Bitcoin experienced a massive rally over the past month, recording a new all-time high (ATH) at $111,980. This significant price surge raised questions about whether Bitcoin's momentum would be sustainable as June approaches.

While some investors remain optimistic about further increases, others are wondering if the price will stabilize or if Bitcoin holders will choose a more cautious path.

Bitcoin Investors' Mass Purchases

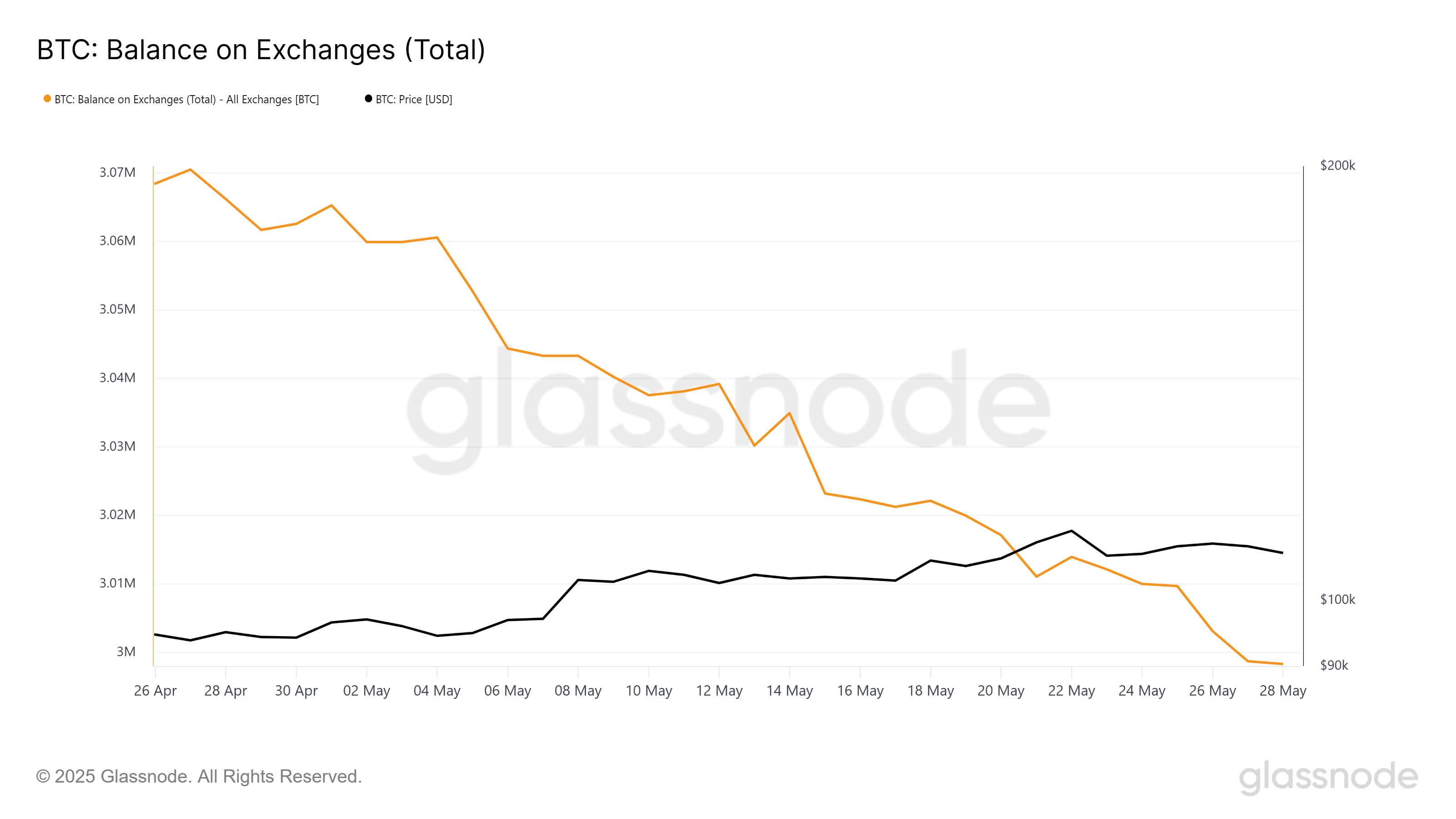

Bitcoin's market sentiment is currently driven by strong accumulation. Exchange balances have decreased by 66,975 BTC, which corresponds to over $7.2 billion. This indicates that investors are moving their holdings from exchanges to personal wallets. Such a significant reduction in available Bitcoin on exchanges suggests growing confidence in the asset and implies belief in further price appreciation.

