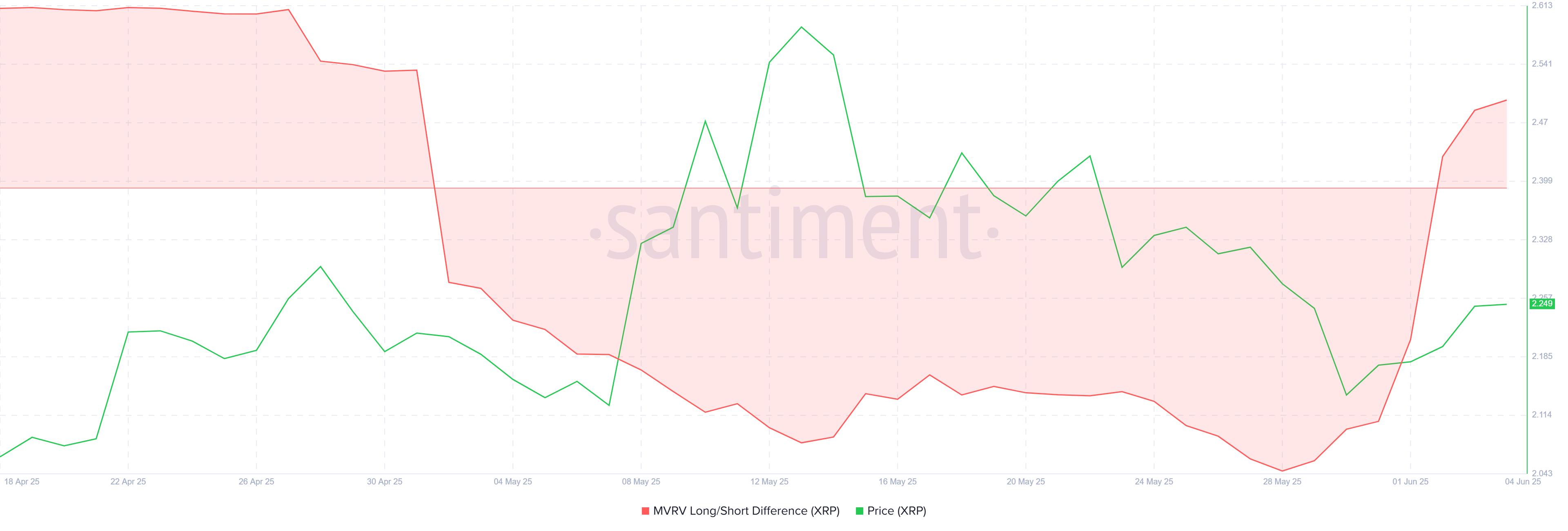

The MVRV short-term and long-term difference indicator has recently moved back to a positive area for the first time in almost a month. This indicates that long-term holders (LTH) are seeing increased profits. LTH are more patient with their investments and are less likely to sell during short-term fluctuations.

Therefore, their XRP holdings provide a stable force against sharp price declines. LTH maintaining their positions can provide the necessary support for price recovery, which could help XRP break out of its current downtrend.

