1. BlackRock's IBIT Asset Value Exceeds 98 Trillion Won

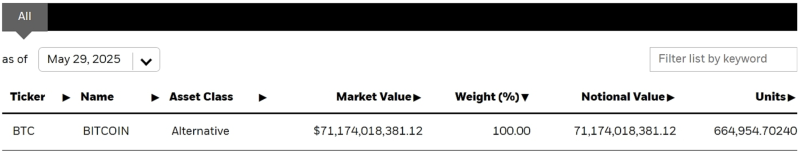

As of May 29th, BlackRock's IBIT's Bitcoin asset value reached $7.117 billion (approximately 98.3881 trillion won), with a Bitcoin holding of 664,954.70240 BTC. BlackRock is the world's largest asset management company, and IBIT is a Bitcoin trust fund operated by BlackRock.

2. Coinbase Announces cbBTC Market Cap Surpassing 6 Trillion and Bitcoin Premium Index

Coinbase's Wrapped Bitcoin (cbBTC) circulation reached 43,017, with a market cap of $4.547 billion (approximately 6.3 trillion won). cbBTC is actively traded, with a 64.1% share on Ethereum and a 30.3% share on Base Network.

Simultaneously, Coinbase's Bitcoin Premium Index is currently reported at 0.0643%. This index represents the percentage difference between Bitcoin prices on Coinbase Pro (in USD) and Binance (in USDT), used to compare market pressures between US investors (especially large institutions) and global investors.

3. Bitcoin Liquidation Intensity: Long > Short

According to cryptocurrency data platform Coinglass, if Bitcoin (BTC) price falls below $103,000, the long position liquidation intensity on major centralized exchanges (CEX) is expected to reach $521 million. Conversely, if Bitcoin price breaks above $105,000, the short position liquidation intensity is projected to be $301 million.

Coinglass explained that liquidation intensity does not represent the exact number or value of liquidation contracts, but shows the relative importance of liquidation clusters. Therefore, a higher 'liquidation intensity' at a specific price point suggests a strong potential impact on market liquidity.

4. Michael Saylor: "Everyone Should Hold Bitcoin"

At the closing speech of the Bitcoin 2025 Conference in Las Vegas, Michael Saylor described Bitcoin as a "perfect capital" suitable not only for institutions but also for households and individuals. He stated that both corporations and individuals should hold Bitcoin, emphasizing that his company Strategy currently holds over $60 billion (approximately 83 trillion won) worth of Bitcoin and is promoting Bitcoin's mainstream adoption.

During his speech, he also mentioned Bitcoin's transparency and censorship resistance as more attractive features in the current global monetary system. He said, "It is a superior asset form that anyone can freely own, transfer, and store, without value depreciation due to government or bank actions. Bitcoin's monetary policy is 'immutable', and this mathematically-based scarcity is attracting more long-term investors."

5. El Salvador Holds 6,194.18 Bitcoin

According to Mempool data, El Salvador currently holds 6,194.18 BTC, equivalent to approximately $646 million (approximately 898 billion won).

Choi Joo-hoon joohoon@blockstreet.co.kr

As of May 29th, BlackRock's IBIT's Bitcoin asset value reached $7.117 billion (approximately 98.3881 trillion won), with a Bitcoin holding of 664,954.70240 BTC. BlackRock is the world's largest asset management company, and IBIT is a Bitcoin trust fund operated by BlackRock.

2. Coinbase Announces cbBTC Market Cap Surpassing 6 Trillion and Bitcoin Premium Index

Coinbase's Wrapped Bitcoin (cbBTC) circulation reached 43,017, with a market cap of $4.547 billion (approximately 6.3 trillion won). cbBTC is actively traded, with a 64.1% share on Ethereum and a 30.3% share on Base Network.

Simultaneously, Coinbase's Bitcoin Premium Index is currently reported at 0.0643%. This index represents the percentage difference between Bitcoin prices on Coinbase Pro (in USD) and Binance (in USDT), used to compare market pressures between US investors (especially large institutions) and global investors.

3. Bitcoin Liquidation Intensity: Long > Short

According to cryptocurrency data platform Coinglass, if Bitcoin (BTC) price falls below $103,000, the long position liquidation intensity on major centralized exchanges (CEX) is expected to reach $521 million. Conversely, if Bitcoin price breaks above $105,000, the short position liquidation intensity is projected to be $301 million.

Coinglass explained that liquidation intensity does not represent the exact number or value of liquidation contracts, but shows the relative importance of liquidation clusters. Therefore, a higher 'liquidation intensity' at a specific price point suggests a strong potential impact on market liquidity.

4. Michael Saylor: "Everyone Should Hold Bitcoin"

At the closing speech of the Bitcoin 2025 Conference in Las Vegas, Michael Saylor described Bitcoin as a "perfect capital" suitable not only for institutions but also for households and individuals. He stated that both corporations and individuals should hold Bitcoin, emphasizing that his company Strategy currently holds over $60 billion (approximately 83 trillion won) worth of Bitcoin and is promoting Bitcoin's mainstream adoption.

During his speech, he also mentioned Bitcoin's transparency and censorship resistance as more attractive features in the current global monetary system. He said, "It is a superior asset form that anyone can freely own, transfer, and store, without value depreciation due to government or bank actions. Bitcoin's monetary policy is 'immutable', and this mathematically-based scarcity is attracting more long-term investors."

5. El Salvador Holds 6,194.18 Bitcoin

According to Mempool data, El Salvador currently holds 6,194.18 BTC, equivalent to approximately $646 million (approximately 898 billion won).

Choi Joo-hoon joohoon@blockstreet.co.kr