- Bitcoin absorbs $1.25 billion from a long liquidation without causing significant price disruption.

- BTC structure remains intact, suggesting an upcoming supply scarcity.

Bitcoin [BTC] continues to demonstrate tremendous strength despite volatility.

Looking Back at the "Liberation Day" Event in April:

Bitcoin dropped 10.5% that week, closing at 76,191 USD, reaching a five-month low.

Current Situation and Market Impact

Despite macroeconomic obstacles (such as new tax information), the 3.79% intraday decline went almost unnoticed. According to TinTucBitcoin, this might just be the tip of the iceberg.

Source: CryptoQuant

Long Liquidation Fails to Knock Down BTC

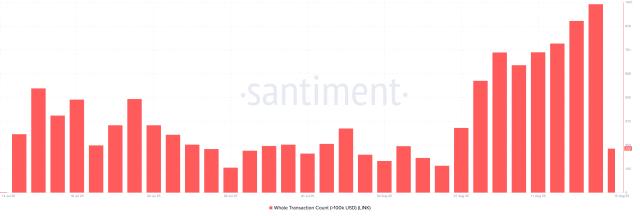

The intraday decline eliminated many leveraged long positions. On-chain data from CryptoQuant revealed a sudden liquidation event: 2,560 BTC, approximately 275 million USD, was eliminated during a rapid drop from 111,699 USD to 107,270 USD on 5/23. This was the first large long liquidation in over a month, pulling BTC down 3.79% in a single session. The message is clear: Under high volatility conditions, longing with 20x–40x leverage often leads to liquidation. This serves as a stark reminder of how quickly positions can be swept away and prices can change.

But if you think this is enough to stun large investors, think again. Data from Lookonchain discovered a "whale" using 40x leverage with 11,588 BTC, valued at $1.25 billion, expected to be liquidated at 105,108 USD. When BTC fluctuated between 106K and 109K, the "whale" chose to manually close the position, bringing over 11K BTC into the market. Nevertheless, BTC did not waver. Could this be a silent accumulation, preparing for an upcoming supply shock?

Bitcoin Gradually Consolidating Development Foundation

May data suggests an imminent supply scarcity trend, but it's crucial to examine the figures carefully.

ETF certificates have accumulated 52,000 BTC, locking those coins out of circulation. Exchange reserves continue to decrease near the 107K USD price, reducing available BTC for trading. In total, approximately 70,000 BTC have left exchanges this month, further tightening liquidation.

Source: CryptoQuant

Moreover, many countries are actively investing – UAE is actively buying and mining, Singapore has allocated 68% to BTC with strong determination. And the real surprise? BlackRock's iShares Bitcoin Trust (IBIT) alone added 44,000 BTC to its treasury this month, indicating significant institutional demand is silently growing.

Therefore, the $1.25 billion long liquidation truly did not impact much. In summary, Bitcoin seems to be quietly building a solid foundation above the 100K USD level, which could be the launchpad for the next major development step.