Author: Chi Anh, Ryan Yoon Source: Tiger Research Translation: Shan Ouba, Jinse Finance

TL;DR

Ethereum currently leads the RWA market, thanks to its first-mover advantage, past institutional experiments, deep on-chain liquidity, and decentralized architecture.

However, general-purpose blockchains with faster transactions and lower costs, as well as RWA-specific chains designed for compliance, are making up for Ethereum’s limitations in cost and performance. These emerging platforms are positioning themselves as next-generation infrastructure by offering superior technical scalability or built-in compliance features.

The next phase of RWA growth will be led by chains that successfully integrate three elements: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and meaningful on-chain liquidity.

1. Where is the RWA market currently developing?

The tokenization of real-world assets (RWA) has become one of the most prominent themes in the blockchain industry. Global consulting firms such as Boston Consulting Group (BCG) have released extensive market forecasts, and Tiger Research has conducted in-depth analysis of emerging markets such as Indonesia, highlighting the growing importance of the industry.

So, what exactly are risk-weighted assets (RWAs)? They refer to the conversion of tangible assets (such as real estate, bonds, and commodities) into digital tokens. This tokenization process requires blockchain infrastructure. Currently, Ethereum is the leading infrastructure to support such transactions.

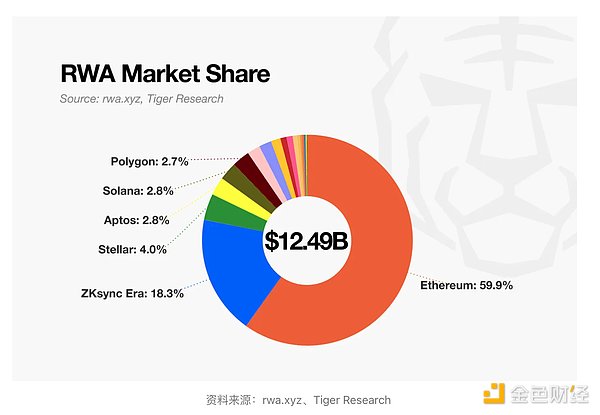

Despite growing competition, Ethereum continues to maintain its dominance in the risk asset management (RWA) market. Several dedicated RWA blockchains have emerged, and platforms like Solana, which have established themselves in the DeFi space, are also expanding into the RWA space. Even so, Ethereum still accounts for more than 50% of market activity, highlighting its solid market position.

This report examines the key factors that underpin Ethereum’s current dominance of the RWA market and explores the changing conditions that could impact the next phase of growth and competition.

2. Why does Ethereum remain ahead?

2.1. First-mover advantage and institutional trust

It’s easy to see why Ethereum has become the default platform for institutional tokenization. It was the first to introduce smart contracts and is actively preparing for the risk-weighted asset market.

Backed by a highly active developer community, Ethereum established key tokenization standards, such as ERC-1400 and ERC-3643, long before competing platforms emerged. This early foundation provided the necessary technical and regulatory foundation for pilot projects.

As a result, many institutions began evaluating Ethereum before considering alternatives. Some important moves in the late 2010s helped validate Ethereum’s position in institutional finance:

JPMorgan Chase’s Quorum and JPM Coin (2016-2017): To support enterprise use cases, JPMorgan Chase developed Quorum, a permissioned fork of Ethereum. The launch of JPM Coin for interbank transfers demonstrated that Ethereum’s architecture — even in its private form — could meet regulatory requirements for data protection and compliance.

Societe Generale Bond Issue (2019): Societe Generale FORGE issued a €100 million collateralized bond on the Ethereum public mainnet. This demonstrated that regulated securities can be issued and settled on a public blockchain while minimizing the involvement of intermediaries.

EIB Digital Bond (2021): The EIB, in partnership with Goldman Sachs, Santander and Societe Generale, issued a €100 million digital bond on Ethereum. The bond was settled using a central bank digital currency (CBDC) issued by the Bank of France, highlighting the potential of Ethereum in fully integrated capital markets.

These successful pilot cases strengthen Ethereum’s credibility. For institutions, trust is based on proven use cases and recommendations from other regulated players. Ethereum’s strong track record continues to attract interest and forms a reinforcing adoption cycle.

