Author: Sumanth Neppalli, author of Decentralised.co; Translation: Jinse Finance xiaozou

In July 1944, representatives from 44 Allied nations gathered in the rural ski town of Bretton Woods, New Hampshire, to redesign the global monetary system. They pegged their currencies to the dollar, which the United States would peg to gold. The system, designed by British economist John Maynard Keynes, ushered in an era of stable exchange rates and frictionless trade.

Let’s imagine that summit as a GitHub project: the White House forked the codebase, the Treasury Secretary submitted a pull request, and the finance ministers quickly clicked merge, hard-coding the dollar into every future trade cycle. Stablecoins are that merge commit for today’s digital age — while the rest of the world is still debugging its own codebase, trying to build a future without the dollar.

Within 72 hours of returning to the Oval Office, Trump signed an executive order containing a directive that sounds more like Crypto Twitter (CT) fan fiction than fiscal policy: “ Promote and protect the sovereignty of the dollar, including through globally legal, dollar-backed stablecoins. ”

Congress subsequently introduced the GENIUS Act (Guidance and Establishment of a National Innovation for Stablecoins in the United States Act) - the first bill to set ground rules for a stablecoin framework and encourage the use of stablecoins for payments around the world.

The bill has been debated and sent to the Senate for review, and may be voted on this month. Staff believe that the Democratic Alliance's suggestions have been incorporated into the latest draft and the bill is likely to pass.

But why is Washington suddenly so fond of stablecoins? Is this just a political show, or is there a deeper strategic layout behind it?

1. Why overseas demand is still crucial

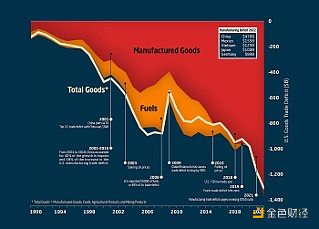

Since the 1990s, the United States has outsourced manufacturing to China, Japan, Germany and the Gulf countries, and each batch of imported goods has been paid for with newly issued US dollars. As imports have long exceeded exports, the United States continues to maintain a huge trade deficit. The trade deficit is the difference between a country's total imports and total exports.

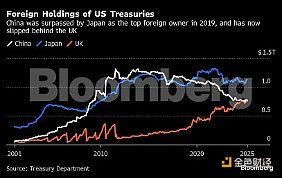

These dollars put exporting countries in a dilemma: if they convert dollars into their own currencies, the exchange rate will rise, weakening the competitiveness of their products and damaging their own exports. Therefore, central banks choose to absorb dollars and switch to U.S. Treasury bonds to realize the circulation of funds without disrupting the foreign exchange market. This move can not only obtain the income of Treasury bonds, but its credit risk is almost the same as holding idle dollars.

This mechanism forms a self-reinforcing cycle: export to the United States to earn dollars → invest in U.S. bonds to earn interest → maintain the weakness of the local currency to continue to expand exports. This "supplier financing cycle" formed with exporting countries contributes about a quarter of the U.S.'s $36 trillion debt, locking in key advantages. If this cycle is broken through a long-term trade war, the cheapest financing channel for the United States will gradually dry up.

Deficit financing mechanism: US government spending continues to exceed tax revenue, resulting in a structural budget deficit. The deficit pressure is shared by selling Treasury bonds overseas: short-term Treasury bonds mature within 1 year, and long-term Treasury bonds have a maturity of 20-30 years.

Low interest rate effect: High demand for government bonds drives down yields (interest rates). When major buyers such as China push up government bond prices, yields fall, which in turn reduces financing costs for governments, businesses, and consumers. This low cost of funding both sustains economic growth and supports expansionary fiscal policy.

The cornerstone of the dollar's hegemony: The dollar's status as a reserve currency depends on global confidence in U.S. assets. Foreign holdings of U.S. debt symbolize trust in the U.S. economy, ensuring that the dollar maintains its dominance in international trade, oil pricing, and foreign exchange reserves. This privilege enables the United States to raise funds at extremely low costs and exert economic influence around the world.

Without this demand, the United States will face soaring financing costs, a depreciating dollar exchange rate, and declining geopolitical influence. The crisis warning has already appeared. When Warren Buffett left office, he admitted that he was most worried about the imminent dollar crisis. For the first time in a century, the United States lost its AAA credit rating from the three major rating agencies - this is the "gold certification" in the bond market, which means that the debt safety level has reached its peak. After the downgrade, the U.S. Treasury has to raise yields to attract buyers. As the national debt continues to soar, interest expenses will also rise.

