Written by: Sam @IOSG

TL;DR

Using the stablecoin bill as an introduction, highlighting recent public attention and discussion on RWA on Ethereum

Data analysis (zkSync can be a highlight)

What impact will Etherealize have on Ethereum

Ethereum's stablecoin issuance and DeFi have always had a strong moat. With new US policies, can RWA organically connect traditional finance and DeFi? As the most trusted and decentralized blockchain, where do we continue to be optimistic about Ethereum

Bill Catalysis and Market Attention

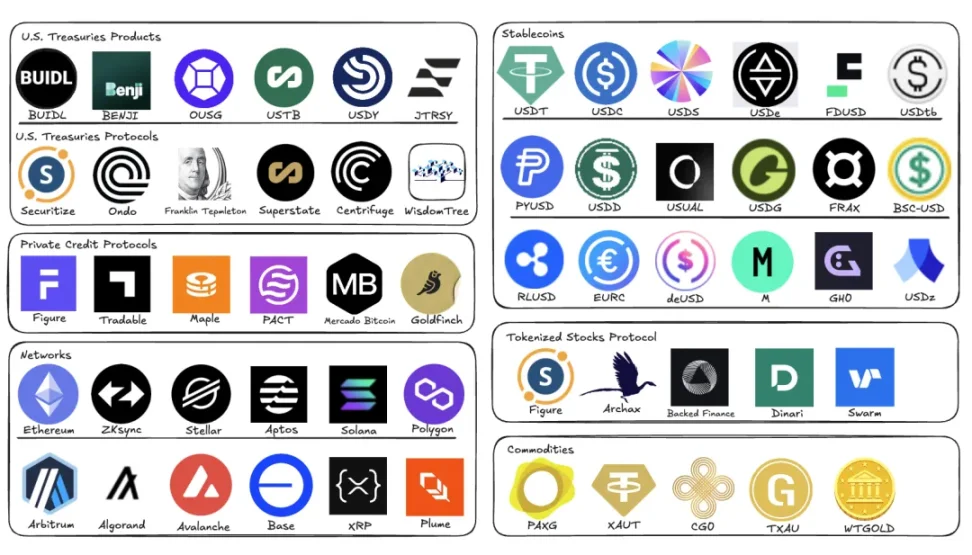

Against the backdrop of rapid evolution in traditional finance and regulatory environment, the recent passage of the GENIUS Bill has reignited market interest in RWA. Beyond stablecoins and major legislative progress, the RWA field has quietly achieved multiple important milestones: sustained strong growth momentum and a series of eye-catching breakthroughs—such as Kraken launching tokenized stocks and ETFs, Robinhood proposing to the SEC to grant token assets equal status with traditional assets, and Centrifuge issuing a $400 million decentralized JTRSY fund on Solana.

At a time of unprecedented market attention and imminent broader adoption by traditional finance, it is crucial to closely examine the current RWA landscape—especially the position of leading platforms like Ethereum. RWA based on Ethereum has shown amazing month-on-month growth, consistently maintaining double-digit highs; the growth rate in 2025 is even more accelerated compared to single-digit months in 2024. Another key factor driving this momentum is "Etherealize" as a catalyst for regulatory development, and the Ethereum Foundation listing RWA as a strategic priority. At this critical juncture, this article will delve into the development dynamics of RWA on Ethereum and its Layer-2 networks.

RWA Ecosystem Map, IOSG

Data Analysis: Comprehensive View of Ethereum RWA Growth

Data clearly shows that Ethereum's RWA value has entered a distinct growth cycle. Looking at the long-term trend of Ethereum's non-stablecoin RWA total value, its trajectory is noteworthy—remaining in the $1-2 billion range for years until entering a rapid growth phase in April 2024. This growth momentum continues to accelerate in 2025. The core driving force comes from BlackRock's BUIDL fund, which currently has a scale of $2.7 billion. As the orange trend line shows, BUIDL has been exhibiting parabolic growth since March 2025, powerfully driving the overall expansion of the Ethereum RWA ecosystem.

(Translation continues in the same manner for the entire text)In 2024, only FDUSD and FRAX are medium-sized projects ($500 million to $5 billion); BUSD, due to termination of issuance, plummeted from $1 billion in January to less than $500 million in March. However, in 2025, USD0 and PYUSD both break through the $500 million threshold, making medium-sized stablecoins more diverse.

Top-tier stablecoins (>$5 billion) continue to be dominated by USDT and USDC: USDT remained stable at around $40 billion in market cap for most of 2024, surging to $70 billion in early December before gradually stabilizing, and recently experiencing some market cap reduction; USDC steadily grew from $22 billion in January 2024 to $38 billion in May 2025. In early 2025, USDS and USDe both broke through $5 billion, but USDT and USDC still lead by a significant margin in market share.

[Rest of the translation continues in the same professional manner, maintaining the specified translations for specific terms]Traditional financial institutions' decision-making processes differ from DeFi: regulatory review, pilot verification, and proof of concept (PoC) significantly extend deployment cycles. In the early stages of a project, institutions typically adopt a cautious strategy, initiating expansion only after pilot results are validated. Although the top Ethereum project BUIDL dominates, it still took nearly a year of accumulation before experiencing explosive growth. Ethereum's core advantage lies in its early ecosystem leadership—having completed experimental collaborations with multiple top financial institutions even before the RWA wave emerged.

