Solana (SOL) has limited price fluctuations despite recent significant token accumulation. The altcoin has remained relatively stable during May due to overheating.

This stagnation is a signal of caution, but the market remains optimistic. This could bring potential gains to Solana.

Solana Investors Continue Accumulating

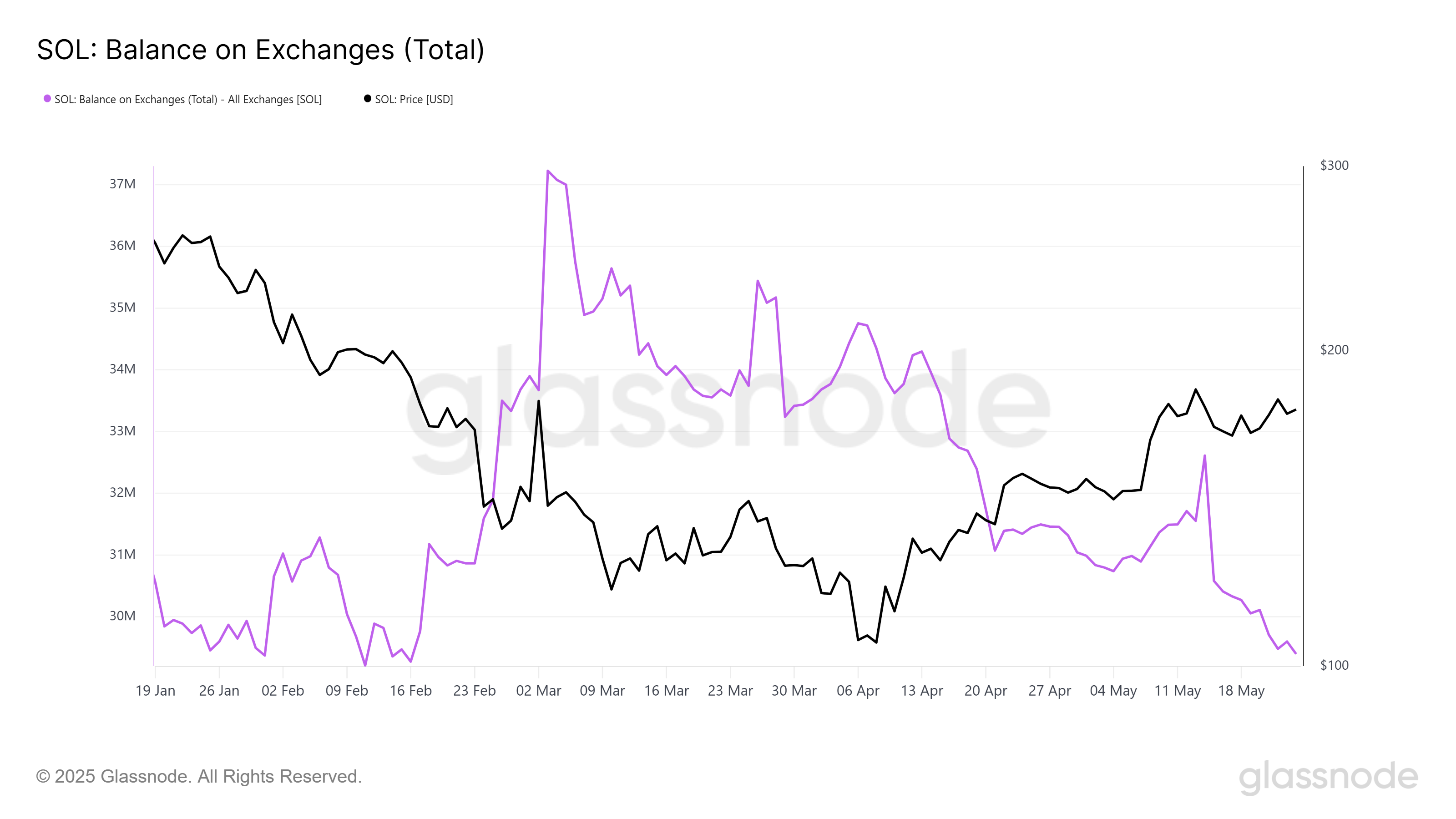

Over the past 10 days, Solana balances on exchanges decreased by 2.2 million SOL. This corresponds to approximately $381 million. This supply reduction indicates that investors have been accumulating Solana during this period.

Continued accumulation is driven by several factors, including broad bullish market sentiment, fear of missing out (FOMO), and expectations of future price increases.

This supply reduction reflects increased investor confidence. Many are choosing to hold rather than sell SOL. As more investors accumulate tokens, exchange supply decreases, which could create upward price pressure in the long term.

Solana's overall market momentum shows potential volatility. Technical indicators like Bollinger Bands indicate the bands are narrowing.

Band narrowing is a classic signal of an imminent price volatility surge.

If this compression leads to a bullish breakout, Solana could experience a price increase, especially when the broader market shows positive momentum.

However, the Bollinger Bands' narrowing suggests a potential correction might occur before a significant movement.

SOL Price Breakout Needed

Solana's price has been consolidating for most of May due to previous week's overheating. However, this cooling period could create an opportunity for a bullish movement.

As the broader market continues to show positive signals and the accumulation trend persists, Solana could break out of its current correction phase.

At $173, Solana is testing an important support level. To initiate a rally, Solana needs to secure $178 as a support line. If it breaks through $180 and successfully crosses $188, this could indicate the start of an upward trend.

Successfully breaking these levels would suggest additional upside potential.

Conversely, if Solana fails to maintain support at $178, it could drop below $168, potentially reaching $161. Such a decline would invalidate the bullish logic and suggest additional downside risk for the token.