In the past 24 hours, a large-scale liquidation of leveraged positions has occurred in the cryptocurrency market.

According to the currently aggregated data, most of the liquidated positions were long positions, with long position proportions as high as 96.9% across different exchanges.

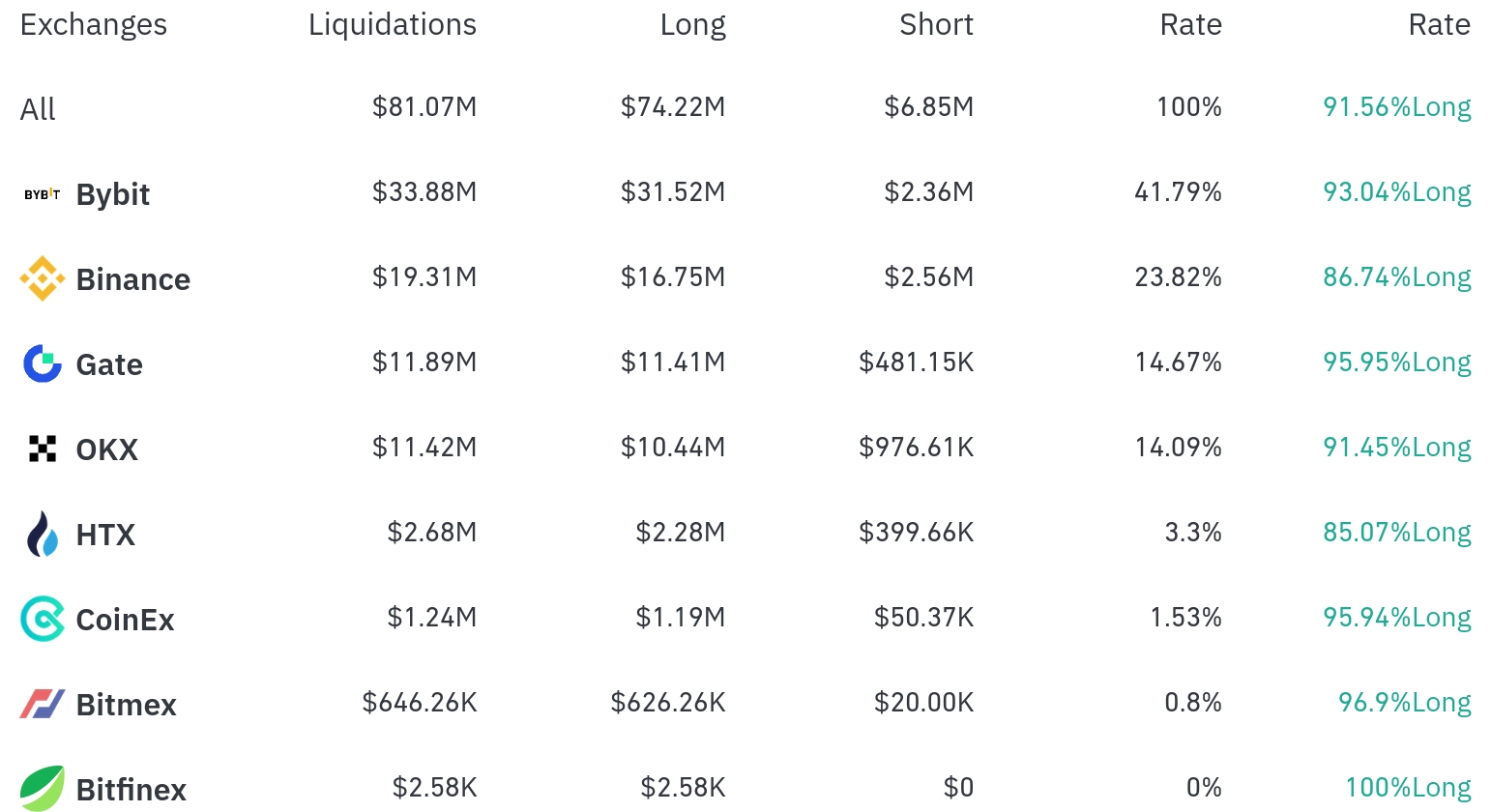

Bybit experienced the most position liquidations in the past 4 hours, with a total of $33.88 million (41.79%) liquidated. Among this, long positions accounted for $31.52 million, or 93.04%.

Binance was the second exchange with the most liquidations, with $19.31 million (23.82%) of positions liquidated, of which long positions were $16.75 million (86.74%).

Gate and OKX also saw liquidations of $11.89 million (14.67%) and $11.42 million (14.09%) respectively, with both exchanges recording over 90% long position liquidation rates.

BitMEX showed the highest long position liquidation rate (96.9%), with a relatively small liquidation scale of $646,260 (0.8%).

By coin, Bitcoin (BTC) and Ethereum (ETH) recorded the most liquidations. Bitcoin had approximately $120.46 million in positions liquidated in 24 hours, with up to $37.55 million in long position liquidations within 4 hours.

Ethereum (ETH) had approximately $113.01 million in positions liquidated in 24 hours, with long position liquidations of $5.41 million and short position liquidations of $2.71 million within 4 hours.

Solana (SOL) saw about $14.95 million liquidated in 24 hours with a price drop of -2.10%, and $6.45 million in long position liquidations within 4 hours.

Doge (DOGE) experienced about $8.68 million in liquidations in 24 hours, with $3.38 million in long position liquidations within 4 hours.

Notably, meme coins like HYPE and WIF also saw liquidations with significant price drops of -4.65% and -4.23% respectively, and the TRUMP Token also had approximately $1.33 million in long position liquidations within 24 hours with a price drop of -2.08%.

This large-scale liquidation appears to have occurred as the recent cryptocurrency market's upward trend temporarily slowed down. Particularly, the overwhelmingly high long position liquidation rates across almost all exchanges suggest that many investors who expected a continued upward trend suffered losses by using leveraged long positions.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>