Author: Dong Bizheng; Source: Huxiu APP

On May 19, the US Senate passed the GENIUS Act, legislating for stablecoins. Immediately after, on May 21, the Hong Kong Legislative Council passed the Stablecoin Ordinance Draft.

In just 48 hours, legislation or legalization surrounding stablecoins has been put on the agenda, and a war without gunpowder has quietly begun.

Stablecoins can be understood as a mapping of real legal currency in the virtual world.

Similar to the real world, major powers are trying to build a virtual currency system dominated by stablecoins, evolving it into an existence similar to the Bretton Woods system.

Behind this lies the major powers' desire to compete for the discourse of global monetary expansion.

So, what exactly are stablecoins?

I. Shadow "Legal Tender"

To understand what stablecoins are, we first need to reiterate the process of establishing US dollar hegemony.

The reason why the US dollar gradually became a global currency is that: initially, the US dollar was pegged to gold, and other countries' currencies were pegged to the US dollar, forming the Bretton Woods system; subsequently, although the US dollar was decoupled from gold, it first occupied the discourse of consumption and trade, bundled with oil, and consolidated the US dollar's hegemonic position.

In the 1970s, the United States reached an agreement with Saudi Arabia and other major oil-exporting countries to price and settle oil transactions in US dollars.

Moreover, after World War II, the United States became the world's most powerful economy. As one of the world's largest consumer countries, the US needed to "transmit" dollars globally, which required using dollars for settlement to meet global dollar demand - other countries often earned dollars through exports and then recycled these dollars back to the US by purchasing US Treasury bonds, stocks, and other assets, forming a "dollar cycle".

Therefore, changes in US monetary policy will affect the economies of these countries. For example, when the Federal Reserve raised interest rates multiple times between late 2015 and 2018, emerging market countries faced increased capital outflow pressures, with some enterprises facing high US dollar debt interest expenses, leading to increased financial pressure and forcing some companies to reduce investment and production scales.

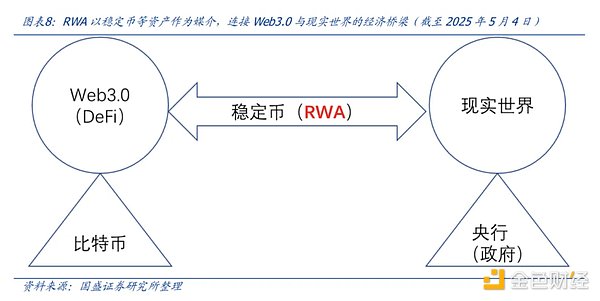

For the virtual world economy to have value, it must be anchored to the economic system of the real world, and currency is a crucial link. Stablecoins emerged in response.

Stablecoins are like a bridge on the blockchain, connecting the traditional legal tender and cryptocurrency worlds. Due to their stable value, they typically peg their value to familiar legal currencies like the US dollar or Hong Kong dollar, avoiding the extreme price fluctuations seen with Bitcoin.

Therefore, stablecoins possess monetary tool attributes such as value storage, trading medium, and pricing tool. However, stablecoins are not a risk-free technological innovation. Their value is entirely supported by reserve assets, and if the issuer "misappropriates funds" or there are issues with reserve assets, problems can arise.

The United States was the first to see the value of stablecoins as a new tool for global expansion. Therefore, which country's underlying currency a stablecoin is anchored to becomes extremely critical. Because this will also become the cornerstone of constructing a new digital economic landscape, evolving into a virtual economic world similar to the Bretton Woods system.

Countries and enterprises are also rushing to seize the opportunity.

In addition to China's Hong Kong and the United States issuing related bills, on April 28, 2025, payment giant Mastercard announced that it would allow customers to consume with stablecoins and enable merchants to settle transactions using stablecoins. Another payment giant, PayPal, is intensifying efforts to develop its PYUSD stablecoin market.

II. A New Round of Competition

The simultaneous introduction of the US GENIUS Act and Hong Kong's Stablecoin Ordinance Draft marks a new stage of institutional competition in global stablecoin regulation, with stablecoins officially becoming a political tool.

The essence of this legislative confrontation is a power struggle for monetary reconstruction in the digital age.

On the surface, the United States is establishing a regulatory framework for stablecoins, but in reality, it is letting stablecoins take over the "abandoned" US Treasury bonds to consolidate dollar hegemony.

The GENIUS Act mandates that stablecoins be 100% reserved by cash, demand deposits, or short-term US Treasury bonds, essentially deeply binding stablecoins with US Treasury bonds.

Everyone can see through this intention.

This way, stablecoins are expected to become potential buyers of US Treasury bonds, helping to rescue their declining status. The United States can still exploit globally. If US bonds default significantly, stablecoins anchored to them will also depreciate or de-anchor.

Miaotou previously pointed out in "Trump Controlled by US Bonds" that due to US dollar credit overdraft, capital markets no longer treat US bonds as a "safe haven".

The United States frequently uses dollar hegemony as an attack tool, interfering with and destroying other countries' economies through sanctions and asset freezes. Especially during the Russia-Ukraine conflict, the US froze Russia's foreign exchange reserves, directly exacerbating the global trust crisis in the US dollar and causing many trade surplus countries to start "abandoning" US Treasury bonds.

The US national debt scale has long exceeded $36 trillion, with debt-to-GDP ratio over 120%. Analyst Larry McDonald pointed out that if interest rates remain at 4.5%, US debt interest expenses might reach $1.2-1.3 trillion by 2026, exceeding defense spending, and the US fiscal deficit will be unbearable.

China is also testing stablecoin value using Hong Kong as a bridgehead. Compared to US dollar stablecoins, Hong Kong stablecoins are more flexible, capable of anchoring single or basket currencies, with unspecified bottom fund usage methods.

The US GENIUS Act limits it to "payment-type stablecoins" without interest income, emphasizing its non-securities nature and restricting stablecoin innovation in revenue creation.

However, generating interest is a key method to potentially attract customers.

Hong Kong's stablecoins currently do not restrict interest income and anchoring structures, providing financial institutions with greater flexibility in stablecoin product innovation and revenue design, making them more attractive.

Moreover, expanding stablecoin usage scenarios is a battleground.

Currently, domestic internet giants have already "entered the game", not only creating application scenarios for stablecoins but also competing for payment entry points in the Web3 era.

At present, domestically, it is still in a stage of technological exploration and regulatory adaptation, with certain achievements.

On May 23, JD Coin Technology CEO Liu Peng stated that JD's stablecoin has entered the second phase of sandbox testing, and will provide mobile and PC application products for retail and institutional users. Test scenarios mainly include cross-border payments, investment trading, and retail payments.

Ant Digital explores stablecoin binding with physical assets through new energy RWA projects. Under the guidance of the Hong Kong Monetary Authority's Ensemble sandbox project, Ant Digital supported a mainland new energy listed company, Longnew Group, to complete its first cross-border RWA financing, amounting to approximately 100 million yuan.

Of course, this is not enough. More scenario implementations are needed to make users choose Hong Kong stablecoins. After all, US dollar stablecoins have a slight advantage through digital cryptocurrency trading.

The battle for RMB internationalization and US dollar hegemony is yet to come, and this bill's introduction is merely a preliminary skirmish.

III. Conclusion

When 36 trillion US dollars flow into the blockchain via USDT, when Hong Kong leverages HKD stablecoins for cross-border payments, the code of personal wealth has long been embedded in the underlying logic of national competition.

The winning move in this competition may be hidden in JD's sandbox test code or USDC's US Treasury bond holdings.