After Bitcoin's price exceeded $111,000, it showed a stagnant pattern over the past two weeks. Some investors have begun to worry about a potential "double top" scenario.

This technical pattern often indicates a sharp reversal similar to what occurred in 2021. However, experienced analysts argue that these concerns are unfounded. They believe the current market situation is completely different from four years ago.

Why a 2021-style Double Top is Difficult in 2025

According to a recent BeInCrypto report, certain divergence signals have appeared. This suggests Bitcoin could change direction in June. If this occurs, it could complete a double top pattern and lead to a correction of over 70%, similar to 2021.

However, analyst Stockmoney Lizards believes the RSI-based divergence signal is unreliable. He points out that this indicator rarely accurately predicted market peaks in most past cases.

"Want to know what I found? This indicator is wrong most of the time. 2015: 'Divergence means the peak!' – BTC rose 10x. 2017: 'This divergence is different!' – BTC continued rising for months. 2019: 'Finally confirmed!' – Another 4x rise is coming. It only actually worked in 2021. That's 1 out of 5 times. So should we sell everything based on an 80% failed indicator?" – Stockmoney Lizards said.

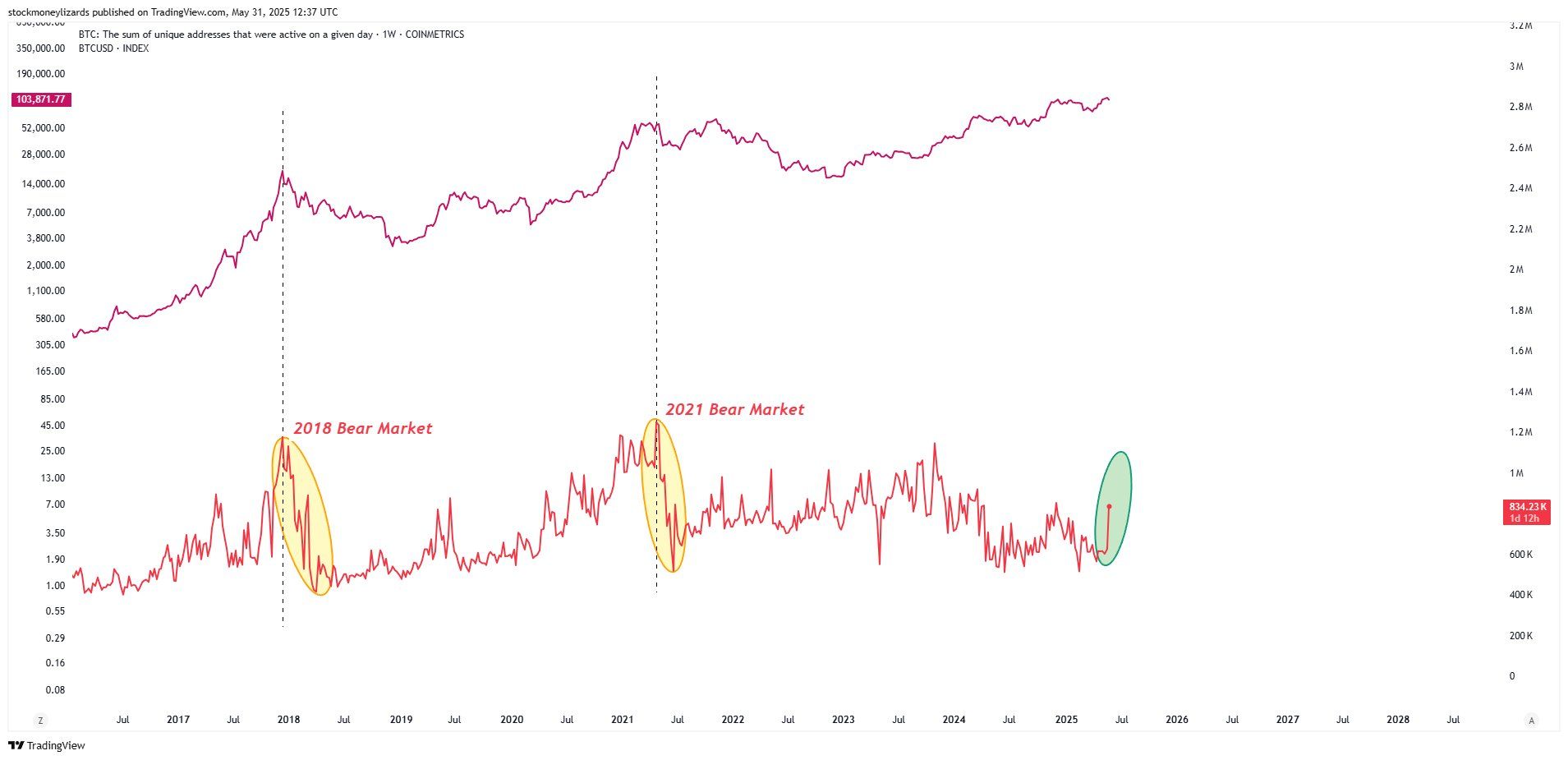

Beyond doubting technical indicators' reliability, he emphasizes overlooked positive signals. For instance, the number of active wallet addresses has surged, suggesting increased participation from both retail and institutional investors.

Moreover, the MVRV Z-Score, an on-chain indicator measuring Bitcoin's fair value, is currently low. Historically, this indicates Bitcoin is not overvalued and still has room for growth.

Beyond technical and on-chain indicators, ApolloSats founder Thomas Fahrer points out fundamental differences between now and 2021. He explains that the 2021 market suffered from multiple negative events.

Several factors contributed to Bitcoin's decline after its peak. These included the collapse of the well-known Ponzi scheme Luna project, FTX's "paper Bitcoin" sales not actually backed by assets, and the Federal Reserve's sharp interest rate increases to curb inflation.

These circumstances created an unstable environment for cryptocurrencies, causing a significant drop in Bitcoin's value.

However, Fahrer emphasizes that 2025 is a completely different story. He mentions that the market now receives strong support from positive developments. These include the introduction of Bitcoin ETFs, major corporations purchasing billions of dollars of Bitcoin as reserves, and some U.S. states building Bitcoin treasuries. These movements represent major structural changes.

Bitcoin is now becoming a trusted asset among institutions, unlike its previous speculative nature.

"Comparing the 2021 double top is foolish." – Thomas Fahrer said.

Stockmoney Lizards shares Fahrer's view on the role of institutional capital in 2025.

Initially, the price chart might seem similar to 2021, which could easily raise concerns among technical analysts. However, market dynamics constantly evolve and are never identical.