Written by: Ponyo : : FP, FourPillarsFP Researcher

Translated by: BlockBeats Deep

Editor's Note: Ethena maintains a $5 billion market cap stablecoin USDe with a 26-person team, using a delta-neutral strategy to hedge against asset volatility of ETH, BTC, and others, maintaining a $1 peg while providing double-digit annual yields. Its automated risk management and multi-platform hedging have built a moat, successfully navigating market turbulence and the Bybit hacking incident. Ethena plans to drive USDe circulation to $25 billion through iUSDe, Converge chain, and Telegram app, becoming a financial hub connecting DeFi, CeFi, and TradFi.

The following is the original content (slightly edited for readability):

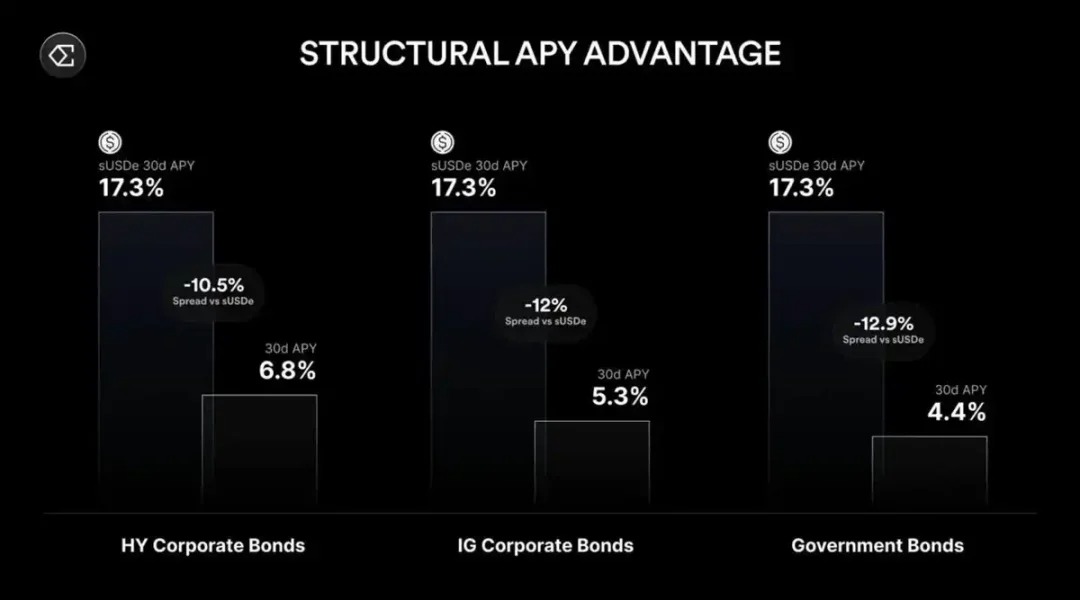

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English]The driving force behind this growth is the arbitrage between on-chain funding rates and traditional interest rates. As long as there is a significant yield gap, funds will flow from low-interest markets to high-interest markets until balance is reached. Therefore, USDe has become a hub connecting crypto yields with macro benchmarks.

Source: Ethena 2025: Convergence

Meanwhile, Ethena is developing a Telegram-based application that will introduce high-yield dollar savings to ordinary users through a user-friendly interface, bringing hundreds of millions of users into sUSDe. In terms of infrastructure, the Converge chain weaves DeFi and CeFi tracks together, with each new integration bringing cyclic growth to USDe's liquidity and utility.

Notably, sUSDe's returns are negatively correlated with actual interest rates. When the Federal Reserve cut rates by 75 basis points in the fourth quarter of 2024, fund yields jumped from around 8% to over 20%, highlighting how declining macro interest rates inject potential into Ethena's earnings.

This is not a slow, incremental advancement, but a cyclical expansion: broader adoption enhances USDe's liquidity and yield potential, which in turn attracts larger institutions, driving further supply growth and more solid anchoring.

Looking Forward

Ethena is not the first stablecoin to promise high yields or position itself as an innovative method. The difference is that it delivers on its promises, with USDe consistently anchored at $1 even during the most severe market shocks. Behind the scenes, it operates like a high-level institution, shorting perpetual futures and managing staking collateral. However, what ordinary holders experience is a stable, yield-bearing dollar that is simple and easy to use.

Expanding from $5 billion to $25 billion is no easy feat. Stricter regulatory scrutiny, larger counterparty exposure, and potential liquidity tightening may bring new risks. However, Ethena's multi-asset collateral (including $1.44 billion in USDtb), robust automation, and solid risk management suggest it is more capable of handling challenges than most projects.

Ultimately, Ethena demonstrates a method of navigating crypto market volatility using delta-neutral strategies at an astonishing scale. It outlines a future vision where USDe becomes the core of every financial domain, from DeFi's permissionless frontier and CeFi trading desks to TradFi's massive bond markets.