Prelude: A 48-Hour Crypto "Blitzkrieg"

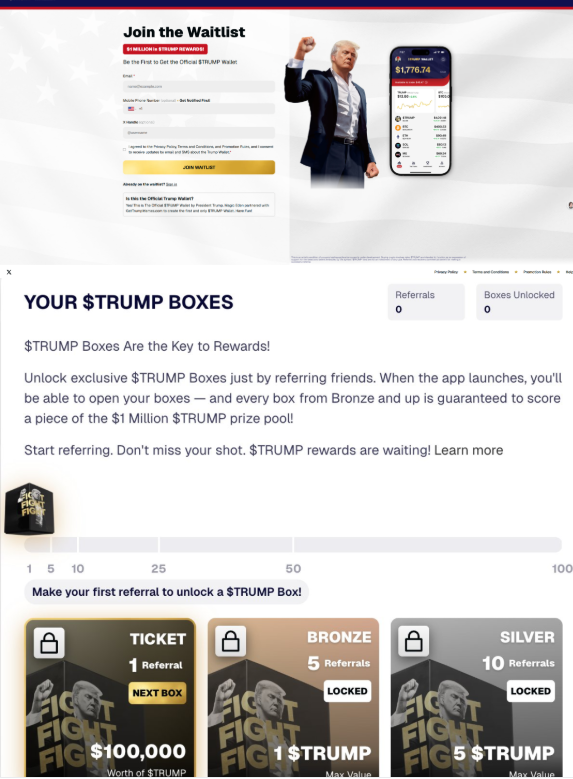

At 00:42 on June 4, 2025, the crypto world was ignited by a message: President Trump would launch a branded crypto wallet Trump Wallet, encouraging supporters to buy MEME coins and other crypto assets. The "authority" endorsement from Walter Bloomberg (not the official Bloomberg) and the "confirmation" from the Non-Fungible Token trading platform Magic Eden instantly sparked market sentiment. The 40% surge of ME token and 80,000 users rushing to register created a marketing climax. However, the plot took a sharp turn within two hours. Donald Trump Jr. and Eric Trump successively denied any association with the project on X platform, stating that the Trump Group was unaware, and previewed their own platform World Liberty Financial (WLFI)'s official wallet. ME token immediately dropped 20%, the Trump Wallet X account was banned, but the official website continued to attract funds. This absurd drama not only exposed the internal division of the Trump family's crypto territory but also revealed the deep crisis of the crypto market under political power.

Three Strategic Pillars of Crypto Layout

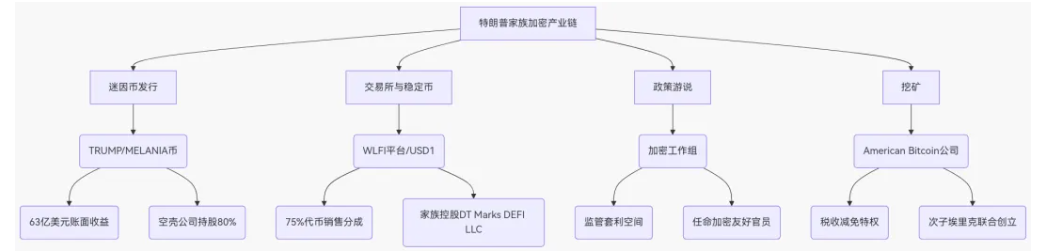

The Trump family's crypto ambition is far from spontaneous. According to media like Bloomberg, their business has covered five major areas: stablecoins, exchanges, mining, Non-Fungible Tokens, and social media financialization, forming a closed-loop ecosystem

- World Liberty Financial (WLFI): A DeFi platform with 60% family-controlled shares, issuing stablecoin USD1 and receiving a $2 billion investment from Abu Dhabi Sovereign Wealth Fund, aiming to replace USDT/USDC;

- TRUMP MEME Coin: 80% of tokens controlled by the family, creating price fluctuations through policy shilling and White House dinners, harvesting over $300 million in transaction fees;

- Bitcoin Mining and ETF: Investing in American Bitcoin and promoting its listing, with Truth Social submitting a Bitcoin ETF application, attempting to replicate the MicroStrategy model.

This combination of "political IP + financial infrastructure + regulatory arbitrage" essentially transforms presidential influence into a crypto market manipulation tool. For example, Trump's sudden announcement of including Solana in "national strategic reserves" just before taking office in January 2025 directly caused a 15000% surge in related tokens.

Three-Tier Power Monetization Mechanism

- Primary Market Monopoly: Holding 80% of TRUMP tokens through shell companies, creating "hunger marketing" through unlock periods;

- Secondary Market Manipulation: Synchronizing policy signals with family member shilling, such as Eric Trump releasing positive news before adding ETH to WLFI;

- Regulatory Arbitrage: Revoking the crypto enforcement team from Biden's era, promoting the "Stablecoin Act" for USD1, while hindering competitor regulation.

