Written by: 1912212.eth, Foresight News

After breaking through $110,000 and setting a new all-time high, Bitcoin has recently experienced a pullback.

On the evening of May 25, BTC even fell to around $106,000 before slowly climbing back up, once again approaching the $110,000 mark. Some cryptocurrencies have turned from decline to rise. According to Coinglass data, the network liquidated approximately $208 million in the past 24 hours, with long positions liquidating $114 million and short positions liquidating $93.59 million. Among these, Bitcoin liquidations were $42.01 million, and Ethereum liquidations were $49.05 million.

Famous whale James Wynn closed his $1 billion BTC short position between 6:09 and 6:15 this morning, totaling 9,402 BTC, with an average entry price of $107,069 and an average exit price of $108,757, resulting in a loss of approximately $15.86 million.

Since early April this year, Bitcoin has achieved seven consecutive weeks of gains on the weekly chart, showing an extremely rare funding momentum. Historically, after achieving 7 consecutive weeks of gains on the weekly or monthly chart, prices tend to experience a pullback and consolidation. Will it be the same this time?

However, there are still catalysts worth noting in the subsequent market.

Bitcoin and Ethereum Spot ETF Data Shows Extremely Strong Performance

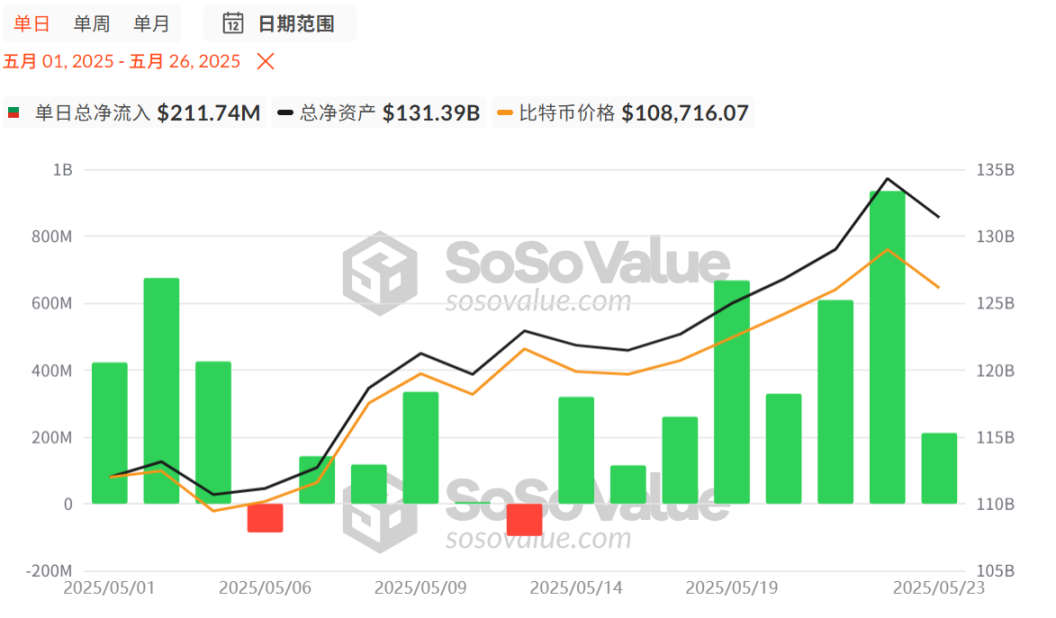

Since May this year, Bitcoin spot ETF data has been very strong in terms of inflows. From May 1 to date, there have only been two days of small net outflows, with the rest recording significant inflows. There have been four instances of single-day net inflows exceeding $600 million, and only four times this month were net inflows less than $200 million.

Currently, the total net inflow of Bitcoin spot ETF has reached $44.53 billion.

