" Recently, global stablecoin legislation has accelerated. On May 20, the U.S. Senate passed a procedural vote on the Guiding and Establishing a National Innovation for Stablecoins in the United States (GENIUS Act). Just one day later, the Stablecoin Bill of Hong Kong, China was formally passed by the Legislative Council of the Special Administrative Region and officially came into effect on May 30 to establish a licensing system for issuers of legal currency stablecoins in Hong Kong. For a time, the concept of stablecoins was popular in the market.

In fact, the CF40 study pointed out at the beginning of the year that "cryptocurrency is no longer what it used to be. " Cryptocurrency has changed from a "money laundering tool" and "speculation tool" that was outside the mainstream financial system in the past to an emerging asset class that is becoming mainstream and has attracted large-scale participation from institutional investors, becoming an indispensable component of the global financial ecosystem. With the development of the cryptocurrency market, the regulation of cryptocurrencies by major economies around the world has also gradually transitioned from the early focus on speculation and illegal activities to a more comprehensive and systematic multi-level regulatory framework.

As an important node in the cross-integration of traditional finance and crypto ecology, stablecoins are one of the important directions of global cryptocurrency regulation in recent years. Recent global legislative trends mean that their strategic position and market size will continue to rise. Stablecoins are just one category of cryptocurrency. As an evolving innovation field, the concept and application of cryptocurrency are still in the process of continuous expansion.

Rereading this article, we hope to help readers understand the development history and potential trends of cryptocurrency and deepen their understanding and research of cryptocurrency. This article suggests that the mainstreaming of cryptocurrency is driven by multiple factors such as technological innovation, institutional participation, regulatory evolution, and changes in social cognition. Considering the multi-dimensional complexity of cryptocurrency, the rapid development of the market, and the emergence of new concepts, China urgently needs to clarify the basic concepts and operating mechanisms of cryptocurrency, build a systematic research framework, and lay the foundation for effective supervision.

*The author of this article is Zhong Yi from the China Finance 40 Research Institute. The original article "Cryptocurrency is no longer what it used to be" was first published on the "CF40 Research" applet on January 5, 2025. Log in to the "CF40 Research" applet to learn more about "Major Trends in Global Cryptocurrency Regulatory Policies" .

In 2009, Bitcoin (BTC) created by Satoshi Nakamoto ushered in the era of decentralized digital currency. Although this blockchain-based innovation was controversial in the early days due to its anonymity and other attributes, and was linked to speculation and illegal activities, it also showed the potential to innovate the financial system.

After 2014, Ethereum introduced smart contracts, expanding the boundaries of blockchain applications. The rise of professional exchanges improved the market infrastructure. The wave of initial coin offerings (ICOs) promoted the formation of a regulatory framework. The emergence of stablecoins such as Tether (USDT) injected stability into the market.

In 2020, the global loose monetary policy prompted institutional investors to re-examine and reposition the cryptocurrency market. The final approval of the Bitcoin spot ETF in January 2024 broadened the mainstream investment channels for cryptocurrencies. In particular, after Trump was elected as the US President, his campaign proposals of "making the United States the world's cryptocurrency capital" and establishing a Bitcoin reserve triggered a warm response in the market, pushing the price of Bitcoin to more than $100,000, which attracted widespread attention and discussion on cryptocurrencies around the world.

Today, cryptocurrencies represented by Bitcoin have gradually gotten rid of the early labels of "money laundering tools" and "speculation tools", and their new asset class attributes have begun to be recognized by the mainstream market . Federal Reserve Chairman Powell compared Bitcoin to "digital gold."

These changes prompt us to think deeply: What kind of transformation has cryptocurrency undergone over the past decade?

Basic Introduction to Cryptocurrency

1. Cryptocurrency has evolved into at least three types with different characteristics.

Cryptocurrency refers to a currency that exists only in digital form and uses encryption technology to ensure transaction security. Cryptocurrency usually runs on a decentralized network, using blockchain technology as a public ledger for transactions. It can be divided into central bank digital currency (CBDC) and private cryptocurrency according to the issuer.

CBDC is issued and managed by the central bank and is a digital form of national legal tender, such as the digital renminbi (DCEP) issued by the People's Bank of China. Private cryptocurrencies are issued by non-governmental organizations and are not controlled by any central agency. This article mainly focuses on the relevant content of private cryptocurrencies.

Since the birth of Bitcoin in 2009, there have been thousands of cryptocurrencies, and new cryptocurrencies may appear every day. Although these cryptocurrencies are all based on decentralized consensus mechanisms and distributed ledger technology, there are some differences in their specific implementation. According to the design mechanism and function, private cryptocurrencies can be mainly divided into three categories: Store of Value Cryptocurrencies, Utility Tokens, and Stablecoins.

It should be noted that as a constantly evolving innovation field, the concepts and applications of cryptocurrency are constantly expanding , so these classification boundaries are not absolute. Take USDT as an example. It is not only a stablecoin anchored to the US dollar, but also a token on the Ethereum network, which also has the characteristics of a utility token.

Category I: Value-storing cryptocurrencies, typically Bitcoin and Litecoin (LTC). Although this type of cryptocurrency was originally designed to achieve peer-to-peer electronic payments, it has since taken on more of the function of digital value storage. They have the characteristics of decentralization, trustlessness (transactions are verified by the entire network rather than relying on specific institutions), global circulation, and anonymity.

This type of cryptocurrency usually has a dedicated blockchain that supports only this purpose, and does not support smart contracts and decentralized applications (DApps). They usually use a fixed supply cap to maintain scarcity, such as the total amount of Bitcoin is about 21 million, and Litecoin is limited to 84 million. Its price is determined entirely by market supply and demand and is not linked to any other assets.

Category II: Utility tokens, typically represented by Ethereum (ETH), Solana (SOL), etc. Ethereum is the first blockchain platform to support smart contracts, allowing developers to create and deploy decentralized applications (DApps) and digital assets on its network. This programmable feature has greatly expanded the application scope of blockchain technology and spawned innovative application scenarios such as decentralized finance (DeFi).

Tokens refer to any crypto assets that run on a blockchain platform like Ethereum. That is, tokens do not need to build and maintain their own blockchain network, but are "parasitic" on the main chain like Ethereum. The issuance and transfer of tokens requires the payment of Ether as a gas fee.

According to the specific functions of utility tokens, they can be roughly divided into the following three categories:

The first is infrastructure tokens. These utility tokens are native tokens of blockchain platforms that support smart contracts and are mainly used to maintain network operations and pay for computing resources.

Ethereum is the most representative infrastructure token. Its usage scenarios include paying network transaction fees, providing an operating environment for decentralized applications, and participating in network verification through a staking mechanism to maintain system security.

