Wondering how to invest in Internet Capital Markets without getting rugged on day one? You’re not alone. With ICM tokens launching off tweets and trending in minutes, it’s easy to miss the signal in the hype. This guide walks you through exactly how to get started: from funding your wallet to spotting real momentum, so you can play the game without getting played.

KEY TAKEAWAYS➤ Internet Capital Markets (ICM) allow anyone to invest in internet-native ideas like memes, tools, or apps, turning cultural energy into tradeable assets.➤ There are multiple ways to invest in ICM tokens, from DEXs like PancakeSwap and Binance to launch platforms like Pump.fun and AGM Trade.➤ Momentum, narrative, and community often matter more than traditional fundamentals, so timing and project relevance are key to evaluating ICM tokens.

In this guide:- How to invest in Internet Capital Markets: Step-by-step

- Why invest in Internet Capital Markets?

- What to know before investing in ICM

- Which ICM tokens are getting the most attention?

- Is it worth investing in Internet Capital Markets?

- Frequently asked questions

How to invest in Internet Capital Markets: Step-by-step

So, you’ve seen tokens launch off tweets, ride meme waves, and show up on trending dashboards within hours. It’s not just noise: it’s Internet Capital Markets (ICM) in action. But how do you actually get in on these trades?

Here’s how the process typically flows if you’re looking to make your first move:

- Choose your platform: Pump.fun, Believe, or newer dashboards like AGM.Trade.

- Set up a wallet that talks to Solana or bridge in via MetaMask

- Fund your wallet with SOL or USDC

- Scan listings or trending tokens

- Buy directly or convert using built-in options

- Track your holdings or exit via DEX/convert tools

Let’s unpack each step.

Step 1: Pick your entry point

ICM tokens aren’t listed on major exchanges by default. They usually launch on niche platforms. Your options:

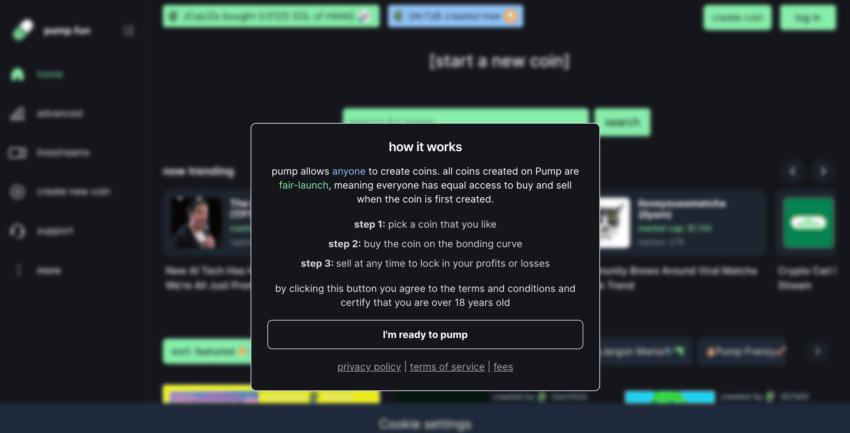

- Pump.fun: Launchpad for idea tokens, using bonding curves. Think “meme stocks for the Solana crowd.”

- Believe: Selective token launcher with fee-sharing and creator-focused mechanics. Believescreener.com redirects token trades to Axiom.Trade. Axiom Gateway Markets acts as a hybrid DEX and token screen. Tokens from Believe are surfaced here. You can Deposit, Convert, and Track positions.

ICM investing: Pump.fun

ICM investing: Pump.fun- Binance or DEXs (like PancakeSwap v3): Some matured tokens like VINE; eventually get listed on mainstream venues. Therefore, you should keep an eye out if you want to enter early.

Did you know? VINE was a nostalgia-driven relaunch of the short video platform. DUPE, on the other hand, tokenizes a product-lookup engine. Both are ICM tokens launched on Solana platforms.

Step 2: Set up a wallet

Most ICM tokens run on Solana, so you’ll need a compatible wallet:

- Phantom and Solflare are native Solana wallets.

- MetaMask users can also connect via Solflare. This bridges your ETH wallet into Solana DApps without installing anything new.

Connecting wallet to invest in ICM tokens: Pump.fun

Connecting wallet to invest in ICM tokens: Pump.funNo need to switch networks manually. Just sign the wallet access prompt and you’re in.

Step 3: Fund your wallet

Most platforms require SOL, not ETH or BNB.

You can buy SOL on:

- Centralized exchanges (like Binance, Coinbase)

- Then, transfer to your wallet (Phantom/Solflare)

Wallet funding via Axiom: Axiom

Wallet funding via Axiom: AxiomIf you’re looking for a more detailed demonstration of this step, check out our complete guide on how to buy Solana.

Step 4: Browse ICM tokens

Here’s where to explore:

- Pump.fun: Live listings, trending tokens, early-stage launches

- Axiom.Trade: Redirected screener for Believe tokensIncludes Deposit, Convert, Chart toolsShows top market movers

- DEX listings: Tokens like VINE may be listed on PancakeSwap v3 or other DEXs

ICM tokens to check: CoinMarketCap

ICM tokens to check: CoinMarketCapYou can also check the top ICM tokens on CoinMarketCap and Believe Screener.

Graduation thresholds: Some tokens “graduate” to DEXs once they cross $90K–$100K market cap. Watch for that if you want liquidity.

Step 5: Make your first buy

- On Pump.fun: Select the token, enter amount, approve the transaction. Prices rise as more buyers join due to the bonding curve model.

