Bitcoin ('BTC) has recently reached an all-time high but dropped nearly 2% in the past 24 hours. At the Bitcoin 2025 Conference, US Vice President JD Vance publicly supported BTC as a hedge against inflation and political excess.

Meanwhile, the Federal Reserve's recent meeting minutes warned of rising inflation and unemployment risks, fueling macroeconomic uncertainty. The combination of political support and economic instability is strengthening Bitcoin as a hedge asset during volatile times.

JD Vance Supportsive Bitcoin...Federal Reserve Warns of Inflation-Unemploymenteled

US Vice President JD Vance today expressed strong support for cryptocurrency, especially Bitcoin, at the Bitcoin 2025 Conference in Las Vegas. In his, v:

"Cryptocurrency is a hedge against the wrong policy decisions in Washington, of party in power. is a hedge against soaring inflation that has eroded the real savings rate of Americans over the s in the past four years. And as you know, it is a a hedge against the private sector trying to discriminate against consumers based on fundamental beliefs, including political beliefs." – JD Vance, US Vice President

By confirming he personally holds Bitcoin, he strengthened Bitcoin's image as a symbol of financial freedom and resistance to central control.

Simultaneously, the Federal Reserve's May meeting minutes revealed growing concerns about inflation and unemployment rates.

Federal Reserve officials warned of a "difficult choice" in balancing inflation control and job support. Tariffs proposed by the Trump administration are adding more pressure, and fears of recession persist despite delays.

These economic stresses, policy uncertainties, and political support could enhance Bitcoin's hedge appeal. Investors seeking protection from instability may may be drawn to Battracted to BTC.

Bitcoin Whales Retreat After Price Peak...Cloud Caution Signal

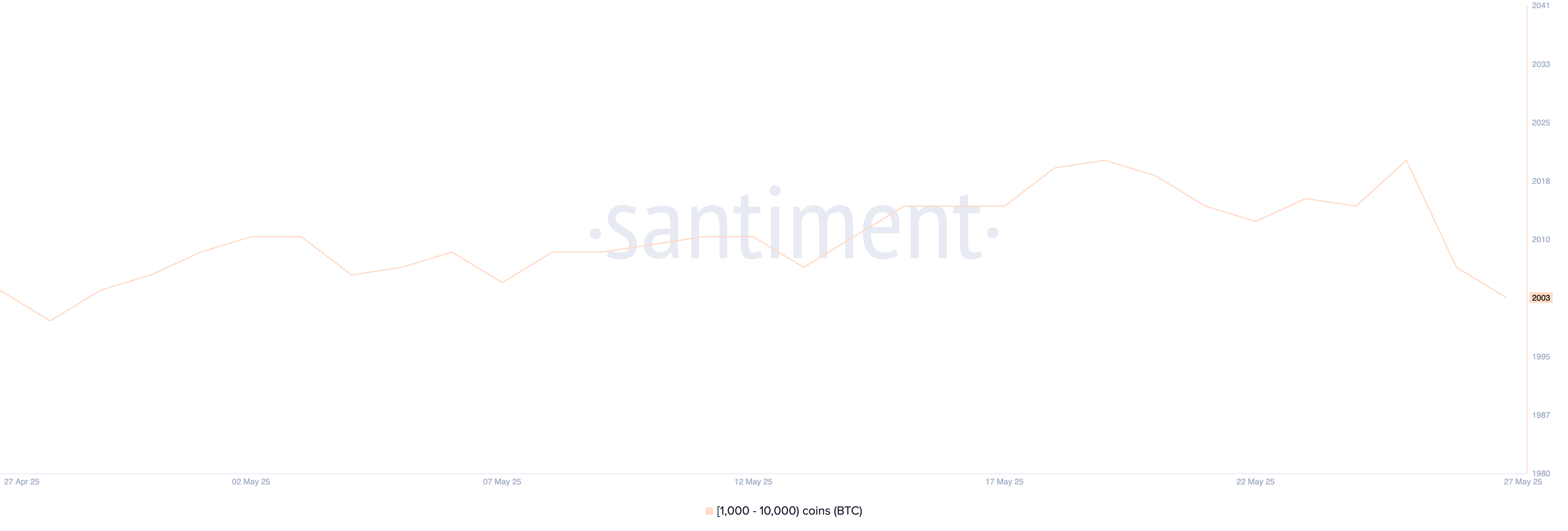

The number of Bitcoin whales—wallets holding 1,000 to 10,000,increased to 2,021 on May 25, reaching its highest level in almost a year.

These large holders are considered the most influential market participants. The increase in whale numbers typically indicates growing confidence among long-term investors, especially when coinciding with strong price movements.

However, just two days after reaching a year-high, the whale count sharply dropped to, on May 27.

This sharp decrease might indicate that some large holders have begun realizing profits after Bitcoin's rally near its all-time all-time>

Currently, on Bitcoin's Ichimoku chart, the Conversion Line (blue line) is above the Base Line (red line), indicating short-term momentum is stronger than the medium-term trend.