The second is service tokens. Service tokens are a special type of utility tokens that allow holders to gain access to specific network services or perform related operations. For example, Basic Attention Token (BAT) is a token based on Ethereum ERC-20 (the most commonly used token technology standard on the Ethereum network). It is used in the Brave browser ecosystem to incentivize users to watch ads, pay for ads, and reward content creators.

The third is financial tokens. Financial tokens have a wide range of application scenarios, including decentralized lending, trading, crowdfunding and other financial activities. Holders can usually participate in project governance and share platform revenue. Project parties usually limit the total issuance, set a lock-up period, and adopt management mechanisms such as multi-signatures. Binance Coin (BNB) is a typical representative, and BNB holders can get transaction fee discounts.

Category III: Stablecoins, typical representatives are USDT, USDC, etc. Stablecoins are a type of cryptocurrency that aims to maintain a stable value relative to a specific asset or a basket of assets. The biggest difference between them and Bitcoin is that they need to be anchored to other assets. They are issued or destroyed by the issuing institution according to market demand. They can be mainly divided into the following four categories.

The first is the stablecoin pegged to fiat currency, which is currently the most popular type of stablecoin. It is backed by a 1:1 reserve of fiat currency (US dollar, euro, etc.), similar to the currency board system, such as USDT and USDC pegged to the US dollar.

The second is commodity-linked stablecoins, which are linked to the value of physical assets such as gold, silver or other tangible commodities. For example, PAX Gold is a stablecoin backed by gold reserves, with each token representing one troy ounce of gold stored in a secure vault.

The third is stablecoins backed by cryptocurrencies, such as DAI and LUSD, which usually use over-collateralization to mitigate the inherent volatility of their underlying assets. Taking DAI as an example, users need to pledge $150 worth of Ethereum to obtain $100 worth of DAI (150% collateralization rate).

Fourth, algorithmic stablecoins, which can theoretically maintain price stability by automatically adjusting the supply and demand of tokens through smart contracts without relying on collateral, but in reality, many projects have failed. The "algorithmic central bank" pointed out by Eichengreen (2018) is inherently unstable, which was also verified in the Terra/LUNA collapse in 2022.

In addition to the three cryptocurrencies mentioned above, blockchain technology has some expanded applications, such as non-fungible tokens (NFTs) , which represent digital certificates of an asset on the blockchain. Each NFT has a unique identifier, which is indivisible and cannot be replaced by each other.

NFT is currently mainly used in the fields of digital art transactions (such as digital paintings, music, videos), virtual real estate (such as virtual plots of land in the metaverse), game props (such as special equipment and characters in games), and digital collectibles (such as sports event souvenirs).

For example, in March 2021, digital artist Beeple's work Everydays: The First 5000 Days was sold at a Christie's auction for US$69.346 million (approximately RMB 450 million), becoming a landmark event in the NFT market.

In addition, there are some derivative assets based on cryptocurrencies , such as Bitcoin futures, Bitcoin futures ETFs, Bitcoin spot ETFs, etc.

The cryptocurrency market has built a unique financial innovation ecosystem

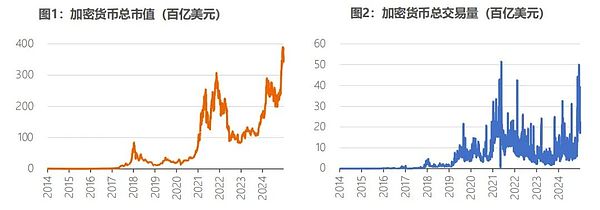

First, the market capitalization and trading volume of cryptocurrencies have experienced significant growth over the past decade.

As of December 28, 2024, the Coingecko website counted 16,022 cryptocurrencies from 1,200 cryptocurrency exchanges worldwide. The market value of all cryptocurrencies was approximately US$3.43 trillion, and the trading volume in the past 24 hours was approximately US$165.3 billion.

In terms of relative size, this market value is equivalent to 5% of the total market value of the US stock market and 35% of the Chinese stock market. In early 2014, the total market value of global cryptocurrencies was only US$10.6 billion. In ten years, the cryptocurrency market has achieved more than 300 times growth.

Data source: Coingecko, as of December 28, 2024.

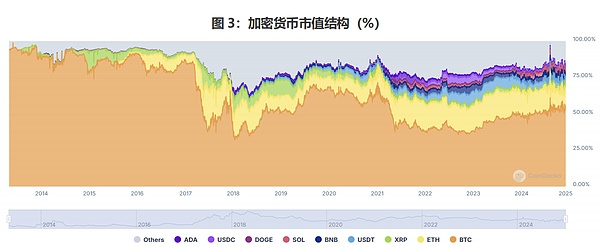

Second, the cryptocurrency market is diversified, and Bitcoin still occupies a dominant position. As of December 28, 2024, the top three cryptocurrencies by market value are Bitcoin, Ethereum, and USDT, with market values of $1.87 trillion, $403.3 billion, and $138.6 billion, respectively, accounting for approximately 54%, 12%, and 4% of the total cryptocurrency market value.

Over the past decade, cryptocurrencies have gone from being dominated by Bitcoin to being diversified. Before 2017, Bitcoin was in an absolute dominant position, accounting for more than 75% of the total cryptocurrency market value. In 2017-2018, with the rise of the Ethereum smart contract platform, the market value of Ethereum reached a peak of about 31%, and the share of Bitcoin dropped to a historical low of about 33%.

Bitcoin's market value has since rebounded, rising to around 70% in 2020, and currently remains above 50%, continuing to dominate. In addition, the market share of stablecoins (USDT and USDC) has also risen from zero to 5%-7%, and emerging cryptocurrencies such as BNB and SOL also occupy a certain market share.

Data source: Coingecko, as of December 28, 2024.

Source: Coingecko, as of December 28, 2024, compiled by the author.

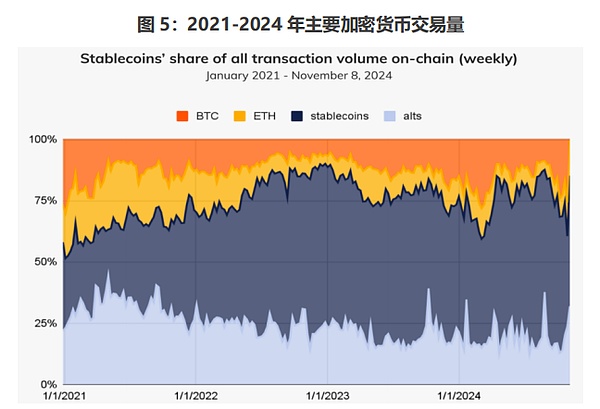

Third, since 2022, the trading volume of stablecoins has begun to dominate among cryptocurrencies.

