The major cryptocurrency Bitcoin entered a correction after reaching an all-time high of $111,968 on May 22nd. The coin is currently trading at $104,536, below the key support level of $105,000, reflecting selling pressure.

However, on-chain data suggests the possibility of rebounding above this critical support level and potentially retesting BTC's all-time high. This analysis breaks down key insights.

BTC Liquidity Cluster, Signaling Surge to $109,000

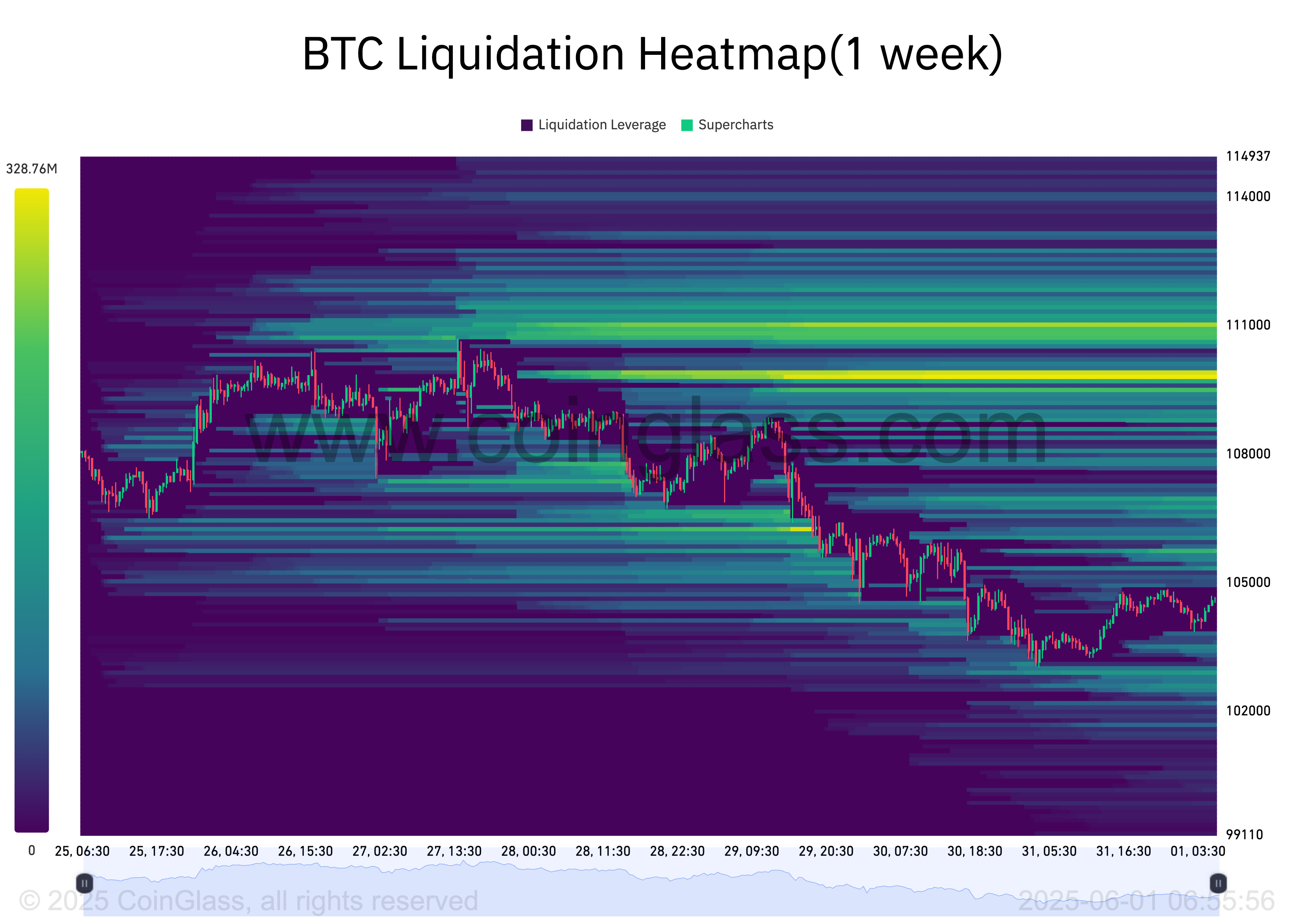

According to BTC's liquidation heatmap, liquidity is concentrated around the $109,933 price level.

