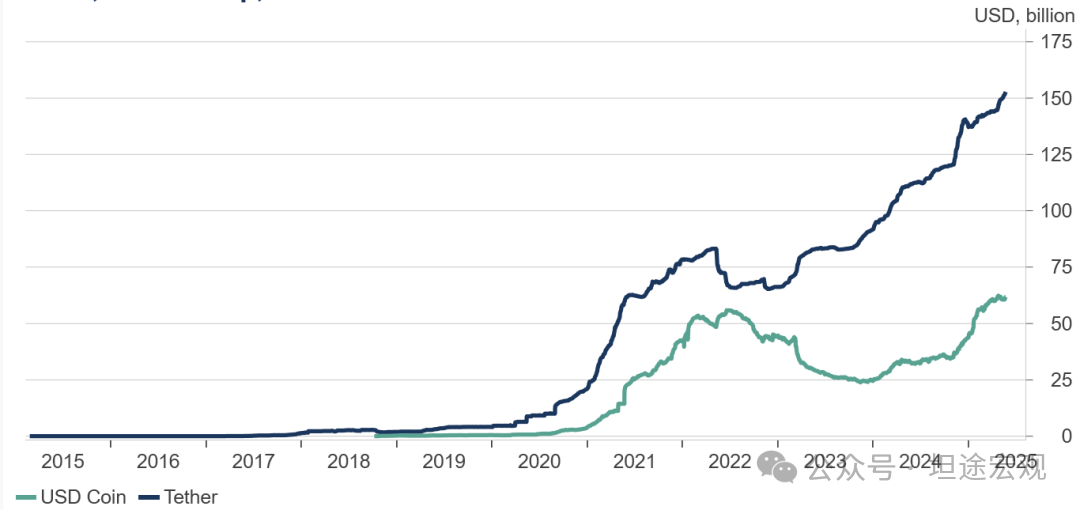

Editor's Note: On May 21, 2025, the Senate passed the procedural motion for the GENIUS Stablecoin Act with a vote of 69:31, entering the stage of full debate and amendment. This is the first comprehensive federal regulatory law on stablecoins in U.S. history, marking a critical step in stablecoin legislation. Interestingly, the timing of this stablecoin bill coincides with weak U.S. debt demand and continuously rising long-term interest rates. Some bond investors have high hopes for the bill, believing that the growth of stablecoin scale will bring new U.S. debt demand, thereby alleviating U.S. debt pressure. What are stablecoins? What is their relationship with U.S. bonds? Can stablecoins save U.S. bonds? In this article, we attempt to answer these questions.

II. What is the U.S. Stablecoin Bill?

Stablecoins are very much like currency, or even a type of currency, but they exist outside of regulation, and their rapid development implies several financial stability risks.

First, there are risks of bank runs and asset fire sales. Roughly speaking, stablecoins are the "shadow banking" of the current crypto ecosystem—they perform liquidity, maturity, and credit transformation functions, but lack deposit insurance mechanisms and cannot obtain central bank liquidity support like banks, thus presenting clear bank run risks.

Gorton and Zhang (2021) compare current stablecoins to the free banking era of the 19th century, arguing that stablecoins, like private bank notes, do not satisfy the "no questions asked" information-insensitive characteristics. Once a stablecoin experiences a large-scale bank run, it will necessarily sell off its held corporate bonds, commercial papers, and other traditional financial assets, and the panic may even trigger a run on traditional money market funds.

For example, after Lehman's bankruptcy on September 15, 2008, the Reserve Primary Fund, one of the largest U.S. money market funds, fell below $1 net asset value due to holding Lehman-issued commercial papers, which then triggered a comprehensive run on U.S. money market funds. Similarly, in 2023, USDC briefly de-pegged to $0.95 due to the Silicon Valley Bank crisis, but fortunately, the U.S. Treasury and Federal Reserve intervened to ensure full deposit redemption.

Second, it may cause deposit migration and financial disintermediation. Stablecoin deposit (staking) interest rates on some blockchain platforms are far higher than bank deposits or money market fund interest rates in the real economy.

This is partly because the massive speculative trading activities on the blockchain have spawned "borrowing and leveraging" demand, pushing up stablecoin borrowing rates; on the other hand, new DeFi projects are emerging constantly, and like newly established banks, they often choose to offer high interest rates to "attract deposits".

In the 1970s, the birth of U.S. money market funds and high interest rates triggered deposit migration and exacerbated the savings and loan crisis. The current rapid growth of stablecoins may trigger a new round of bank deposit or money market fund share losses. If decentralized finance represented by stablecoins and smart contracts further develops, it may even accelerate the business loss of traditional financial institutions, leading to financial disintermediation.

