As competition in the crypto domain intensifies, professional risk manager Santisa points out that the entire crypto market, excluding Bitcoin, has become a PvP battlefield: "Continuously transferring funds among the same group of people, paying transaction fees, ultimately becoming an ATM for exchanges and insider personnel." In comparison, market-neutral strategies might be one of the few domains still capable of consistently generating alpha.

Table of Contents

ToggleBattlefield Reality: The Brutal Truth of Crypto Market PvP Mode

Santisa bluntly stated: "The crypto market has no new money flowing in, only funds circulating among old players."

People continuously pay transaction fees in each trade, while being diluted by insiders or "rat trading" with almost zero cost. The originally potential 50/50 profit probability becomes 49:51 after paying fees. With each rotation, the probability of losing increases.

He emphasized that Binance's ability to pay a $4 billion fine and Bybit's instant filling of a $1.5 billion gap fully illustrates the scale of this "fund extraction" game paid for by market participants:

Those who ultimately "succeed" in the crypto market are often those who know how to withdraw in time; those who remain in the market long-term will eventually lose everything.

Why Can "Market Neutral Strategy" Survive Against the Trend?

Therefore, instead of entering the battlefield, Santisa chose to play the role of providing capital and leverage. He emphasized that the "market neutral strategy" allows rational investors to lend capital to speculators willing to pay excessive costs for "success opportunities" while barely incurring any costs themselves.

The core advantage of this model lies in the capital structure's host-guest distinction:

Those who own capital (Maker) are already in an advantageous position, while those who must predict price direction or bet on meme coins for returns (Taker) are at a relative disadvantage.

(Comprehensive Analysis of Stablecoin Yield Strategies: Cross-Cycle Stable On-Chain Investment Guide)

This is not just a financially rational choice, but also a psychologically healthy lifestyle: "Stay away from emotional price fluctuations and market noise, and focus on low-volatility, high-stability income sources."

8 Years of Experience Talking About Low-Key Wealth: Is 15% Annual Return Attractive?

Although a 15% annual return doesn't sound as eye-catching as "100x coins", Santisa reminds that this is achieved with almost no drawdown and extremely low risk. He provides actual numbers as an example:

If $1 million was invested 8 years ago, the assets would have grown to about $3.05 million today, which is equivalent to $2.41 million in current dollar purchasing power, achieving a 141% real return.

However, he also candidly admits that behind all this are years of time investment and infrastructure expenses, such as approximately $200 monthly for equipment and analysis tools, and several hours of strategy assessment and adjustment each week.

Risk and Reflection: Market Neutral is Not a Golden Ticket

Despite Santisa's high evaluation of market neutral strategies, respondent @shant1deva raised an important reflection:

As high-yield market neutral farms gradually disappear and crypto high-volatility profit opportunities simultaneously shrink, investors might ultimately only obtain returns similar to "junk bonds" while bearing higher risks.

(Let Data Speak the Truth: How Self-Deception Affects Your Portfolio Performance?)

He suggests a more flexible Barbell strategy: "Allocate conservative market neutral positions on one side, while making small high-risk speculative investments on the other to capture explosive returns, balancing overall risk and returns."

Alpha Won't Always Be There, But Discipline and Rationality Can

Santisa finally pointed out that even though he doesn't believe this alpha can exist forever, crypto markets always present opportunities in unexpected places:

While everyone is chasing 100x coins, rational players who provide liquidity at the bottom, master risk control and leverage boundaries, can steadily earn the "silent wealth" of 15% annual returns.

The crypto market is ultimately an investment market. Instead of joining a competitive and unbalanced wealth game, it's better to receive long-term rewards by maintaining discipline and calmness. Perhaps the true alpha is the ability to remain rational when others are going crazy.

Risk Warning

Crypto investment carries high risks, and prices may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.

Cantor Fitzgerald's crypto lending division welcomed its first batch of clients, announcing the completion of a Bitcoin-backed loan transaction with Maple Finance and FalconX. This not only symbolizes traditional finance's further embrace of digital assets but also represents a rebirth of the crypto lending market after the 2022 crisis.

Table of Contents

ToggleNew Path for BTC Monetization: Cantor's First BTC Collateral Loan

After nearly a year of preparation, Cantor Fitzgerald's Bitcoin financial business officially opened in March this year and completed its first batch of BTC collateral loan transactions yesterday. According to Bloomberg, the Wall Street financial company has provided loans to crypto broker FalconX and on-chain lending protocol Maple Finance.

Cantor Fitzgerald first announced its entry into the Bitcoin financing market last July, with an initial financing limit of $2 billion, primarily targeting institutional investors looking to operate BTC leverage. The plan designated Anchorage Digital as the custody institution to ensure asset safety and transparency:

These transactions allow many Bitcoin-holding enterprises to obtain liquidity by pledging assets without selling them.

FalconX stated that it received over $100 million in loans as part of its long-term financing structure. Maple Finance completed the first phase of funding collaboration with Cantor.

Reviewing 2022 Bear Market: The Collapse and Reconstruction of Crypto Lending

The 2022 crypto market crash highlighted the fragility of unregulated lending structures. Large crypto lending platforms like Celsius, Genesis, and BlockFi essentially collapsed like dominoes, with some falling due to high-risk operations and fraud allegations, while others experienced a chain reaction from the FTX collapse.

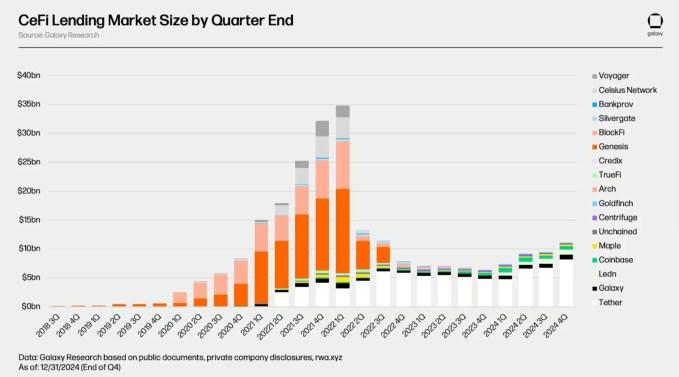

This crisis severely damaged investor confidence and caused the overall crypto lending market to shrink dramatically. Galaxy data shows that the overall crypto loan market size in 2024 is still far below the 2021 peak of $64.4 billion, with a decline of nearly 80%.

However, with Bitcoin leading market heat, on-chain lending platforms have shown a strong recovery. In the fourth quarter of 2024, total on-chain loans surged to $19.1 billion, more than doubling compared to two years ago. This indicates that market funds are gradually returning to the DeFi domain.

(Crypto Lending Recovery, Cantor Fitzgerald Launches $2 Billion Fund)

In this context, Cantor's entry is seen as an endorsement of market maturity, gradually moving the previously high-risk, gray-area crypto credit business towards standardization and compliance.

From Custody to Lending: Cantor's Comprehensive Layout

As one of the large institutions actively crossing into the crypto field, Cantor not only promotes Bitcoin lending business but is also responsible for the custody of Tether stablecoin USDT and acquired 5% of Tether's shares in early 2024, demonstrating its high regard for crypto assets.

The company currently serves over 5,000 institutional clients in 20 countries, with business covering investment banking, brokerage trading, stock and bond sales, and other fields. Its entry into crypto lending is seen as a key step in deepening its digital asset financial strategy and is expected to attract more traditional institutions to join the battle.

Risk Warning

Crypto investment carries high risks, and prices may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.