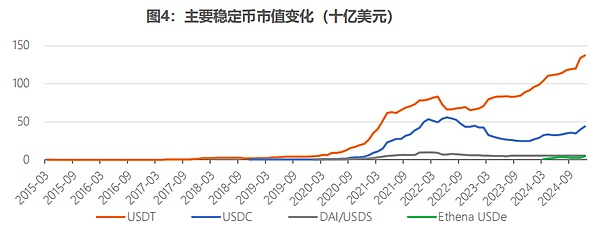

First, the market value of stablecoins has steadily increased. Stablecoins developed relatively slowly before 2019, but experienced explosive growth after 2020. As of December 2024, the total market value of stablecoins reached US$211 billion, accounting for 6.12% of the total market value of all cryptocurrencies.

Among them, USDT has a dominant position of 69% in the stablecoin market with a market value of US$138.6 billion, while USDC ranks second with a market value of US$42.5 billion, accounting for 22%. The two major stablecoins together account for more than 90% of the market share, showing a highly concentrated pattern (Figure 4).

Data source: CoinMarketCap, as of December 31, 2024.

Second, the application scenarios of stablecoins are gradually expanding. In recent months, stablecoins have accounted for about two-thirds of the trading volume of all cryptocurrencies with a market value of 5%-7% (Figure 5). It is worth noting that these transactions may mainly be reflected in the nature of asset transactions rather than daily consumption payments.

Source: Chainalysis.

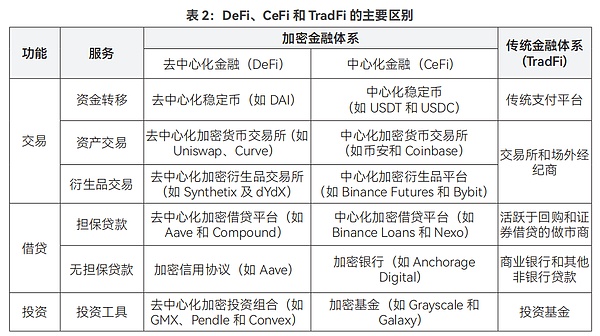

Fourth, decentralized finance (DeFi) is fluctuating upward (Figure 6). DeFi provides financial services similar to the traditional financial system, while achieving financial disintermediation (Table 2). As of December 28, 2024, the DeFi market value reached US$122.7 billion, accounting for approximately 3.6% of the total cryptocurrency market value.

Source: Coingecko, as of December 28, 2024.

In the early days (2017-2019), DeFi applications were relatively simple, mainly focusing on lending protocols and stablecoins; in 2020, driven by the concept of "yield farming", projects such as Uniswap rose rapidly; around 2021, due to the congestion of the Ethereum network, some projects began to migrate to emerging high-performance, low-cost public chains such as Solana; in 2022, the collapse of the Terra/LUNA ecosystem caused the DeFi market value to plummet, and the industry entered an adjustment period. The market began to stabilize and recover from 2023.

Source: IMF, updated with examples from original text.

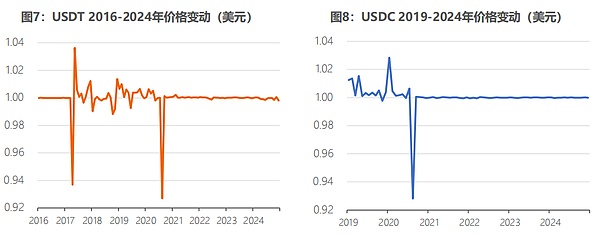

Fifth, the prices of cryptocurrencies show different trends. First, the prices of stablecoins USDT and USDC have basically achieved the goal of stabilizing at around US$1 since 2021 (Figures 7 and 8).

Data source: CoinMarketCap.

The two major stablecoins experienced many price fluctuations before 2021: Since 2017, Tether, the issuer of USDT, has been subject to frequent legal investigations due to banking disputes at its affiliated company Bitfinex Exchange, which raised questions about its dollar reserves; in 2020, affected by the COVID-19 pandemic, panic selling in the cryptocurrency market caused the two currencies to decouple; after 2021, as the issuer strengthened reserve transparency and the market mechanism improved, the price basically stabilized at the US$1 level.

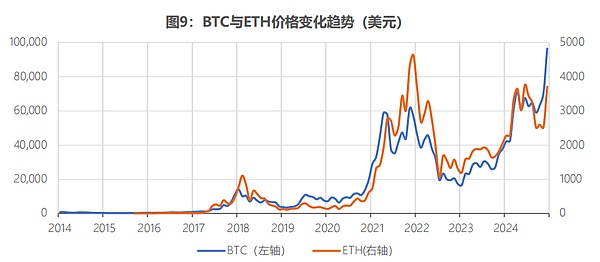

Second, the price trend of cryptocurrencies has a strong internal linkage (Figure 9). The price trends of Bitcoin and Ethereum are highly correlated, and their rise and fall often drive the trend of the entire cryptocurrency market. Moreover, they are all affected by many factors such as the global monetary policy environment, regulatory policies, major industry events (such as the bankruptcy of FTX Exchange in 2022), and inflation expectations.

Data source: Coingecko.

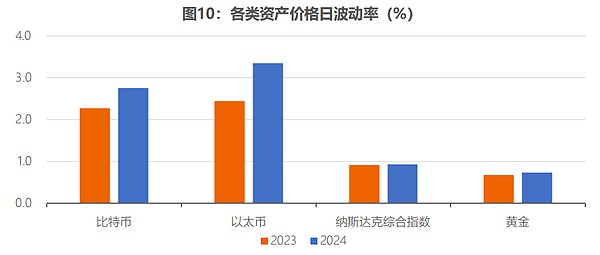

Third, the price of cryptocurrencies is more volatile than traditional financial assets (Figure 10). Comparing the daily volatility of various asset prices: In 2023, the daily volatility of Bitcoin was 2.27%, which is 3.4 times that of the traditional safe-haven asset gold (0.68%), and 2.5 times that of the traditional risk asset Nasdaq Composite Index (0.91%). In 2024, the volatility of various assets increased, and the fluctuation of Bitcoin was more significant. The daily volatility of Bitcoin rose to 2.76%, which is 3.7 times that of gold (0.74%) and 3.0 times that of the Nasdaq Composite Index (0.93%).

Data source: Coingecko, WIND, calculated by the author.

The trajectory of the cryptocurrency market

The development trajectory of the cryptocurrency market is shaped by many factors, including institutional participation, regulatory evolution, changes in social perceptions, and technological innovation.