Third, stablecoins face criticism for lack of compliance and transparency. A few years ago, there were constant doubts about USDT's opaque issuance, Tether "manipulating the market", and "issuing stablecoins out of thin air" (Griffin and Shams, 2020). In March 2021, Tether agreed to disclose its reserve asset composition quarterly after paying a $40 million fine.

As the Bank for International Settlements (BIS) said: "Stablecoins are creating a new parallel monetary system, but their risk management mechanisms are still in the steam age." Against this background, the Senate and House have each promoted corresponding stablecoin bills in 2025.

The Senate's GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) is the first comprehensive federal stablecoin regulatory framework in the United States. It was proposed by Senator Bill Hagerty (Republican - Tennessee) on February 4, 2025, and passed a vote and entered the full debate and amendment stage on May 21. The act requires stablecoin issuers to obtain federal or state licenses, and all stablecoins must be 100% backed by U.S. dollars, short-term U.S. Treasury bonds, or equivalent high-liquidity assets to ensure 1:1 redemption. Issuers must regularly disclose their reserve composition, publish monthly reports, and undergo annual audits, with issuers with a market value exceeding $10 billion subject to federal oversight. The act also prohibits stablecoins from paying interest or yields, limits large tech companies and foreign companies from issuing stablecoins, emphasizes anti-money laundering (AML) and know-your-customer (KYC) compliance requirements, and requires issuers to have the technical capability to freeze or destroy tokens to cooperate with law enforcement and national security needs. Due to the requirement of 1:1 reserve redemption, the GENIUS Act effectively bans algorithmic stablecoins.

The House's STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act) is similar to the Senate's but focuses more on consumer protection and U.S. dollar sovereignty. It is reported that the House is currently coordinating with the Senate, aiming to pass a unified stablecoin bill before the August congressional recess.

What is the relationship between stablecoins and U.S. Treasury bonds?

Simply put, off-chain collateralized stablecoins typically hold a large amount of short-term U.S. Treasury bonds to maintain price stability and address redemption pressure. Currently, USDT and USDC collectively hold approximately $120 billion in short-term bonds.

Similar to money market funds, off-chain collateralized stablecoins need to frequently handle large inflows and redemption requests while ensuring "rigid redemption," which means ultra-short-term U.S. Treasury bonds with extremely high liquidity, safety, and almost no market value fluctuations are their most important holdings.

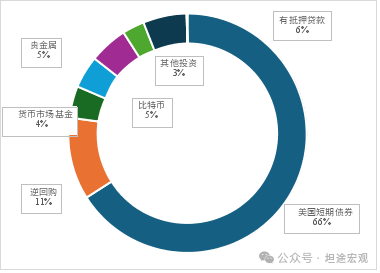

From Tether's 2025 first-quarter audit report, approximately two-thirds of its total assets are short-term Treasury bills (T-bills), totaling around $100 billion; 15% are cash and equivalents (repos, money market funds), with precious metals and Bitcoin each accounting for 5%, and other investments around 10% (Figure 2). In terms of maturity, Tether clearly states in its audit report that the remaining maturity of its U.S. Treasury bonds is within 3 months.

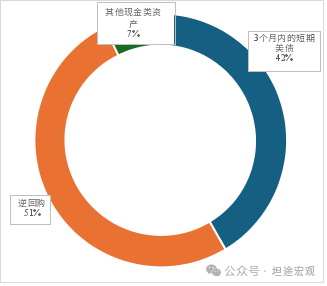

Looking at USDC, as of the end of March, approximately 40% of its total assets are short-term U.S. Treasury bills (T-bills), totaling around $20 billion, 50% are reverse repos, and the remaining 7% are cash-like assets (Figure 3). Similar to USDT, USDC's U.S. Treasury bonds are also short-term, with an even shorter remaining maturity of just 12 days. Although their reverse repos may provide financing for other investors to hold long-term U.S. Treasury bonds, the stablecoins themselves do not directly hold any U.S. Treasury bonds with a maturity of over 1 year.

Figure 2: USDT Asset Allocation in Q1 2025

Source: Tether, GMF Research

Source: Tether, GMF Research

Figure 3: USDC Asset Allocation in Q1 2025

Source: Circle, GMF Research

However, due to the small total scale of stablecoins, their current U.S. Treasury bond demand is negligible in terms of alleviating U.S. Treasury bond selling pressure. Approximately $120 billion in short-term U.S. Treasury bonds represents only about 2% of the total U.S. T-bills and 0.4% of the total tradable U.S. Treasury bonds. Additionally, in terms of maturity, both USDT and USDC hold T-bills with a duration of within 3 months, which has no effect on mitigating the upward pressure on long-term interest rates.