Original Author: 1912212.eth, Foresight News

On May 30, the last day of the Bitcoin 2025 Conference, the market once again verified the curse of a significant drop during the conference.

Bitcoin briefly fell below $105,000 this morning, dropping to a low of $104,600. Ethereum also declined from its high of $2,788 to a low of $2,557. The altcoin market generally experienced a correction, with some altcoins like BERA even hitting historical lows.

In the futures market, according to Coinglass data, the network liquidated $330 million in the past hour, with long positions liquidated at $321 million and short positions liquidated at $7.89 million.

In the macro market, crypto stocks COIN and MSTR both declined after hours. Regarding the Federal Reserve's interest rate cuts, opinions remain uncertain. Fed's Daley stated on Thursday that while policymakers might still cut rates twice this year, current rates should remain stable to ensure inflation reaches the Fed's 2% target. Daley emphasized that as long as inflation remains above the target and uncertain, it will be a focus, given the robust labor market conditions. Additionally, the trade court's Wednesday ruling blocking Trump's tariff measures was overturned by the appeals court on Thursday, highlighting trade policy uncertainty, which makes many businesses and the Fed uneasy.

Is this pullback a healthy short-term correction or the beginning of a prolonged consolidation? Let's hear the market perspectives from experts and analysts.

Placeholder Partner: Small Market Correction Doesn't Mean the Trend is Over, Risk Structure Remains Favorable

Placeholder Partner Chris Burniske posted on social media, "Don't mistake a small correction for the end of the trend; the overall risk/reward structure remains favorable."

Matrixport: Futures Data Suggests Traders May Be Taking Profits

According to the latest report from Matrixport (by analyst Markus Thielen from 10x Research), futures open interest has significantly increased since the April low. Although Solana has been relegated to second place due to the cooling of meme coins and Pump.fun, Bitcoin's open interest has shown significant growth. This surge might reflect a shift in market risk appetite, especially after the recent reversal of Trump's tariff policies. Bitcoin continues to play a dual role of "risk appetite" and "safe haven", increasingly aligning with the "digital gold" narrative.

However, open interest currently seems to be stabilizing, which may confirm our view that traders are taking profits and planning to re-enter at lower levels.

Bitfinex Report: Bitcoin Enters Healthy Consolidation Phase, Short-Term Holders' Profit-Taking May Trigger Selling Pressure

Bitfinex Alpha reported on May 26 that after hitting a historical high in January and experiencing a 32% correction, Bitcoin strongly rebounded over 50%, reaching a new high of $111,880, and is now in a healthy consolidation phase. Strong ETF capital inflows, surging spot market participation, and positive "realized net capital" growth have driven structural buying in the market, rather than excessive speculation. Despite a decline in macro risk appetite, such as rumors of potential 50% tariffs on European imports by the US, Bitcoin remains resilient—showing no significant drops during deleveraging and profit-taking.

This resilience is drawing market attention to Bitcoin's evolution into a "macro-sensitive, belief-driven asset", with its trading behavior now more closely tied to global liquidity trends than retail sentiment. Notably, Japan's Metaplanet increased its Bitcoin holdings by $104 million, and Michigan proposed crypto-asset-friendly legislation, further validating institutional and policy-level support for digital assets.

Looking ahead, whether Bitcoin can maintain consolidation above its short-term holder cost basis (around $95,000) will be crucial. In the past month, short-term holders have realized over $11.4 billion in profits, potentially creating some selling pressure in the short term. However, structural demand remains. ETF buying strength, low volatility, and spot market premium signals indicate market maturation, with potential for further increases once the macro environment clarifies. Currently, the next few weeks will determine whether this breakthrough is a temporary top or a prelude to a stronger Q3 rally.

Arthur Hayes: Ethereum Price Could Double to $5,000 This Year

BitMEX co-founder Arthur Hayes stated at the Bitcoin 2025 Conference that Ethereum's price could reach $4,000-$5,000 this year. Hayes believes Ethereum is currently the "least popular Layer 1 blockchain", but this could be an investment opportunity during market cycle transitions.

