In the last week of May, the cryptocurrency market slowed down in trading activity as participants realized profits after the recent rally.

Despite this short stagnation, some altcoins are attracting the attention of large investors known as whales, who are increasing their positions in anticipation of potential price increases in June.

Dogecoin (DOGE)

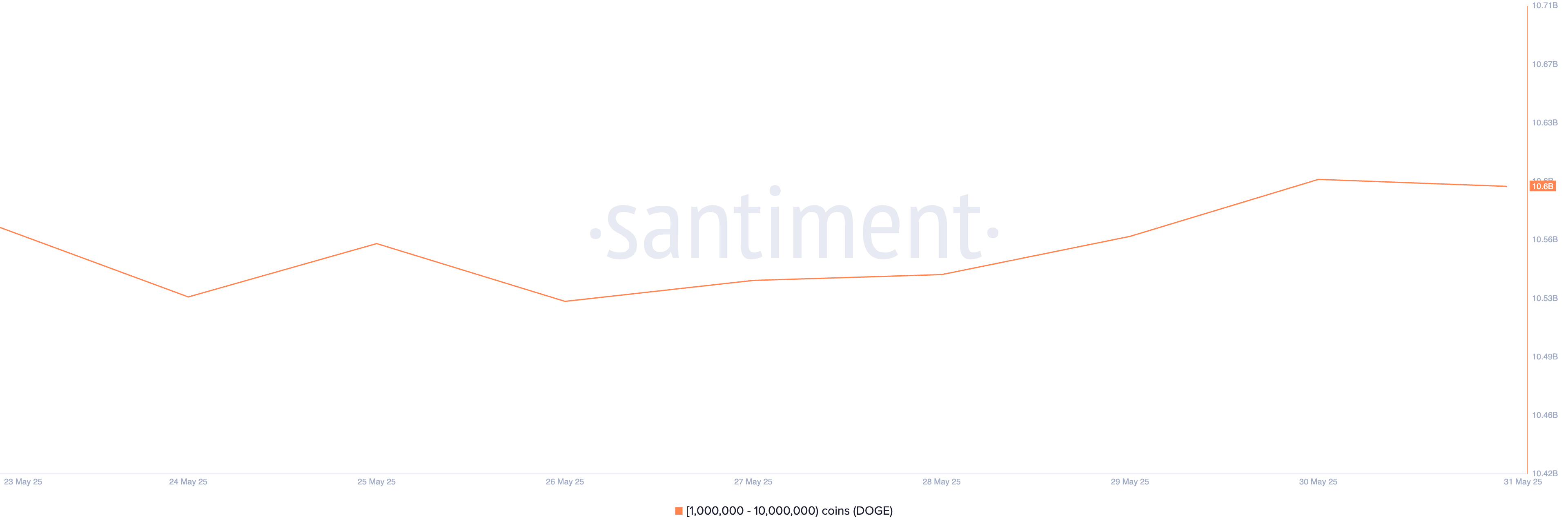

DOGE, the major meme coin, is one of the assets that crypto whales are accumulating for potential gains in June. This trend is evident in the recent surge of DOGE accumulation in whale wallets holding between 1 million and 10 million tokens.

According to Santiment, an online cryptocurrency data platform, this DOGE whale group added 30 million tokens to their wallets last week.

These whale buying activities can serve as a strong signal for retail traders. Seeing large investors confidently increasing their positions can stimulate retail participation, potentially driving up DOGE's value by creating buying momentum across the market.

If buying pressure continues, the token could resume its rally and rise to $0.206.

However, if whale accumulation stops and selling intensifies, DOGE's value could drop to $0.175.

Avalanche (AVAX)

Avalanche (AVAX), a layer-1 (L1) coin, is another asset that crypto whales are holding for potential June gains. This is reflected in a 474% increase in large holder net inflows over the past seven days.

Large holders are whale addresses holding more than 0.1% of the asset's circulating supply. Their net inflows track the difference between coins purchased and sold during a specific period.

An increase in large holder net inflows indicates more tokens are moving into major investors' wallets. This trend suggests AVAX whales are accumulating assets, showing confidence in its future value.