This is generally a bullish signal. However, Bitcoin's price entering the green cloud (Mo suggests uncertainty and potential adjustment.

When price enters the cloud, the market is considered neutral or undecided, especially after a sharp upward trend. Leading Span A (is green line) is still remains above Leading Span B (red line), technically line indicating the long-term trend remains bullish.

However, the cloud'satting momentum weakening selling pressure could Bitcoin fails to stay above the the cloud's lower boundary.

Conversely, a rebound from the cloud could set up another bullleg if buyers intervene.

BTC, $112,000 Target...Death Cross Risk

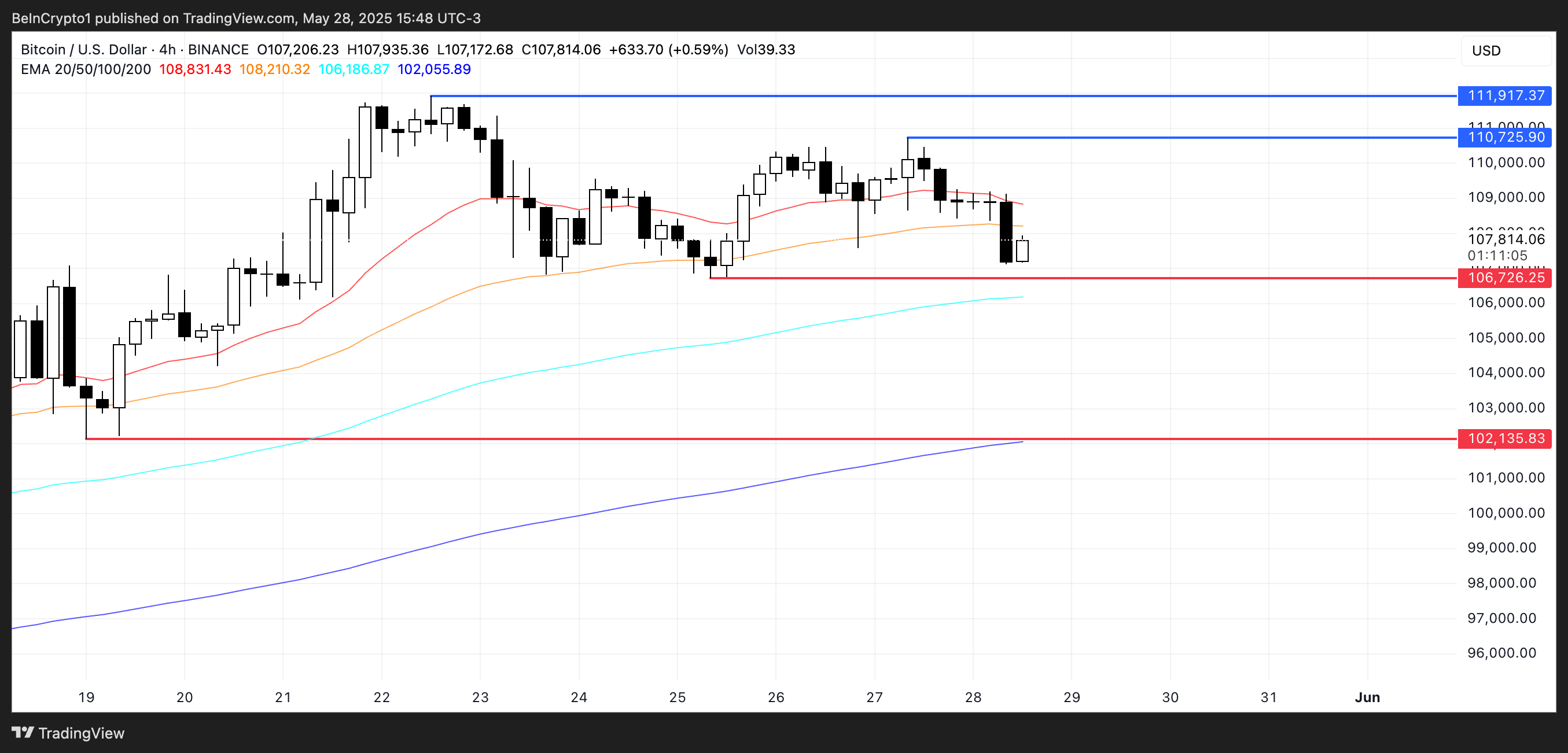

Bitcoin's moving averp reflects a, short-term moving averabove long-moving term moving>

A death cross formation cross when-crosses below the long-term moving average—trigger a deeper adjustment.

In this case, BTC could test the support support level of $106,726. If that level breaks breaks, $102,135 135 become becomes the next major observation point.

Conversely, if buyers regain control and momentum recovers, BBTC could retest the resistance at $111,725.

If a breakout occurs there, it could open another rise to the $112,000 zone, which recently recorded an all-time high.