XRP's price has been continuing its downward trend over the past two weeks, challenging bullish investors.

Despite the current downward trend, some traders see this period as an opportunity to accumulate XRP before a potential price rebound.

XRP, Strong Support Line

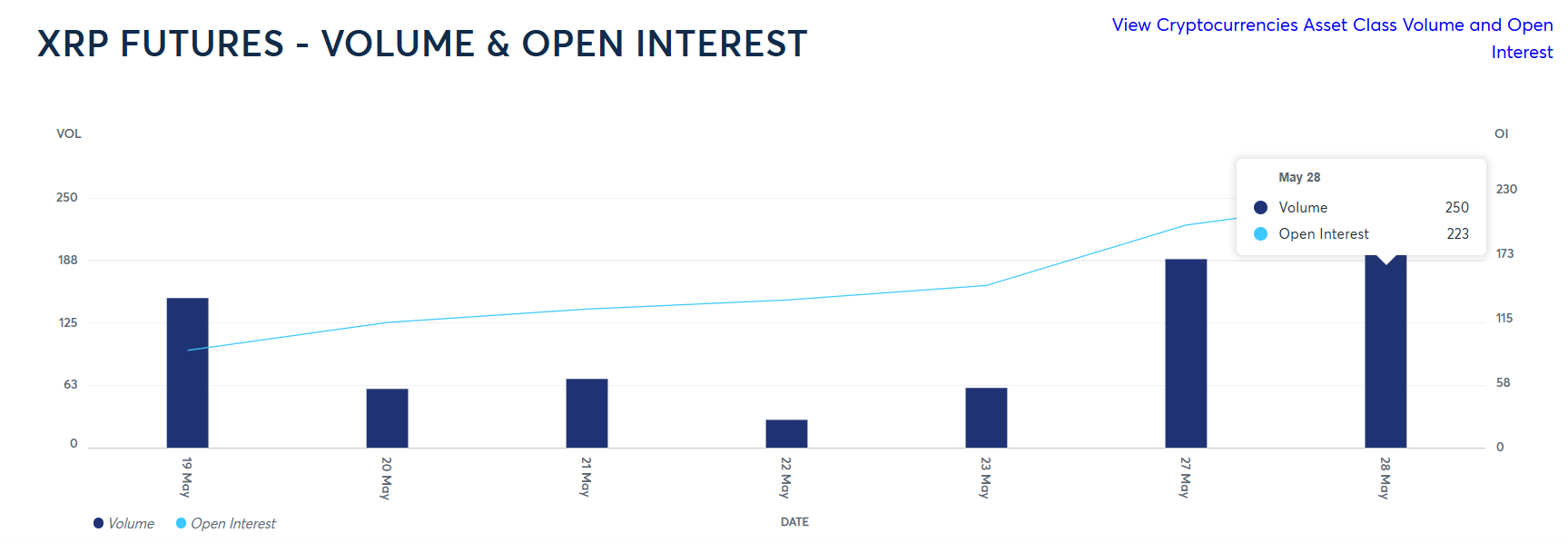

Demand for XRP has sharply increased in the futures market. XRP CME futures open interest reached $223 million within 10 days of launch. A surge in open interest is typically a bearish signal, indicating traders are likely to enter short contracts.

However, this situation is different. This is because XRP futures have been launched on CME, providing better exposure to the token. Therefore, investors allocating capital in this area seem to be expecting returns.

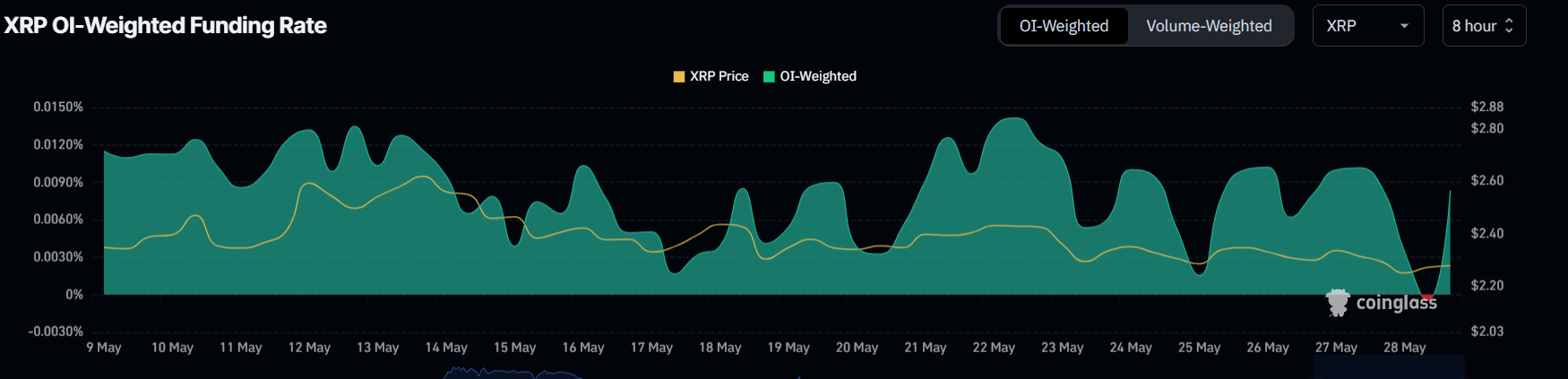

The funding rate has been almost always positive over the past three weeks, further supporting the bullish outlook. This shows that long contracts are overwhelming short contracts.

