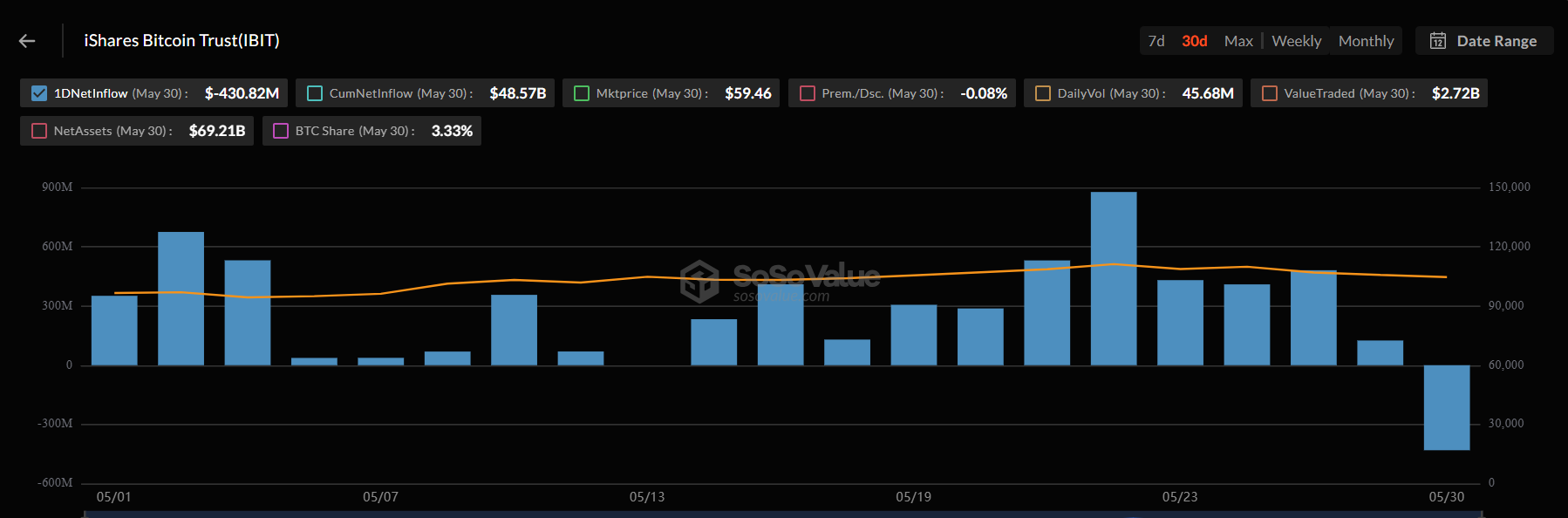

BlackRock's iShares Bitcoin Trust (IBIT) recorded its largest single-day outflow on May 30, with investors withdrawing $430.8 million from the fund.

This marks the end of a 31-day inflow streak and the first net outflow in seven weeks.

BlackRock IBIT Still Dominates Bitcoin ETF Inflows

Prior to this reversal, IBIT raised $6.5 billion in May alone, marking one of the strongest months since its debut in January 2024.

IBIT's rapid rise is not limited to the cryptocurrency sector. It has entered the top 25 US-listed ETFs by assets under management in 18 months, which many describe as unprecedented.

Simultaneously, the fund is among the top 5 in inflows year-to-date among over 4,200 US-listed funds.

IBIT hits new monthly record for inflows…

— Nate Geraci (@NateGeraci) May 30, 2025

Nearly $6.5bil in May.

Has now taken in money 31 of past 32 trading days overall.

via @sidcoins pic.twitter.com/mWWkoImjFD

Nate Geraci, chairman of ETF Store, praised IBIT's performance. He pointed to the fund's continued attractiveness in both bullish and uncertain market conditions as evidence of its dominance in the sector.

"It's a remarkable performance over the past 30 days. IBIT has surpassed $70 billion in assets less than 17 months after its launch. I'm at a loss for words to describe this situation." – Nate Geraci, Chairman of ETF Store

Industry analysts attribute IBIT's momentum primarily to increased institutional demand for Bitcoin.

Bloomberg ETF analyst Eric Balchunas emphasized that IBIT has absorbed over 100% of recent Bitcoin ETF net inflows, a significant change from the typical 70% ratio.

The IBIT vs Everyone Else flow disparity is interesting. Normally IBIT takes in 70% of the net inflows but lately it's over 100%. My theory: the latest rally was more an institutional buying spree than retail (perhaps sparked by the decoupling and lessened vol). https://t.co/9mNLCUaOaOz

— Eric Balchunas (@EricBalchunas) May 31, 2025

This institutional shift occurred as inflation concerns, economic uncertainty, and improved US regulatory clarity drew traditional investors to digital assets.

Bitcoin is increasingly seen as a hedge against fiat currency devaluation and systemic risks, with companies and nations adopting it as part of their financial strategy.

As a result, Bitcoin price reached an all-time high of over $111,000 in May, highlighting the increasing influence of institutional capital in the cryptocurrency market.

According to BeInCrypto data, major cryptocurrencies subsequently retreated to around $105,000 last week.