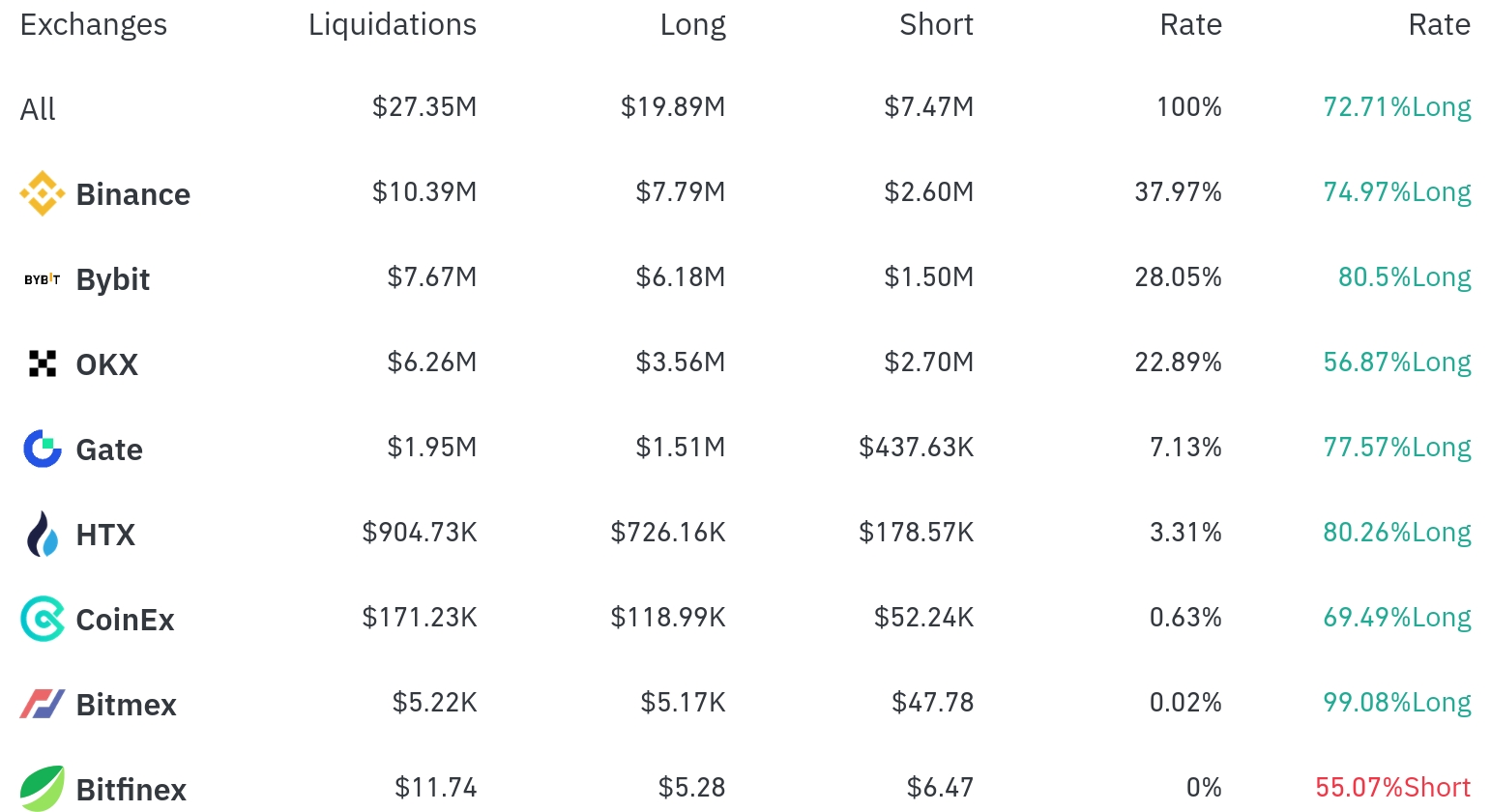

Over the past 24 hours, approximately $27.35 million (about 37 billion won) worth of leverage positions were liquidated across cryptocurrency exchanges.

According to the current data, long positions accounted for $19.89 million, representing 72.71% of the total liquidations, while short positions were $7.47 million, accounting for 27.29%.

Binance had the highest liquidation in the past 4 hours, with a total of $10.39 million (37.97%) liquidated. Among this, long positions were $7.79 million, accounting for 74.97%.

Bybit was the second-highest, with $7.67 million (28.05%) of positions liquidated, of which long positions were $6.18 million (80.5%).

OKX saw approximately $6.26 million (22.89%) in liquidations, with long position ratio at 56.87%, relatively lower compared to other major exchanges.

Notably, BitMEX showed an overwhelmingly high long position liquidation rate of 99.08%, with a relatively small liquidation scale of $5,220.

By coin, BTC and ETH recorded the most liquidations. Over 24 hours, approximately $55.94 million in positions were liquidated for Ethereum, and $51.26 million for Bitcoin.

For Bitcoin, about $3.68 million in long positions and $820,000 in short positions were liquidated in 4 hours, with the price rising 0.82% to $105,690 over 24 hours.

Ethereum saw $2.94 million in long positions and $2.49 million in short positions liquidated in 4 hours, with the price rising 2.99% to $2,614.

Solana (SOL) had approximately $11.04 million liquidated over 24 hours, with $2.71 million in long positions and $110,000 in short positions liquidated in 4 hours.

In the meme coin sector, '1000PEPE' recorded $7.23 million in liquidations over 24 hours, with $1.06 million in long positions liquidated in 4 hours. Its price rose by 3.53%.

Particularly, the 'FARTCO' Token saw about $860,000 in long positions liquidated over 4 hours, accompanied by a 4.25% price drop. The 'TRUMP' Token also experienced $270,000 in long position liquidations with a slight price decline (-0.25%).

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This liquidation data can be seen as an indicator of continued price volatility in the recent cryptocurrency market.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>