A $680 million long liquidation swept through the crypto market within 24 hours, turning the stalemate at the negotiation table into a bloodbath on trading screens.

The moment U.S. Treasury Secretary Scott Bessent's words fell, the cryptocurrency market collapsed. "I want to say they (China-US trade negotiations) are somewhat stagnant," Bessent candidly admitted in a Fox News interview on May 29, emphasizing that this requires "direct dialogue between the leaders of both countries" to break the impasse.

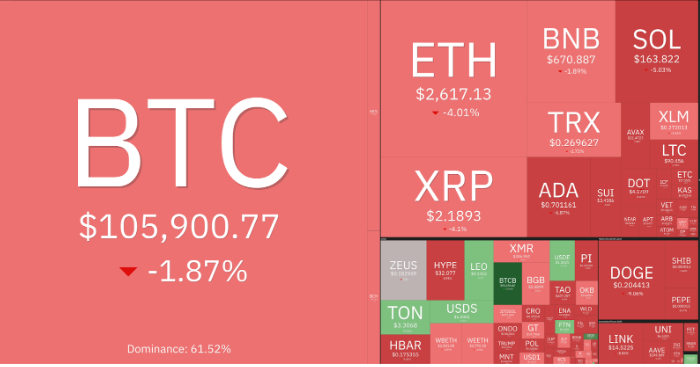

Market risk-aversion mode was instantly activated. Bitcoin broke through the key support level of $105,000, while Ethereum fell to a low of $2,557, with the entire cryptocurrency market value evaporating 2.6% within 24 hours, shrinking to $3.34 trillion.

24-hour performance of major cryptocurrencies

Crash Scenario: Trade Stalemate Triggers "Liquidation Domino"

When Bessent's "stagnation theory" spread through media, the crypto market in the New York trading session immediately staged a long liquidation massacre. Bitcoin plummeted to $104,600 on Bitstamp, with a 24-hour decline of 2.1%, while Ethereum was even more brutal, breaking below $2,600 with a 4.21% drop.

Altcoin market ran with blood: Layer2 sector was hit first, with an overall plunge of 8.7%, among which Arbitrum (ARB), Optimism (OP), and Starknet (STRK) fell by 11.31%, 11.43%, and 12.94% respectively.

- DeFi and MEME coins' death spiral: DeFi sector dropped 7.24%, with Uniswap (UNI) plummeting 10.78%; MEME sector fell 8.21%, Pepe (PEPE) dropped 8.01%, Fartcoin dropped 9.4%.

- Exchange liquidation data was shocking: In the past 24 hours, network-wide liquidations reached $683.4 million, with over 90% being long positions, and Bitcoin alone contributed $211.21 million in liquidation amount.

This liquidation storm showed a clear self-reinforcing characteristic - price drops trigger forced liquidation, and liquidation selling pressure further suppresses prices, forming a death loop. As panic spread, even the relatively resilient PayFi sector couldn't escape a 4.34% decline, with only Safe (SAFE) rising 22.09% against the trend.

[The translation continues in the same manner for the rest of the text]- Downward Channel Opened: If the total market value falls below $3.22 trillion, it may quickly slide towards the 200-day moving average at $3.1 trillion

- Momentum Indicator Weakens: The Relative Strength Index (RSI) dropped from the overbought state of 79 on May 10 to 52, indicating accumulated downward pressure

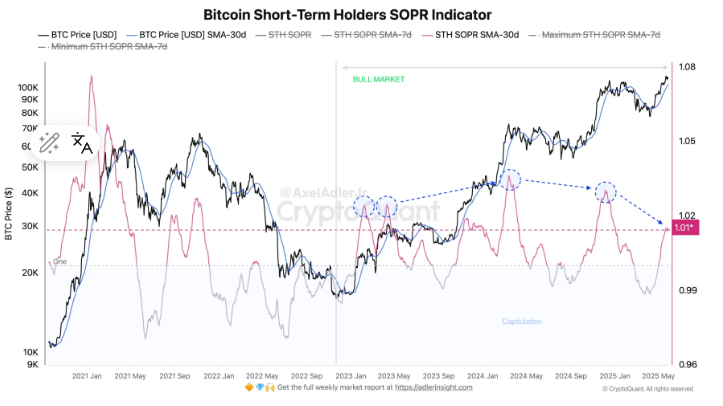

- Bitcoin Cost Basis Support: Bitfinex emphasizes that the short-term holder cost basis of $95,000 is the bull-bear dividing line, with the current price still consolidating above it

Derivatives Market Reveals Contradictory Signals: Although options open interest reached a new high, Matrixport's report points out: "Open interest currently seems to be stabilizing, indicating that traders are taking profits and planning to re-enter at lower levels." This high-level turnover, if accompanied by sustained volume, may actually solidify the foundation for an upward movement.

The Next Act of the Bull Market: Consolidation or Turning Point?

Standing at the crossroads of pullback from historical highs, professional traders see opportunity, not an end. Derive founder Nick Forster judges: Consolidation is a "healthy pause" before a new round of significant rise, allowing the market to digest gains and prepare for the next stage.

Core Variables of Q3 Transformation:

- Federal Reserve Policy Inflection Point: The June 18 FOMC meeting will be crucial, with potential rate cut expectations possibly igniting a new market trend

- Institutional Allocation Cycle: Historically, Bitcoin's average third-quarter rise is only 6.03%, but Forster believes "favorable regulatory developments and continued institutional interest may support an exceptionally strong performance this year"

- Trade War Risk Transformation: If the US-China tariff war reignites after 90 days, Bitcoin may truly enter the mainstream sequence of "global trade hedging tools", forming a three-dimensional hedging system with gold and Swiss francs

Bitcoin researcher Sminston With proposes a more aggressive prediction: BTC could rise 100%-200%, with cycle peak reaching $220,000-$330,000. This expectation is based on Bitcoin increasingly becoming a "macro-sensitive, belief-driven asset" - with trading behavior more anchored to global liquidity than retail sentiment.

Federal Circuit Court overturns tariff ruling, Federal Reserve meeting minutes warn of inflation risks - these events hang like the Sword of Damocles over the market. However, institutional investors continue to act amid this uncertainty: BlackRock Bitcoin ETF's monthly inflow of $6.2 billion has not yet been fully reflected in the price.

The crypto market always spirals upward in the cycle of fear and greed. Glassnode on-chain data reveals the truth: Despite market pullback, the relative unrealized profit indicator has not reached a truly euphoric level, and the $11.4 billion in profits realized by short-term holders over the past month has far from exhausted the market's structural demand.

When the smoke of trade war clears, what remains may not be ruins, but the foundation of a new financial order.