If traditional buyers start to withdraw from the Treasury market, who will absorb the trillions of dollars of newly issued debt? Washington is betting that regulated, fully-reserve stablecoins will open up new channels. The GENIUS Act forces stablecoin issuers to buy short-term Treasury bonds, which explains why the government is embracing digital dollars while taking a tough stance on trade.

2. Enlightenment from the Eurodollar System

Such financial innovations are not new to the United States. The $1.7 trillion Eurodollar system has also gone through a journey from total resistance to total acceptance. Eurodollars refer to U.S. dollar deposits held in overseas banks (mainly in Europe) that are not subject to U.S. banking regulations.

Eurodollars were born in the 1950s when the Soviet Union deposited dollars in European banks to circumvent US jurisdiction. By 1970, the market size had reached $50 billion, a fifty-fold increase in ten years. The United States was initially skeptical, and French Finance Minister Giscard d'Estaing once called it a "Hydra monster." After the 1973 oil crisis, when OPEC's actions quadrupled global oil trade in a few months, these concerns were temporarily shelved - the world needed the dollar as a stable medium of trade.

The Eurodollar system strengthened the United States’ ability to project influence without force. It continued to expand as international trade and the Bretton Woods system solidified the dollar’s hegemony. Although Eurodollars were only used for payments between foreign entities, all transactions were settled through U.S. banks via a global network of correspondent banks.

This creates a powerful lever for U.S. national security goals: Officials can not only block transactions within the United States, but also kick bad actors out of the global dollar system. Because the United States acts as a clearinghouse, it can track money flows and impose financial sanctions on countries.

3. Stablecoin: Digital upgrade of the US dollar

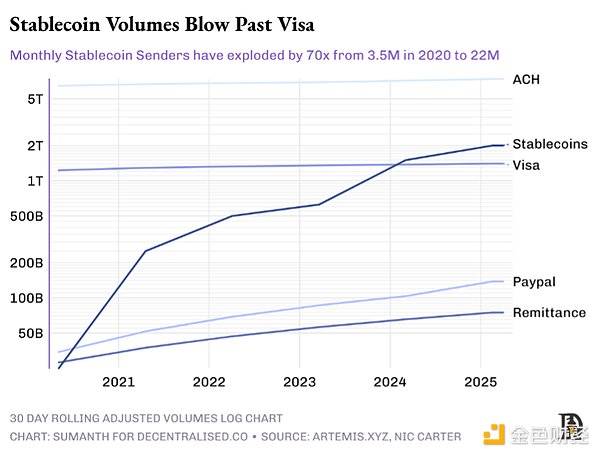

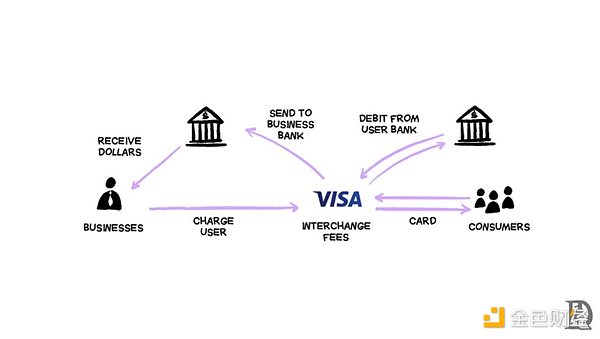

Stablecoins are modern Eurodollars with public blockchain explorers. Instead of being stored in a London vault, dollars are "tokenized" on the blockchain. This convenience brings real scale: $15 trillion in on-chain dollar token settlements in 2024, slightly more than the Visa network. Of the $245 billion in stablecoins currently in circulation, 90% are fully collateralized USD stablecoins.

Demand for stablecoins is growing as investors look to lock in returns and hedge against cyclical market fluctuations. Unlike the wild market cycles of cryptocurrencies, stablecoin activity continues to grow, suggesting that their use cases extend far beyond trading.