1. Early Development (2009-2016): Technology development was in its infancy, traditional financial institutions generally took a negative and wait-and-see attitude, and regulators focused on illegal activities.

Bitcoin was officially released in 2009 and was initially spread mainly among geeks and cryptography enthusiasts, who viewed it as a technical experiment.

In May 2010, American programmer Laszlo Hanyecz used 10,000 bitcoins to buy two pizzas (worth $25, which is about $0.0025 per bitcoin after conversion), becoming the first real-world application case of Bitcoin.

From 2010 to 2013, cryptocurrencies gradually moved from early experiments to the public eye. First, the market size expanded rapidly. The price of Bitcoin reached $1 for the first time in February 2011, and continued to rise after the first "halving" in November 2012, reaching $100 in April of the following year, and breaking through $1,000 for the first time in November.

Second, technological innovations continued to emerge. In 2012, Peercoin (PPC) innovatively adopted the Proof of Stake (PoS) consensus mechanism, which greatly reduced energy consumption. Subsequent blockchain projects such as Ethereum all adopted the improved PoS mechanism. The Ethereum white paper was also released during this period and proposed the concept of smart contracts.

Third, payment-related commercial applications have started tentatively. The web content management system WordPress announced in November 2012 that it would begin accepting Bitcoin payments, but stopped this payment option three years later. Its founder said that the usage rate of cryptocurrency is too small and that the emergence of cryptocurrency is more out of a philosophical perspective than commercial use. In October 2013, Canada set up its first Bitcoin ATM to handle the exchange of Canadian dollars and Bitcoin.

Fourth, infrastructure such as exchanges began to be established. After the birth of Bitcoin, there was no exchange for a long time. At that time, people mainly traded Bitcoin on the Bitcoin Talk forum. In October 2009, the New Liberty Standard began to publish the price of Bitcoin calculated based on power consumption, and the first quotation was 1 US dollar to 1309.03 Bitcoins. In July 2010, the earliest mainstream trading platform Mt.Gox went online, accounting for about 70% of the trading volume at the time. Since then, cryptocurrency exchanges such as OKCoin, Huobi, and Coinbase have been established one after another.

From 2014 to 2016, cryptocurrencies entered a short period of adjustment. First, technical security issues attracted widespread attention. In February 2014, Mt.Gox, the world's largest Bitcoin exchange at the time, declared bankruptcy due to a hacker attack, losing more than 850,000 Bitcoins. The price of Bitcoin continued to fall from a high of more than $1,000 in December 2013 to less than $200 in January 2015.

Second, technological innovation continues to advance. On the one hand, the official launch of the Ethereum mainnet in August 2015 ushered in the era of smart contracts. The birth of smart contracts has made the application of cryptocurrencies no longer limited to simple transfer tools, but can automatically run according to preset rules, laying the foundation for the subsequent development of DeFi. On the other hand, Bitcoin ushered in its second halving in July 2016, and the technical discussion on how to "expand capacity" (allowing the network to carry more transactions) has become increasingly intense.

In the early stages of development, traditional financial institutions actively embraced new blockchain technologies, but generally took a wait-and-see, negative attitude toward cryptocurrencies. Institutions tend to discuss blockchain technology and cryptocurrencies separately, reflecting an attitude of embracing technology and being cautious about assets.

JPMorgan Chase CEO Jamie Dimon called Bitcoin a terrible investment, and BlackRock CEO Larry Fink called Bitcoin a "money laundering tool" in 2017, representing the general view of the mainstream financial community in the United States at the time.

However, since 2015, these traditional financial institutions have begun to pay attention to and try to apply blockchain technology. In 2015, the Nasdaq Stock Exchange launched Linq, a private equity trading platform based on blockchain technology, to support companies in issuing "digital" equity to investors through private placement. The R3 blockchain alliance was established and attracted about 50 major financial institutions around the world, including Morgan Stanley and Goldman Sachs, to join. Various innovative projects based on blockchain have also emerged.

Lael Brainard, a member of the Federal Reserve Board, said at a meeting organized by the Institute of International Finance (IIF) in 2016 that the Federal Reserve already has a 300-person team specifically responsible for researching and following up on blockchain technology and keeping up with market developments.

From 2013 to 2016, countries focused on risks such as speculation, anti-money laundering and counter-terrorist financing, and transaction security, and established a preliminary regulatory framework.

The United States focuses on issues such as speculation and consumer protection. As early as 2013, the Financial Crimes Enforcement Network (FinCEN) issued a regulatory guide for cryptocurrencies, defining it as "a payment medium" and requiring exchanges to perform know-your-customer (KYC) due diligence and register as money service businesses (MSBs). The Internal Revenue Service (IRS) issued a notice in 2014, defining cryptocurrencies as property rather than currency, and applying capital gains tax rules; the Commodity Futures Trading Commission (CFTC) regards cryptocurrencies as commodities and regulates market manipulation and fraud under the Commodity Exchange Act (CEA); New York State introduced the BitLicense regulatory framework in 2015, requiring companies to obtain a license before operating in the state. Japan recognizes cryptocurrencies as a legal means of payment.

In May 2016, the Financial Services Agency (FSA) of Japan added a chapter on "digital currency" to the Payment Services Act, officially recognizing it as a legal means of payment and providing legal protection for digital currency exchanges. As a supporting regulation, the Japanese government also announced the "Fund Settlement Act Implementation Order" on March 24, 2017, which made detailed provisions on fund transfer and settlement.

In Europe, the European Banking Authority (EBA) issued a report in 2013 warning that Bitcoin may be subject to risks such as the collapse of trading platforms leading to the inability to withdraw cash, hacker attacks, and price fluctuations. In 2016, the European Commission began to propose that cryptocurrencies and their trading platforms be included in the regulatory scope of the Anti-Money Laundering/Counter-Terrorist Financing Directive (AMLD4). After two years of in-depth discussions, the EU finally officially released the fifth version of the Anti-Money Laundering/Counter-Terrorist Financing Directive (AMLD5) in June 2018, incorporating cryptocurrencies into the regulatory system for the first time.

2. ICO Bubble Period (2017-2018): The ICO craze promoted the development of cryptocurrencies, and the coexistence of large amounts of fundraising and fraud and scams led to strong regulation

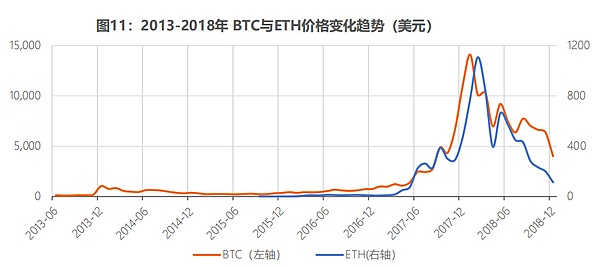

Cryptocurrency experienced a relatively short bull run from 2017 to 2018 (Figure 11), reaching a peak in market value in 2018. This period was mainly driven by the ICO boom.

