Key Points:

- Bitcoin price is currently range-bound, with resistance at $110,000 continuing to hinder its rise to a new all-time high.

- Traders are in a wait-and-see mode due to macroeconomic uncertainty.

Bitcoin's bull market has stalled, with prices consolidating around $3,500 since May 23rd. The $110,000 level has proven to be a difficult barrier to break.

Figure 1: BTC/USD 4-hour chart.

Bitcoin Encounters Resistance at $110,000

Data from Cointelegraph Markets Pro and Bitstamp shows BTC price fluctuating in a narrow range between $106,600 and $110,700, with no clear directional bias.

Analyst and trader BitMonty in his latest X Bitcoin analysis stated that BTC price has "broken out of a triangle pattern and is moving upward," but with key resistance at $110,000.

In the past few days, Bitcoin bulls have twice attempted to break through the $110,000 resistance level, both unsuccessfully.

Traders note that breaking this level could drive BTC to a new all-time high.

"However, if the price is rejected at this level, it may fall back to the support area."

Figure 2: BTC/USD hourly chart. Source: BitMonty

Figure 2: BTC/USD hourly chart. Source: BitMonty

For market intelligence firm Santiment, failing to break the $110,000 level has led to a gradual decline in trader enthusiasm.

With Bitcoin price hovering around $110,000, traders showed a bit of FOMO, but "excitement has calmed down," the company explained in an X post, adding:

"As market movement contradicts retail expectations, we may continue to see some rational skepticism."

Figure 3: Ratio of positive to negative Bitcoin comments on social media. Source: Santiment

Figure 3: Ratio of positive to negative Bitcoin comments on social media. Source: Santiment

Macroeconomic Uncertainty Cools Bitcoin Price

This week's macroeconomic events have added doubt and hesitation to the crypto market, with rising bond yields causing concern.

The release of the Federal Reserve's latest meeting minutes is the focus for investors seeking clues about future rate decisions. On May 7th, the Fed maintained interest rates, with Chairman Jerome Powell pointing out that President Donald Trump's tariff measures are the source of inflation and uncertainty.

This week, the US April Personal Consumption Expenditures (PCE) index and initial jobless claims will be released on May 29th. These figures will come after the first-quarter GDP's initial revision.

Meanwhile, the earnings report from AI giant Nvidia could impact the tech market and indirectly affect cryptocurrencies. A disappointing report could trigger broader market selloffs, putting additional pressure on Bitcoin.

Additionally, at the 2025 Bitcoin Conference in Las Vegas, Trump family members have been speaking, and their presence has previously caused significant market volatility.

Trading firm QCP Capital in its May 27th Telegram report to investors stated: "Last July, when Trump gave the keynote speech in Nashville, 1-day implied volume spiked to over 90, quickly reversing, with BTC dropping nearly 30% in two days. This event continues to influence market memory."

"While the likelihood of a similar drawdown seems low, position sizing indicates a defensive tendency."

Bitcoin Bulls Compete for Key Support Levels

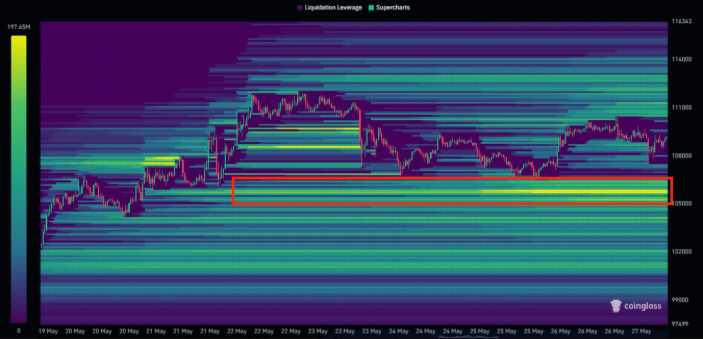

Meanwhile, well-known trader Daan Crypto Trades noted that the longer the price lingers in the $110,000 area, the denser the liquidity clusters above and below become.

He wrote in an X post: "Below $106,000, there's significant liquidity clustering, and above $111,000, there's also substantial liquidity. The key levels to watch are the historical highs above and below $111,000, down to $105,000, which marks the beginning of the recent trend."

Daan Crypto Trades added:

"Closely watch when the price touches these two areas, as they often act like magnets when approached."

Figure 4: BTC/USDT Liquidation Heatmap. Source: Glassnode

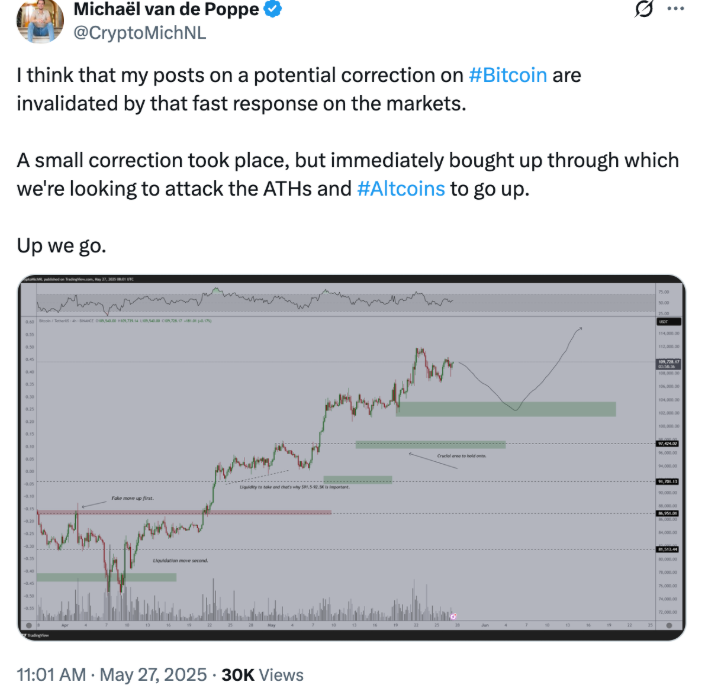

For MN Capital founder Michael van de Poppe, the $102,000 to $104,500 range is crucial for maintaining upward momentum.

Figure 5: Source: Michael van de Poppe

Figure 5: Source: Michael van de Poppe

According to Cointelegraph, Bitcoin has entered an "overheated zone," and long-term profit-taking may hinder BTC price growth in the short term.