The earliest demand arose in 2014, when Chinese cryptocurrency exchanges needed a non-bank USD settlement solution. They chose Realcoin (later renamed Tether), a USD token based on the Bitcoin Omni protocol. Tether initially connected its fiat currency channel through the Taiwanese banking network until Wells Fargo terminated its correspondent banking relationship with these banks due to regulatory pressure. In 2021, the U.S. Commodity Futures Trading Commission (CFTC) fined Tether $41 million for false reporting of reserves, accusing it of not fully collateralizing its tokens.

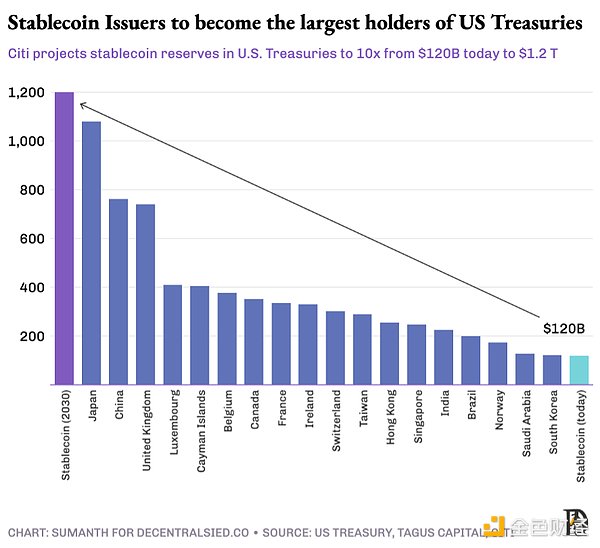

Tether's operating model is a classic banking method: absorb deposits → invest in float → earn interest rate spreads. It converts about 80% of its issued reserves into U.S. Treasury bonds. With a 5% short-term Treasury bond yield, the annual income of $120 billion holdings can reach $6 billion. In 2024, Tether achieved a net profit of $13 billion, while Goldman Sachs' net profit was $14.28 billion during the same period - but the former has only 100 employees (earning $130 million per person), while the latter has 46,000 employees (earning $310,000 per person).

Competitors try to build trust through transparency. Circle publishes monthly audit reports on USDC, detailing minting and redemption records. Even so, the industry still relies on the credit endorsement of the issuer. In March 2023, Silicon Valley Bank collapsed, trapping Circle's $3.3 billion reserves. USDC once fell to $0.88 until the Federal Reserve intervened to back it up.

Washington is working to establish a system of rules. The GENIUS Act explicitly requires:

100% of the reserves must be high-quality liquid assets (HQLA) such as government bonds/reverse repurchase agreements;

Real-time audit verification through permissioned oracles;

Regulatory interface: issuer-level freezing function, FATF rule compliance;

Compliant stablecoins can obtain liquidity support from the Federal Reserve’s main account and reverse repurchase.

A graphic designer in Berlin can now hold dollars without a US account, German bank or SWIFT documents - a Gmail account plus a KYC selfie will do, as long as Europe does not force the digital euro. Money is flowing from bank ledgers to wallet apps, and the companies that control these apps will be like global banks without branches.

If the bill comes into effect, existing issuers will face a choice: either register in the U.S. and accept quarterly audits, anti-money laundering reviews and proof of reserves, or watch U.S. trading platforms switch to compliant tokens. Circle, which has placed most of its USDC collateral in SEC-regulated money funds, is clearly in a more advantageous position.

But Circle will not have this blue ocean to itself. Tech giants and Wall Street have every reason to join the game - imagine Apple Pay launching "iDollars": you can earn income by recharging $1,000 and spend it in all scenarios that support contactless payment. The yield on idle funds far exceeds the existing card swipe fees, while completely bypassing traditional middlemen. This may be the reason why Apple terminated its cooperation with Goldman Sachs credit card: when payments are completed in the form of on-chain dollars, the original 3% transaction fee will be reduced to a blockchain network fee calculated by cents.

Large banks such as Bank of America, Citigroup, JPMorgan Chase and Wells Fargo have begun exploring the joint issuance of stablecoins. The GENIUS Act prohibits issuers from distributing interest income to users, which has relieved the banking lobby. This model essentially becomes a super cheap checking account: instant, global and never interrupted.

