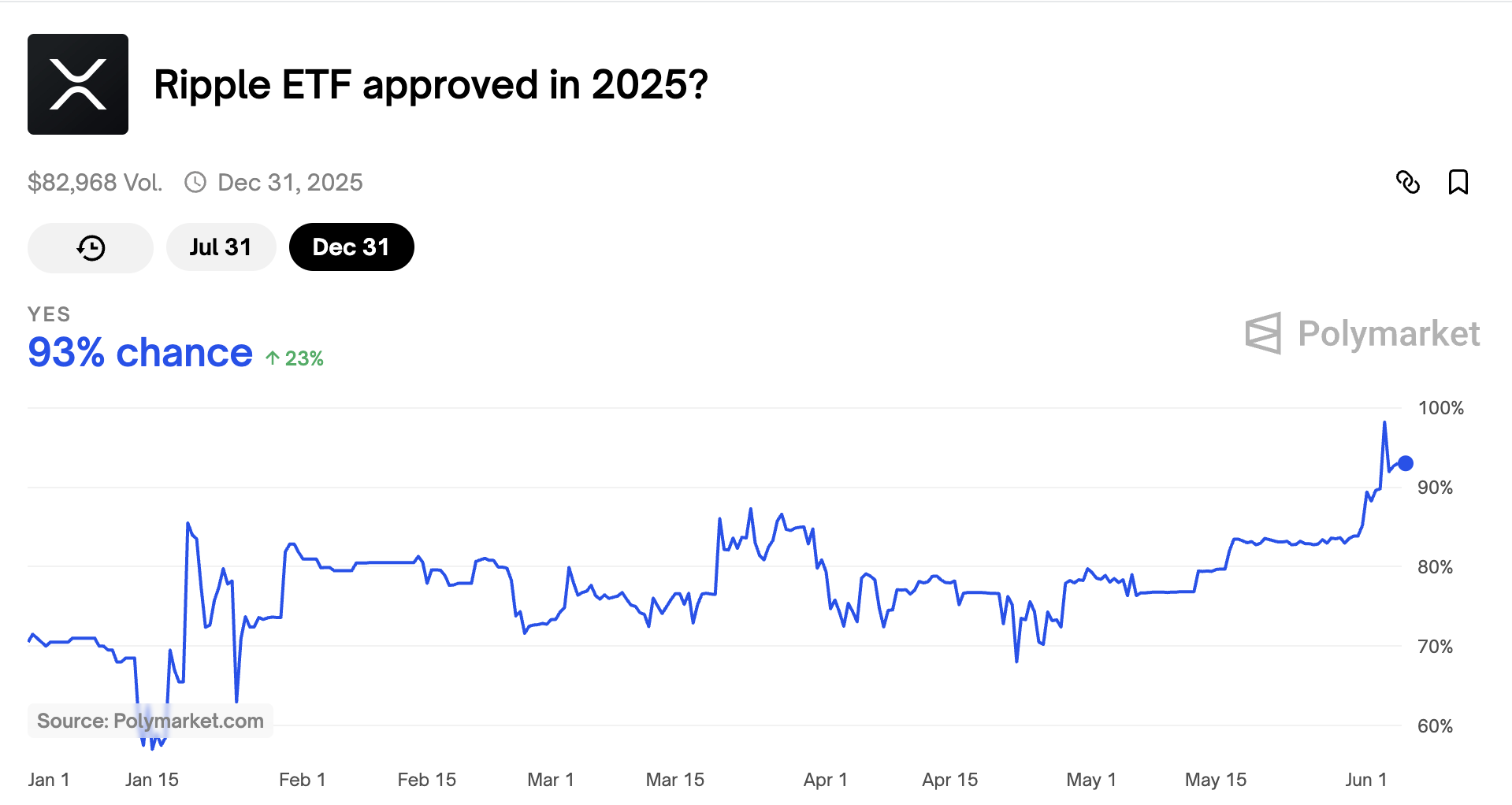

On June 3rd, the prediction market platform Polymarket saw the XRP (XRP) ETF approval probability for 2025 surge to an all-time high of 98%.

This optimistic investor sentiment emerged despite the recent delay by the U.S. Securities and Exchange Commission (SEC) in making a decision on the spot XRP ETF. This indicates confidence in the future of altcoins in traditional financial markets.

XRP ETF Approval Possible by 2025?

In April, BeInCrypto reported that the SEC had delayed its decision on Franklin Templeton's spot XRP ETF application. The regulatory authority set June 17th as the review deadline. Additionally, 21Shares' XRP ETF application also experienced a similar delay in late May.

These setbacks weakened short-term market confidence. According to Polymarket data, the probability of XRP ETF approval by the SEC by July 2025 dropped to a historically low 19%.

Despite these challenges, long-term sentiment remains positive. At the time of writing, the probability of XRP ETF approval by December 2025 was recorded at 93% and reached 98% yesterday.

This indicates that many expect the product to be launched in 2025, possibly in the last quarter coinciding with the SEC's final decision deadline. Bloomberg ETF analyst James Seyfarth previously predicted that the final decision could come around October 18th.

