In the past 24 hours, approximately $104.51M (about 152.6 billion won) worth of leveraged positions were liquidated in the cryptocurrency market.

According to the currently compiled data, long positions accounted for $43.12M, representing 41.3% of the total liquidations, while short positions were $61.39M, accounting for 58.7%.

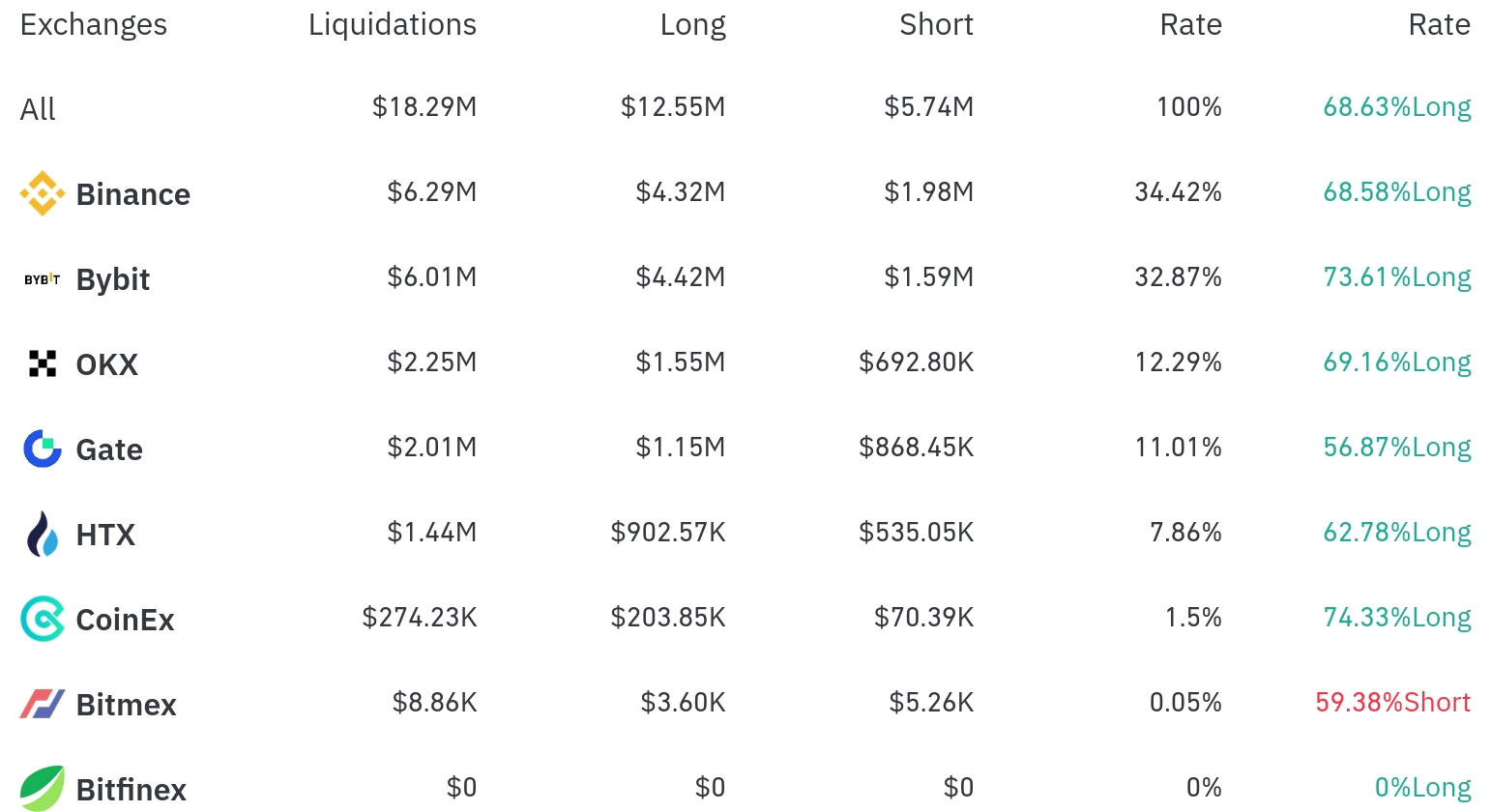

Binance experienced the most liquidations over the past 4 hours, with a total of $6.29M (34.42% of the total) liquidated. Among these, long positions accounted for $4.32M, or 68.58%.

Bybit was the second-highest in liquidations, with $6.01M (32.87%) of positions liquidated, of which long positions comprised $4.42M (73.61%).

OKX saw approximately $2.25M (12.29%) in liquidations, with long positions at 69.16%.

Overall, in the 4-hour liquidation data, most exchanges saw more long position liquidations, but BitMEX was an exception, with short position liquidations at 59.38%.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $43.12M in Bitcoin positions were liquidated in 24 hours, and despite the price rising to $109,595.6, a 1.82% increase in 24 hours, $1.82M was liquidated from long positions and $805.45K from short positions in the 4-hour timeframe.

Ethereum (ETH) had about $41.59M in positions liquidated in 24 hours, with the current price at $2,566.64, up 1.74%. In the 4-hour timeframe, $2.34M was liquidated from long positions and $2.19M from short positions.

Solana (SOL) saw approximately $5.71M liquidated in 24 hours, and among other major altcoins, Doge (DOGE) recorded $4.95M in liquidations, which is related to DOGE's 3.14% price increase in 24 hours.

Notably, 1000PEPE Token experienced a large liquidation of $5.04M alongside a significant 6.69% price increase. Additionally, PEPE saw $3.54M in liquidations with a 6.67% price rise.

The TRUMP Token had about $1.45M in positions liquidated in 24 hours while its price increased by 1.59%, and the WIF Token, in particular, recorded a massive $3.22M liquidation with a high 7.06% price increase.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. The current market shows substantial liquidations despite price increases, indicating continued volatility.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>