If whale accumulation continues, AVAX could rebound and rise to $24.28.

Meanwhile, the altcoin's price could drop to $14.66 if whales start selling to take profits.

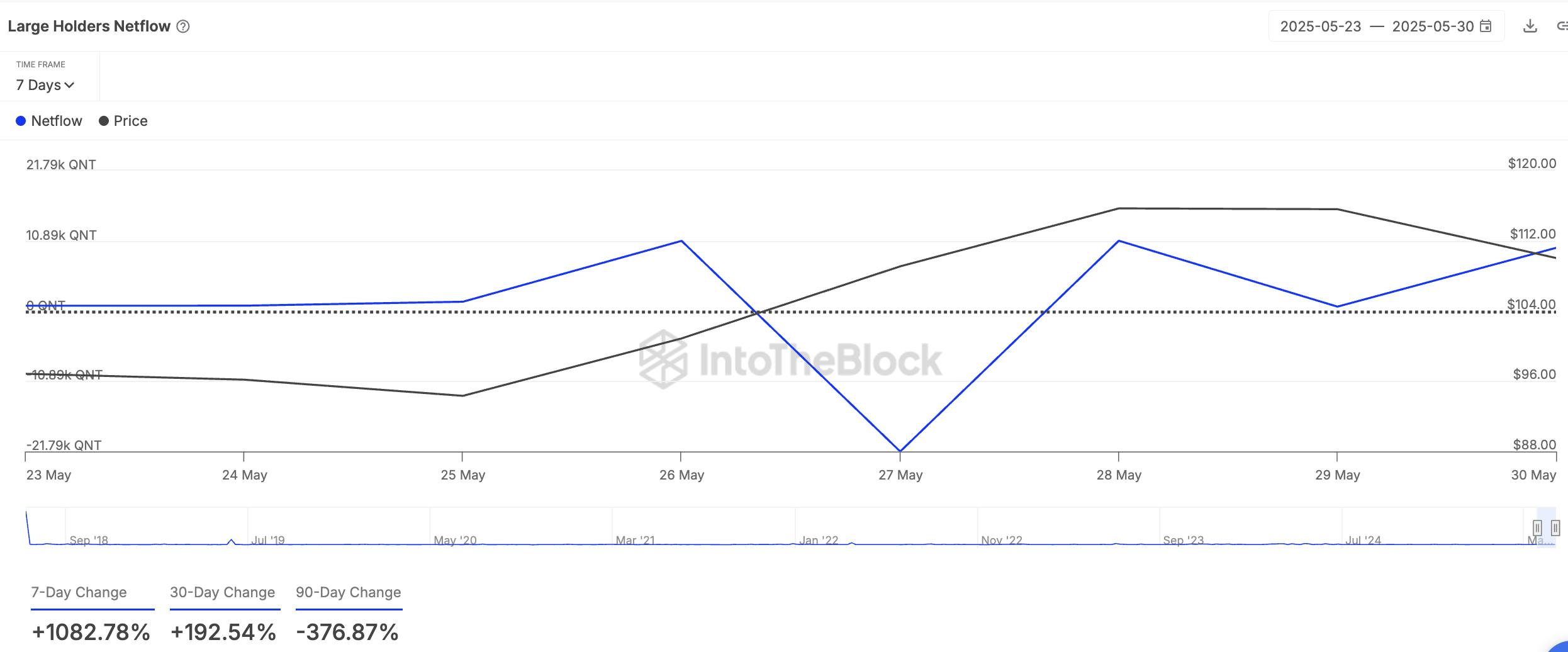

Quant (QNT)

QNT recorded a 7% increase, ignoring the overall market downturn this week. The approximately 10% rally appears to be due to renewed investor interest following the launch of Overledger Fusion, a layer 2.5 network designed to connect institutions, enterprises, and the DeFi ecosystem.

This led to a 1083% increase in large holder net inflows last week, causing a surge in whale accumulation. This increase suggests growing confidence in QNT's short-term performance and hints at the possibility of additional rallies as large investors increase their holdings.

If these traders continue to buy QNT, the price could rise to $115.20.

However, if selling resumes, QNT could fall below $101.87 to $93.52.