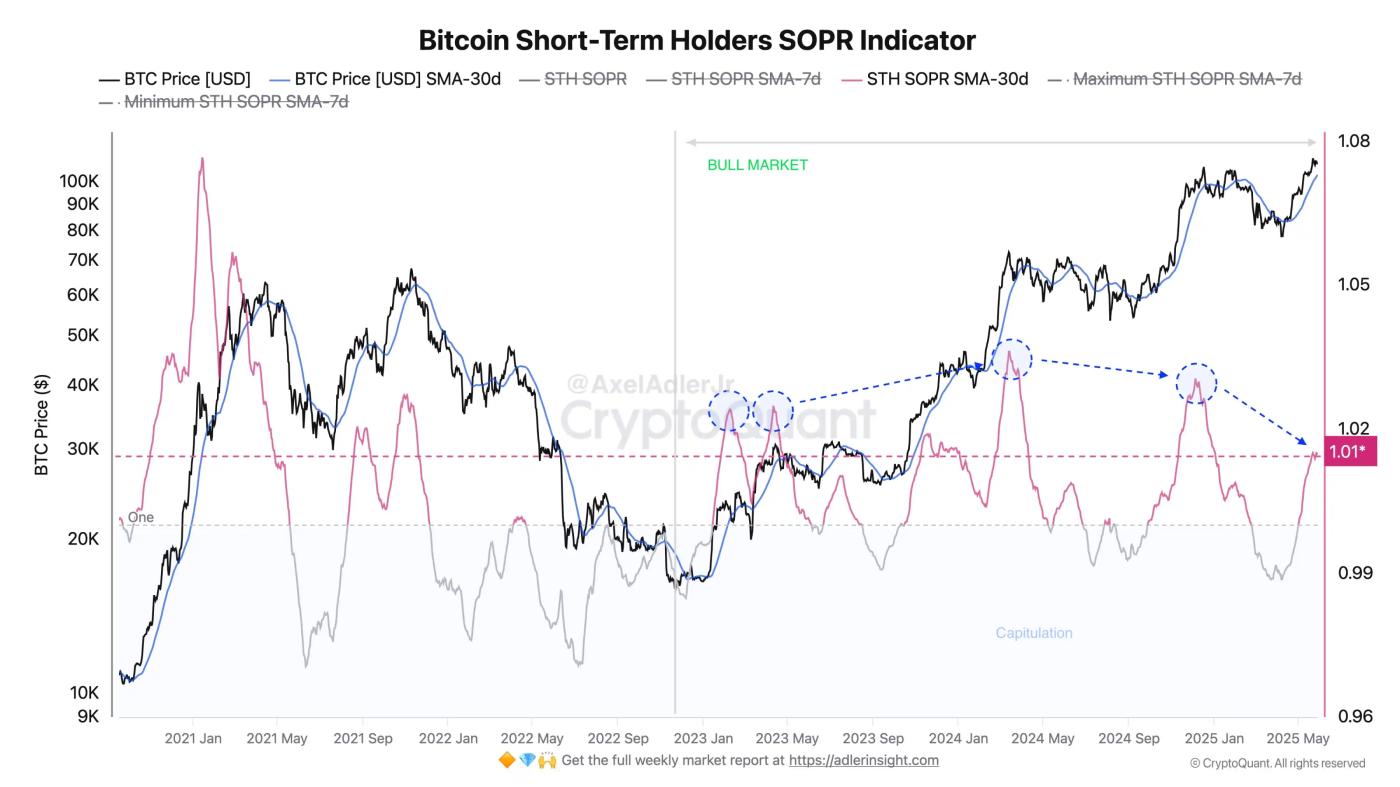

CryptoQuant Analyst: BTC Short-Term Holders' Realized Profits Reach Local High, But Not Yet at Previous Bull Market Peaks

CryptoQuant analyst Axel Adler Jr posted on social platforms that the STH SOPR (30-day moving average) indicator, which measures short-term investors' on-chain token spending profits/losses, recently touched a local high, indicating significant profit realization by short-term holders.

Nevertheless, market token demand remains strong and has not affected the current upward trend. The indicator has not yet reached the euphoric levels seen at previous important price highs.