Data source: Coingecko.

Initial Coin Offering (ICO) is an innovative financing mechanism developed in the field of cryptocurrency. Its basic principle is that the project party raises cryptocurrencies with good liquidity (Bitcoin, Ethereum) by issuing new cryptocurrencies on the blockchain.

Mastercoin first attempted ICO in 2013, and Ethereum ICO attracted widespread attention after successfully raising $18 million in 2014. As the main ICO issuance platform, Ethereum's price also rose accordingly. Cryptocurrency gradually attracted heated discussions in the media, and "blockchain" became a hot word, attracting a large number of retail investors to enter the market.

However, due to lack of regulation, high speculation, technical loopholes and other issues, the ICO bubble finally burst in 2018. As early as May 2016, the Ethereum-based project The DAO raised about $152.3 million through ICO, but was hacked a month later due to a smart contract loophole, losing about 3.6 million ether. The failure of a large number of low-quality projects and frequent frauds made ICO once regarded as a synonym for "Ponzi scheme".

According to statistics from CipherTrace, a US cybersecurity company, losses due to ICO exit scams, fake transactions, hacker attacks and Ponzi schemes reached $750 million in 2018. According to statistics from the Russian Association of Cryptocurrency and Blockchain (RACIB), Russia attracted a total of $300 million in ICO funds in 2017, but half of them were Ponzi schemes.

Countries have stepped up their re-examination of cryptocurrencies and regulation of ICOs. In April 2017, the People's Bank of China and seven other departments jointly issued an announcement requiring all types of token issuance and financing activities to be stopped immediately and to arrange for liquidation. In July 2017, the U.S. Securities and Exchange Commission (SEC) issued a statement, emphasizing the need to strengthen compliance management of ICOs, using The DAO project as an example. The SEC made it clear that some ICOs may constitute securities issuance and must comply with relevant regulations. It also warned that ICOs have high risks such as fraud and market manipulation, and reminded investors to be wary of false promises of high returns and low risks, and to pay special attention to unregistered or unlicensed operations. In addition, the SEC also suspended transactions of several problematic ICOs, including CIAO and First Bitcoin Capital. Under the dual pressure of project quality and supervision, this round of rise ended with the withdrawal of speculative funds and a sharp market correction.

As of this stage, cryptocurrency is not frequently used as a payment tool and is linked to illegal activities. Athey et al. (2016) found that as of mid-2015, the active use of Bitcoin was not growing fast, which means that there are not many users who actually use Bitcoin for daily payments, and most Bitcoin is held as an investment.

Foley et al. (2019) found that from January 2009 to April 2017, illegal activities accounted for a large proportion of Bitcoin users and transaction activities, with about a quarter of users (26%) and nearly half of Bitcoin transactions (46%) being related to illegal activities; if calculated by transaction amount, about one-fifth (23%) of the total transaction amount and about half (49%) of Bitcoin holdings were related to illegal activities.

According to their estimates, as of April 2017, there were approximately 27 million Bitcoin market participants who primarily used Bitcoin for illicit purposes, collectively holding $7 billion in Bitcoin and conducting approximately 37 million transactions per year worth approximately $76 billion.

As an asset, cryptocurrencies have little correlation with traditional financial assets and are mainly driven by their own and market uncertainties. Bianchi (2020) analyzed the trading data of 14 major cryptocurrencies between April 2016 and September 2017 and found that the yield of cryptocurrencies has no obvious correlation with the stock market, bond market, etc. The trading volume of cryptocurrencies is mainly driven by historical price trends and market uncertainty.

At the end of 2017, the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange Group (CME) successively launched Bitcoin futures contracts, settled in U.S. dollar cash, which will help increase Bitcoin trading activity and achieve price discovery.

(III) Institutional investment period (2019-2021): Against the backdrop of global liquidity flooding, some institutional investors began to include cryptocurrencies in their investment portfolios

In fact, as early as around 2018, the attitudes of institutional investors began to change subtly.

Fidelity established its subsidiary Fidelity Digital Assets in 2018 and began preparing digital asset custody and trading services for institutional investors. In 2019, JPMorgan Chase launched the encrypted digital currency JPM Coin for instant settlement of payment transactions between customers (although its CEO Jamie Dimon is still criticizing Bitcoin in 2024).

The fundamental change in the attitude of institutional investors began in 2020, with more and more traditional financial institutions beginning to make positive comments on cryptocurrencies and start strategic layout.

First, the global quantitative easing policy triggered by the COVID-19 pandemic has exacerbated inflation concerns, prompting institutional investors to seek new hedging tools. The price of Bitcoin has gradually recovered from the $3,800 plunge on "Black Thursday" in March 2020, and exceeded $20,000 at the end of 2020. During this period, institutional-level infrastructure such as custody, trading, and settlement has been gradually improved, and industry compliance and security have been improved, laying the foundation for subsequent institutional investors to enter the market.

Second, institutional investors have shifted from their previous total denial to cautious participation, and continue to increase the depth of their participation. In May 2020, the famous investor Paul Tudor Jones announced that he would use Bitcoin as a hedge against inflation. Investment giants such as BlackRock have successively laid out their crypto asset businesses. BlackRock CEO Larry Fink's view on Bitcoin has changed from a "money laundering tool" in 2017 to a "global asset"; in March 2021, Morgan Stanley became the first major US bank to provide its high-net-worth clients with a Bitcoin fund investment channel, with $4 trillion in client assets. Goldman Sachs followed suit and announced that it would provide cryptocurrency investment options for high-net-worth clients.

Payment giants have successively connected to the crypto ecosystem. In October 2020, PayPal announced that it would support users to buy, hold and sell cryptocurrencies, and expanded the service to Venmo users at the beginning of the following year; digital payment company Square not only supports cryptocurrency business in its Cash App, but also purchased US$50 million in Bitcoin as a reserve asset; in March 2021, payment platform Visa announced that it would allow the use of cryptocurrencies to settle transactions on its payment network.

Listed companies represented by MicroStrategy have begun to allocate Bitcoin. After the company first purchased $250 million worth of Bitcoin in August 2020, it has increased its holdings several times and financed the purchase of Bitcoin through the issuance of convertible bonds and stocks. As of December 15, 2024, it already held approximately 439,000 Bitcoins; Tesla also announced the purchase of $1.5 billion worth of Bitcoin in early 2021.