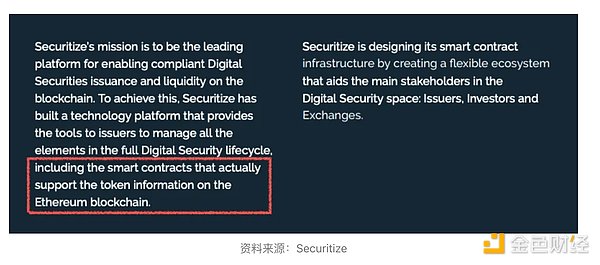

For example, in 2018, Securitize announced in an official document that it would build tools on Ethereum to manage the entire life cycle of digital securities. This move laid the foundation for BlackRock's eventual launch of BUIDL (the largest tokenized fund currently issued on Ethereum).

2.2. Platform for the flow of real capital

Another key reason for Ethereum’s continued dominance in the risk-weighted asset (RWA) market is its ability to convert on-chain liquidity into real purchasing power. Tokenizing real-world assets is more than just a technical process. A functioning market requires capital that can actively invest in and trade these assets. In this regard, Ethereum stands out as the only platform with deep and deployable on-chain liquidity.

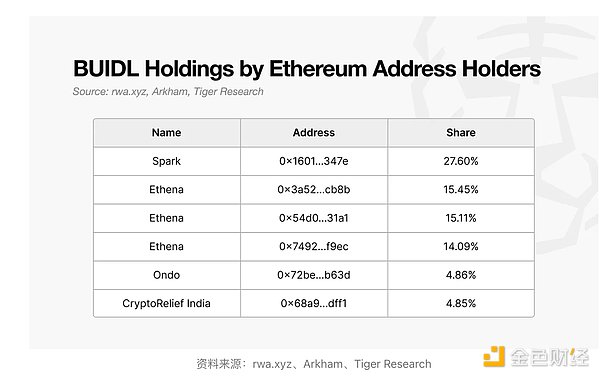

This is particularly evident on platforms like Ondo, Spark, and Ethena, which all hold large amounts of tokenized BUIDL funds on Ethereum. These platforms have attracted hundreds of millions of dollars by offering products based on tokenized US Treasuries, stablecoin-based lending, and synthetic yield-generating USD instruments.

Ondo Finance has accumulated a total value locked (TVL) of over $600 million through its treasury-backed products USDY and OUSG.

Spark Protocol leveraged MakerDAO’s DAI liquidity to purchase over $2.4 billion worth of real-world Treasuries.

Ethena has built a bank-free yield infrastructure on Ethereum with its synthetic stablecoins USDe and sUSDe, attracting institutional demand and DeFi liquidity.

These examples show that Ethereum is more than just a platform for tokenizing assets. It provides a strong liquidity foundation that supports real investment and asset management. In contrast, many emerging venture asset management platforms have struggled to secure capital inflows or secondary market activity after the initial token issuance.

The reason for this difference is obvious. Ethereum has integrated stablecoins, DeFi protocols, and compliant infrastructure. This creates a comprehensive financial environment where issuance, trading, and settlement can all be done on-chain.

Ethereum is therefore the most efficient environment for converting tokenized assets into actual purchasing activity. This gives it a structural advantage beyond simple market share.

2.3. Trust through decentralization

Decentralization plays a vital role in building trust. Tokenizing real-world assets requires transferring the ownership and transaction records of high-value assets to digital systems. In this process, institutions focus on the reliability and transparency of the system. This is where Ethereum's decentralized architecture has its unique advantages.

Ethereum is a public blockchain supported by thousands of independently operated nodes around the world. The network is open to everyone, and all changes are determined by consensus rather than centralized control. As a result, it is able to avoid single points of failure, ensure resistance to hacking and censorship, and maintain uninterrupted uptime.

In the risk-weighted asset (RWA) market, this structure creates tangible value. Transactions are recorded on an immutable ledger, reducing the risk of fraud. Smart contracts enable trustless transactions without intermediaries. Users can access services, enter into agreements, and participate in financial activities without centralized approval.