It is not surprising that traditional payment giants are rushing to make their presence felt: Mastercard and Visa have launched stablecoin settlement networks, PayPal has issued its own stablecoin, and Stripe has completed its largest crypto acquisition to date (acquisition of Bridge) this year. They are well aware that change is coming.

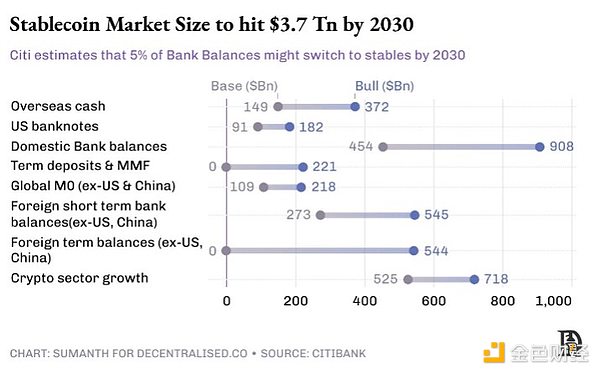

Washington is also well aware of this. Citigroup predicts that under the baseline scenario, the size of the stablecoin market will increase sixfold to $1.6 trillion by 2030. A study by the U.S. Treasury Department shows that the figure may exceed $2 trillion in 2028. If the GENIUS Act requires that 80% of reserves be allocated to Treasury bonds, the "stable dollar" will replace China and Japan as the largest holder of U.S. debt.

4. Queueing up assets for on-chain

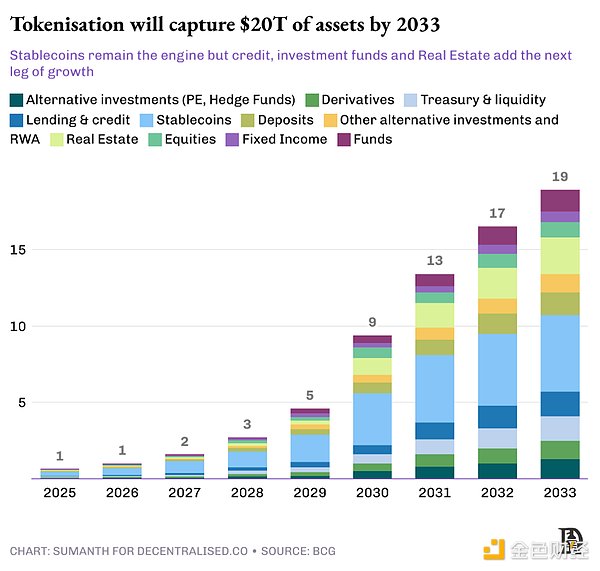

As "US dollar stablecoins" become popular, they will become the liquidity that drives the entire token economy. Once cash is tokenized, people will perform regular off-chain operations at the speed of the Internet (not the speed of banks): savings, loans, and mortgages. These endless liquidity will continue to look for the next tokenization target, introducing more "real world assets" (RWA) into the blockchain and giving them the same advantages.

24/7 settlement : Traditional T+2 settlement cycles will become obsolete, with blockchain validators able to confirm transactions in minutes rather than days. For example, a Singaporean trader could buy a tokenized New York apartment at 6pm local time and get confirmation of ownership before dinner.

Programmability : Smart contracts embed behavioral logic directly into assets. This makes complex financial operations possible: coupon payments, distribution rights, and asset-level compliance parameter settings can all be automatically executed.

Composability : Tokenized treasury bonds can be used as collateral for loans and the interest income can be automatically distributed among multiple holders. An expensive beach house can be split into 50 shares and rented out to a hotel operator who manages bookings through Airbnb.

Transparency : The 2008 financial crisis was partly due to the opacity of the derivatives market. Regulators can now monitor on-chain collateralization rates, track systemic risks, and observe market dynamics in real time without having to wait for quarterly reports.

The main obstacle is regulation. The protection mechanisms of traditional exchanges are the result of painful lessons, and investors know what kind of protection they can get. Take the "Black Monday" in 1987 as an example: the Dow Jones Industrial Average plummeted 22% in a single day, just because the price fluctuations triggered the program to automatically sell, which triggered a chain reaction. The SEC's solution is the circuit breaker mechanism - suspending trading to allow investors to reassess the situation. Today, the New York Stock Exchange stipulates that trading will be suspended for 15 minutes if the decline reaches 7%.