Ecosystem Accumulation

Beyond institutional collaborations, RWA ecosystem maturity requires long-term sedimentation. Ethereum maintains its leadership position by:

Breadth: Covering diverse asset issuers and protocol architectures

Depth: Multiple projects breaking through billion-dollar market capitalization, forming scale effects

The integration of traditional finance and DeFi continues to deepen. Most RWA projects prioritize deployment on the Ethereum mainnet, directly utilizing Ethereum's mature decentralized lending, market-making, and derivatives protocols to enhance capital efficiency. Recent cases include Ethena using BUIDL as 90% of USDtb stablecoin reserves. The GENIUS Act's policy mandating stablecoin reserves to shift towards US Treasury bonds is driving the convergence of US Treasury bonds, on-chain Treasury products, and stablecoin protocols. Simultaneously, mainstream DeFi protocols are incorporating BUIDL into their core collateral systems.

Ethereum maintains an advantage in RWA liquidity: leading in active addresses, token varieties, and liquidity depth. While Layer2 ecosystems have uncertain collaboration mechanisms, they remain the core expansion path.

Security

Security is the cornerstone of the RWA ecosystem, with smart contract technological maturity being crucial. As RWA project logic becomes more complex, smart contract requirements increase. In May 2025, the Cetus protocol on the Sui chain was hacked (losing $223 million), exposing the fatal risks of oracle manipulation and contract vulnerabilities. Although $162 million was recovered through on-chain freezing, such passive emergency mechanisms highlight risk management limitations. In contrast, Ethereum's core advantage lies in its more decentralized architecture, reliable operational record, and thriving developer ecosystem.

Technical Evolution

Ethereum's technical roadmap will accelerate RWA development. First, improving L1 performance to bridge core gaps with high-performance public chains. Second, promoting L2 interoperability and focusing on the application layer to connect traditional finance with on-chain RWA.

Simultaneously, Ethereum's privacy roadmap strengthens security standards and privacy protection mechanisms (such as integrating privacy tools into mainstream wallets, simplifying anti-censorship transaction processes), providing guarantees for RWA transactions and constructing an asset confidentiality system meeting institutional requirements.

《Genius Act》: Regulatory Double-Edged Sword

The new stablecoin regulatory system, while strengthening centralized control, also injects regulatory certainty into the market. Currently, Section 4(6) of the act does not explicitly allow stablecoin issuers to pay interest to token holders, and although the market might generate alternative solutions, uncertainty remains. Additionally, the GENIUS Act requires stablecoin reserves to be 1:1 US dollars or high-liquidity safe assets like US Treasury bonds.

USDC stablecoin's reserves are already almost entirely allocated to US Treasury bonds, complying with new regulations. However, other mainstream issuers must completely restructure their reserve structures or risk being forced out of the US market. This will directly impact algorithmic stablecoins and specific designs like Delta Neutral stablecoins.

By anchoring collateral to US sovereign credit, regulators gain stronger intervention capabilities (while simultaneously driving Treasury bond demand), but legislative loopholes might introduce new systemic risks—as learned from the 2000 Commodity Futures Modernization Act (CFMA).

The positive aspect is that the act's clear compliance boundaries might accelerate institutional entry: the long-sought regulatory certainty for banks and asset management institutions is satisfied. More large companies and institutions will obtain stablecoin issuance permissions. For instance, several major US banks are discussing a joint crypto stablecoin, and Meta might reconsider launching a new stablecoin project.

Ethereum's Resilience: Diverse Ecosystem

Ethereum's stablecoin ecosystem's resilience stems from its diversity. Since early 2025, multiple stablecoin issuers' market values have significantly increased, with numerous new stablecoin projects emerging, containing rich design dimensions: diverse collateral structures, yield strategies, and governance models. The GENIUS Act's mandatory 1:1 Treasury bond reserve requirement puts compliance pressure on most projects, forcing them to choose: either adjust reserve structures or temporarily exit the US market.

Ethereum's ecosystem resilience distinguishes it from public chains dominated by few stablecoin/RWA projects—reducing the risk of homogenization after widespread regulatory acceptance. The diverse structure creates a natural risk isolation mechanism: even if some stablecoins adjust strategies due to compliance requirements, projects will continue driving innovation and maintaining decentralized cores, preventing complete absorption into the US bond system. However, subsequent developments will depend on the Ethereum Foundation and Etheralize's strategic positioning.

Conclusion

Ethereum's RWA ecosystem has experienced explosive growth in recent months. BUIDL has been the strongest recent driver of RWA development, while numerous Treasury bond projects have shown robust growth momentum. Behind the scale expansion, Treasury bond projects increasingly demonstrate integration trends with Ethereum's existing DeFi and RWA ecosystems, such as BUIDL serving as collateral for lending or stablecoin projects.

Ethereum still maintains significant advantages in the RWA domain. Whether it's the first-mover advantage, security, deep ecosystem accumulation, ambitious technical roadmap updates, BUIDL's strong leadership, Layer2 diversity, or Etherealize's deep empowerment, these factors collectively construct Ethereum's core barriers in the traditional finance on-chain wave.

With the GENIUS Act's promotion, US dollar credit is accelerating integration into the on-chain world. This not only brings larger capital inflows and creates more yield and growth opportunities but also poses a challenge: it makes Ethereum's financial system's underlying support more fiat-oriented (US dollar), thus introducing fiat credit risks and potentially making the on-chain settlement system an extension of US dollar hegemony—the on-chain world is no longer an independent parallel financial system. Amidst this explosive growth, hidden concerns lurk, fundamentally revolving around Ethereum's exploration of its own positioning—whether to support deep binding with the US dollar system.