Source: cryptoslate

Translated by: Blockchain Knight

"We are no longer in the early stage." This phrase is widely circulated in the Crypto Twitter circle. Last week, 35,000 people attended the 2025 BTC conference, including BTC enthusiasts, US senators, White House staff, BlackRock analysts, and even the imprisoned Silk Road founder Ross Ulbricht. BTC's spot price has far exceeded $100,000, and BTC supporters are celebrating its "path to mainstream".

However, behind the applause and ETF-driven price charts, a more sober fact is hidden: BTC is still far from true mainstream adoption.

Despite BTC's record-high price and increasing acceptance on Wall Street, only 4% of the global population holds BTC. In absolute numbers, approximately 337 million people hold BTC, which is only half the number of Snapchat users. Even when including all alternative asset holders, the total number is only 659 million, still billions less than mainstream application users.

Despite containing trillions of dollars in potential, BTC remains a marginal tool in its still-developing ecosystem.

BTC is Still in the Late 1990s Internet Stage

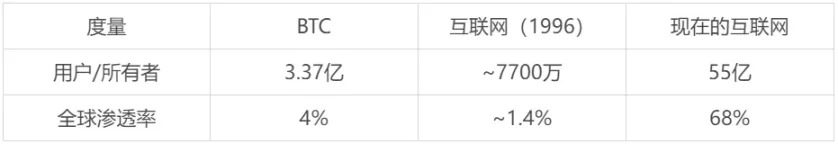

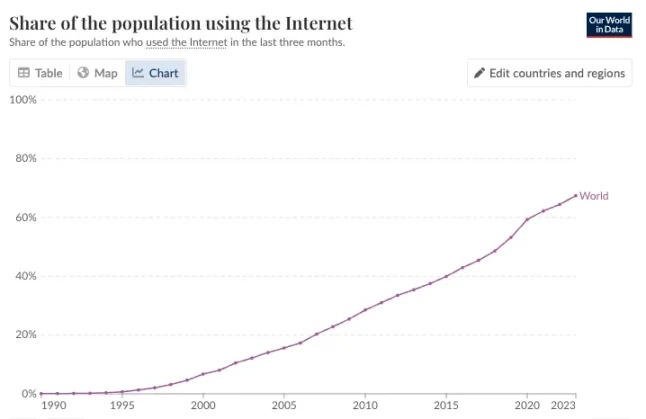

Comparing BTC's adoption curve to early internet:

BTC in 2025 is like the internet before email was fully popularized. It's a field full of innovation but far from ubiquitous. Using a BTC wallet and reading such articles is like having an AOL account or installing the latest version of Netscape browser from a magazine CD.

When BTC's penetration rate is 4%, it's equivalent to the internet's state on New Year's Eve 2000. At that time, the world was afraid of leaving computers on at midnight, fearing the Y2K virus would destroy human civilization.

At that time, Nokia 3210 phones were everywhere, basic images could only be loaded line by line, downloading an album took an entire day, and searching was done by an online butler named Jeeves. Since then, the internet has undergone earth-shattering changes. Similarly, for BTC to continue developing along the same path, its ecosystem integration still requires numerous transformations.

Some conference attendees in Las Vegas might think they are latecomers. But statistically, they are still early adopters.

Internet Penetration Rate (Data source: Our World in Data)

Wall Street Buys In, but the Public Doesn't Use

The narrative in the Crypto asset field increasingly depends on institutional participation. Since the SEC approved ETFs in early 2024, over $44 billion has flowed into US spot BTC ETFs. Pension funds, asset management companies, and family offices are using BTC as a portfolio hedge.

