The cryptocurrency market is a high-volatility environment where highs and lows change rapidly within a day. By tracking assets that have set new all-time highs (ATH) and all-time lows (ATL), one can early detect bullish and bearish trends. Based on tokens with a market capitalization of over $10 million, this analysis reviews tokens that have set new highs or lows within a day and diagnoses market recovery potential and trends by analyzing the correction rates of top market cap assets and real-time domestic popular assets. [Editor's Note]

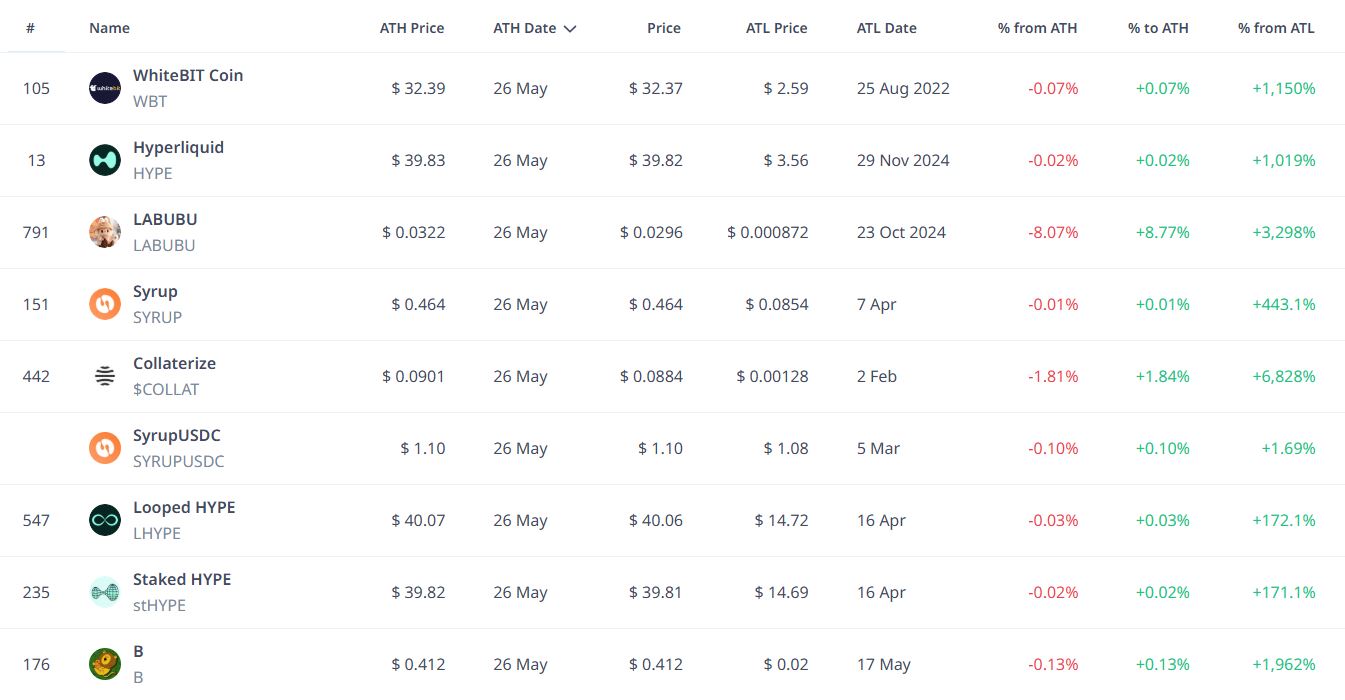

Assets Renewing All-Time High (ATH)

① WhiteBIT Coin(WBT): $32.39(ATH) → $32.37(Current) –0.07%

② Hyperliquid(HYPE): $39.83(ATH) → $39.82(Current) –0.02%

③ LABUBU(LABUBU): $0.0322(ATH) → $0.0296(Current) –8.07%

④ Syrup(SYRUP): $0.464(ATH) → $0.464(Current) –0.01%

⑤ Collaterize(COLLAT): $0.0901(ATH) → $0.0884(Current) –1.81%

Additionally, a total of 9 assets including ▲SyrupUSDC ▲Looped HYPE ▲Staked HYPE ▲B set new record highs on this day.

Altcoin rises accompanying BTC's strength are spreading across the on-chain sector, with new highs notably emerging in low-liquidity small and medium-sized assets. Particularly, WhiteBIT Coin and Hyperliquid maintain strong buying momentum with price drops within 0.1% after reaching new highs.

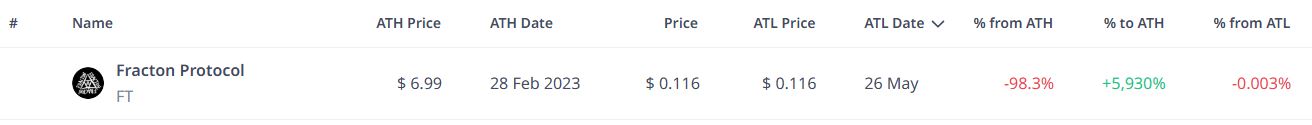

Assets Renewing All-Time Low (ATL)

① Fracton Protocol(FT): $0.116(ATL) → $0.116(Current) –0.003%

Fracton Protocol recorded its all-time low and slightly rebounded, but remains in a downward trend. It has entered a volatility zone with expanding short-term price drops.