Third, the regulatory policy framework is becoming clearer, which will help the mainstreaming of the crypto industry. In 2020, the Office of the Comptroller of the Currency (OCC) of the United States issued guidance to allow federal banks and savings associations to provide custody services for crypto assets. This move reduces the technical threshold and risks for individual users to keep digital assets, and also expands new business directions for traditional financial institutions. It is expected that the world's four largest banks, BNY Mellon, State Street, JPMorgan Chase and Citi, will begin to provide crypto asset custody services in 2025. These banks jointly manage more than $12 trillion in assets.

The Commodity Futures Trading Commission (CFTC) considers cryptocurrencies as commodities and is responsible for approving new cryptocurrency derivatives, etc. The SEC's regulatory attitude towards cryptocurrencies remains strict, and it continues to crack down on multiple ICO projects on the grounds of "unregistered securities." For example, Telegram's TON project was forced to shut down and pay $18.5 million in settlement.

In addition, the European Union proposed the draft Markets in Crypto-Assets (MiCA) in September 2020, aiming to establish a unified crypto-asset regulatory framework for member states.

(IV) Structural changes (2022): Major risk events trigger deep adjustments in the cryptocurrency market

First, the market hit a record high and then fell back sharply. Driven by institutional allocation and retail investment, the price of Bitcoin climbed from $30,000 at the beginning of 2021 to a high of nearly $68,000 in November, and Ethereum also broke through $4,800. However, in 2022, affected by factors such as the Fed's interest rate hike, the collapse of Terra/LUNA, and the bankruptcy of FTX Exchange, Bitcoin fell to a minimum of $16,000.

Second, the outbreak of risks has prompted the crypto industry to re-examine systemic risk management. In May 2022, the Terra LUNA ecosystem collapsed. In just a few days, its native token LUNA plummeted from a high of $119 in early April 2022 to near zero. At the same time, its algorithmic stablecoin UST was severely decoupled, causing the market value of the entire ecosystem to evaporate by more than $40 billion. This incident exposed fundamental defects such as algorithmic stablecoins' over-reliance on market confidence and lack of sufficient external reserve support.

The collapse had a significant impact on the cryptocurrency market, with mainstream cryptocurrencies such as Bitcoin and Ethereum seeing a significant drop in prices, triggering a series of chain reactions. The well-known cryptocurrency hedge fund Three Arrows Capital (3AC) went bankrupt due to its heavy use of leverage to invest in LUNA and other cryptocurrencies, and owed more than billions of dollars in debt to institutions including Voyager Digital and Genesis Trading; the centralized lending platform Celsius froze user withdrawals and declared bankruptcy in June 2022, disclosing a balance sheet gap of up to $1.2 billion; Voyager Digital also filed for bankruptcy protection due to 3AC's default.

The crisis reached its peak in November 2022, when FTX, the world's second largest cryptocurrency exchange, and its affiliate Alameda Research were exposed to serious financial problems, including misappropriation of customer funds and using its own FTT tokens as primary loan collateral. The exposure of these problems triggered market panic, causing FTX to fall from a valuation of $32 billion to bankruptcy in just one week.

These incidents exposed the shortcomings of centralized institutions in risk management, capital isolation and corporate governance, including excessive leverage, maturity mismatch, lack of internal control and other issues.

Third, market turmoil has led to a split in institutional investors' participation in the cryptocurrency market. Some institutions have chosen to shrink their businesses. Tesla sold 75% of its Bitcoin holdings (about $936 million) in the second quarter of 2022, citing the need to maintain liquidity; many banks suspended or reduced cryptocurrency-related services after the FTX incident.

On the other hand, some institutions that view cryptocurrencies as long-term strategic layouts continue to invest. MicroStrategy continued to increase its holdings of Bitcoin during the market downturn; Fidelity Digital Assets officially provided Ethereum purchase, sale and transfer services to institutional clients at the end of October 2022.

Fourth, the technical foundation continues to be consolidated, and key technology upgrades are being advanced as planned. In September 2022, Ethereum successfully completed the "The Merge" upgrade, transitioning its consensus mechanism from proof of work (PoW) to proof of stake (PoS). This upgrade reduced the energy consumption of the Ethereum network by more than 99.9%, transforming block production from relying on energy-intensive mining to a staking-based verification mechanism. After the upgrade was completed, the number of Ethereum validators and staking requirements increased, reflecting the community's confidence in the proof of stake (PoS) mechanism.

Ethereum's second-layer expansion network (Layer 2) has made significant progress. Major projects Arbitrum and Optimism have reduced user costs and improved network performance by processing transactions on the mainnet. In addition, with the improvement of cross-chain bridge security, the establishment of decentralized identity (DID) standards, and the development of privacy protection technologies such as zero-knowledge proofs, Web3 infrastructure has gradually improved.

Fifth, the impact of industry events has accelerated the process of regulatory legislation. Japan began discussing stablecoin regulation as early as 2019. After the Terra/LUNA incident in May 2022, Japan accelerated the legislative process and passed the amendment to the Funds Settlement Act in June 2022 to comprehensively regulate the issuance, circulation, and redemption of stablecoins. The European Union officially passed the MiCA Act in 2022, which is the world's first comprehensive crypto asset regulatory framework, covering issuance standards, service provider specifications, and market behavior supervision.

(V) Steady Development Period (2023-2024): The market stabilizes, the regulatory framework is basically formed, and the Bitcoin spot ETF is approved, which broadens the channels for participating in the crypto market.

First, the market gradually recovered after experiencing major risk events. The negative impact of events such as the FTX bankruptcy in 2022 gradually subsided, and the price of Bitcoin steadily recovered from $16,000 at the end of 2022, and exceeded $70,000 in March 2024. The market structure has been further optimized, and the transparency of centralized exchanges (CEX) has been improved. In order to restore market trust and meet regulatory requirements, many centralized exchanges (such as Binance, Coinbase, etc.) have begun to implement more transparent asset proof mechanisms (Proof of Reserves) to ensure that users' assets are properly managed and verified; at the same time, the development of decentralized exchanges (such as Uniswap, SushiSwap, etc.) has also provided the market with more diversified trading options.

Second, the application and infrastructure of the crypto industry continue to develop, and technological innovation is accelerating. Ethereum's Layer2 ecosystem (such as Polygon, Arbitrum, and Optimism) continues to grow; NFT technology continues to innovate in the application of brand marketing, games, art, and other fields; blockchain infrastructure begins to integrate AI functions, such as smart contract automation and risk control; the Bitcoin network is trying to transform from a static chain to a multifunctional ecosystem; new application forms such as decentralized social networks (DeSoc) begin to emerge; and the decentralized physical infrastructure network (DePIN) also made a leap forward in 2024, with a total market value exceeding US$40 billion, a year-on-year increase of 132%. DePIN has emerged in important global industries such as telecommunications, mobile communications, and energy, injecting new vitality and possibilities into the transformation of these traditional industries.

