In the past 24 hours, approximately $213.6 million (about 312 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

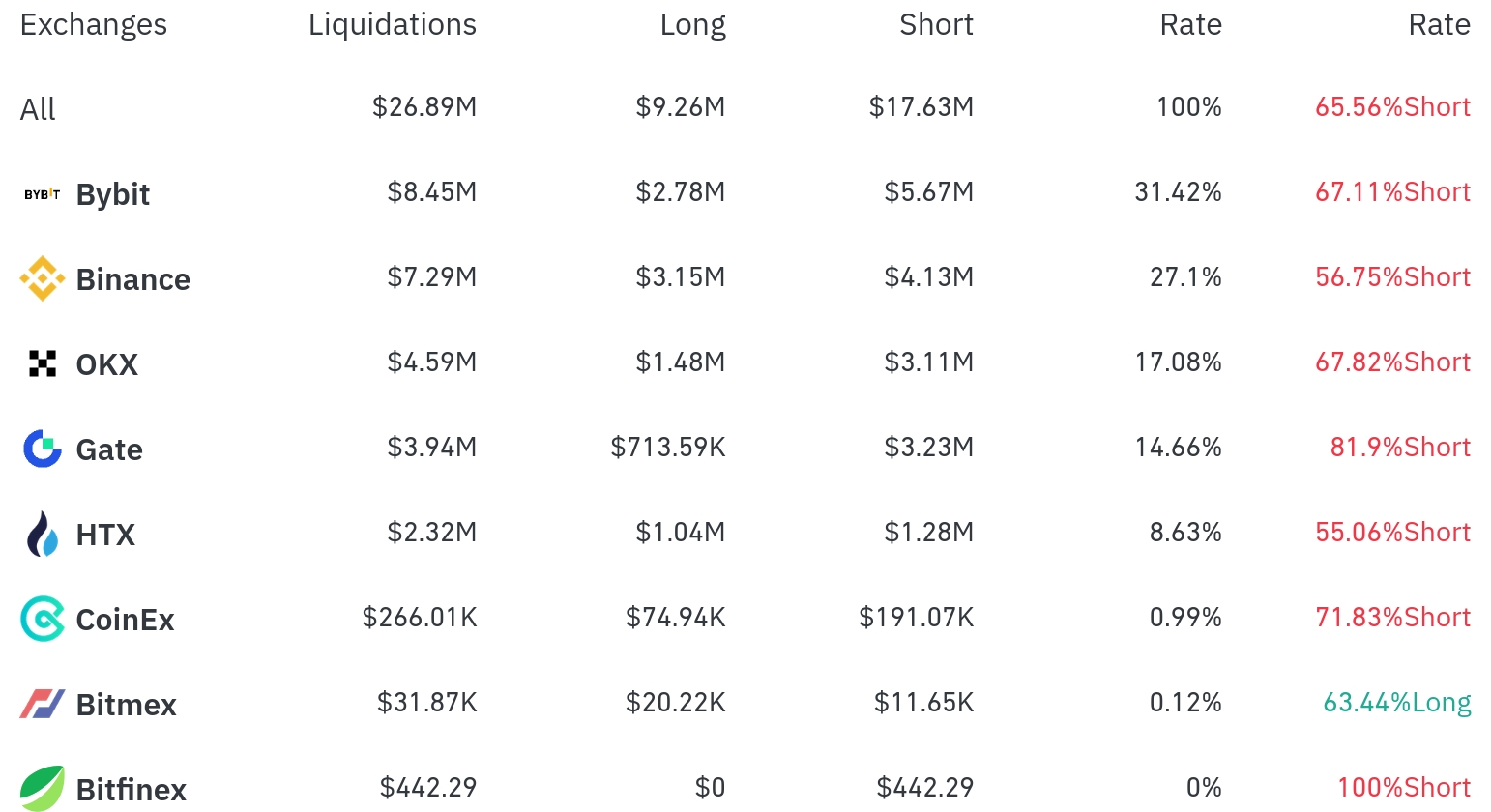

According to the currently compiled data, short positions dominated the liquidations. Most major exchanges showed a higher liquidation rate for short positions compared to long positions.

Bybit had the most position liquidations in the past 4 hours, with a total of $8.45 million (31.42%) liquidated. Among these, short positions accounted for $5.67 million, representing 67.11%, which was higher than long position liquidations.

Binance was the second-highest exchange, with $7.29 million (27.10%) of positions liquidated, of which short positions were $4.13 million (56.75%).

OKX saw approximately $4.59 million (17.08%) in liquidations, with a high short position ratio of 67.82%.

Gate.io also showed a very high short position liquidation rate of 81.90%, and most exchanges predominantly saw short position liquidations. BitMEX was the only exchange where long position liquidation rate was higher at 63.44%.

By coin, Bitcoin (BTC) and Ethereum (ETH) had the most liquidated positions. Approximately $80.74 million in Bitcoin positions were liquidated in 24 hours, with about $1.9 million liquidated in 4 hours.

Particularly for Ethereum (ETH), about $79.89 million in positions were liquidated in 24 hours. In 4 hours, long positions were $3.86 million, while short positions were $11.07 million, with short positions overwhelmingly dominant. This appears to be influenced by Ethereum's 4.05% rise in the past 24 hours.

Solana (SOL) saw about $7.24 million liquidated in 24 hours, and among other major altcoins, TRB ($10.85 million), 1000PEPE ($6.01 million), and Doge ($5.74 million) had significant liquidations.

Notably, the Sui Token showed a strong 6.17% rise, with short position liquidations over 10 times more than long positions. In 4 hours, $3.11 million in short positions were liquidated, while long positions were only about $28,000.

In the meme coin market, 1000PEI and PEPE rose by 1.10% and 1.08% respectively, with substantial liquidations. The FARTCO token, in particular, dropped 1.66% with about $1.7 million in positions liquidated in 24 hours.

The TRUMP token, related to Trump, showed a unique pattern with more long position liquidations despite a slight rise (+0.49%).

The prevalence of short position liquidations in the cryptocurrency market can be interpreted as an indicator of overall market uptrend, with Ethereum and some altcoins showing notable increases.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>