Get the best data-driven crypto insights and analysis every week:

The After-Effects of Ethereum’s Pectra Upgrade

By: Tanay Ved

Key Takeaways:

Ethereum’s Pectra upgrade went live on May 7, raising the validator max effective balance from 32 to 2048 ETH (EIP-7251) and doubling blob space to support Layer-2 scaling (EIP-7691).

Over 11,000 validators have consolidated so far, reducing the active validator set by ~16,000 while maintaining overall staked ETH and raising the average stake per validator to ~32.4 ETH.

The number of blobs posted to Ethereum has increased from ~21K to ~28K, though rollup demand remains below the new target of 6 blobs per block.

Layer-2 transaction counts have climbed as costs fall, with total blob fees near zero. A rise in fees would require greater blob demand from rollups.

Introduction

Ethereum’s Pectra hard fork successfully went live on May 7th, introducing a range of improvements to validator operations and staking flexibility, user-experience (UX) enhancements via smart accounts, and increased capacity to support Layer-2 scaling. With 11 EIPs going into effect, Pectra embodies another major milestone since the inception of the Beacon chain, building upon the foundations of The Merge, Shapella and Dencun, to deliver incremental progress along Ethereum’s roadmap.

In this issue of Coin Metrics' State of the Network, we analyze the early impacts of Pectra, focusing on how raising Ethereum’s max effective balance and doubling Ethereum’s blobspace are impacting staking dynamics and the Layer-2 ecosystem going forward. With these EIPs in focus, we also highlight key changes in related Ethereum’s metrics since the upgrade.

Staking & Validators

A major focus of the Pectra upgrade was to streamline validator operations and introduce more flexibility for those taking part in Ethereum’s proof-of-stake (PoS) system. One enhancement comes in the form of EIP-7251, which raised the maximum effective balance of a validator from 32 ETH to 2048 ETH, which could restructure network economics. This means that stakers can now top up existing validators or consolidate multiple validators into a single one to earn compounding rewards more efficiently.

Max-Effective Balance Increase (EIP-7251)

To understand the implications of this change, it’s helpful to look at how validator consolidation works in practice. To consolidate, validators need to:

Update withdrawal credentials to type 0x02, which signals the ability to consolidate multiple validators into one.

Select the source validator (to be consolidated) and target validator (which will receive the effective balance).

Submit a consolidation request. After a request is placed, the source validator enters an exit queue (used for voluntary exits & consolidations), as there are limits to how many validators can exit or consolidate in each epoch.

Once the source validator’s withdrawable slot is reached, it is exited from the active set, and its effective balance is transferred to the target validator, processing the consolidation.

Source: Coin Metrics Network Data Pro

The chart above shows the number of validators that have successfully consolidated (entered the active set), along with the total amount of ETH consolidated. Since the Pectra hard-fork went live on May 7th, a total of 11,150 validators have consolidated thus far, resulting in the consolidation of 359,146 ETH (as of May 25th).

