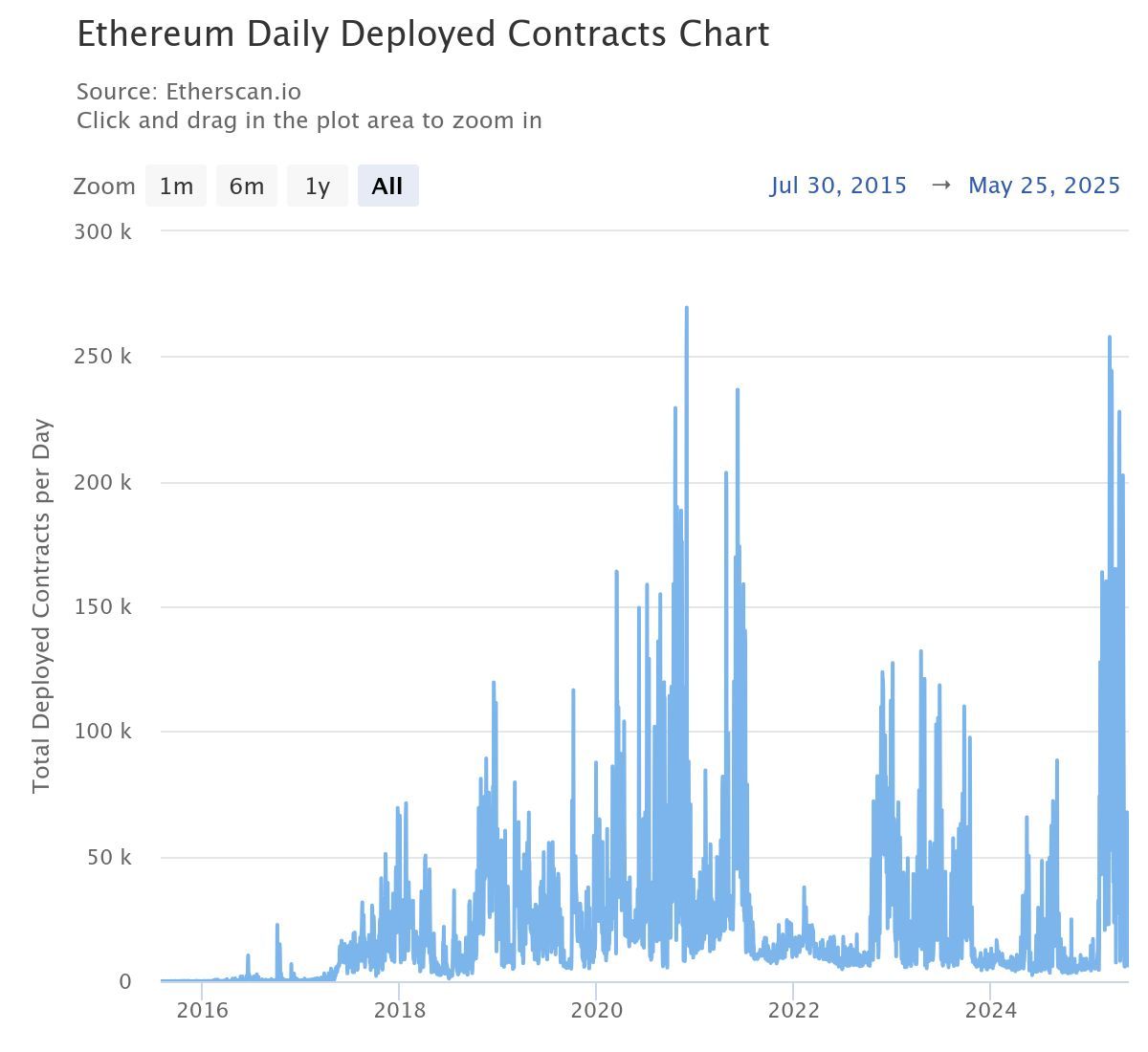

In 2025, Ethereum (ETH) experienced a significant surge in smart contract deployment activities. The number of contracts deployed daily reached a level not seen since 2021.

This indicates a powerful revival of the Ethereum ecosystem, one of the world's top blockchain platforms. It also reinforces positive predictions for ETH's price and raises questions about whether Ethereum can recover its all-time high from 2021.

Smart Contract Surge, Factor for ETH Reaching $10,000?

According to Etherscan data, the number of smart contracts deployed daily on Ethereum has surged since the beginning of the year. The chart shows that daily deployments reached their highest level since 2021 in the first quarter of 2025, when ETH recorded its all-time high of over $4,800.

This surge in the first quarter was primarily driven by anticipation of the Petra upgrade. Additionally, the increasing number of smart contracts reflects Ethereum's growing utility, which increases demand for ETH.

However, ETH's price has not fully reflected this positive trend. The price dropped from $3,700 to $1,400 and has since recovered to $2,500 at the time of writing.

Despite the price lagging behind smart contract growth, crypto investor Ted remains optimistic. He believes ETH could soon exceed its 2021 peak.

"Ethereum's daily contract deployments have reached levels not seen since the 2021 bull market. Builder activity is increasing, which is a clear signal that on-chain momentum is returning. Price follows fundamentals. ETH will reach $10,000 in this cycle," Ted predicted.