Third, the regulatory framework for cryptocurrencies has been further improved, and Bitcoin has officially entered the mainstream investment field. The position of the U.S. Securities and Exchange Commission (SEC) has undergone a transformation from strict restrictions to gradual acceptance - from strict supervision of ICOs in 2017, the application for Bitcoin ETFs was rejected several times in 2019, to the approval of Bitcoin futures ETFs in 2021, and then to the approval of Bitcoin spot ETF applications from 11 institutions including BlackRock and Fidelity in early January 2024, providing a compliant channel for institutional investors to participate. The European Union will also officially implement the MiCA Act in 2023. Hong Kong, China has also introduced a new virtual asset service provider (VASP) licensing system and allows retail investors to trade products such as ETFs.

Fourth, traditional financial institutions have entered the market on a large scale, and crypto finance and traditional finance have accelerated their integration. First, traditional investment institutions have actively expanded their cryptocurrency investment channels. In June 2023, BlackRock began to apply to the SEC for a spot Bitcoin ETF, and other large financial institutions followed suit, and were finally approved in January of the following year. According to Messari's report, the influence of cryptocurrency lobbying surged in 2024, and the industry stepped up its efforts to promote favorable regulations, with total spending reaching $200 million, ranking among the top five lobbying spending industries.

Second, the crypto market has seen a substantial breakthrough in institutional investment. Bitcoin ETFs have performed strongly since their listing, with continued capital inflows. The total size of the Bitcoin spot ETF market will be approximately $100 billion in 2024. Among them, the Bitcoin spot ETF (IBIT) launched by BlackRock set a new record in the ETF market, with a management scale of over $3 billion in the first month and climbing to $40 billion within 200 days.

Third, traditional financial institutions are making layouts in multiple fields such as tokenization of physical assets and stablecoins in the crypto industry. Institutions such as Sky (formerly MakerDAO) and BlackRock have launched on-chain money market funds; Ondo Finance's USDY (tokenized Treasury bond fund) has a management scale of US$440 million; institutions are actively exploring the application potential of blockchain in reducing costs, improving transparency and payment efficiency, and PayPal has issued the PYUSD stablecoin on the Solana platform.

Fourth, institutional investors are generally optimistic about cryptocurrencies. According to Fidelity's survey on institutional investors' investment in digital assets in 2023, 51% of the surveyed institutions said they have already invested in digital assets. The core logic is: if digital assets really become a more mainstream means of value storage in the future, the market space will be far greater than it is now. The current market value of gold exceeds 18.5 trillion US dollars, and the proportion of Bitcoin's market value in the market value of gold has increased from 1.6% in 2020 to nearly 10% in November 2024.

With the emergence of more traditional investment tools such as ETFs, it will become more convenient for institutions to invest in digital assets, and Bitcoin's pace of catching up may further accelerate. According to PwC's 2024 survey on hedge fund digital asset investments, hedge funds generally increased their allocation to digital assets, mainly driven by increased regulatory transparency, the launch of new investment tools (especially ETFs), increased investor interest, and the entry of mainstream institutions.

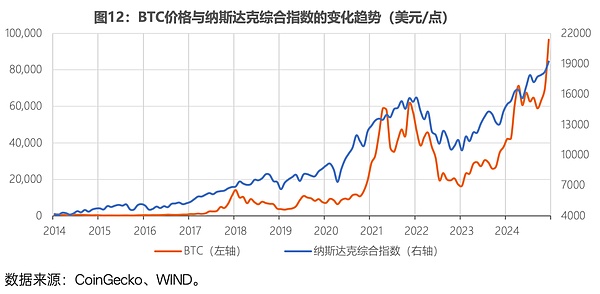

Fifth, Bitcoin exhibits a similar safe-haven function as gold in certain situations (Figure 12, Figure 13). After 2020, the relationship between Bitcoin price, gold price and Nasdaq index has undergone significant changes. In the early stage of the COVID-19 pandemic (March-April 2020), all three rebounded after a brief decline, but the performance rhythm and strength varied: Nasdaq took the lead in a strong rebound driven by technology stocks, gold rose steadily due to safe-haven demand, and Bitcoin fluctuated most violently. Subsequently, during the period of global liquidity easing (the second half of 2020 to the beginning of 2021), Bitcoin and Nasdaq showed a significant positive correlation, showing its characteristics as a risky asset, while gold diverged after hitting a record high in August-September 2020 and entered a correction phase. During the period of rising inflation in 2021, this divergence further intensified, with Nasdaq continuing to hit new highs, Bitcoin experiencing two rounds of significant increases, and gold performing relatively flat.

After the Fed started the interest rate hike cycle in 2022, both Nasdaq and Bitcoin fell sharply, especially the FTX incident, which exacerbated the decline of Bitcoin, while gold showed strong stability due to safe-haven demand. During the regional banking crisis caused by the collapse of Silicon Valley Bank in the United States in 2023, Bitcoin and gold showed a strong positive correlation, both due to the rise in safe-haven demand, and Nasdaq continued its upward trend after short-term fluctuations. This evolution may indicate that Bitcoin has gradually begun to show a safe-haven function similar to gold in a specific market environment from its early characteristics of a risky asset that is highly correlated with Nasdaq.

Previous studies have also suggested that Bitcoin has risk hedging capabilities similar to gold (Dyhrberg, 2016) and can be used as an inflation hedging tool (Blau et al., 2021; Choi and Shin, 2022).

This is also reflected in the views of some institutional investors. BlackRock expressed similar views in October 2023 and September 2024. It believes that the long-term return drivers of Bitcoin are fundamentally different from those of traditional asset classes, and in some cases are even opposite. Global investors face the challenges of increasing geopolitical tensions, deepening US debt crisis and turbulent political environment. Bitcoin may be seen as a unique hedging tool against these fiscal, monetary and geopolitical risk factors. Federal Reserve Chairman Powell publicly stated in December 2024 that Bitcoin "is like gold, except that it is virtual and digital."

Conclusion and Thoughts

The cryptocurrency market is undergoing profound changes. Throughout its development trajectory, cryptocurrency has evolved from a "speculative tool" outside the mainstream financial system to an indispensable component of the global financial ecosystem. This transformation is both profound and rapid, and is driven by multiple factors such as technological innovation, institutional participation, regulatory evolution, and changes in social cognition. Today's cryptocurrency market has taken on a new look in many key dimensions.