Impact on Validators & Staking Economics

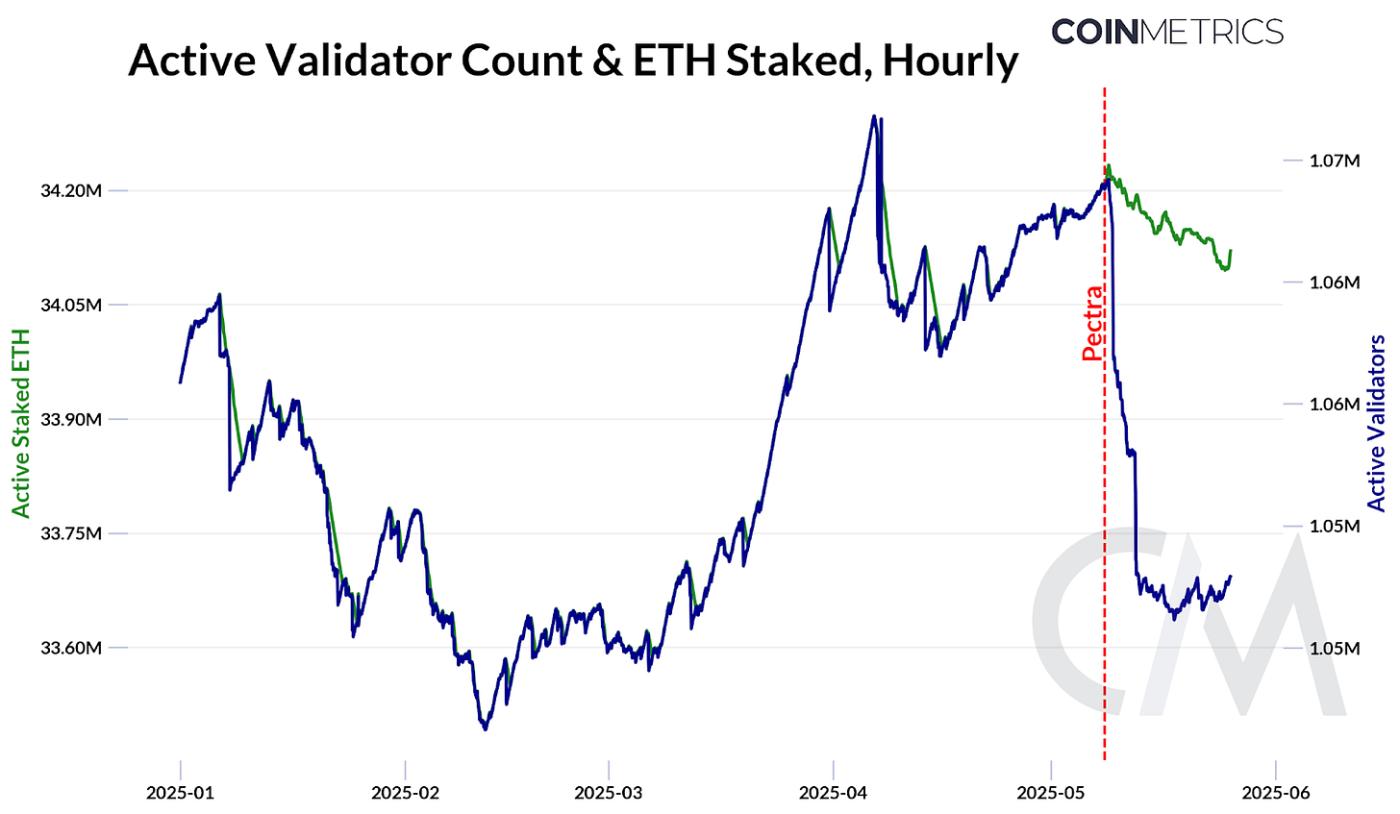

As a result of consolidations and exits, the active validator set has declined by 16,344 validators, reflecting a net reduction since Pectra. This may also be a result of EIP-7002, which streamlines and accelerates the validator exit process. The number of active validators has begun to decouple from total staked ETH, as stake is increasingly consolidated into fewer, higher-balance validators.

This not only introduces more capital efficiency for stakers but also helps alleviate network overhead and peer-to-peer communication load associated with a large validator set.

Source: Coin Metrics Network Data Pro

The average amount of ETH staked per validator has modestly increased from ~32 ETH to ~32.4 ETH, with a majority of validators still having an effective balance of less than 128 ETH. As more operators consolidate their stake to get more out of their ETH, we can expect this average to trend higher, and the overall distribution of validator sizes to shift accordingly.

Blob Scaling & Layer-2s

Doubling Blob Throughput (EIP-7691)

Another focus of the upgrade was to support the scaling of Layer-2’s, by doubling Ethereum’s blob throughput. Introduced as a cost-efficient data availability solution for rollups in the Dencun upgrade, blobs are central to Ethereum’s scaling roadmap.

With EIP-7691 in Pectra, the blob target was raised from 3 to 6 (green line), and the limit from 6 to 9 (red line), effectively increasing the supply of blobspace. This means greater transaction capacity and lower data availability costs for Layer-2s.

Source: Coin Metrics Network Data Pro

The daily number of blobs posted by rollups has increased from ~21,300 to ~28,000 (4 blobs per block) after Pectra went live. This translates to ~3.4 gigabytes of blob space being used post-upgrade, compared to 2.7 gigabytes before. At an hourly frequency, we can see the average number of blobs per block approach the new target of 6, as transaction demand from Layer-2s trends higher.

However, with utilization still below the new target, blob fees remain extremely low. The distribution of blobs since Pectra shows that >40K blocks contain 0 blobs, while ~52K blocks have seen 6 or more blobs posted thus far, suggesting more room for growth.

Source: Coin Metrics Network Data Pro

When the number of blobs submitted per block exceeds the target, typically during periods of high demand or congestion, the blob fee market will kick in and increase blob fees (and thus the cost for Layer-2s). Additionally, EIP-7623, which was also implemented in Pectra, disincentivizes the use of calldata by raising its cost, encouraging rollups to adopt blob space as the preferred, cost-efficient alternative.

Impact on Layer-2s

The increase in blob supply has had a direct impact on rollup costs. Average blob fees have been slashed further, making them more predictable and effectively free for rollups like Base, Arbitrum, Optimism and others. As a result, total blob fees paid by Layer-2s have dropped to $0.00001 (~4 gwei). These lower costs translate to better margins for Layer-2s, as they’re also able to facilitate more transactions on their respective chains.

Source: Coin Metrics Network Data Pro

Layer-2s, like Base and Optimism, have seen an increase in throughput, with transaction counts spiking from 8M to 14M after Pectra. This is similar to the impact seen when blobs were introduced in March 2024 with the Dencun upgrade. For Ethereum to capture a fair share of value from blob fees, rollups will need to gradually ramp up their consumption of blobs and drive them towards the new threshold (6 blobs per block).

Source: Coin Metrics Network Data Pro

Conclusion

Pectra represents a major step forward in Ethereum’s goal of becoming a globally accessible settlement layer, exemplifying the continuous evolution of the protocol. While not as flashy as previous upgrades, this feature-rich hard-fork introduced greater flexibility and efficiency in the staking ecosystem, making it more future-proof and institutionally ready, while laying the essential groundwork for scalability and enhanced user experience (UX).

While early metrics show that validator consolidation is underway and Layer-2s are ramping up blob usage, many of the intended economic and scaling shifts are expected to play out gradually. Pectra may not have made headlines, but it quietly sets the stage for Ethereum’s next era of adoption and growth.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.