XRP price has noticeably declined over the past few days, erasing most of May's gains and transitioning from an upward trend to a downward trend as it enters June.

As altcoins approach the last month of the second quarter, traders and investors are questioning whether this downward trend will continue or if a recovery is possible.

XRP, Not at Its Peak

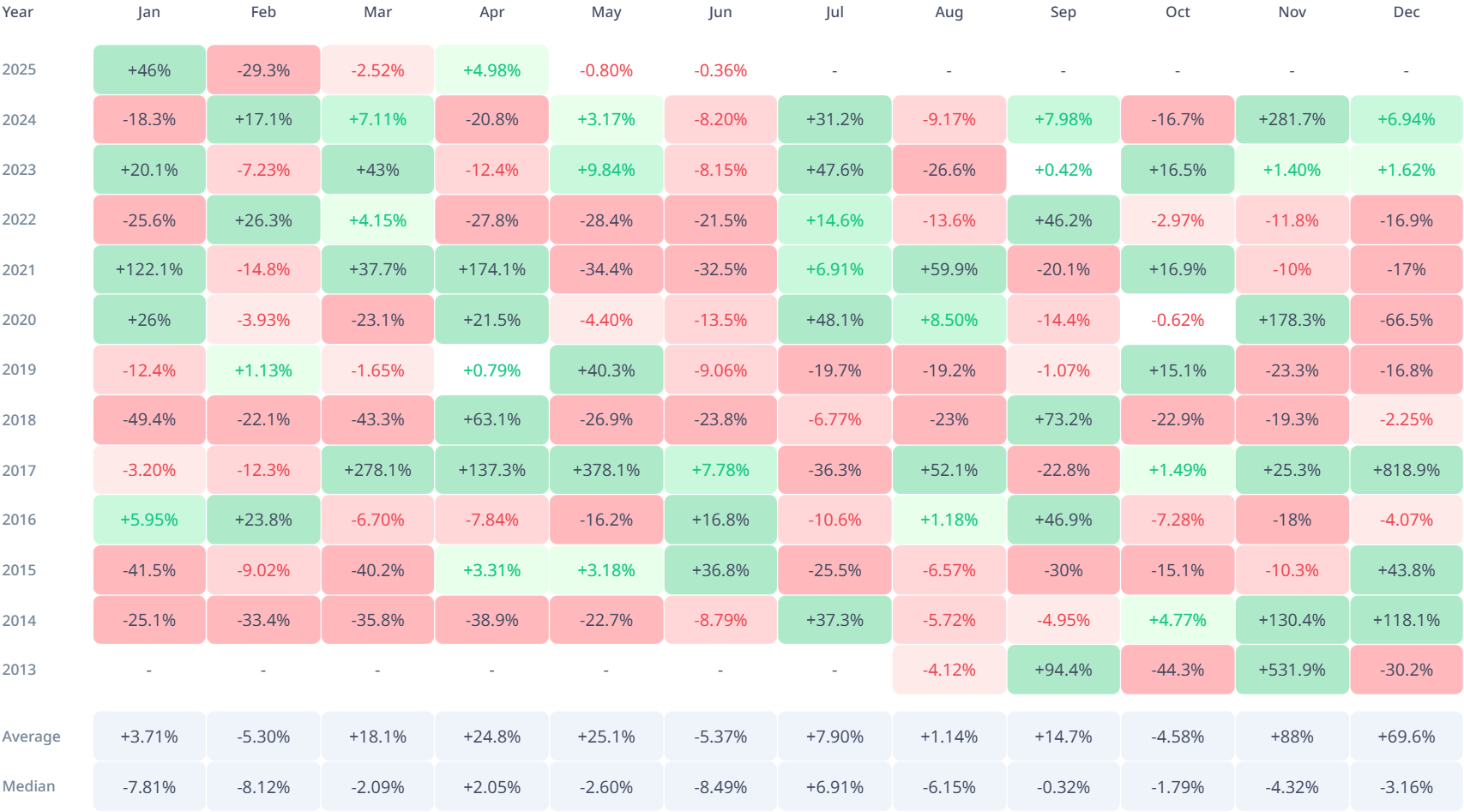

Historically, June has been a challenging month for XRP investors. Data from the past 11 years shows that XRP's median monthly return in June is -8.49%. This pattern highlights that June could be unfavorable for holders seeking profits after recent losses.

The consistent historical trend suggests that XRP may continue to face selling pressure in June. Investors should be cautious as the typical seasonal weakness could reinforce the current downward trend and exert additional pressure on the altcoin's price.