- On Axiom.Trade: Use the Convert tab to buy using USDC/SOL. This abstracts away bonding curves and gives you cleaner UI. Some tokens also allow Deposits to earn passive yields (depends on platform updates)

ICM token trading interface: Axiom

ICM token trading interface: AxiomFor the unversed: Bonding curves mean that token price increases with each new buyer. Buying early = cheaper entry. Selling later depends on demand holding up.

- On Binance/DEXs: Buy just like any standard crypto asset. But these tokens may be more volatile and illiquid.

Step 6: Track or exit

After investing, track performance on:

- Pump.fun dashboard

- Axiom.Trade’s “Portfolio” view

- DEX tools (like GeckoTerminal, Raydium)

- Binance app (if tokens are listed)

You can also sell via Convert (Axiom) or trade directly on a DEX like PancakeSwap if liquidity is available.

Did you know? Pump.fun and Believe tokens follow a bonding curve model where early buyers benefit. But the same curve works in reverse when users start exiting.

Why invest in Internet Capital Markets?

Most tokens are about tech. With ICM, you’re not buying into protocols; you’re backing momentum. Internet Capital Markets flip the script, allowing you to invest in ideas before they’re products, in creators before they’re founders.

Here’s why it’s catching on:

- Early access to upside: Like getting equity in a startup before the pitch deck is made.

- Minimal gatekeeping: No VC rounds, no waiting lists—just launch and trade.

- Cultural alpha: Tokens like VINE or JELLYJELLY ride memes, nostalgia, and internet moments. If you understand what’s catching fire online, you’re already ahead.

- New type of liquidity: With tools like Believe or Pump.fun, capital moves fast. Be careful, as so do exits.

What to know before investing in ICM

Before you plan to invest in ICM tokens, here’s what to evaluate first:

Token origin and platform dynamics

]Tokens on Believe or Pump.fun follow different launch models. On Believe, early buys face higher dynamic fees, and tokens may be more community-aligned. Pump.fun tends to favor viral concepts with low entry friction. Know the platform’s tokenomics before aping in.

Speed and timing matters

ICM tokens operate on bonding curves. That means your entry timing affects price. Getting in early often means higher upside, but also comes with risk. Once a token hits a $100K market cap, it may auto-list on a DEX like Jupiter, boosting exposure.

We advise you watch wallet counts and trading velocity closely.

Who’s the creator and does it matter?

ICM tokens are often creator-led. Some are meme accounts. Others are serious builders. Check:

- Is the creator active on X?

- Do they have a roadmap (even if loose)?

- Are they engaging with buyers post-launch?

A silent creator usually means a short-lived token.

Is this narrative durable? Or just dopamine?

Some tokens ride nostalgia (e.g., VINE), others parody real-world ideas (e.g., DUPE). But not all memes are worth money. Ask:

- Will people care next week?

- Is there community energy or just hype?

If it feels like a flash-in-the-pan, it probably is.

Exit optionality and DEX paths

Check if the token is likely to hit a DEX (based on cap threshold). Will there be enough liquidity? Is the LP owned or community-provided?

Remember that you can’t exit if there’s nowhere to sell.

Which ICM tokens are getting the most attention?

With new tokens launching daily, it’s tough to track what’s worth your time. Here are a few ICM tokens that have seen strong traction across communities, either due to narrative heat, nostalgia, or first-mover attention:

- LAUNCHCOIN (Believe): The rebranded Pasternak token, native to the Believe platform.

- VINE: A nostalgic revival of the classic short-form video app.

- DUPE: A discovery tool for cheaper product alternatives — meme meets utility.

- JELLYJELLY: A social video app with group chat features, built for Gen-Z vibes.

- SPIT: A token for controversial hot takes and anonymous forums.

- FYP: Playing off TikTok’s “For You Page”— attention farming as an asset.

Top ICM tokens: Believe Screener

Top ICM tokens: Believe ScreenerIt’s important to note that these aren’t blue chips. Most ICM tokens are volatile, unvetted, and often creator-dependent. But in a market where attention equals value, they’ve been hard to ignore. This is not a complete or recommended list. Just tokens that have captured recent community buzz.

Is it worth investing in Internet Capital Markets?

If you’re wondering whether investing in Internet Capital Markets is worth it, the answer depends on your appetite for speed, risk, and cultural momentum. ICM isn’t about fundamentals — it’s about backing internet-native ideas at the pace they emerge. From meme-led tokens to tool-based experiments, learning how to invest in Internet Capital Markets early gives you a front-row seat to a high-risk, high-reward frontier. Ensure you only enter with clarity, never due to FOMO.

Disclaimer: This article is for educational purposes only and should not be considered investment advice. Always do your own research (DYOR).

Frequently asked questions

Can U.S. users invest in Internet Capital Market tokens legally?

ICM tokens are currently unregulated in most jurisdictions. U.S. users often access them through decentralized exchanges or non-KYC wallets, but this carries legal risk depending on local securities laws.

Is launching a token on platforms like Believe or Pump.fun really no-code?

Yes. Platforms like Believe allow users to create a token just by connecting a wallet and posting a tweet. There’s no coding or smart contract deployment involved — it’s plug-and-play for creators.

Are ICM tokens similar to NFTs in any way?

Not quite. ICM tokens are usually fungible and tied to a broader internet narrative or community use-case, while NFTs represent unique, non-fungible ownership over a single asset like art or media.