Bitcoin and Ethereum Market Analysis on 6.4: BTC, ETH Highlights Today

Market Review

Yesterday, BTC continued consolidation, with a slight increase in the evening, maintaining an oscillating upward trend on the 4-hour level, with the daily top divergence repair nearly complete, and the weekly trend remaining healthy. Focus on fundamental information, the Federal Reserve's interest rate cut process, and observe the stability at 105,000 today, considering gradual entry. On the larger cycle, the weekly golden cross has formed, potentially launching a new market trend

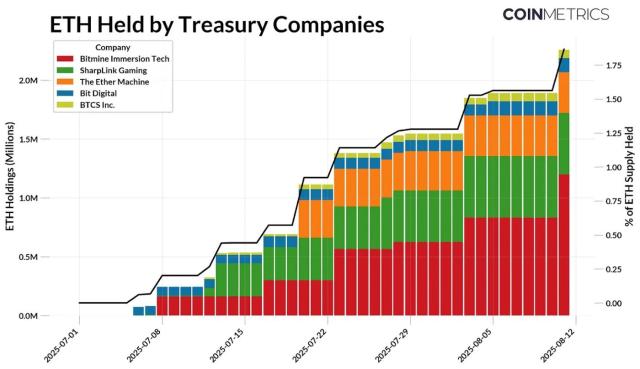

The secondary market followed BTC's consolidation, maintaining a healthy 4-hour trend, with the daily downward momentum also decreasing. It is expected to continue rising today, and can be followed after stabilization

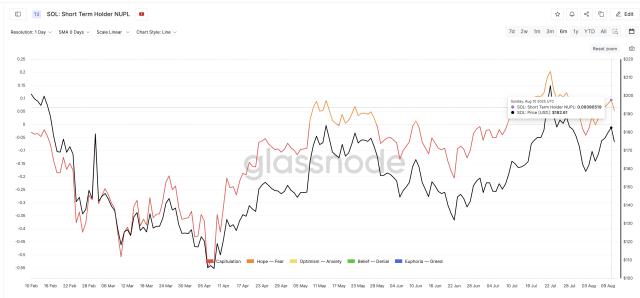

Altcoins synchronized consolidation with mainstream coins, with market sentiment still low. The altcoin index has again pulled back to a lower level. After mainstream coins stabilize, consider following, paying attention to meme, ETH track coins. With frequent Binance activities, ongoing Alpha point events can be utilized while waiting for the next activity. SOL's on-chain activity continues to rise, with more focus on MEME coins recommended

Today's Highlights:

BTC returns to a healthy range on 1-hour and 4-hour levels, with the daily level also returning to a healthy range. Expected to continue rising if stabilized during the day, with lower support at 105,200-105,700 and upper resistance at 107,000-107,500

ETH returns to a healthy range on 1-hour and 4-hour levels, with the daily level also returning to a healthy range. Expected to continue rising today, with lower support at 2,520-2,570 and upper resistance at 2,700-2,750