Written by: lowstrife, Crypto KOL

Translated by: Felix, PANews

Recently, Bitcoin reserve companies like MSTR, Metaplanet, Twenty One, and Nakamoto have gained significant attention. However, in my personal opinion, their "reserves" are destructive leverage and the worst thing that has happened to Bitcoin and what it represents. Here's an analysis of how this model might collapse under certain conditions.

The feedback loop these companies use is to purchase Bitcoin with company funds, record it on their balance sheet, and then use various corporate mechanisms to raise more funds based on that balance sheet. This model has been widely praised as the greatest invention in history.

Funds raised through issuing new stocks (ATM), bonds, preferred stocks, loans, etc., are immediately used to purchase Bitcoin to drive this flywheel.

An important distinction here is the use of value-added leverage: companies like Tesla simply deposit assets into Bitcoin (which I have no objection to).

But the key to this flywheel is that common stockholders are the ultimate holders of these financial assets. All these financing mechanisms will ultimately lead to stock dilution, selling stocks to the market to fund this flywheel.

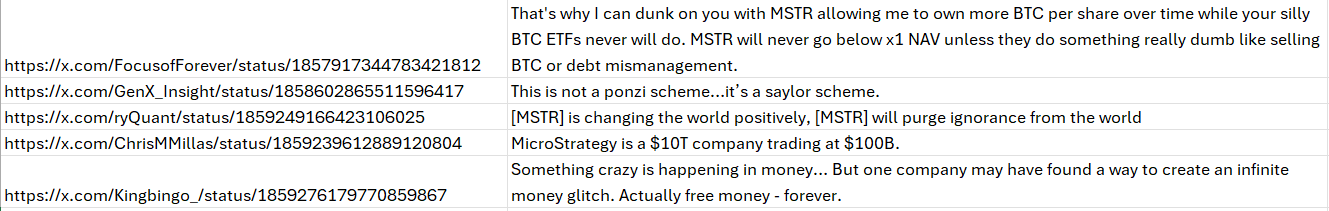

MSTR primarily uses issuing new stocks (ATM) to achieve value-added dilution. If mNAV (PANews note: representing the current stock price and its Bitcoin value ratio) is greater than 1.0, this method works well. However, the problem is that this leverage depends on issuing new stocks to meet its cash flow. If MSTR's stock price falls below 1.0 times mNAV (as it did in 2022), problems arise.

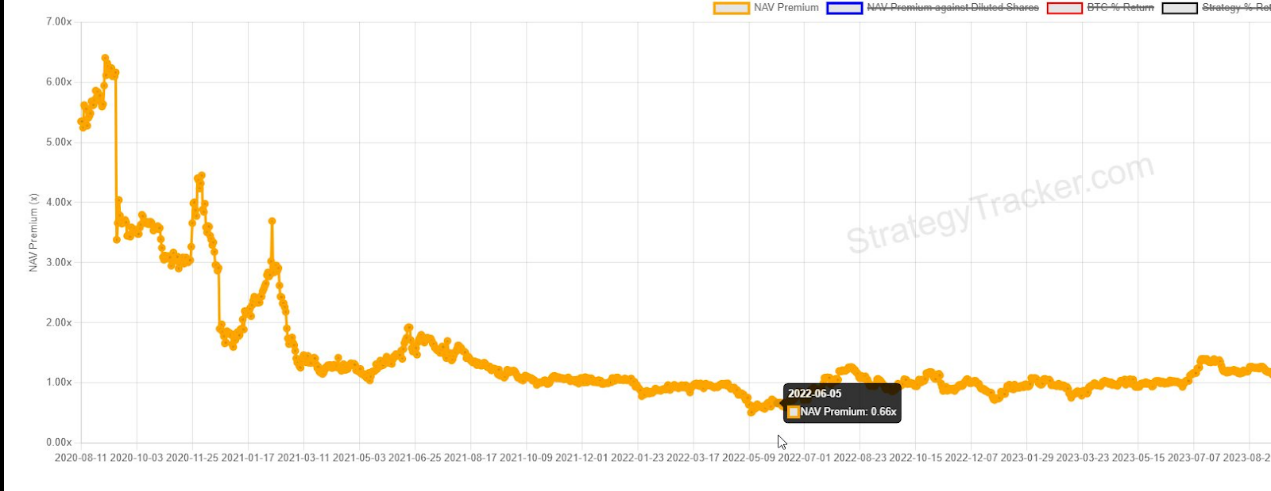

Another tool is using leverage to enhance product yield, such as convertible bonds and perpetual preferred stocks. Because future purchases are expected, this accelerates the anticipated value of equity and first amplifies stock premium.

Issuing more common stocks, diluting existing shareholders' equity, this leverage will ultimately expire. But they allow this dilution to occur later, exchanging today's dollars for tomorrow's cash flow/dilution, pushing this payment and "cost" to a distant future. How "clever".

There are two issues here:

The first issue is that if the underlying stock fails to meet performance targets, these products cannot become the pivot for all leverage. For convertible bonds, MSTR must refinance or sell BTC to raise cash.