Features such as transparency, security, and accessibility make Ethereum an ideal choice for institutions exploring asset tokenization. Its decentralized system meets key requirements for operating in a high-risk financial environment.

3. Emerging challengers reshape the landscape

The Ethereum mainnet has proven the feasibility of tokenized finance. However, while it has been successful, it has also exposed some structural limitations that have hindered its wider institutional adoption. The main obstacles include limited transaction throughput, latency issues, and an unpredictable fee structure.

To address these challenges, Layer 2 Rollup solutions such as Arbitrum, Optimism, and Polygon zkEVM have emerged. Major upgrades including Merge (2022), Dencun (2024), and the upcoming Pectra (2025) have improved scalability. However, the network still cannot match traditional financial infrastructure. For example, Visa processes more than 65,000 transactions per second, while Ethereum has not yet reached this level. These performance gaps remain a critical constraint for institutions that require high-frequency trading or real-time settlement.

Latency and final confirmation also pose challenges. Block generation takes an average of 12 seconds, and with the additional confirmations required for secure settlement, final confirmation often takes up to three minutes. In the event of network congestion, latency can increase further, creating challenges for time-sensitive financial operations.

More importantly, the volatility of gas fees continues to be a concern. At peak times, transaction fees exceed $50, and even in normal times, fees often exceed $20. This fee uncertainty complicates business planning and can undermine the competitiveness of Ethereum-based services.

Securitize is a case in point. After running into the limitations of Ethereum, the company expanded to other platforms like Solana and Polygon, while also developing its own blockchain, Converage. While Ethereum played a crucial role in early institutional experiments, it now faces increasing pressure to meet the needs of a more mature, performance-sensitive market.

3.1. The rise of fast and cost-effective general-purpose blockchains

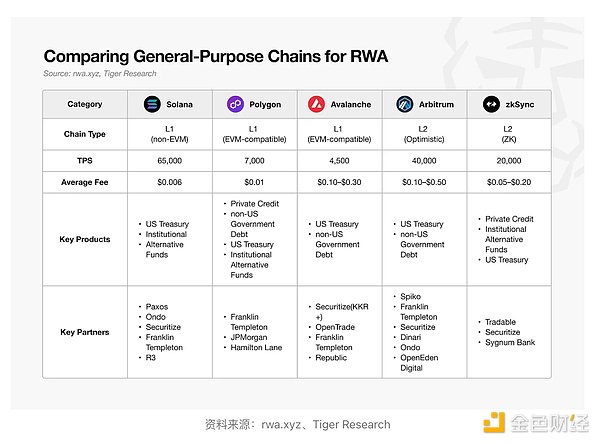

As the limitations of Ethereum become increasingly apparent, more and more institutions are exploring general-purpose blockchains that can replace Ethereum. These platforms can address key performance bottlenecks of Ethereum, especially in terms of transaction speed, fee stability, and finality time.

However, despite continued collaboration with institutional investors, the actual scale of tokenized assets (excluding stablecoins) on these platforms remains far lower than that of Ethereum. In many cases, tokenized assets launched on general-purpose chains are still part of a multi-chain deployment strategy dominated by Ethereum.

Even so, there are some signs of meaningful progress. In the private credit space, new tokenization initiatives are emerging. On zkSync, for example, the Tradable platform has gained traction, accounting for more than 18% of activity in the space, second only to Ethereum.

At this stage, general-purpose blockchains are only beginning to gain a foothold. Platforms like Solana, whose DeFi ecosystem has achieved rapid growth, now face a strategic question: how to convert this momentum into a sustainable position in the RWA space. It is not enough to simply have superior technical performance. Competing with Ethereum requires infrastructure and services that meet the trust and compliance expectations of institutional investors.

Ultimately, the success of these blockchains in the RWA market will depend less on raw throughput and more on their ability to deliver tangible value. The differentiated ecosystems built around each chain’s unique strengths will determine their long-term positioning in this emerging space.