Asset tokenization is not technically difficult. The issuer only needs to guarantee the rights and interests of the real assets corresponding to the token. The real challenge lies in ensuring that the underlying system can implement all offline applicable rules: this includes wallet-level whitelists, national identity verification, cross-border KYC/AML, citizen holding limits, real-time sanctions screening and other functions that must be written into the code.

The European Crypto-Asset Market Regulation Act (MiCA) provides a complete regulatory framework for digital assets, and Singapore's Payment Services Act is the starting point for Asia. However, the global regulatory landscape is still fragmented.

This process will almost certainly proceed in waves. The first phase will prioritize the on-chain of highly liquid, low-risk financial instruments, such as money market funds and short-term corporate bonds. The operational benefits of instant settlement are immediate, and the compliance process is relatively simple.

The second phase will move to the high end of the risk-return curve, covering high-yield products such as private credit, structured financial products and long-term bonds. The value of this phase lies not only in improving efficiency, but also in releasing liquidity and composability.

The third phase will achieve a qualitative leap and expand to illiquid asset classes: private equity, hedge funds, infrastructure and real estate mortgage debt. To achieve this goal, it is necessary to achieve universal recognition of tokenized assets as collateral and build a cross-industry technology stack that can serve these assets. Banks and financial institutions need to custody these real-world assets (RWA) as collateral while providing credit.

Although the pace of on-chain development varies for different asset classes, the direction of development is clear. Each wave of new "stable dollar" liquidity is pushing the token economy to a higher stage.

(1) Stablecoin landscape

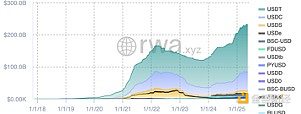

The market for dollar-pegged tokens is a duopoly, with Tether (USDT) and Circle (USDC) accounting for 82% of the market share. Both are fiat-collateralized stablecoins - the euro stablecoin operates on the same principle, backing each token in circulation by storing euros in banks.

In addition to the fiat currency model, developers are exploring two experimental solutions to achieve decentralized anchoring without relying on off-chain custodians:

Crypto-asset collateralized stablecoins: use other cryptocurrencies as reserves, usually over-collateralized to protect against price fluctuations. MakerDAO is the flagship in this field, having issued $6 billion in DAI. After the bear market in 2022, Maker quietly converted more than half of its collateral into tokenized treasury bonds and short-term bonds, which not only smoothed ETH volatility but also generated returns. Currently, this part of the configuration contributes about 50% of the protocol's revenue.

Algorithmic stablecoins: These stablecoins do not rely on any collateral, but are anchored through an algorithmic minting-destruction mechanism. Terra's stablecoin UST once had a market value of $20 billion, but a run was triggered by a collapse in confidence during the depegging incident. Although new projects such as Ethena have achieved a scale of $5 billion through innovative models, it will still take time for this field to gain widespread recognition.

If Washington only grants "qualified stablecoins" certification to fully fiat-collateralized stablecoins, other types may be forced to abandon the "dollar" logo in their names to comply with regulations. The fate of algorithmic stablecoins is still unclear - the GENIUS Act requires the Treasury Department to conduct a one-year study on these protocols before making a final decision.

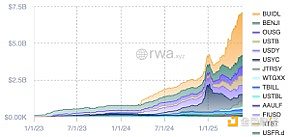

(2) Money market instruments

Money market instruments include highly liquid short-term assets such as government bonds, cash and repurchase agreements. On-chain funds are "tokenized" by encapsulating ownership rights into ERC-20 or SPL tokens. This vehicle supports 24/7 redemption, automatic profit distribution, seamless payment docking and convenient collateral management.

Asset managers retain the original compliance framework (anti-money laundering/identity verification, qualified investor restrictions), but settlement times are reduced from days to minutes.

BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) is a market leader. The institution appointed SEC-registered transfer agent Securitize to handle KYC onboarding, token minting/destruction, FATCA/CRS tax compliance reporting and shareholder register maintenance. Investors need at least $5 million in investable assets to qualify, but once on the whitelist, they can subscribe, redeem or transfer tokens around the clock - a flexibility that traditional money market funds cannot provide.