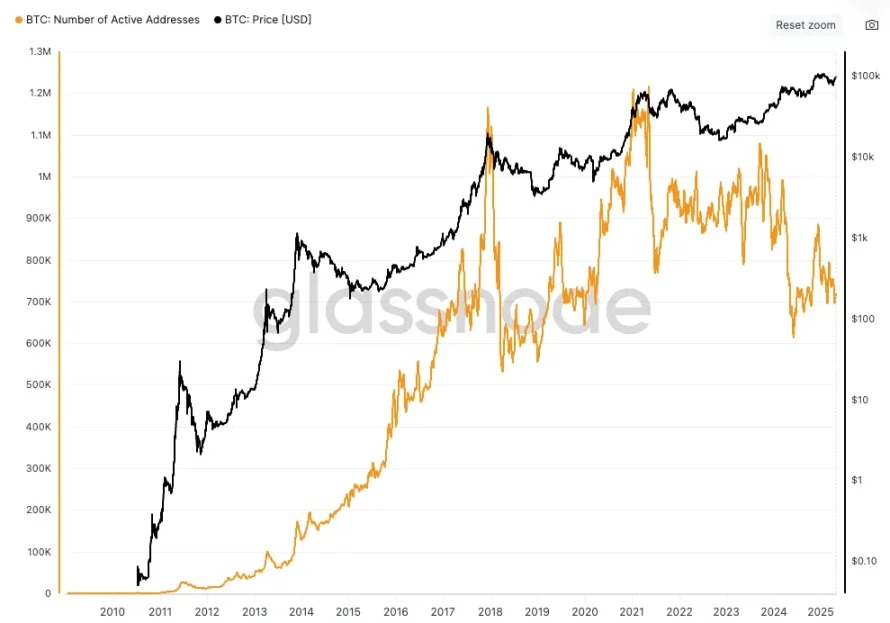

However, BTC's daily usability has not improved. Daily active addresses have dropped from the 2021 peak of 1.1 million to nearly 700,000. Although traditional finance (TradFi) funds have legitimized BTC as an asset class, this has not translated into broader trading applications. Ross Ulbricht's attendance as a symbol of BTC's rebellious roots highlights the contradiction between BTC as a political tool and an institutional commodity.

BTC Active Addresses (Data source: glassnode)

Despite BTC's increasing visibility, it still faces many obstacles on the path to mass adoption:

Poor user experience: Setting up wallets or managing seed phrases is not intuitive. A mistake can lead to permanent asset loss.

High entry barriers: For underserved users, small deposit channels sound ideal, but exchange fees, regulatory checks, and slow transaction times undermine user experience.

Unclear regulation: While ETFs bring legitimacy to BTC, fragmented global regulations for wallets, mining, and business activities introduce confusion and risk.

Low cultural awareness: Even in highly digitized societies, BTC is seen more as a speculative asset than a payment or savings tool.

Groundwork and Real Agenda

Multiple plans are laying the foundation for broader BTC adoption:

"BTC is no longer niche," said WisdomTree analyst Dovile Silenskyte in January. This might be true in capital markets, but it's not yet reflected in how people use money. Now, a BTC is priced over $100,000, far exceeding the average US household net worth (excluding home equity). As BTC becomes increasingly collectible, its usability might decrease unless Layer 2 solutions and broader access can reverse this trend.

To transform hype into actual financial inclusivity, BTC supporters should reposition around the following points:

Prioritize use cases: Highlight real examples like Argentine freelancer income or East African Lightning Network remittances, not just ETF fund inflows or celebrity endorsements.

Adopt meaningful metrics: Penetration should not be measured by market cap, but by tracking active wallet usage, Lightning Network liquidity, and merchant integration.

Design for marginal users: The most critical user group lives in economically unstable regions with poor banking services. BTC's promise is tested in these areas, not at Las Vegas conferences.

Clear policies: Regulatory consistency is more important than political showboating. Frameworks like Europe's Crypto Assets Regulation (MiCA) or targeted mining incentives can drive BTC adoption.

The Real Beginning After Celebration

BTC might have made breakthroughs in news headlines and hedge funds, but the real test has not yet begun. Just as the internet's 90s promise was only realized in the early 2000s with mobile phones, broadband, and user-friendly applications, BTC's global impact will depend on innovation after the hype.

BTC wallet numbers continue growing, but Lightning Network usage, active wallets, and daily on-chain traders have not returned to historical peaks. BTC prices have soared, but on-chain usage has not synchronized. We cannot declare victory when the battle is far from over.

So, while we can celebrate BTC breaking $100,000 like the 1999 internet bubble, the internet's popularization benefited from smartphones, especially the iPhone. So what similar innovations have emerged in the BTC field?

The Las Vegas summit is a celebration. But BTC's revolution in payments, savings, remittances, and financial sovereignty will not be televised. It will unfold silently, moving forward step by step.