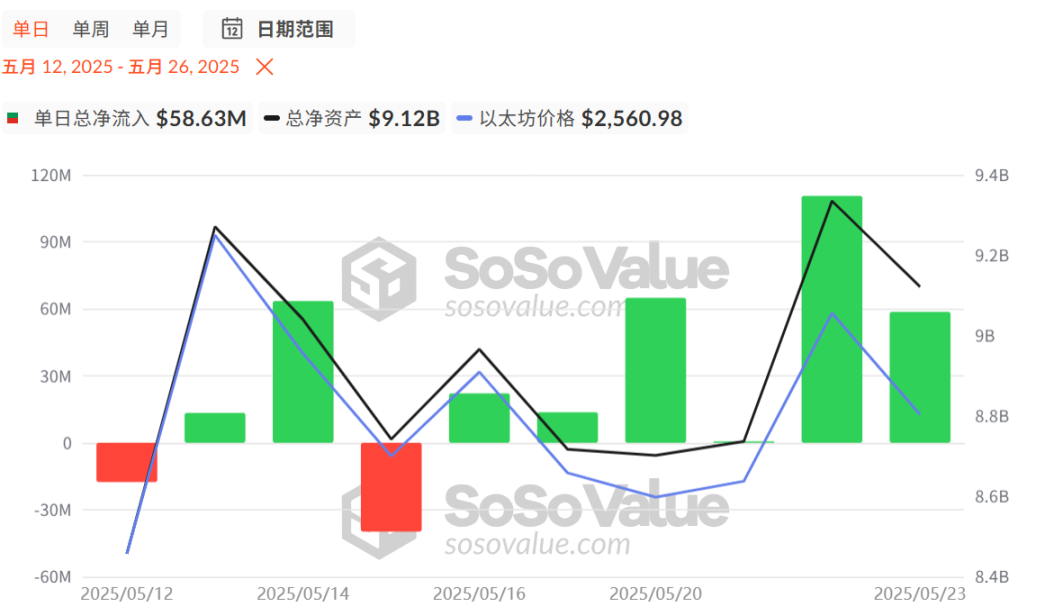

Ethereum spot ETF has also performed relatively optimistically. Since May 12, there have only been 2 small net outflows, with the rest being net inflows. Notably, on May 22, there was a single-day net inflow of over $110 million, which is quite rare and has set a new high since February this year.

The strong fund inflows of Bitcoin and Ethereum spot ETFs have injected optimistic sentiment into subsequent price movements.

Bitcoin 2025 Conference to be Held from May 27 to 29

The annual Bitcoin 2025 Conference will be held in Las Vegas from May 27 to 29, 2025.

Speaker list includes: · US Vice President JD Vance · Silk Road founder Ross Ulbricht · Eric Trump · Donald Trump Jr. · Michael Saylor, founder of Strategy · US Senator Cynthia Lummis

It's worth noting that Trump spoke in support of Bitcoin at the Bitcoin 2024 Conference, including supporting Bitcoin's strategic reserve establishment and promoting US leadership in Bitcoin mining and the crypto industry. During the conference from July 26 to 27, Bitcoin turned from decline to rise, and even broke through $70,000 on July 29.

The guests participating this time undoubtedly have huge influence in political and business circles and may promote Bitcoin's development in commercial applications and policy.

