Author | Wu Blockchain

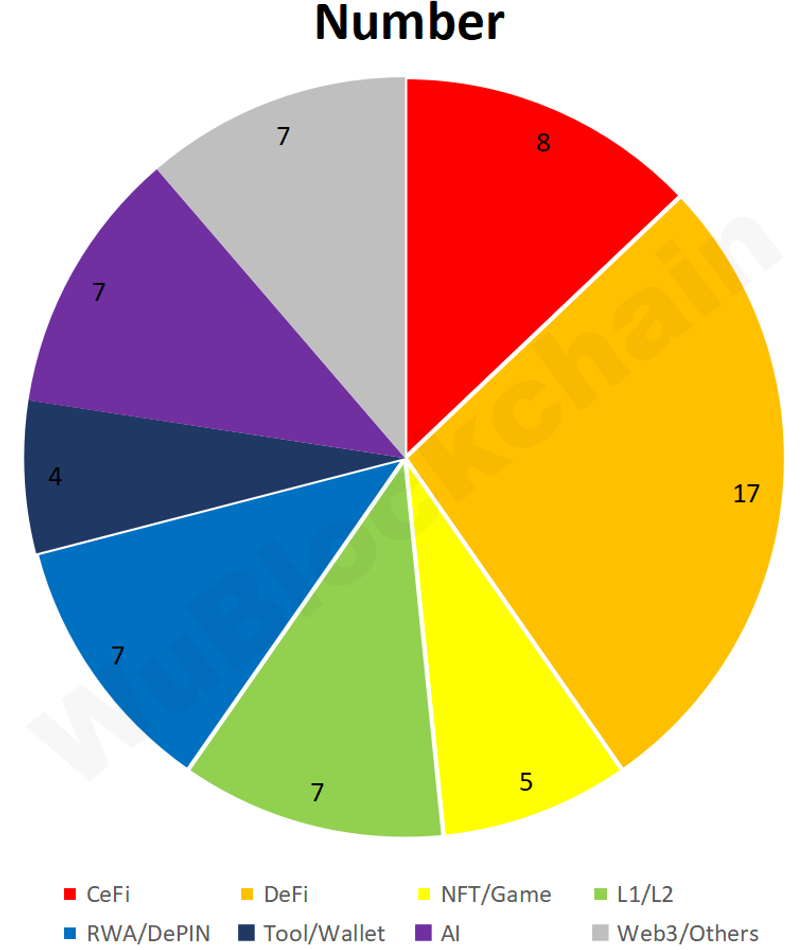

According to RootData statistics, there were 62 publicly disclosed Crypto VC investment projects in May 2025, a 6.1% decrease from the previous month (66 projects in April 2025), and a 61.3% decrease year-on-year (160 projects in May 2024). The number of small-scale financing continues to decline. Note: As not all financing is announced in the same month, the above statistical figures may increase in the future. The number of projects in each track is as follows:

Among them, CeFi accounts for about 12.9%, DeFi accounts for about 27.4%, Non-Fungible Token/GameFi accounts for about 8.1%, L1/L2 accounts for about 11.3%, RWA/DePIN accounts for about 11.3%, Tool/Wallet accounts for about 6.5%, and AI accounts for about 11.3%.

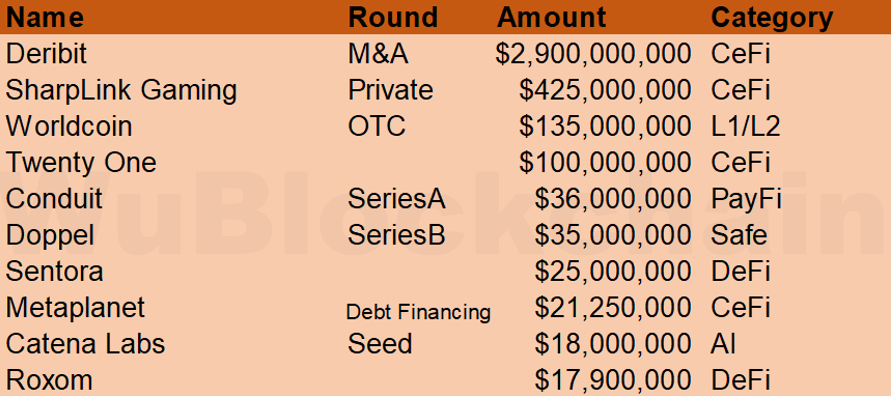

The total financing amount in April 2025 was $3.95 billion, a 32.3% increase from the previous month (2.986 billion in March 2025), and a 289.5% increase year-on-year ($1.014 billion in April 2024). The amount of large-scale mergers and acquisitions continues to rise. The top 10 financing rounds are as follows:

Coinbase has agreed to acquire Deribit, the world's largest crypto derivatives exchange, for $2.9 billion, creating the largest merger in digital market history. Coinbase will pay $700 million in cash, with the remainder paid in stock.

