The market is extremely dull, and Bitcoin's trend seems dangerous, approaching the 7-day and 30-day moving average crossover point. If it breaks down, support may look towards 93,000, and the overall trend is quite similar to 2021.

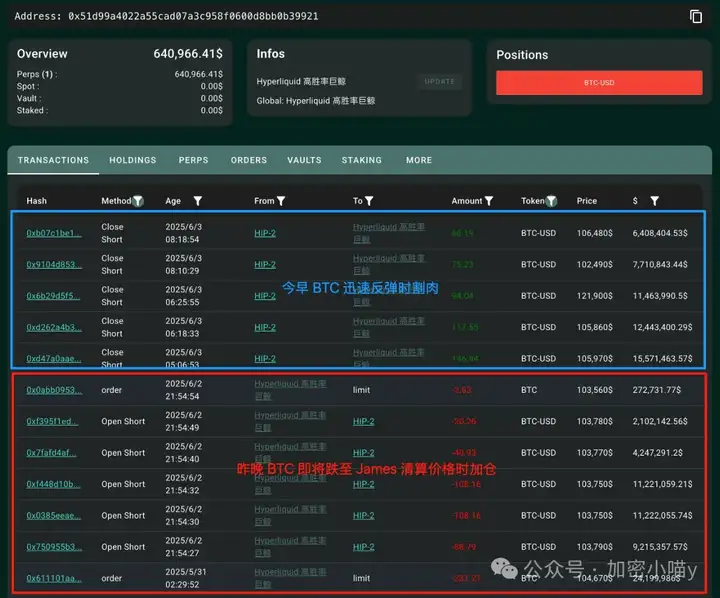

Relatively, $ETH's performance remains robust. Since the ETF passed last year, $BTC and $ETH's correlation has significantly weakened, and most Altcoins are based on the EVM ecosystem, so referencing $ETH is more representative. Among Altcoins, only a few like LPT and #COOKIE perform well, while most are stagnant. The biggest "fun" each day is watching James being besieged.

A trillion-dollar market can't even accommodate someone firmly longing BTC. The final outcome may be hard to escape "cooling down" - which is why I've always advised everyone to stay away from contracts. No matter how skilled, you're just slowing down the path to zero. Unless you're willing to pay enough tuition or are a one-in-ten-thousand expert. Instead of struggling, it's better to hold onto core projects in AI, MEME, and ETH ecosystems, learn from Li Xiaolai to "be friends with time", and wait for trends, interest rate cuts, and the next move of the "dog market".

Bitcoin's "deadly June" is back! Has Wall Street really big trouble this time?

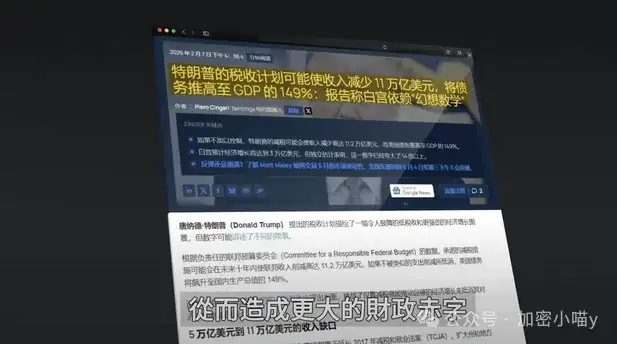

The tariff policy triggered by Trump's victory last year caught the crypto almost off guard, resulting in severe losses. And now an even bigger negative is coming - the M debt crisis.

Once the bond market explodes, US stocks and crypto will be equally affected. Trump's tax cut was meant to stimulate the economy, but reality might be like the previous tariff policy - counterproductive, not only dragging down the economy but also weakening the Fed's anti-inflation efforts. So, this time, we must remain highly vigilant. Don't forget that last year, no one took the tariffs seriously, and real problems emerged. Now, with the tax cut crisis approaching, the second half of the year may bring an even more violent storm.

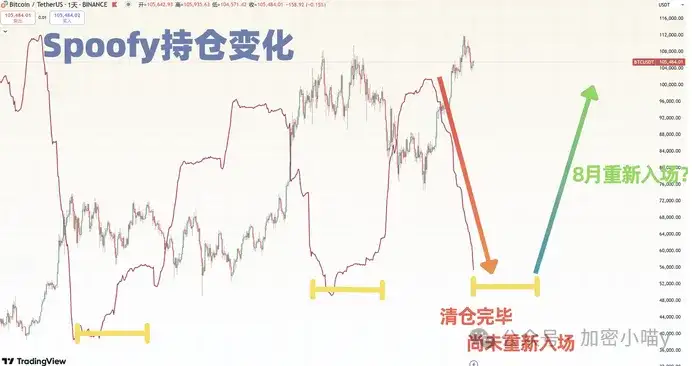

Many are curious: Has the billion-dollar whale Spoofy entered the market? According to on-chain data, Spoofy has not bought back after clearing out, indicating he believes the current price is still too high and not an ideal entry point.