This accumulation was partially triggered by FOMO (fear of missing out), but confidence in Bitcoin's long-term potential is growing. However, Juan Felisert, Research Vice President at Centora, discussed factors influencing Bitcoin's price surge in a recent interview with BeInCrypto.

"Investors' risk appetite this spring was shaped by a series of macroeconomic trends. Inflation is declining, central bank easing is being reconsidered, real yields and the dollar are falling, global liquidity is expanding, and financial support remains broadly open. These forces have lifted all risk assets, including Bitcoin. This also explains why Bitcoin strongly correlated with the S&P 500 during May." – Juan Felisert, Research Vice President at Centora

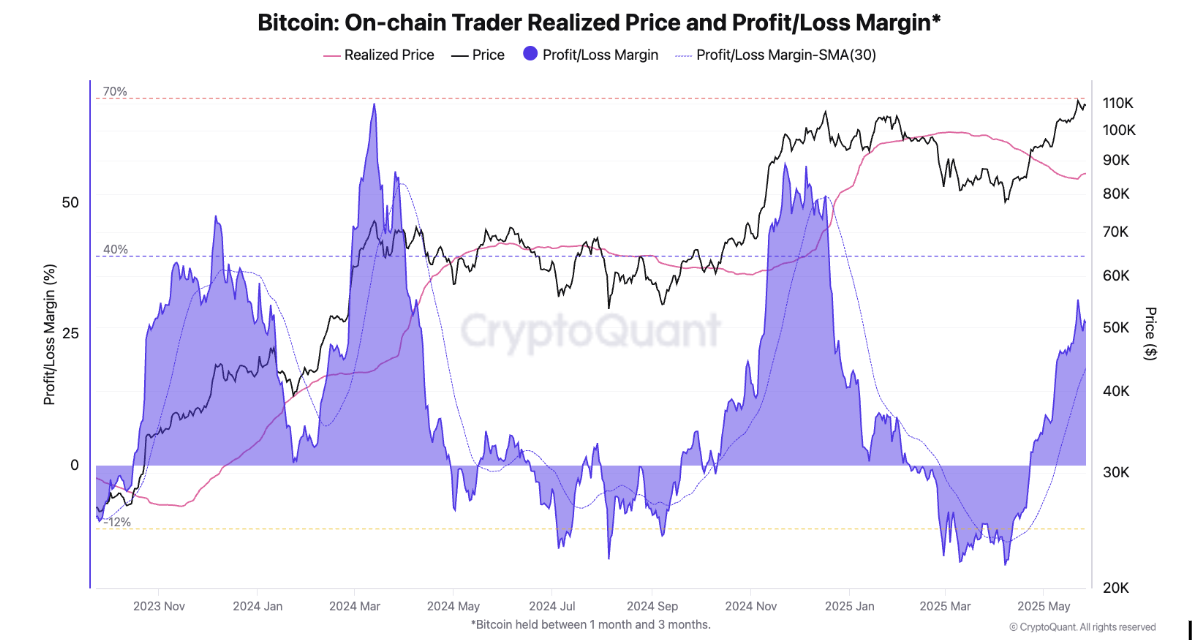

On-chain data shows key indicators that Bitcoin's macroeconomic momentum remains strong. On-chain trader realized prices and profit margins have surged, indicating that investors who purchased Bitcoin 1-3 months ago hold significant unrealized gains. This data helps assess investor behavior and suggests many are still holding and expecting further price increases.

Julio Moreno, Research Head at CryptoQuant, discussed in an interview with BeInCrypto how these short-term holders' profit increases could potentially threaten Bitcoin.