BUIDL's asset management scale has grown to approximately $2.5 billion, distributed among more than 70 whitelist holders on 5 blockchains. About 80% of the funds are allocated to short-term treasury bills (mainly 1-3 months), 10% are invested in longer-term treasury bonds, and the rest are maintained in cash positions.

Products such as Ondo (OUSG) operate as investment management pools, allocating funds to tokenized money market fund portfolios from institutions such as BlackRock, Franklin Templeton, and WisdomTree, and providing free access to stablecoins.

Although the scale of $10 billion is insignificant compared to the $26 trillion Treasury bond market, its symbolic significance is extremely significant: Wall Street's top asset management institutions are choosing public chains as distribution channels.

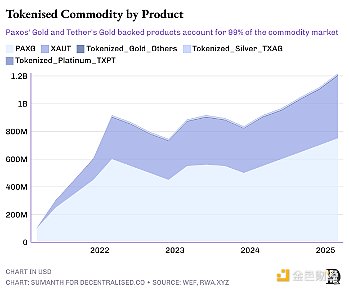

(3) Commodities

The tokenization of hard assets is driving these markets to transform into 24/7, click-and-trade platforms. Paxos Gold (PAXG) and Tether Gold (XAUT) allow anyone to buy a tokenized share of a gold bar; 1 PETRO in Venezuela is pegged to 1 barrel of crude oil; and small pilot projects have linked token supplies to soybeans, corn, and even carbon credits.

The current model still relies on traditional infrastructure: gold bars are stored in vaults, crude oil is stored in tank farms, and auditors sign off on monthly reserve reports. This custody bottleneck creates concentration risk, and physical redemption is often difficult to achieve.

Tokenization not only realizes the division of asset ownership, but also makes traditional illiquid physical assets easy to mortgage financing. The scale of this field has reached 145 billion US dollars (almost all of which is backed by gold). Compared with the scale of the physical gold market of 5 trillion US dollars, the development space is self-evident.

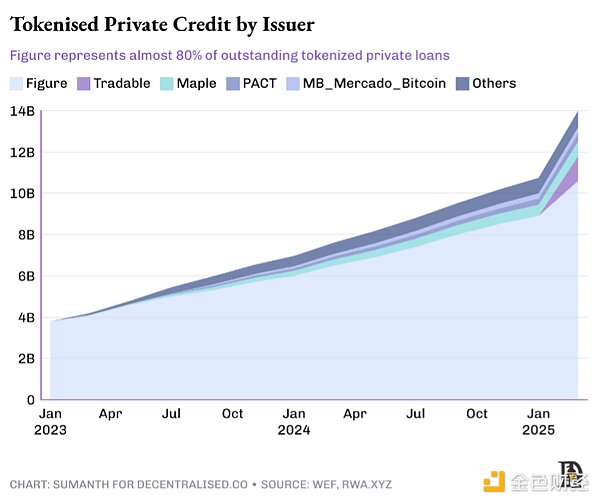

(4) Loans and Credit

DeFi lending initially appeared in the form of over-collateralized cryptocurrency loans. Users pledged $150 worth of ETH or BTC to borrow $100, and the operating model was similar to gold mortgage loans. Such users want to hold digital assets for a long time to bet on appreciation, and at the same time need liquidity to pay bills or open new positions. Currently, the Aave platform has a lending scale of approximately $17 billion, accounting for nearly 65% of the DeFi lending market.

The traditional credit market is dominated by banks, which underwrite risks through decades of proven risk models and strictly regulated capital buffers. As an emerging asset class, private credit has developed in parallel with traditional credit to a global management scale of US$3 trillion. Companies no longer rely solely on banks, but instead raise funds by issuing high-risk, high-yield loans, which is attractive to institutional lenders such as private equity funds and asset management institutions that seek higher returns.

Bringing this area on-chain can expand the group of lenders and improve transparency. Smart contracts can automate the entire loan cycle: fund disbursement, interest collection, while ensuring that liquidation triggers are clearly visible on-chain.

Two models of on-chain private lending:

" Retailized " direct lending : Platforms such as Figure tokenize home improvement loans and sell split notes to yield-seeking wallets around the world, creating a debt version of Kickstarter. Homeowners get lower financing costs by splitting their loans into small portions, retail depositors receive monthly coupons, and the protocol automatically handles the repayment process.

