US cryptocurrency stocks showed mixed performance yesterday. Only MicroStrategy (MSTR) closed higher, while GameStop (GME) and Coinbase (COIN) recorded additional losses. MSTR rose 1.75% after Arkham discovered over 70,000 Bit associated with the company. This strengthened its position as the largest corporate Bit holder.

GME dropped an additional 5.25%. This was due to investors' backlash against the $500 million Bit purchase. Many see this as a risky transition with weak core fundamentals. Despite launching 24/7 XRP and SOL futures, COIN declined 2.14% due to ongoing concerns about a recent $400 million data breach.

MicroStrategy Incorporated (MSTR)

MicroStrategy was the only major US cryptocurrency stock that closed higher yesterday, rising 1.75% while the overall market declined.

This movement occurred days after Arkham Intelligence revealed the company holds 70,816 Bit, estimated at a total of 525,047 BTC, valued at over $54.5 billion. This challenges Michael Saylor's wallet privacy stance and focuses new attention on the company's massive Bitcoin market influence.

This disclosure followed an earlier purchase of 4,020 BTC this week. The company's published holdings increased to 580,250 BTC, solidifying its role as the world's largest corporate Bit holder.

Technically, MSTR remains solidly above the key support level of $362 and is now watching the $383 resistance line. If the current momentum continues, it could trigger a strong short-term rally.

In pre-market trading today, MSTR declined 0.13% after recent gains.

According to TradingView, analysts remain positive about the stock's long-term outlook. 15 predictions point to a potential 42.4% increase next year, with a consensus target price of $527.

GameStop Corporation (GME)

GameStop's recent Bit conversion triggered another wave of investor skepticism, causing the stock to plummet. The company confirmed purchasing 4,710 BTC, approximately $500 million, as part of a broader plan to allocate $1.3 billion to cryptocurrency.

While marketed as a strategy to enhance liquidity and optimize returns, the market reaction was overwhelmingly negative.

Analysts questioned the logic of mimicking MicroStrategy's Bit-centric approach without a strong core business.

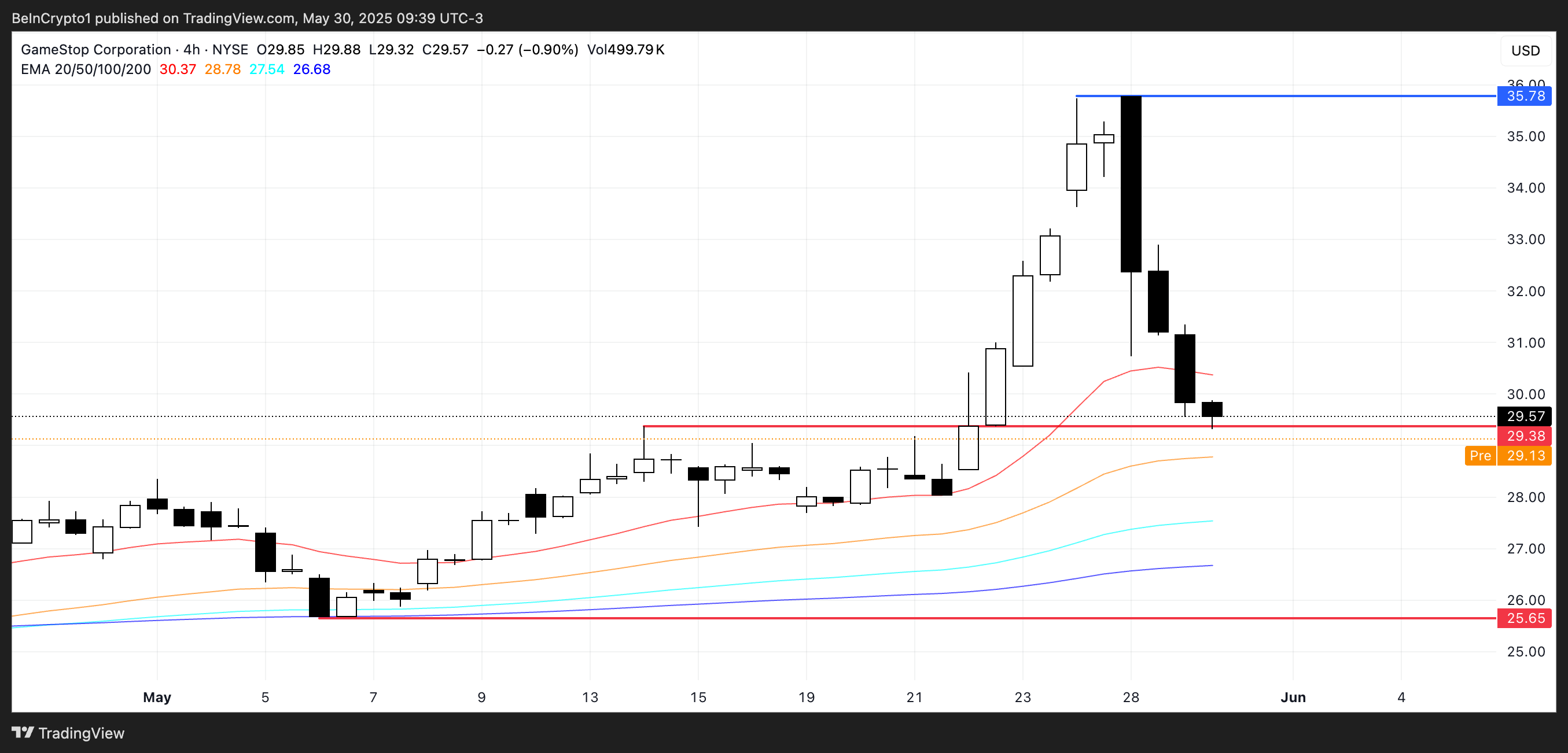

Technically, GME is under pressure, currently testing the key support level of $29.38. If this level doesn't hold, the next downward target is near $25.65, with potential for more pain if the downward momentum continues.