Nasdaq-listed SharpLink Gaming has signed a securities purchase agreement for a private investment in public equity (PIPE), planning to issue approximately 69,100,313 common shares at $6.15 per share, with an expected total fundraising of around $425 million. This financing is led by ConsenSys Software, with participants including ParaFi Capital, Electric Capital, Pantera Capital, Arrington Capital, Galaxy Digital, Ondo, White Star Capital, GSR, Hivemind Capital, Hypersphere, Primitive Ventures, and Republic Digital. The company plans to use the raised funds to purchase ETH as its primary treasury reserve asset and for working capital and other general corporate purposes.

World Foundation's subsidiary World Assets sold $135 million worth of WLD to Andreessen Horowitz and Bain Capital Crypto at market price on May 21 to support World network's expansion in the US and globally. Previously disclosed investors also include Selini Capital, Mirana Ventures, and Arctic Digital.

Bitcoin investment company Twenty One Capital added $100 million in convertible senior secured debt financing, bringing the total financing to $685 million, in preparation for its merger with Nasdaq-listed Cantor Equity Partners. The new financing comes from existing investors and sponsors exercising purchase options in the April financing round, with a 1% annual interest rate and maturity in 2030. Previously, $385 million in bonds and $200 million in PIPE financing were disclosed.

Stablecoin payment company Conduit announced the completion of a $36 million Series A financing round, led by Dragonfly Capital, with participation from Sound Ventures, Altos Ventures, DCG, and Commerce Ventures. The company's total financing now stands at $53 million. Conduit provides cross-border payment solutions through stablecoin technology, currently supporting 14 fiat currencies and operating in 9 countries, including the United States.

Doppel announced the completion of a $35 million Series B financing round, led by Bessemer Venture Partners, with new institutions including 9Yards Capital and Sozo Ventures, and continued support from existing shareholders such as a16z, South Park Commons, SCV, Script Capital, and Sabrina Hahn. Founded three years ago, Doppel focuses on building a social engineering defense platform, covering brand impersonation, executive protection, and multi-channel phishing attacks.

DeFi data analysis company IntoTheBlock and liquidity solution provider Trident Digital announced a merger to form a new entity, Sentora, dedicated to providing a one-stop compliant DeFi platform for institutional investors. They are currently pursuing a $25 million financing round led by New Form Capital, with participation from Ripple and Tribe Capital. Sentora will integrate the expertise of both companies in DeFi data analysis and liquidity structure design, providing services such as yield strategies, risk control, compliance, and structured products for asset managers.

Japanese listed company Metaplanet announced the issuance of its 14th series of ordinary bonds, raising $21.25 million, all of which will be used to purchase Bitcoin. The bond was approved at a board meeting on May 9 and was fully subscribed by EVO FUND. Previously, Metaplanet purchased 555 Bitcoins for approximately $53.4 million, bringing its Bitcoin holdings to 5,555 coins, with a total investment of $481.5 million and an average purchase price of $86,672 per Bitcoin. This makes Metaplanet the largest Bitcoin holder among listed companies in Asia and the ninth-largest globally.

Catena Labs, a crypto asset startup founded by Circle co-founder Sean Neville, completed a $18 million seed round financing, led by a16z crypto, with participation from Breyer Capital, Circle Ventures, Coinbase Ventures, and others. Sean Neville left the Circle board in early 2020 but remains a director. Catena Labs aims to build an AI-native bank.

Bitcoin project Roxom Global announced a total financing of $17.9 million to build a BTC-denominated securities exchange and 24/7 Bitcoin media network RoxomTV, with $7.9 million invested in the exchange by Draper Associates and others, and $10 million in private financing for RoxomTV. The exchange focuses on markets in Latin America, Europe, Asia, and the Middle East, offering BTC-denominated futures, spot, and synthetic tool trading, and has not yet been launched in the United States.