The second issue is preferred stocks. They need to pay permanent, non-value-added dividends (i.e., interest) to these debt holders. MSTR plans to issue trillions of dollars of such securities, with these payments funded by diluting MSTR equity holders.

Especially Strategy's STRF (PANews note: a fixed-income product packaged as preferred stock to easily and continuously raise funds to buy Bitcoin), which has no maturity date, acts as perpetual debt with a 10% annual interest rate. MSTR will forever rely on non-value-added ATM, diluting shareholder equity to finance every dollar issued. Today's purchases come at the expense of tomorrow's shareholder interests. What does this sound like?

The problem with using ATM to provide necessary cash flow is that it depends on mNAV, which is not derived from its own assets. It entirely depends on market sentiment: how much people believe its treasury is worth.

This is simply an insult to the nature of Bitcoin.

Although there are provisions to suspend dividends, this would raise more issues. STRK must pay all outstanding dividends and penalties to convert (mature). Not to mention that suspending dividends would significantly reduce product demand.

If the purpose of yield-bearing assets is to strip away risk, the last thing you want is to destroy the original intent of holding the security. These risks are never mentioned by MSTR's advocates. Suspending dividends would be a warning about solvency.

Supporters argue that issuing these preferred stocks is for purchasing Bitcoin now, and dividend payments are worthwhile. They believe that if it has been "modeled," then raising funds is justified.

You must view the transaction holistically, not in isolation. If they finance with preferred stocks, you must consider their valuation/premium at the time of financing. Then, you can simulate using ATM to pay dividends and look forward based on your predictions about Bitcoin and stock performance, determining how many stocks need to be issued and when conversion would be more value-added. Once you do this, you'll realize how good these preferred stock issuances are.

Currently, about $1.8 billion of such securities are in circulation, and paying these is still possible. But Saylor proposes issuing $30 trillion of such securities, requiring the dilution of $300 billion in shareholder equity annually, which is clearly unsustainable.

So how will this all explode? It all starts with mNAV, which is crucial. It is life, it is vitality. If mNAV has problems, the company's ability to raise funds will disappear, and debt conversion will damage mNAV, causing the company to lose its ability to repay debt.