First, cryptocurrency has evolved from a pure new technology experiment to a sizable asset class. Currently, the market value of cryptocurrency has exceeded 3 trillion US dollars, which is equivalent to one-third of the market value of China's A-shares. Ten years ago, its scale was only over 10 billion US dollars, and cryptocurrency (Bitcoin) was first introduced about 15 years ago. Among them, Bitcoin has jumped from an innovative experimental product that only attracted the attention of technology enthusiasts in the early days to the seventh largest asset in the world, and its market value has surpassed the traditional safe-haven asset silver and energy giant Saudi Aramco.

Second, cryptocurrencies have evolved from a single pattern dominated by Bitcoin to a crypto ecosystem, and it is still evolving. First, there are many cryptocurrencies. The CoinGecko website has counted more than 16,000 cryptocurrencies, and there are 1,200 cryptocurrency exchanges. Second, the crypto ecosystem has built an infrastructure corresponding to the traditional financial system (Table 2), which can realize the core functions of traditional finance such as trading, lending, and investment.

Third, the functions of cryptocurrency are diversified. In the early days, Bitcoin mainly reflected functions such as value storage and means of payment. With the emergence of Ethereum and smart contracts in 2014-2015, the application scope of cryptocurrency has been further expanded, and various new applications such as decentralized finance (DeFi), non-fungible tokens (NFT), decentralized social networks (DeSoc), decentralized physical infrastructure networks (DePIN), and payment finance (PayFi) have been continuously derived. Stablecoins are trying to deal with the problem of excessive volatility in cryptocurrency prices, improve payment efficiency, and reduce payment costs. According to research by Visa and Castle Island Ventures, by 2024, the total circulating supply of stablecoins has exceeded US$160 billion, which was only a few billion dollars four years ago.

Third, there are more and more cross-integrations between crypto-financial businesses and traditional financial businesses. Initially, cryptocurrencies such as Bitcoin were positioned as decentralized systems independent of the current central bank and banking system, but the boundaries between some cryptocurrency businesses and traditional financial businesses are not clear at present.

This trend of integration is manifested in various aspects: for example, stablecoins pegged to legal tender are similar to the currency board system, and the price of cryptocurrencies is supported by actual reserves of assets such as the US dollar and the euro; in 2019, JPMorgan Chase launched the encrypted digital currency Morgan Coin for settlement and payment between customers; starting in 2020, payment giants such as PayPal and Visa began to support cryptocurrency-related payment services; the United States allowed banks to provide custody services for encrypted assets in 2020; institutions such as BlackRock launched on-chain money market funds, etc. The crypto-financial system seems to have transformed from a "competitor" that completely replaces traditional finance to a "collaborator" that promotes integration with traditional finance.

Fourth, the cryptocurrency market has begun to transform from a speculative market dominated by retail investors to an emerging asset class that is becoming mainstream and is participated in by institutional investors on a large scale. In the early days, large investment institutions generally had a negative attitude towards cryptocurrencies, treating them as "money laundering tools" and "speculation tools." As the prices of Bitcoin, Ethereum and other currencies climbed, global quantitative easing policies exacerbated inflation concerns, prompting institutional investors to seek new hedging tools. Since the second half of 2020, investment giants such as BlackRock and Fidelity have successively laid out their crypto asset businesses, and traditional companies represented by MicroStrategy have also begun to allocate Bitcoin.

The 180-degree change in attitude of BlackRock CEO Larry Fink towards cryptocurrencies is also a microcosm of the general change in views of large investment institutions. Since then, these institutions have begun to actively promote the mainstreaming of crypto assets such as Bitcoin. After multiple applications and rejections, the US SEC officially allowed 11 institutions including BlackRock to launch Bitcoin spot ETFs in January 2024, broadening the way for investors to participate in the cryptocurrency market. Stable long-term funds can help reduce market volatility and gradually mature the cryptocurrency market.

Fifth, the regulation of cryptocurrencies has evolved from focusing on speculation and illegal activities to exploring the establishment of a multi-level regulatory framework. Early regulation focused on speculation and illegal activities, and then gradually developed into a more comprehensive and systematic regulatory framework, covering multiple dimensions such as stablecoin payments, anti-money laundering/anti-terrorist financing, and cross-border transactions. During this evolution, countries' regulatory attitudes and attribute recognition of cryptocurrencies have also been constantly adjusted with market development.

As a global financial center, the United States has a representative change in its regulatory attitude. Between 2013 and 2016, the Financial Crimes Enforcement Network (FinCEN), the Internal Revenue Service (IRS), and the Commodity Futures Trading Commission (CFTC) successively issued regulatory rules, mainly targeting speculative risks and illegal activities. The ICO boom in 2017 pushed the U.S. Securities and Exchange Commission (SEC) to include cryptocurrencies in the scope of securities regulation, thus opening up an in-depth game between regulators and the cryptocurrency market. Judging from the approval process of the Bitcoin spot ETF, the SEC's position has undergone a gradual change from initial strict review and multiple rejections to a more open and accepting attitude.

From this, we can get the following inspirations:

First, we need to build a more systematic understanding and research on the cryptocurrency system. Cryptocurrency not only involves multiple professional fields such as finance, cryptography, and blockchain technology, but is also closely related to the core functions of the modern financial system, such as payment, trading, and investment. This multi-dimensional complexity, coupled with the rapid development of the market, has led to the emergence of new concepts, making it difficult to form a clear and unified cognitive framework. Therefore, clarifying the basic concepts and operating mechanisms of cryptocurrency and building a systematic research framework are important foundations for effective supervision.

Secondly, cryptocurrency needs to be considered as an important variable that may affect financial stability. With the rapid increase in the size of the cryptocurrency market and its accelerated integration with traditional financial businesses, policymakers need to consider its possible impact on financial stability in the same way as they evaluate traditional financial market factors. Especially for stablecoins, former Federal Reserve Chairman Ben Bernanke regards them as a kind of bank currency backed by financial assets, and warns that if there is insufficient supervision, stablecoins may face the risk of lack of sufficient asset support, which is similar to a bank run and may even trigger a financial crisis.

Third, more and more countries tend to establish regulatory rules and legislation to manage cryptocurrencies. According to a 2023 PwC survey report on 35 major countries and regions, about 90% of the countries and regions in the sample have begun to establish a system for cryptocurrency regulation, covering regulatory frameworks, anti-money laundering/counter-terrorist financing, travel rules, stablecoin payment use and other aspects. Most countries have at least established an anti-money laundering/counter-terrorist financing framework, which is the current focus of cryptocurrency regulation.