3.2. The emergence of RWA-specific blockchain

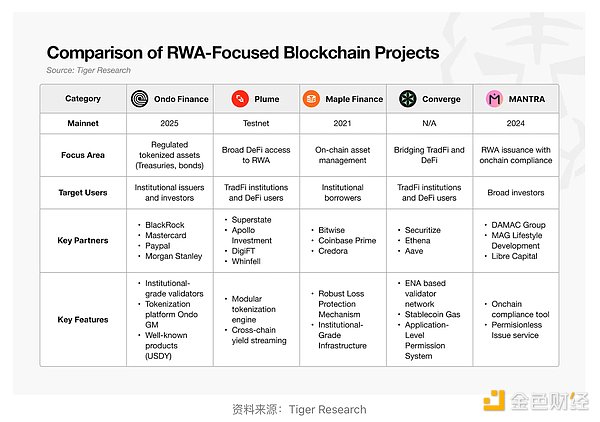

More and more blockchain platforms are abandoning general-purpose designs and focusing on specific areas. This trend is also evident in the RWA space, where a new wave of specialized chains are emerging that are optimized specifically for the tokenization of real-world assets.

The idea behind RWA’s purpose-built blockchain is clear. Tokenizing real-world assets requires direct integration with existing financial regulations, which in many cases makes it difficult to use general-purpose blockchain infrastructure. Specialized technical requirements must be fundamentally addressed, especially in terms of regulatory compliance.

Compliance processing is a key area. KYC and AML procedures are essential to the tokenization workflow, but these procedures are traditionally handled off-chain. This approach limits innovation because it simply wraps traditional financial assets in a blockchain format without redesigning the underlying compliance logic.

The shift now is to move these compliance functions entirely on-chain. There is a growing demand for blockchain networks that can not only record ownership but also natively enforce regulatory requirements at the protocol level.

In response, some RWA-focused blockchains have begun to offer on-chain compliance modules. For example, MANTRA includes decentralized identity (DID) functionality to support compliance enforcement at the infrastructure layer. Other specialized blockchains are expected to take similar initiatives.

In addition to compliance, many of these platforms target specific asset classes with deep domain expertise. Maple Finance focuses on institutional lending and asset management, Centrifuge focuses on trade finance, and Polymesh focuses on regulated securities. Rather than tokenizing widely held assets such as sovereign bonds or stablecoins, these blockchains use vertical specialization as a competitive strategy.

Still, many of these platforms are in their early stages. Some have yet to launch mainnet, and most are still limited in scale and adoption. If general-purpose chains are just beginning to gain traction in the RWA space, specialized chains are still at the starting line.

4. Who will lead the next phase?

Ethereum’s dominance of the risk-weighted asset (RWA) market is unlikely to remain the same. Currently, the tokenized asset market is less than 2% of its expected potential, indicating that the industry is still in its early stages. Ethereum’s dominance to date stems largely from its early discovery of product-market fit (PMF). However, as the market matures and scales, the competitive landscape is expected to change significantly.

Signs of this shift are already visible. Institutions are no longer focused on Ethereum alone. Both general-purpose blockchains and RWA-specific blockchains are being evaluated, and more and more services are exploring custom chain deployments. Tokenized assets originally issued on Ethereum are now expanding to a multi-chain ecosystem, breaking the previous monopoly.

A key turning point will be the use of on-chain compliance. For blockchain finance to truly embody innovation, regulatory processes such as KYC and AML must be conducted directly on the chain. If professional chains can successfully provide scalable protocol-level compliance and drive industry-wide adoption, the current market landscape may be completely overturned.

Equally important is the existence of actual purchasing power. Tokenized assets are only worth investing in if there is active capital willing to buy them. Regardless of the technology used, the utility of tokenization is limited without effective liquidity. Therefore, the next generation of RWA platforms must build a strong service ecosystem based on tokenized assets and ensure that users have strong liquidity participation.

In short, the conditions for success are becoming increasingly clear. The next leading RWA platform will likely be able to achieve the following three goals simultaneously:

Fully integrated on-chain compliance framework

A service ecosystem built on tokenized assets

Deep and sustainable liquidity facilitates real investment

The RWA market is still in its infancy. Ethereum has proven the concept. Now, the opportunity lies with platforms that can provide superior solutions - those that can both meet institutional needs and unlock new value in the tokenized economy.