This model has created nearly $16 billion in book gains but also planted systemic risks: if 80% of locked tokens are sold, it may trigger a market avalanche.

Family Internal Strife and External Conspiracy - A "Trojan War" of Crypto Power

Trump Wallet Controversy: The Fragility of Interest Alliances

This event exposed deep contradictions in the Trump camp:

- Magic Eden's "Riding the Wave" Dilemma: As a Non-Fungible Token platform, ME attempted to enter the trading market through Trump Wallet but was "de-centralized" by over-relying on Trump IP;

- Family Faction Struggle: The WLFI led by Donald Trump Jr. and the mining business of Eric Trump have resource competition, leading to split external communication;

- The Battle between "Official" and "Copycat": The Trump MEME team urgently needs to cash out, while WLFI needs to maintain "compliance", making their interests hard to reconcile.

This chaos stems from the Trump family using crypto business as a "political feudal" tool - different children manage different sectors, forming a divided landscape.

Geopolitical Capital Game: UAE, Binance, and Trump's "Iron Triangle"

Trump's crypto allies are not limited to his family:

- UAE Sovereign Fund MGX: Investing $2 billion in Binance through WLFI, promoting USD1 as a Middle Eastern capital entry to the US;

- Binance's "Indulgence": CZ seeks Trump's pardon, while WLFI provides a path to legalize political donations;

- Compliance Breakthroughs in Countries like Pakistan: WLFI uses "promoting crypto adoption" as a name to help US capital penetrate emerging markets.

This "political-capital-geopolitical" triangular alliance is reshaping the global crypto power structure.

The "Crypto Banana Republic" in a Regulatory Vacuum

Constitutional Crisis: President Becomes the "Ultimate Operator"

Trump's crypto strategy has touched legal red lines:

- Compensation Clause Violation: Hosting a White House dinner for TRUMP token holders, potentially receiving benefits covertly;

- Money Laundering Channel: 56% of TRUMP tokens circulate through overseas exchanges, avoiding KYC review;

- SEC Selective Law Enforcement: Suspending investigations on allies like Justin Sun, while accelerating attacks on competitors.

Democratic lawmakers point out that this "regulatory double standard" has turned the US financial system into a "Trump family hedge fund".

The Death of Crypto Idealism

Bitcoin's "decentralization" vision has been completely distorted under political power:

- Technological Instrumentalization: Blockchain becomes a "centralized ledger" for family wealth flow control;

- Community Consensus Collapse: 58 mysterious accounts profited $1.1 billion through insider trading, reducing retail investors to "fuel";

- Regulatory Ethics Collapse: SEC officials publicly declare "duty is to help the industry make money", abandoning a neutral stance.

As The Economist said: "When the president's son shills Ethereum on Twitter, the US is just one step away from Venezuelan-style corruption."

Future in the Eye of the Storm - Crypto Dollar or Dollar Crypto?

Trump's Ultimate Ambition

Family documents show the goal is to extend US dollar hegemony to the crypto field through USD1 stablecoin and Bitcoin ETF:

- USD1's "Digital Colonies": Using partners like UAE and Pakistan to build an alternative SWIFT settlement network;

- Truth Social's "Closed-Loop Ecosystem": Planning to embed TRUMP coin payment function, creating a "Conservative Crypto Economy";

- 2026 Midterm Election Chips: Converting crypto holders into voters, using token airdrops instead of traditional fundraising.

The Unavoidable "Moment of Reckoning"

Potential risks are accumulating:

- Legal Storm: New York court has accepted a class-action lawsuit by TRUMP coin investors, with claims exceeding $5 billion;

- Market Backlash: WLFI's $2 billion Binance investment faces collateral risks from CZ's case;

- Geopolitical Countermeasure: China and the EU may jointly restrict USD cross-border flow to prevent digital dollar monopoly.

This crisis will test a fundamental proposition: When crypto technology becomes a servant of power, is it the spark to subvert the old order or the shackle that consolidates privilege?

Conclusion: Trojan Horse Siege and Crypto "New Rome"

From the Trump Wallet farce to Truth Social's ETF ambitions, the Trump family is writing a "Crypto Monarch Theory". The irony of this experiment is: A populist leader who claims to be "anti-establishment" has transformed crypto technology into the most efficient tool of wealth centralization; a movement proclaiming "people's financial sovereignty" ultimately channeled 78% of profits to 0.2% of addresses. When Athenian citizens cheered for the gold in the Trojan horse, Troy's fall was already predetermined. The difference is that this Trojan horse doesn't hide Greek soldiers, but cryptocurrencies stamped with a presidential portrait. Perhaps this is the darkest metaphor of the crypto revolution:

"All great technological revolutions will ultimately be tamed by power, but Trump's madness lies in directly letting power sit at the table."