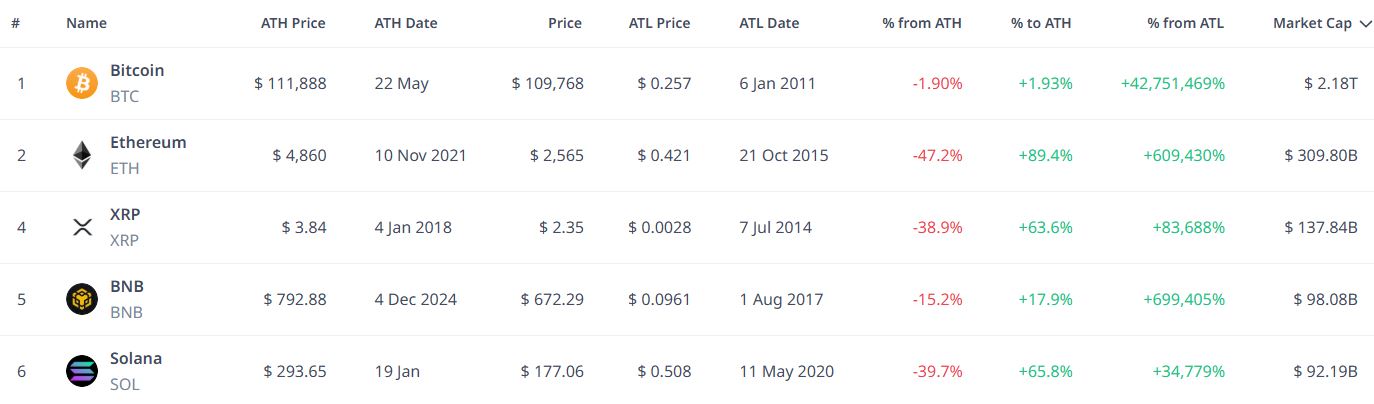

Top 5 Market Cap Assets – ATH/ATL Status

① BTC: $109,768 | ATH $111,888 (–1.90%) | ATL $0.257 (+42,751,469%)

② ETH: $2,565 | ATH $4,860 (–47.2%) | ATL $0.421 (+609,430%)

③ XRP: $2.35 | ATH $3.84 (–38.9%) | ATL $0.0028 (+83,688%)

④ BNB: $672.29 | ATH $792.88 (–15.2%) | ATL $0.0961 (+699,405%)

⑤ SOL: $177.06 | ATH $293.65 (–39.7%) | ATL $0.508 (+34,779%)

The top 5 assets remain in an adjustment zone of around 28% from their ATH. BTC set a new all-time high of $111,888 on the 22nd and is currently experiencing a correction within 1.9%, with a cumulative return of over 42.75 million% from its ATL. ETH has dropped about 47.2% from its ATH but still maintains a long-term cumulative growth rate exceeding 6 million%.

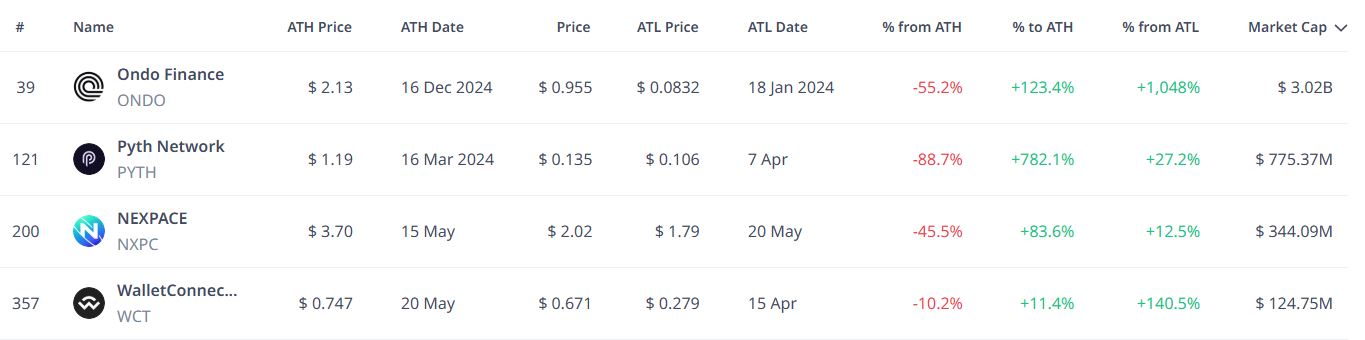

Real-Time Domestic Trending Assets – ATH/ATL Status

① Ondo Finance: $0.955 | ATH $2.13 (–55.2%) | ATL $0.0832 (+1,048%)

② Pyth Network: $0.135 | ATH $1.19 (–88.7%) | ATL $0.106 (+27.2%)

③ NEXPACE: $2.02 | ATH $3.70 (–45.5%) | ATL $1.79 (+12.5%)

④ WalletConnect: $0.671 | ATH $0.747 (–10.2%) | ATL $0.279 (+140.5%)

Trending assets in the domestic community are mostly continuing their correction from ATH. Ondo Finance, in particular, has risen over 1,000% from its ATL, showing a strong long-term trend, and WalletConnect has rebounded over 140% from its low. In contrast, Pyth Network has dropped 88.7% from its high and remains classified as an asset with significant downward pressure.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>