The liquidation heatmap identifies price levels with potential mass liquidation of leveraged positions. This map highlights high-liquidity areas, often distinguished by color to indicate intensity, with bright areas (yellow) representing a higher likelihood of liquidation.

Typically, these cluster areas act like magnets for price movement, with the market moving to these areas to trigger liquidations and open new positions.

Therefore, for BTC, the convergence of high liquidity around the $109,933 price level indicates strong trader interest in buying or liquidating short positions at this price. This creates room for an upward move towards $109,000.

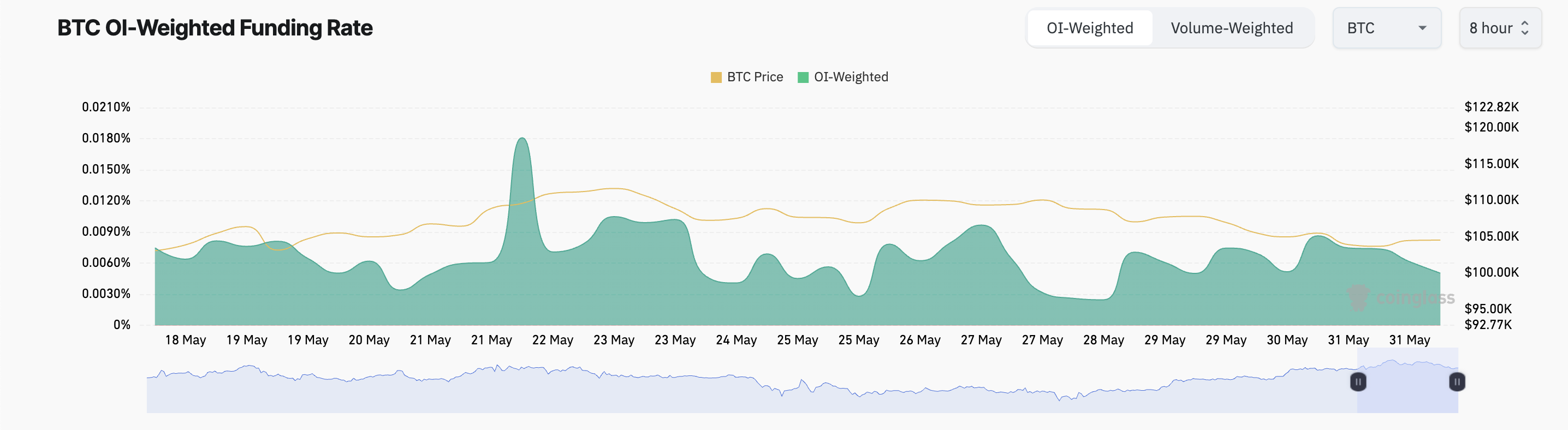

Additionally, the coin's funding rate remains positive despite recent price declines. According to Coinglass, it is currently 0.005%.

The funding rate represents periodic payments between traders in perpetual futures contracts to align contract prices with spot prices. A positive funding rate indicates higher demand for long positions.

This means more traders continue to bet on BTC price increases, even in a situation of weakening momentum.

BTC Price Between $103,000 Support and $109,000 Liquidity Zone

BTC recorded a slight 1% increase over the past 24 hours, rebounding from the $103,952 support level. If demand surges, this support could hold firmly, pushing the price above the psychological barrier of $105,000 and potentially targeting $106,307.

Clearly breaking this area could open the door to the $109,000 price level with concentrated leveraged positions.

However, if profit-taking increases, BTC could fall below $103,952, with further decline expected to $102,590.