"In the short term, there might be some profit-taking as traders approach an overheated margin of around 40%. Please refer to the chart where Bitcoin traders' on-chain profit margin reached 31% in recent days (purple area)." – Julio Moreno, Research Head at CryptoQuant

BTC Price, New Record Target

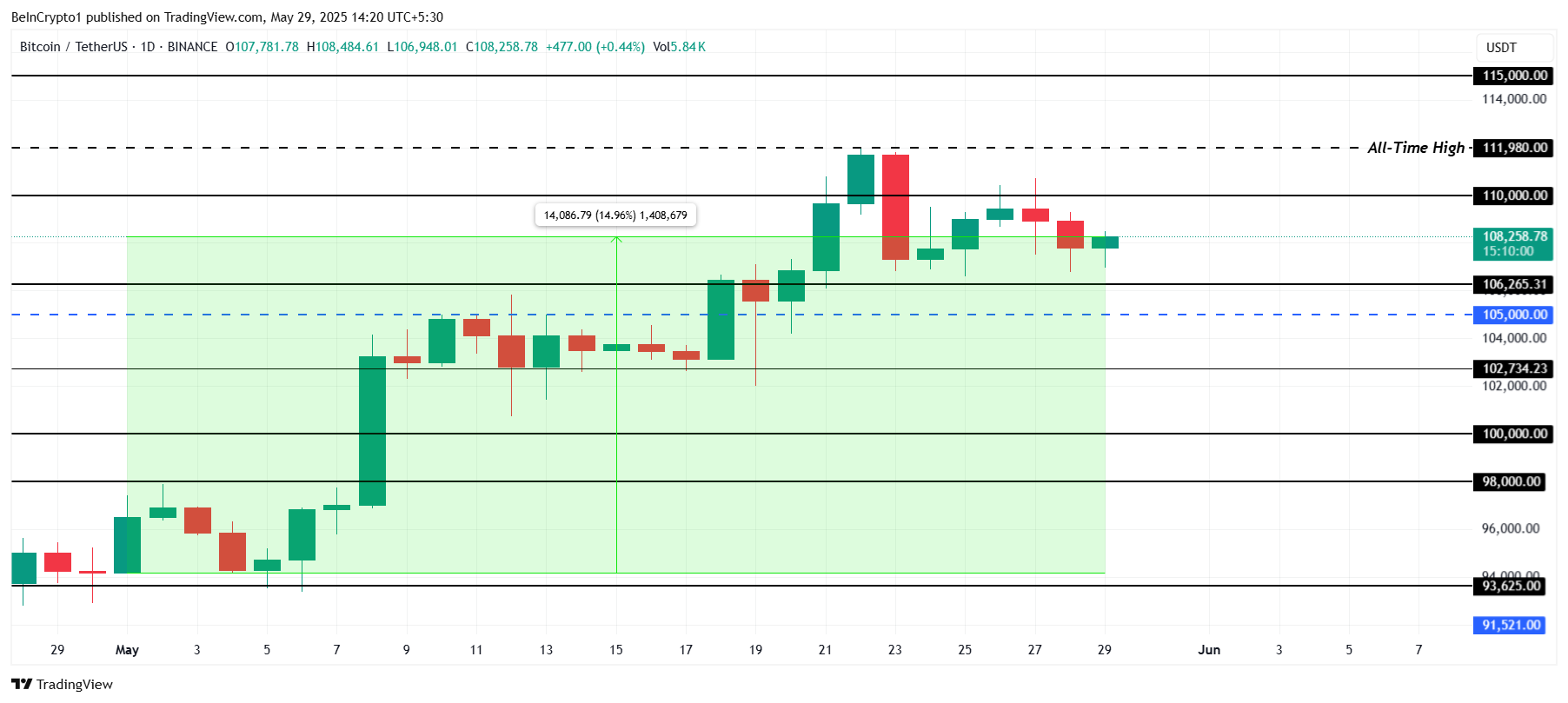

Bitcoin's price rose 14% during May, reaching a new all-time high of $111,980. Currently trading at $108,258, it is testing the $110,000 resistance level. The next few days will be crucial in determining whether Bitcoin can maintain its momentum.

If institutional and individual accumulation continues in June, the price could maintain its upward trend.

Moreover, the "sell in May and go away" strategy was ineffective in the stock market last year, with markets continuing to rise despite seasonal trends. Considering Bitcoin's correlation with the stock market and macroeconomic conditions, it may continue to experience upward momentum in June. Given Bitcoin's resilience, it is likely to record higher prices even amid broader market uncertainty.

Bitcoin's price could eventually break through $110,000, establishing it as a solid support level before targeting $115,000 beyond its ATH. However, if profit-taking intensifies, Bitcoin may experience a correction. A sharp decline is unlikely, but Bitcoin might undergo some adjustment before continuing its upward trend, with support levels at $102,734 and $106,265 acting as buffers.