FTX Repayment to Begin on May 30, Total Distributed Funds Exceed $5 Billion

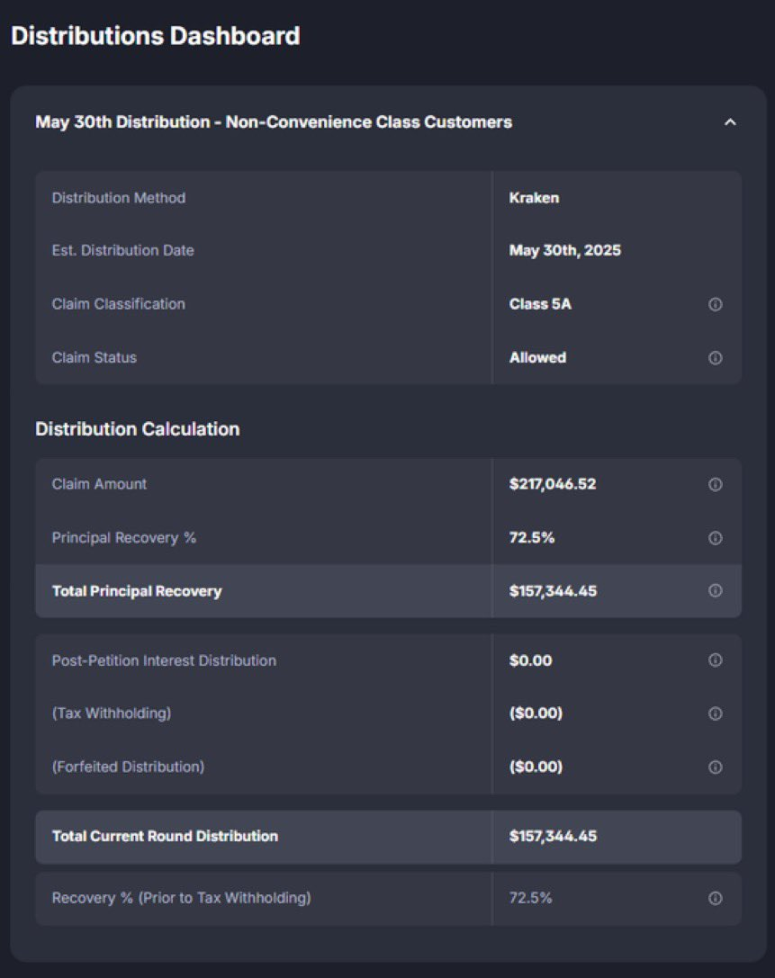

FTX's main repayment will begin on May 30, which is the second distribution to creditors, with total distributed funds exceeding $5 billion. This is another major development following the first payout to small creditors under $50,000 in February 2025. FTX has previously distributed payments to small creditors in the Convenience Classes of the Chapter 11 restructuring plan.

Recently, FTX creditor representative Sunil also confirmed the FTX repayment date as May 30, with Step 9 updated to "Allow Claims":

· Users with amounts over $50,000 will receive 72.5% compensation; · Remaining compensation (up to 100%) and interest will be distributed in subsequent allocations.

The $5 billion fund inflow may short-term enhance market liquidity, and since the compensation is paid in cash, these funds may be converted to buy Bitcoin and other mainstream cryptocurrencies.

Trump Restores 90-Day Negotiation Window with EU

In May 2025, trade tariff negotiations between the EU and the US remained tense. The Trump administration imposed tariffs of 20% to 50% on the EU at the beginning of the year, covering multiple sectors including steel and automobiles, with the EU responding with retaliatory tariffs on US goods. On May 23, Trump stated, "The main purpose of the EU is to take advantage of the US in trade, with no progress in negotiations, and suggested directly imposing 50% tariffs on EU products from June 1, 2025." This statement temporarily caused US stocks and Bitcoin to decline.

However, on May 26, Trump stated that the EU requested an extension of the trade negotiation window, and he has agreed to extend the deadline to July 9. EU Commission President von der Leyen, after speaking with Trump on Sunday, said the EU is prepared to "quickly and decisively" advance trade negotiations with the US but needs Trump to return to the initial 90-day negotiation period.

After this news was announced, Bitcoin briefly rose above $109,000.

Additionally, this month, US tariffs on Chinese goods were reduced from 145% to 30%, and Chinese tariffs on US goods were reduced from 125% to 10%, with a 90-day buffer period initiated (May 14 to August 12). This buffer period aims to provide time for continued negotiations and mitigate the impact of the trade war on the global economy.

The temporary pause in global tariff trade wars allows risk assets to continue moving forward under relatively stable expectations.