Pyse and Glow package solar projects, tokenize power purchase agreements, and handle the entire process from panel installation to meter reading. Investors can just sit back and enjoy the benefits, earning an annualized return of 15-20% directly on their monthly electricity bills.

Institutional liquidity pools: Private credit desks are presented in an on-chain transparent form. Protocols such as Maple, Goldfinch, and Centrifuge package borrower demand into on-chain credit pools managed by professional underwriters. Depositors are mainly qualified investors, DAOs, and family offices, who can earn floating returns (7-12%) and track asset performance on a public ledger.

These protocols are committed to reducing operating costs, allowing underwriters to conduct due diligence on the chain and complete loan disbursement within 24 hours. Qiro adopts an underwriter network model, where each underwriter uses an independent credit model and receives corresponding rewards for analysis work. Due to the high risk of default, the growth rate of this field is not as fast as mortgage loans. When a default occurs, the protocol cannot use traditional collection methods such as court orders, and must rely on traditional collection agencies, resulting in higher disposal costs.

As underwriters, auditors, and collection agencies continue to move to the chain, market operating costs will continue to decline, and the lender funding pool will be greatly deepened.

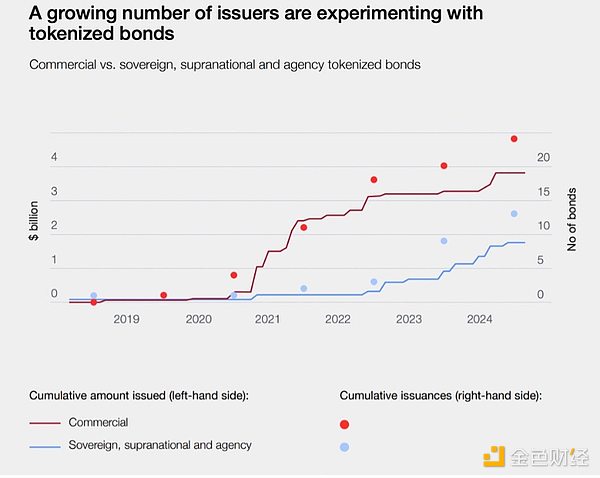

(5) Tokenized bonds

Bonds and loans are both debt instruments, but they differ in structure, standardization, and the way they are issued and traded. Loans are one-to-one agreements, while bonds are one-to-many financing instruments. Bonds are fixed formats - for example, a 5% coupon with a 10-year term are easier to rate and trade in the secondary market. As public instruments subject to market regulation, bonds are usually rated by agencies such as Moody's.

Bonds are often used to meet large, long-term capital needs. Governments, utilities and blue-chip companies issue bonds to finance budgets, build factories or obtain bridge loans. Investors receive interest at regular intervals and receive their principal back at maturity. The size of this asset class is staggering: its nominal value is about $140 trillion by 2023, equivalent to 1.5 times the total market value of global stocks.

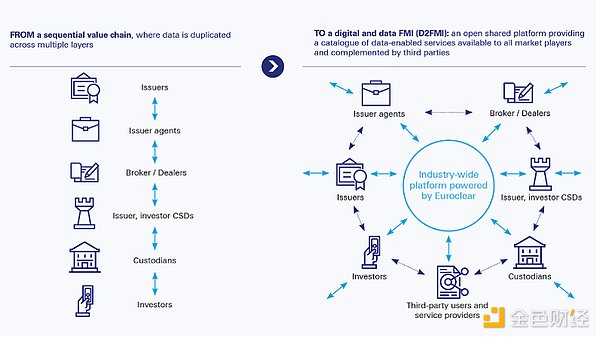

The current market still runs on an outdated infrastructure designed in the 1970s. Clearing institutions such as Euroclear and the Depository Trust & Clearing Corporation (DTCC) need to be transferred through multiple custodians, resulting in transaction delays and a T+2 settlement system. Smart contract bonds can achieve atomic settlement in seconds, automatically pay dividends to thousands of wallets at the same time, have built-in compliance logic, and can access global liquidity pools.

Each bond issuance can save 40-60 basis points in operating costs, and treasurers can also get a 24-hour secondary market without paying exchange listing fees. As Europe's core settlement and custody channel, Euroclear custody 40 trillion euros of assets and connects more than 2,000 institutions to 50 markets. The agency is developing a blockchain-based issuer-broker-custodian settlement platform to eliminate duplication, reduce risks, and provide customers with real-time digital workflows.