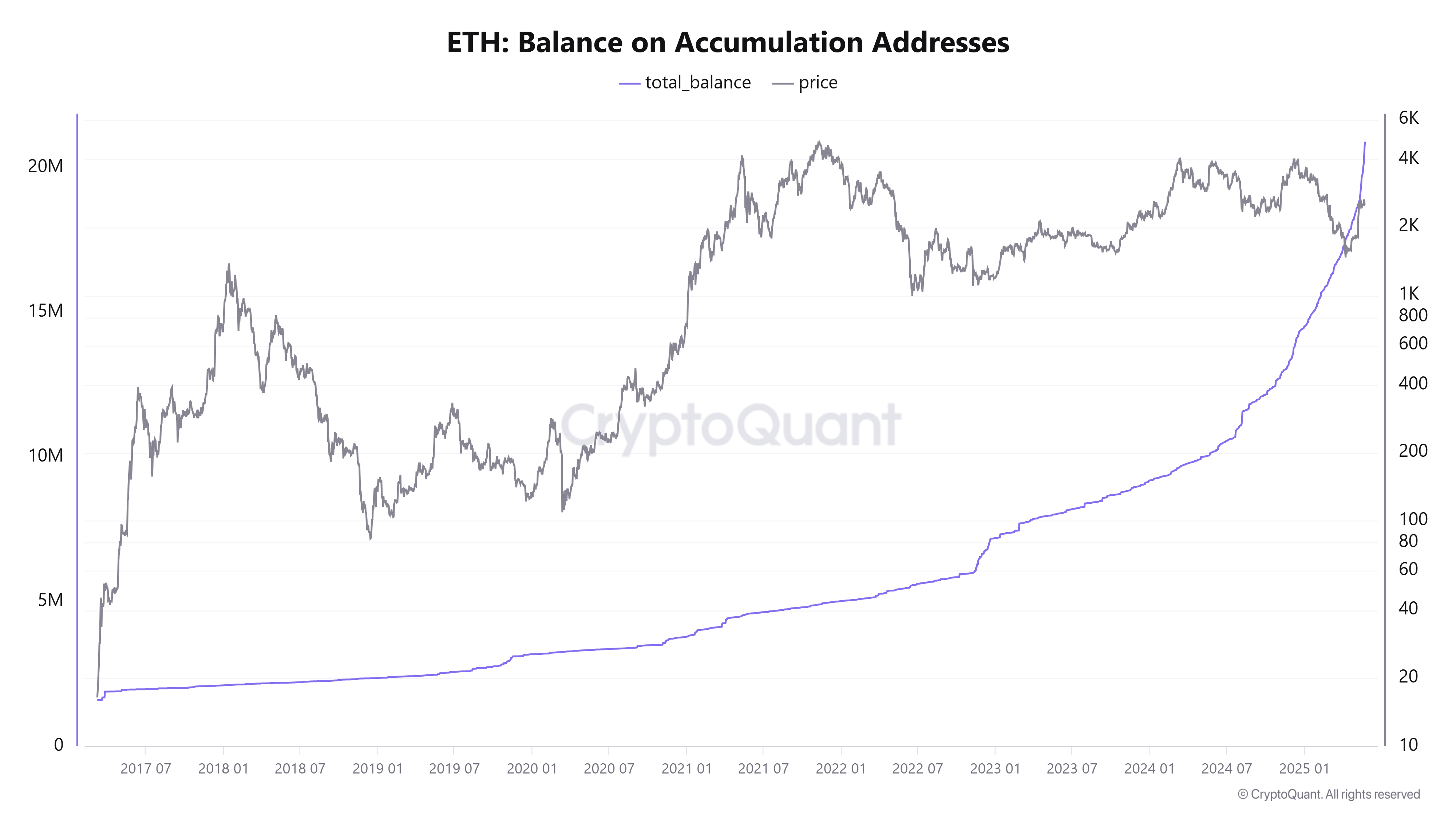

Simultaneously, data from CryptoQuant provides additional optimism. The amount of ETH flowing into accumulation wallets has reached an all-time high. These wallets typically belong to large investors known as "whales". The increased inflow suggests strong long-term confidence in ETH's potential.

As a result, the ETH balance in accumulation wallets reached a new high—approximately 21 million ETH, or 17.5% of circulating supply. The upward trend in this chart in 2025 emphasizes strong ETH demand.

The record highs in smart contract deployment and ETH accumulation reinforce the view that Ethereum remains attractive to developers and investors, despite the volatile crypto market.

Past Price Trends Suggest Short-Term Return to $4,000

Analysts have also made positive price predictions based on ETH's chart patterns.

Analyst Cas Abbe evaluated Ethereum's price trend using the 2-week Gaussian channel indicator. By comparing past price behavior, Abbe predicts ETH could reach $4,000 in the third quarter of 2025.

"ETH is trying to recover the 2-week Gaussian channel. Since 2020, ETH has only recovered this channel twice. Both times it rose strongly. In 2020, ETH rose from $300 to $4,000. In 2024, it rose from $2,400 to $4,100. If ETH recovers this level again, I'm confident it will reach $4,000 in Q3 2025," Abbe said.

Another important factor is ETH's performance against Bitcoin (BTC) in 2025. According to Coinglass data, ETH outperformed BTC in the second quarter. Currently, ETH's Q2 returns are +40%, while BTC's are +33%.

Coinglass's historical data also shows that ETH typically outperforms BTC in the second quarter. ETH's average Q2 returns are 64.22%, compared to BTC's 27.30%.

However, recent on-chain analysis by BeInCrypto emphasizes growing investor caution. Many investors are taking profits after ETH rebounded over 80% since early last month. This selling pressure could pose obstacles to ETH's price appreciation.