Preface

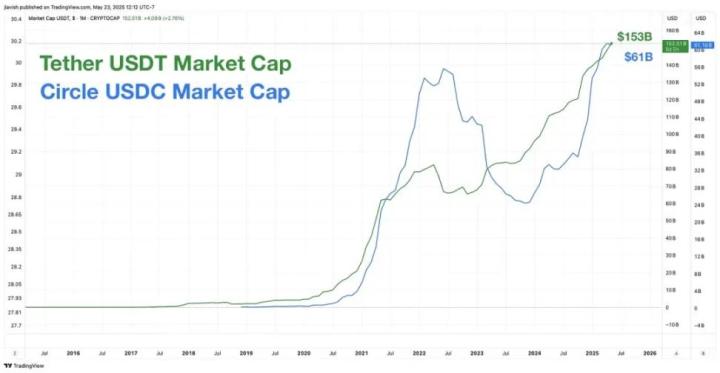

Stablecoins, as a core component connecting traditional finance and the crypto asset ecosystem, are continuously rising in strategic importance. From the earliest centralized custody model (USDT, USDC) to today's protocol-issued stablecoins driven by on-chain synthetic and algorithmic mechanisms (such as Ethena's USDe), the market structure has fundamentally changed.

Meanwhile, the demand for stablecoins in DeFi, RWA, LSD, and even Layer 2 networks is rapidly expanding, further promoting the formation of a new landscape of coexistence, competition, and collaboration among multiple models.

This is no longer a simple market segmentation issue, but a deep competition about the "future form of digital currency" and "on-chain settlement standards". This report focuses on the current trends and structural characteristics of the stablecoin market, systematically combing through the operating mechanisms, market performance, on-chain activity, and policy environment of mainstream projects, helping to effectively understand the evolution trends and future competitive landscape of stablecoins.

[The rest of the translation follows the same approach, maintaining the original structure and translating all text while preserving the <> tags.]Innovative Yield Mechanism

USDE provides high returns for holders through the "Internet Bond" function, derived from stETH staking rewards and funding rate differences in perpetual contract markets. This high-yield model attracts numerous DeFi users and institutional investors, especially in low-interest environments where traditional financial products struggle to offer similar returns.

Deep Integration with DeFi Ecosystem

USDE's widespread support on DeFi platforms (such as Uniswap, Curve) makes it one of the preferred stablecoins for DeFi users. Users can easily trade, provide liquidity, or participate in lending without worrying about price volatility. Defillama data shows a 50% increase in USDE's total value locked on Uniswap, reflecting its important position in the DeFi ecosystem.

Decentralization and Anti-Censorship Characteristics

As a stablecoin fully based on crypto assets, USDE does not rely on traditional financial systems, which is significantly attractive to users seeking decentralization, especially in regions with limited or restricted financial services.

Growth in Market Demand

With the expansion of DeFi and cryptocurrency ecosystems, demand for stablecoins continues to increase. USDE, as an innovative and fully decentralized stablecoin, meets the market's need for new stablecoin solutions.

Institutional Support and Collaboration

Ethena Labs' partnerships with renowned crypto investment institutions (such as Dragonfly Capital, Delphi Ventures) and exchanges (like Binance) have enhanced market confidence and liquidity for USDE.

Marketing and Community Engagement

Ethena Labs quickly attracted users and developers' attention through effective marketing strategies and community incentive programs, such as the airdrop of governance token ENA, promoting USDE's adoption.

2.4 Challenges of Emerging Stablecoins

USD1: Issued by World Liberty Financial (WLFI), with a market cap of $2.133 billion, ranking 7th, its market cap surged from $128 million to $2.133 billion in just one week, showing rapid growth.

WLFI, associated with the Trump family, received a $200 million investment from Binance and MGX, strengthening institutional endorsement. The New Money report noted that USD1 was chosen as a settlement currency for major transactions, such as Pakistan government cooperation projects, further enhancing its market influence.

USD1 is expanding quickly through exclusive agreements and institutional adoption, but its political background may pose regulatory risks.

USD0: Issued by the Usual platform, with a market cap of $641 million, ranking 12th. Usual Blog introduces that it attracts users through the USUAL token incentive mechanism, allowing holders to participate in governance and share platform profits.

USD0 combines the low volatility of stablecoins with DeFi's yield potential, attracting users focused on decentralized innovation.

USD0's unique positioning in the DeFi ecosystem brings growth potential, but it needs to improve market awareness and liquidity.

Emerging stablecoins challenge the market through differentiation strategies (such as institutional endorsement or DeFi incentives) but will find it difficult to shake USDT and USDC's dominant position in the short term.

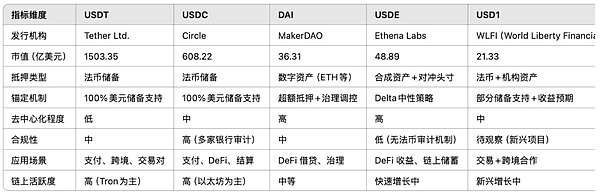

Mainstream Stablecoin Analysis and Comparison

This section provides a systematic analysis and comparison of the top five stablecoins by market cap (USDT, USDC, DAI, USDE, USD1) from dimensions such as mechanism structure, asset backing type, liquidity and application scenarios, and risk points.

3.1 Core Parameter Comparison Table

3.2 Liquidity and Trading Pair Distribution

Mainstream stablecoins like USDT and USDC have extremely abundant liquidity, with deep trading pairs on most major exchanges (Coinbase, Binance, OKX, etc.) and decentralized trading platforms. They cover almost all major public chains: USDT/USDC can be traded on Ethereum, Tron, Solana, BSC, Polygon, etc.; while emerging stablecoins (like USD1, FDUSD) are initially mainly available on specific public chains (such as Tron, Solana) and some centralized exchanges. TRON network recently introduced zero transaction fees for USDT, further increasing its trading volume and liquidity on that chain. Overall, USDT and USDC are the most globally liquid stablecoins, while others have liquidity concentrated in specific ecosystems and exchanges.

(Translation continues in the same manner for the rest of the text)The development of stablecoins not only reflects the technological innovation and institutional evolution of Web3 but is also becoming part of the digitalization of the global monetary system. In the future, stablecoins will no longer be a "crypto version of the US dollar," but rather a bridge to a multi-centric financial world and a carrier of credit and self-governance experiments.