Companies such as Siemens and UBS have issued on-chain bonds as part of the European Central Bank’s pilot projects. The Japanese government is also working with Nomura Securities to test a bond on-chain solution.

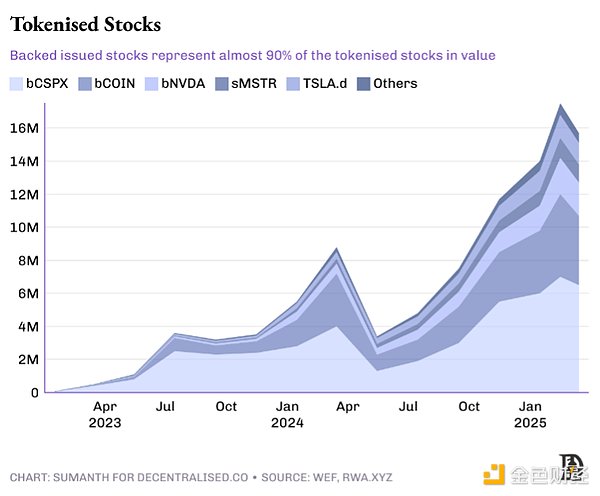

(6) Stock Market

This area naturally has development potential - the stock market itself already has a large number of retail investors participating, and tokenization can create an "Internet capital market" that operates around the clock.

Regulatory barriers are the main bottleneck. The current custody and settlement rules of the U.S. Securities and Exchange Commission (SEC) were formulated in the pre-blockchain era and require intermediaries to participate and maintain a T+2 settlement cycle.

This situation is beginning to loosen. Solana has applied to the SEC for approval of an on-chain stock issuance plan that includes KYC verification, investor education processes, broker custody requirements, and instant settlement functions. Robinhood followed suit and filed an application, advocating that tokens representing U.S. Treasury bond stripping certificates or Tesla single shares be considered securities themselves, rather than synthetic derivatives.

Overseas market demand is even stronger. Thanks to loose regulations, foreign investors already hold about $19 trillion in U.S. stocks. The traditional path is to invest through local brokers such as eTrade (which need to cooperate with U.S. financial institutions and pay high foreign exchange spreads). Startups such as Backed are offering an alternative - synthetic assets. Backed has completed $16 million in business by purchasing equivalent underlying stocks in the U.S. market. Kraken recently partnered with it to provide U.S. stock trading services to non-U.S. traders.

(7) Real estate and alternative assets

Real estate is the asset class most constrained by paper certificates. Every title deed is stored in a government registry, and every mortgage document is sealed in a bank vault. Until registries accept hash values as legal proof of ownership, large-scale tokenization is difficult to achieve. Currently, only about $2 billion of the world's $400 trillion in real estate is on the blockchain.

The UAE is one of the regions leading the change, with real estate deeds worth $3 billion already registered on the chain. In the US market, real estate technology companies such as RealT and Lofty AI have tokenized more than $100 million in residential assets, with rental income flowing directly to digital wallets.

5. Capital is eager to flow

Cypherpunks see "dollar stablecoins" as a step back toward bank custody and permissioned whitelists, while regulators are reluctant to accept permissionless channels that can transfer billions of dollars in a single block. But the reality is that real adoption is born precisely at the intersection of these two " uncomfortable zones . "

Crypto purists will still complain, just as early Internet purists hated TLS certificates issued by centralized institutions. But it was HTTPS technology that allowed our parents to use online banking safely. Similarly, US dollar stablecoins and tokenized treasuries may seem "not pure enough", but they will be the first silent way for billions of people to get in touch with blockchain - through an application that never mentions the word "cryptocurrency".

The Bretton Woods system locked the world into a single currency, but blockchain frees money from the shackles of time. Every asset on the chain can shorten settlement time, free up collateral that sits dormant in clearing houses, and allow the same dollar to guarantee three transactions before lunch.

We keep coming back to the same core idea: the velocity of money will eventually become the killer application scenario for crypto, and real-world assets on-chain fits this theme. The faster the value is settled, the more frequently funds are redeployed, and the bigger the market pie will be. When dollars, debt, and data all flow at network speeds, the business model will no longer be about transfer fees, but about profiting from liquidity potential.