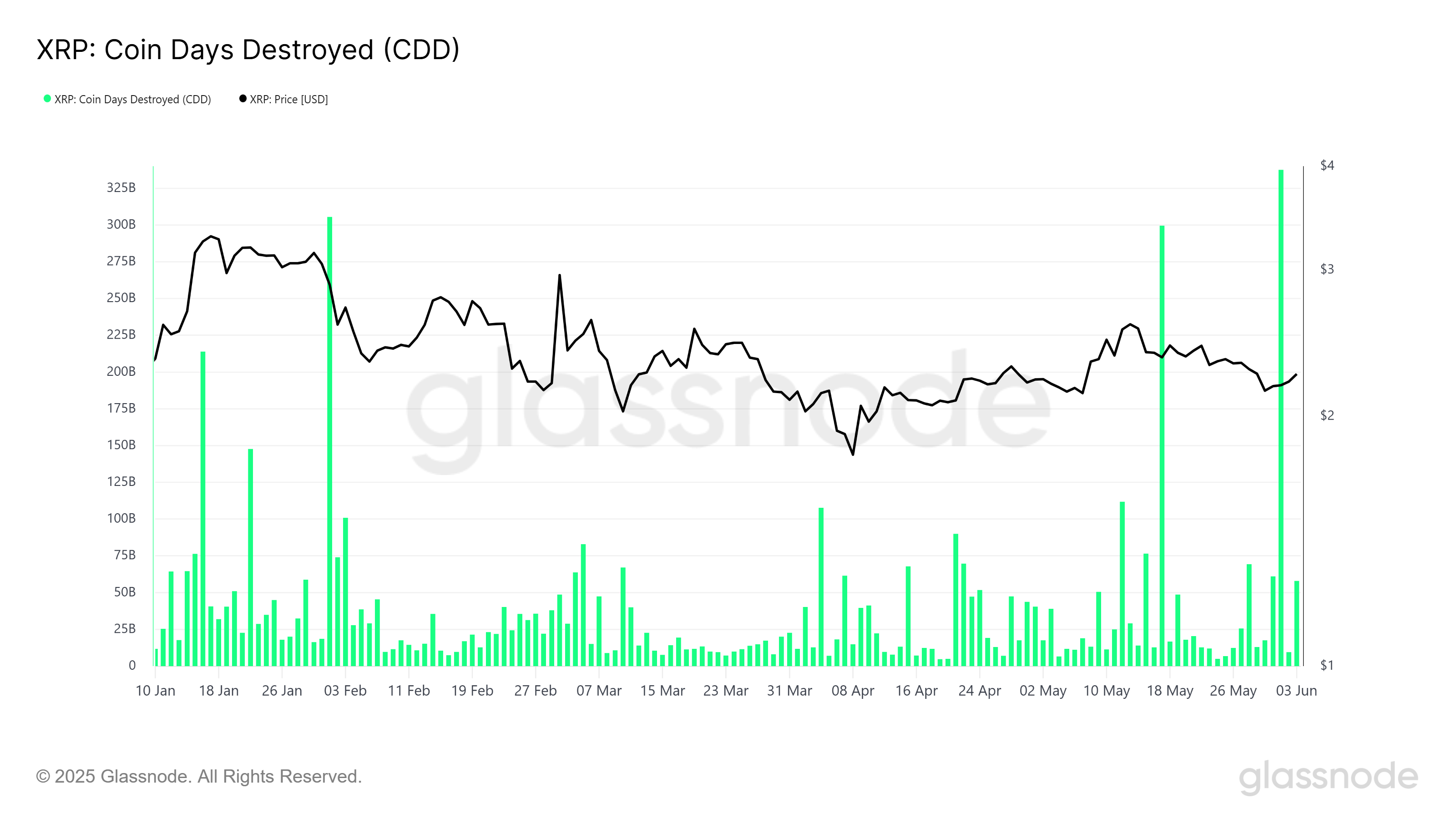

However, XRP's broader macro momentum requires caution. The Coin Days Destroyed (CDD) indicator has surged to its highest point since January this year. The CDD indicator measures the accumulated days destroyed by multiplying the number of coins held by long-term holders and the number of days held before selling.

The recent surge indicates that these holders are selling, which could negatively impact XRP's price.

This selling behavior by LTH may suggest that some investors are taking profits or are concerned about the short-term performance of altcoins. Continued increase in CDD could lead to additional selling pressure, which may limit XRP's ability to fully recover and lead to further declines.

Can XRP Break Through?

XRP's price has been showing a downtrend for the third time in the past three weeks. The altcoin has risen 5% in the last five days, reaching $2.24. Despite this rise, XRP is still under pressure due to broad market and internal selling pressure. This makes it vulnerable to further declines without strong support.

The presence of profitable LTH is promising for a potential rebound. However, their ability to restrain selling is essential for XRP's continued upward movement. If LTH can avoid selling at this critical stage, XRP could convert $2.27 into a support line and pave the way for a move to $2.38.

However, if selling pressure continues, the altcoin may fail to break out of its downtrend. This could cause XRP to return to $2.12 or lower. Monitoring LTH's behavior in the coming days will be crucial in determining the altcoin's short-term direction.