"For any of these assets to receive initial SEC approval, the absolute earliest time would be late June or early July. A more likely period is early Q4." – James Seyfarth, Bloomberg ETF Analyst

Moreover, the launch of XRP futures on May 19th further heightened expectations. Experts believe this could increase the likelihood of the SEC approving a spot XRP ETF.

"A key reason the U.S. SEC has rejected ETFs in the past was the absence of a regulated, mature futures market. If futures are regulated by the CFTC and show strong price correlation with the spot market, this would enhance market transparency and strengthen ETF approval possibilities." – Dean Chen, Bitunix Analyst

Meanwhile, XRP currently has the most ETF applications among all altcoins. Major asset managers including Bitwise, 21Shares, Canary Capital, Grayscale, Franklin Templeton, ProShares, WisdomTree, CoinShares, Volatility Shares, HashDex, MEMX, and Teucrium have submitted applications to the SEC. These companies manage billions of dollars in assets and are betting on the increasing attractiveness of XRP among institutional investors.

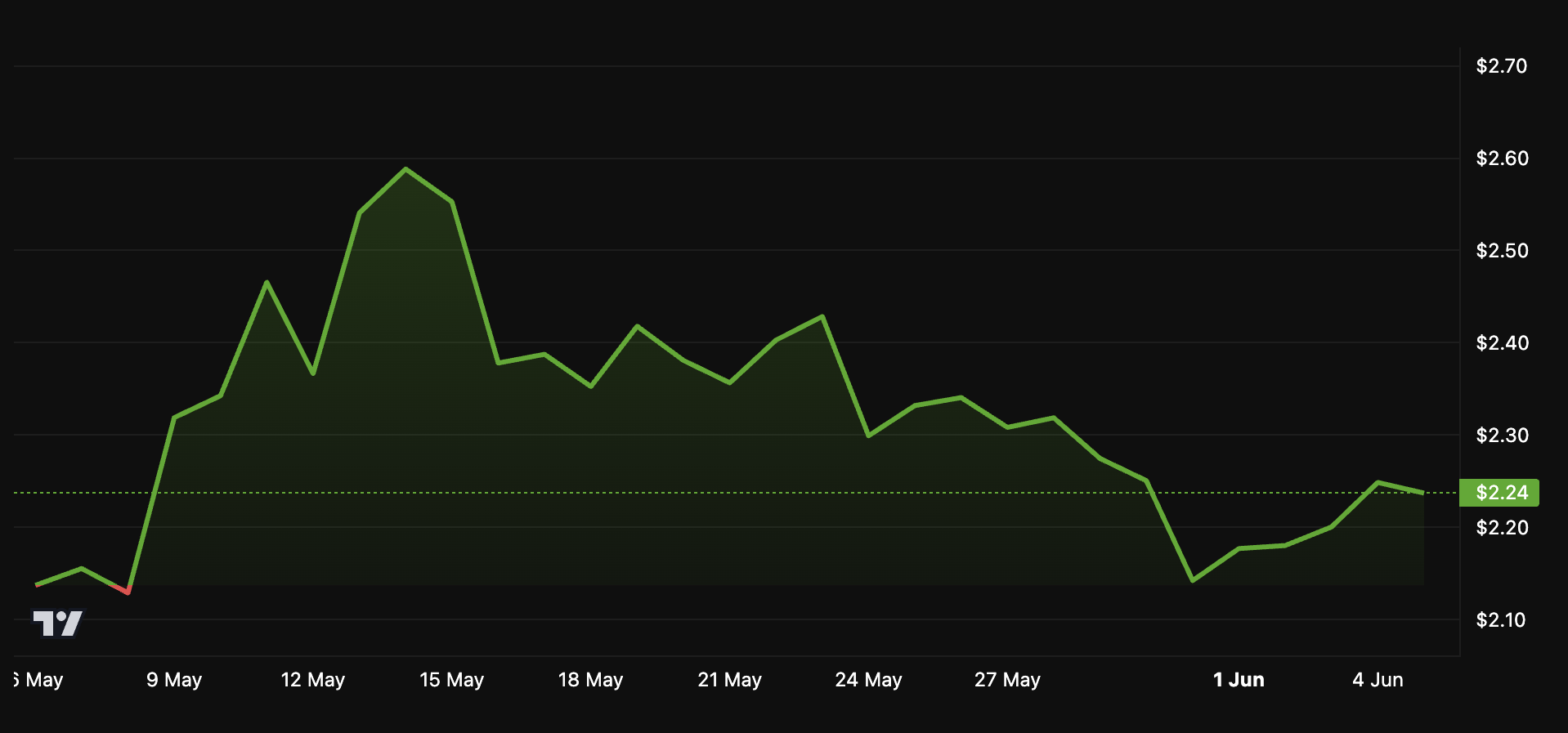

Increasing confidence in ETF approval has also positively impacted prices. According to BeInCrypto data, altcoins experienced a notable 23.08% decline from May 14th to May 31st.

However, since early June, XRP has shown a steady recovery rally, recouping 10% of previous losses. At the time of reporting, XRP is trading at $2.2, up 1.8% in the past 24 hours.