Key XRP Investors Selling

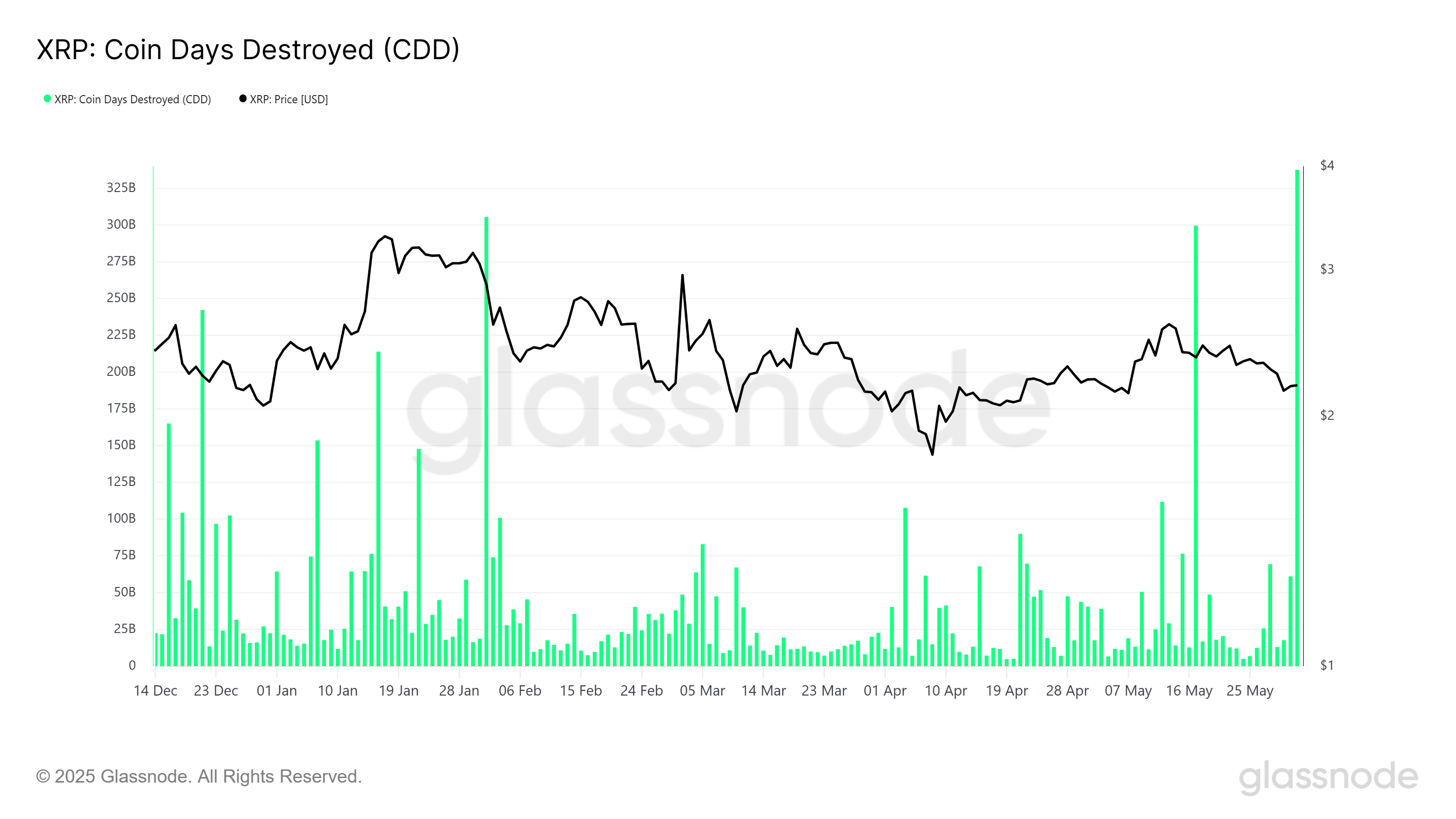

Looking at broader market signals, the Coin Days Destroyed (CDD) indicator is rising sharply. CDD represents the total number of days destroyed due to sales by investors, especially long-term holders (LTH).

It is measured by multiplying the number of coins used in transactions by the number of days held since the last movement. For example, if 100 coins are held for 10 days and then used, the CDD is 1000 (100 coins × 10 days).

XRP's CDD is currently at 337 billion dollars, the highest level since December 2024. The sharp increase in CDD suggests that many LTHs are selling their XRP holdings, seemingly to secure profits before the price drops further.

The increased selling by these seasoned investors indicates a weakening confidence in XRP's ability to recover its previous gains in the short term. LTHs are known as the backbone of an asset, and their selling can negatively impact the price.

Nevertheless, there is one piece of good news for XRP. That is the conclusion of the SEC lawsuit. Soon to be finalized, this case represents a significant development for XRP. Captain Alexis Sirkia of Yellow believes in an interview with BeInCrypto that this will be a major catalyst for Ripple's rapid ICO.

"Of course, everyone is waiting for the SEC lawsuit to end and Ripple's ICO time to come. Ripple is the largest cryptocurrency holder in this space, and it's bigger than its strategy. When Ripple, which owns 50% of XRP supply, is listed, it will be an attractive investment with over 12 billion dollars of XRP. This is more than twice that of MicroStrategy. Ripple will become the world's largest listed cryptocurrency holding company, and I believe this will attract investment and interest that will positively impact XRP's price," Sirkia said.

XRP Price, Adjustment Expected

XRP has been showing a downward trend since mid-May and is currently trading at $2.16. The altcoin is above the key support line of $2.12, but the outlook suggests further decline as the downward trend strengthens.

If XRP falls below the $2.12 support line, the price could drop to $2.02, and if it fails, it could fall further to $1.94. This would mark a two-month low and could further strengthen selling pressure. The Relative Strength Index (RSI), which is below the neutral line, supports this outlook, indicating a lack of buying momentum.

Nevertheless, there is a factor that could change XRP's direction soon. That is the XRP ETF. One of the most anticipated ETFs, it has not yet been approved. If approved, it is expected to attract significant investment to XRP. However, Alexis Sirkia suggests that the next step for XRP might not be an ETF.

"While interest from ETFs like Grayscale is decreasing, companies holding Bitcoin seem to be doing better and increasing their holdings. Therefore, new entrants to XRP like Hypescale or Viva Power could become more important when approved than an XRP ETF. As MicroStrategy (current strategy) has shown us, it may not be crucial if there are options for investors to indirectly invest in XRP," Sirkia said.

Therefore, such exposure could provide significant help to the price. Additionally, if small investors begin to accumulate the XRP sold by LTHs, the altcoin could rebound from the $2.12 support line. Breaking through the $2.27 resistance could lead to a price reversal, potentially driving XRP's price up to $2.50.