Based on past patterns, Spoofy is a calm medium to long-term trader who waits at least 1-2 months after exiting before buying the dips. Therefore, I judge he will likely wait until Bitcoin drops to the 80-90k USD range before re-entering.

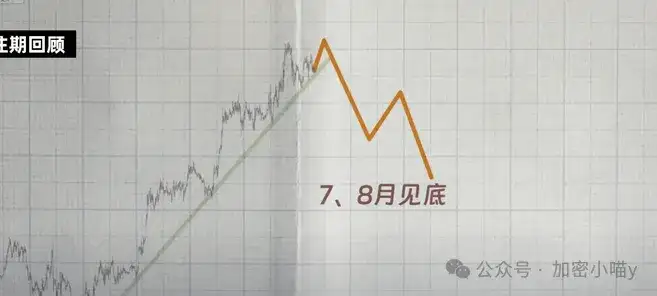

Additionally, from seasonal patterns, June to September are traditionally the off-season for crypto and US stocks, with market performance often weak, even during bull markets. From October to December, influenced by the "Halloween effect", the market generally strengthens, with scientific research supporting this cycle.

Currently, Bitcoin is in a high-level distribution phase, sideways oscillation, with market makers gradually selling, and the pullback trend is gradually established. It's expected to bottom in August and start consolidation. Short-term there might be rebound opportunities, but the overall trend is downward. Ethereum also faces a 70-80% correction probability. I expect August will be a good time to buy the dips, especially for potential coins like Pepe, which might see a rise by year-end and could potentially double in spot, with the key being timely profit-taking at high levels.

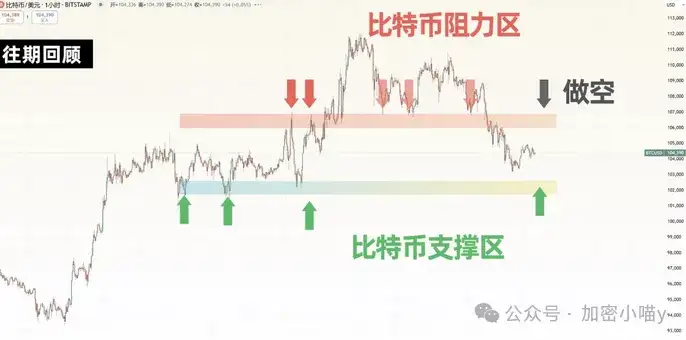

We warned about the June pullback when Bitcoin was at $110,000, and combining multiple signals: conference benefits exhausted, Spoofy clearing out, extreme market greed, ETH false breakout, etc., these are clear escape signals.

In the short term, Bitcoin's $103,000 is a trading-intensive area, likely for a small rebound, offering opportunities for trading or reversing long positions, but the major trend is still continuing downward.

This week's market focus: Employment data and inflation double warning!

Friday night's US unemployment rate and employment data at 8:30 PM will be the market's core focus, with a peculiar situation. Although the unemployment rate is expected to remain stable, non-farm employment expectations have been significantly revised down - from 177,000 to 130,000, a drop of nearly 30%, which is clearly not a good sign.

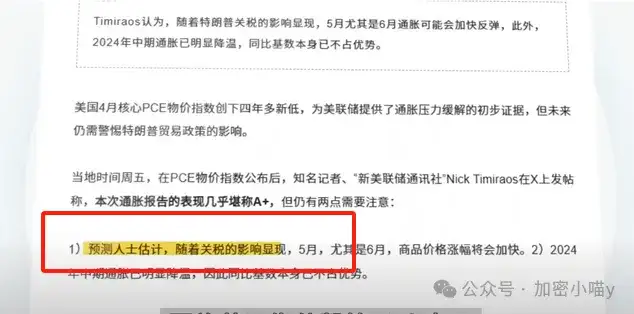

Reviewing last week, unemployment claims exceeded expectations, with a soft job market further confirming the negative effects of Trump's tariff policy: manufacturing hasn't returned, but instead led to job losses and rising unemployment. More worryingly is next week's CPI inflation data. Wall Street's "megaphone" Nick revealed that inflation in May and June might significantly rise, with some predictive institutions even believing CPI could surge from 2.3% to 2.6%, which, if true, would impact the market substantially.

Although the data hasn't been released, the current situation is already tense enough, and early vigilance is always necessary.

That's it for the article! If you're lost in the crypto world, consider joining me in layout and harvesting from market makers! You can join the community (WeChat+QQ group, no threshold for exchange + Q: 3806326575 or V: Mixm5688), get market analysis, individual coin recommendations, and favorable news, layout in advance, with irregular live market analysis! You can also ask questions in the group and get the best answers!