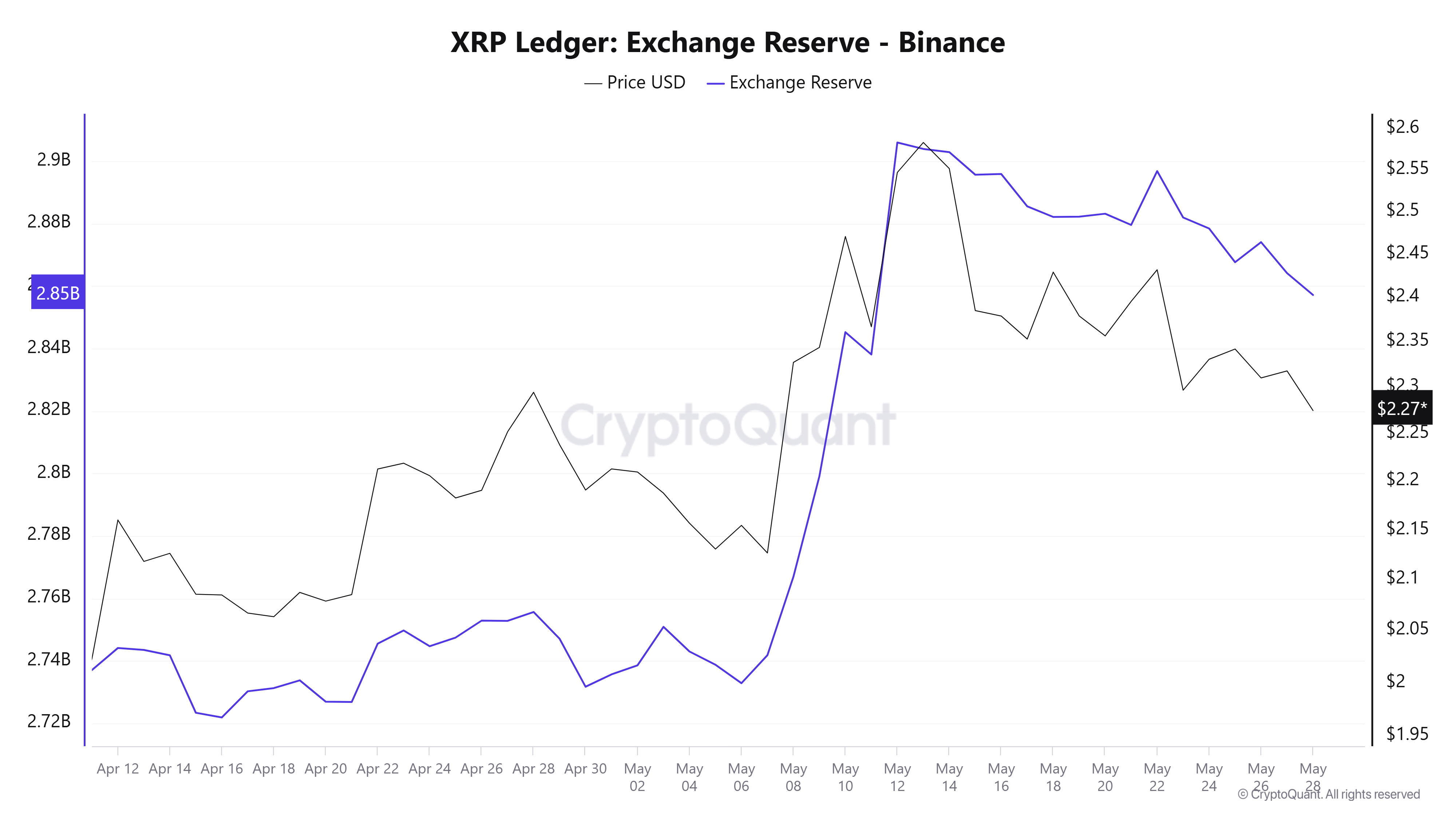

XRP's exchange reserves surged from the beginning of the month until two weeks ago, indicating selling pressure. However, since then, these reserves have decreased by over 50 million XRP, approximately $114 million, indicating massive withdrawals from exchanges.

This decrease in exchange reserves emphasizes increased accumulation by investors, seemingly driven by FOMO (fear of missing out). Buyers are taking advantage of relatively low prices, expecting to generate profits as XRP reverses its downward trend and momentum shifts.

XRP Price Increase Potential

Currently trading at $2.28, XRP is trapped in a two-week downward trend and has not found a breakthrough. The altcoin is slightly above the support level of $2.27, but further decline cannot be ruled out.

If XRP maintains the $2.27 support line, it could break through the downward trend and pull the price up to $2.38. This rebound confirms the recent increase in futures demand and accumulation, indicating restored investor confidence.

Conversely, losing the $2.27 support line will open the door to additional losses. XRP could drop to the next support level of $2.12, which could invalidate the bullish outlook and extend the downward trend before a meaningful recovery.