As of May 23, 2025, 11:15 AM

Bitcoin is trading at $111,429, maintaining a level close to the all-time high recorded the previous day. Although trading volume has somewhat slowed down, investment sentiment and on-chain indicators continue to support a bullish trend.

📈 Price Now

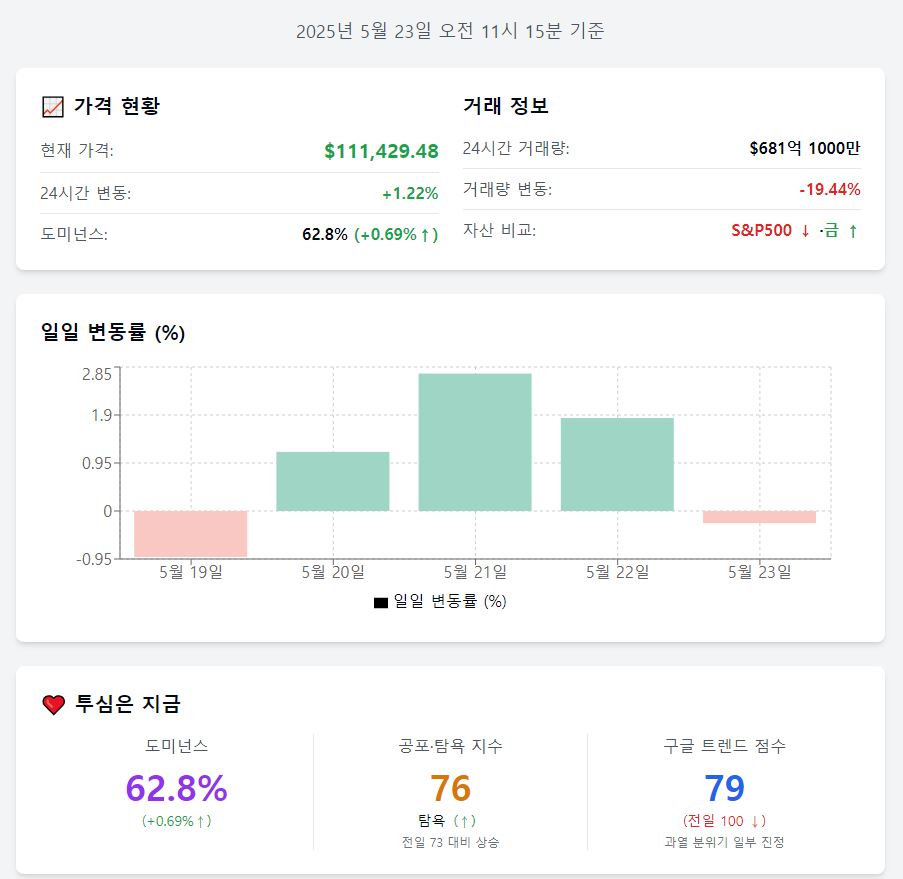

Price $111,429.48 (+1.22%) Bitcoin is trading at $111,429.48, up 1.22% from the previous day. It continues to maintain a strong trend, extending the new high-point breakthrough.

Trading Volume $6.811 Billion (–19.44%) Trading volume has decreased by 19.4% compared to the previous day. Despite the price increase, the reduced trading volume suggests some buying fatigue after short-term overheating.

Daily Fluctuation –0.24% In the last 5 trading days, Bitcoin prices showed –0.91% (19th), +1.17% (20th), +2.72% (21st), +1.84% (22nd), –0.24% (23rd). Despite reaching new highs, the rate of increase has slowed, indicating a phase of speed adjustment.

Asset Comparison S&P500↓·Gold↑ On the 22nd, S&P500 declined 0.04%, while gold prices rose 0.16%. The divergent movements between traditional and digital assets are drawing renewed attention to portfolio risk diversification.

MACD +397.11 (Daily Basis) The daily MACD is +397.11, maintaining a bullish zone. The weekly MACD at 1577.41 also indicates a valid long-term upward trend.

❤️ Investor Sentiment Now

Dominance 62.8% (+0.69%) Bitcoin dominance is 62.8%, up 0.69% from the previous day. Funds are concentrating back into Bitcoin in a bullish market, strengthening its market control.

Fear & Greed Index 76 (Greed) The greed index has risen to 76 from the previous day's 73, reaching the upper end of the greed zone. Investment sentiment remains optimistic, but overheating warning signals are also present.

Google Trend Score 79 The Google trend score on the 23rd is 79, slightly down from the previous day's 100. Search interest remains high, but has decreased from its peak, suggesting some cooling of the overheated atmosphere.

🧭 Market Now

SSR 18.78 The Stablecoin Supply Ratio (SSR) for Bitcoin is 18.78, slightly increased. This indicates that the market cap growth was faster than stablecoin inflow, suggesting a somewhat reduced short-term liquidity capacity.

NUPL 0.5876 The Net Unrealized Profit/Loss (NUPL) has risen to 0.5876. The increasing proportion of investors in profit raises the possibility of profit-taking sell-offs.

Exchange Balance 2,417,100 BTC (+0.17%) Exchange holdings increased by 0.17% from the previous day. The slight inflow opens up the possibility of a short-term adjustment in the supply-dominant structure.

Exchange Net Inflow +3,325 BTC (–0.6%) Approximately 3,325 BTC was net inflow in a day. The outflow scale decreased compared to the previous day, suggesting an increase in short-term sell-waiting volume. This could be for profit-taking or represents a period of position adjustment among market participants.

Active Wallets 1,100,527 The number of active wallets increased from the previous day, maintaining high network activity. The increase in exchange net inflow and wallet numbers shows a complex market sentiment mixing short-term selling and long-term holding.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>