The stock closed 5.25% lower yesterday and has already dropped an additional 1.49% in pre-market trading.

Despite retail investor loyalty, Wall Street remains unconvinced about GameStop's strategic pivot, especially with revenue declining 28% year-over-year and the once-primary used game market weakening.

Coinbase Global (COIN)

Coinbase expanded its institutional offerings by enabling 24/7 futures trading for XRP, SOL, and ADA, aligning with its broad strategy to compete in both cryptocurrency and traditional financial markets.

Previously, 24-hour trading was only available for Bitcoin and Ethereum. This indicates Coinbase's ambition to evolve into a comprehensive derivatives platform, expanding into commodities and stock index futures.

However, the positive momentum of this announcement was overshadowed by a $400 million data breach involving outsourced customer support personnel, raising serious concerns about operational security.

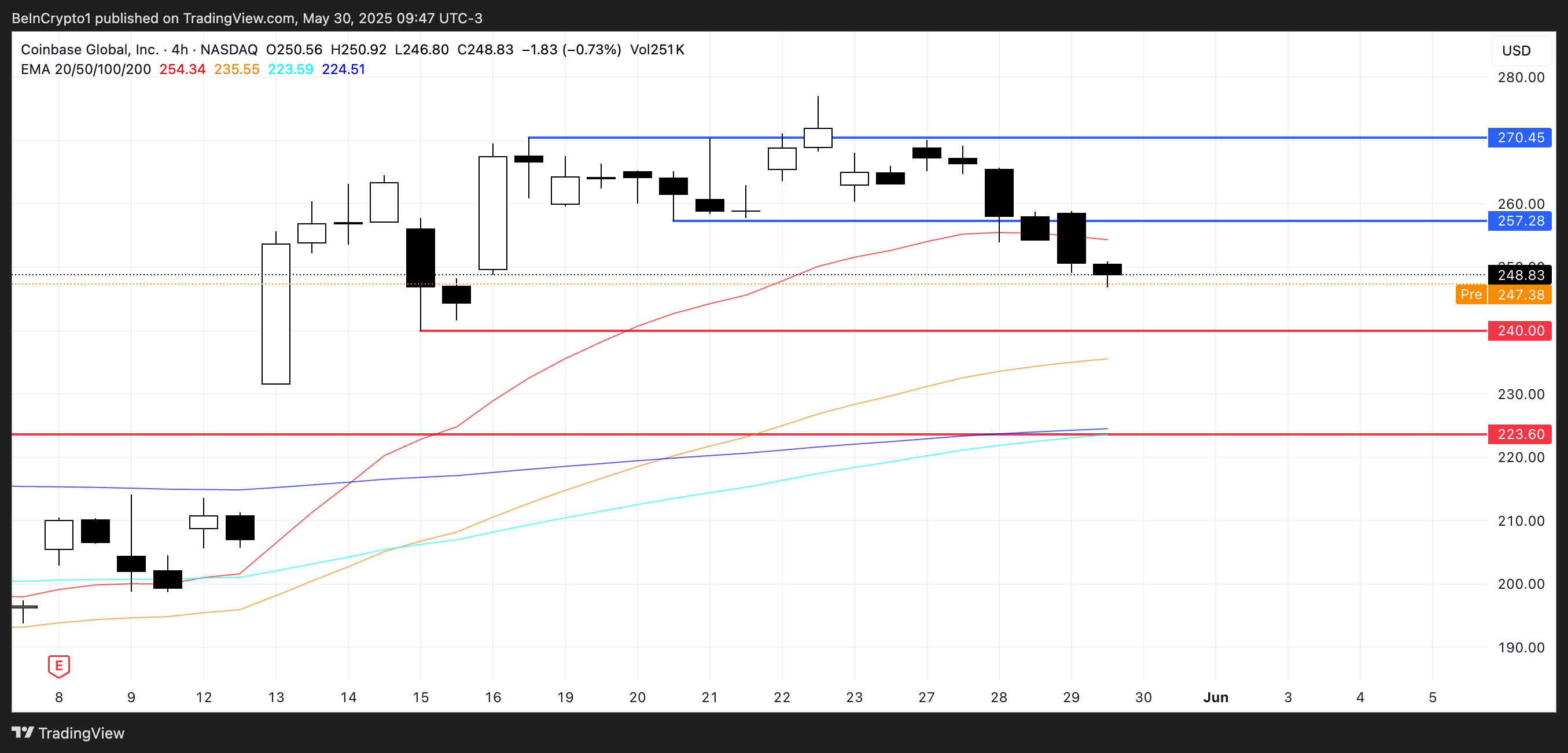

Technically, COIN closed 2.14% lower yesterday and is currently down an additional 0.98% in pre-market trading. The stock is approaching the critical support level of $240, with potential for further decline to $223.60 if this level is breached.

Conversely, if the trend reverses, COIN could test the $257 resistance line, with a potential breakthrough potentially pushing it to $270.45.

Despite recent headwinds, analyst sentiment maintains cautious optimism. 26 predictions anticipate an average 8.36% increase over the next year, with a target price of $269.65. Of 32 analysts, 13 rate COIN as a "strong buy", while 16 recommend holding the stock.