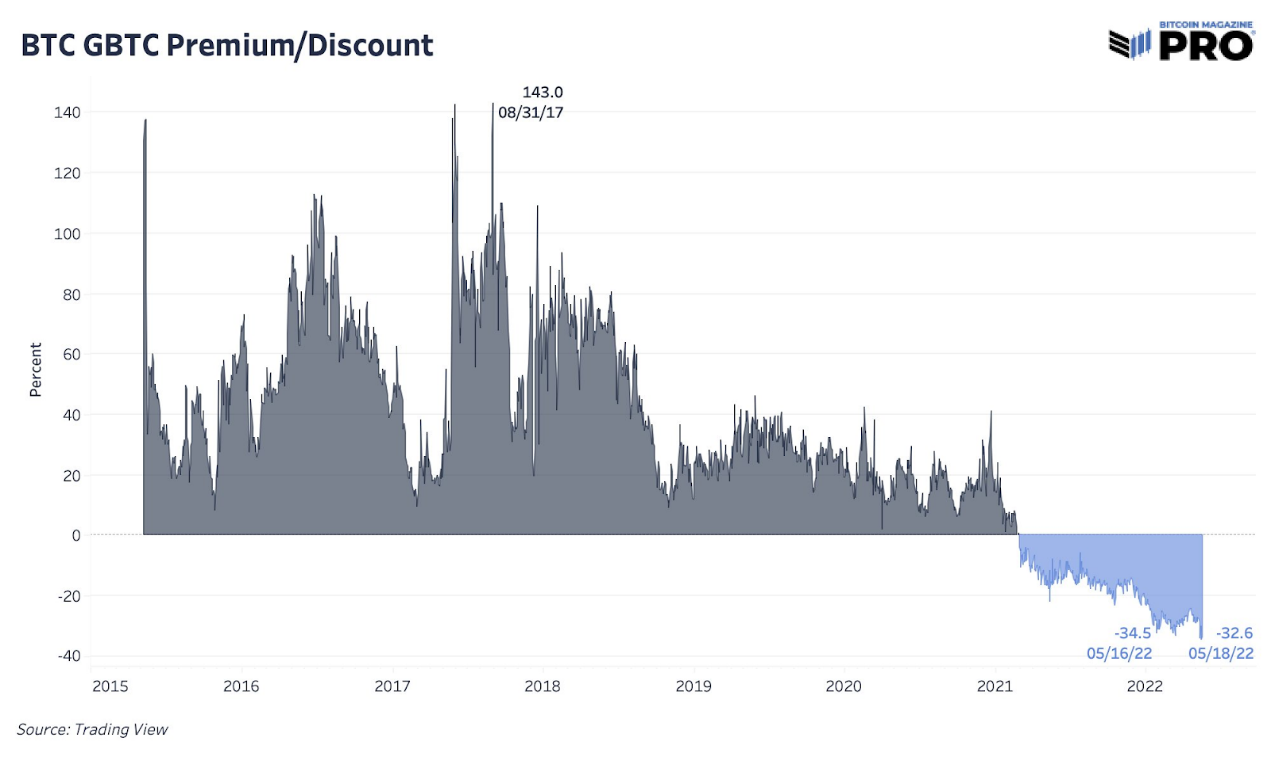

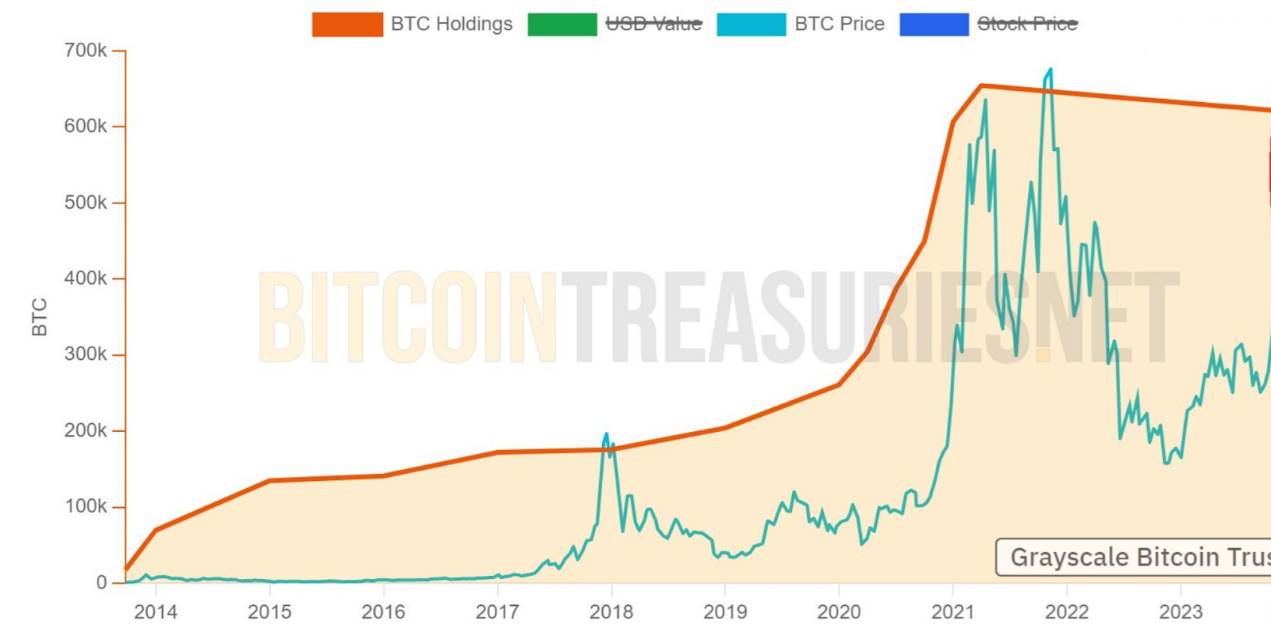

GBTC was another closed-end fund that exploded during the 2021 bull market. People used it to invest in BTC because their existing accounts did not allow it.

Today, MSTR is bought for roughly the same reason. The problem is: Bitcoin acquisition channels are becoming more numerous.

GBTC is a closed-end fund where its price exists at a premium or discount relative to the underlying assets. Once the demand for this investment channel dries up, the fund's demand to purchase new assets also diminishes.

Once mNAV is crushed, demand will disappear.

Once mNAV falls below 1.0, MSTR's financing ability will be in trouble, similar to GBTC's loss of purchase willingness and ability.

It's worth noting that mNAV is entirely based on market sentiment. There is no mechanism or reason requiring it to trade according to asset value.

When mNAV declines, the ability to continue raising funds (and purchasing Bitcoin) in the future will weaken, and the stock's expected value will also decrease. This situation could be exacerbated if forced to pay debt dividends under unfavorable conditions.

Convertible bonds make the situation more complex. Currently, MSTR has $8.2 billion in convertible bonds maturing between 2028 and 2032. The risk of these bonds is not in price; regardless of Bitcoin's price fluctuations (within a reasonable range), the bonds will not "liquidate" or require margin calls.

The problem with convertible bonds is in their name. They need to convert. MSTR's stock needs to appreciate to a predetermined price level to convert the bonds into new stock issuance. Remember: this trigger point is MSTR's stock price, which floats based on mNAV, which is based on market sentiment.

If for some reason the price fails to rise, the problem becomes a matter of time, not price. Regardless of the underlying Bitcoin price, bonds may expire. MSTR must refinance or repay the debt in cash by selling BTC.

Ultimately, the flywheel mechanism will reverse, eventually rendering the entire plan ineffective. Repurchasing stocks below mNAV 1.0 and selling underlying assets to raise funds. Some argue this falls under fiduciary responsibility, and Bailey has publicly stated he would do so.

This is not a financial revolution. It is fanatics of Ponzi schemes chasing leverage. I have held Bitcoin for a long time and it is heartbreaking to see Bitcoin OGs cheering for Saylor, who is repeating the financial engineering of 2008 with BTC. It should be known that it was precisely this approach that led to the birth of Bitcoin.