US-based coins are attracting attention in the last week of May. AVA, Solana (SOL), Pi Network (PI), Uniswap (UNI), and Worldcoin (WLD) are drawing interest. AVA has risen nearly 10% as interest in AI resurges. SOL continues to see institutional accumulation despite ETF delays.

PI has recovered to $0.800 despite ecosystem concerns, building momentum. Meanwhile, UNI is facing legal pressure from Bancor, and WLD is gaining attention with regulatory challenges and US expansion efforts.

AVA

AVA is the native token of AI-tar based storytelling platform Holoworld. The platform is designed for creators, brands, and developers.

This ecosystem allows users to create immimmersive experiences through customized AI avatars,id,-based interactions. It claims to have over 1 million users and tens of millions of interactions.

. TradingView.

. TradingView.First launched on Solana's PumpFun launchpad, AVA currently has a market cap of around $65 million and has risen nearly 10% in the past 24 hours as interest in AI-themed tokens resur>Technical indicators are turning bullish, and AVA's moving averages suggest a golden cross may soon form. If this momentum continues, the token could challenge resistance at $0.069, and if broken, could open paths to $0.0919 and even $0.015.

However, if bullish momentum fades and the $0.060 support fails, the retrace to0519, and if downtrifies could to0.047 or even $417.

Solana (SOL)

Solana is seeing increased institutional investor accumulation in May 2025. Whales have staked large amounts of assets, with some investing millions in Solana-based assets.

Over 65% of SOL's supply is currently staked. Q1 app revenue reached $1.2 billion, the highest in the past year showing strong ecosystem growth.

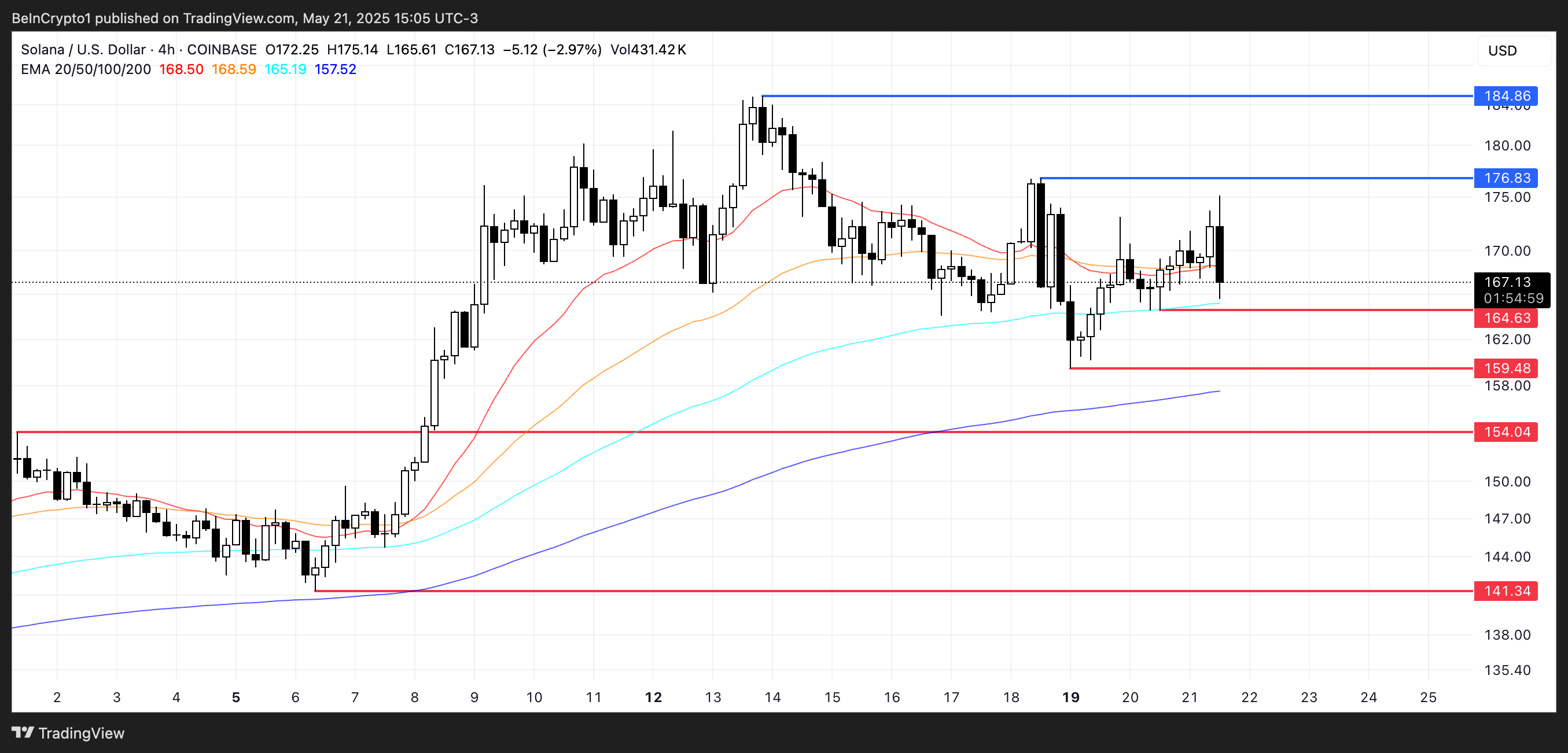

ption analysis TradingView.

ption analysis TradingView.Despite a quiet altcoin market, analysts are comparing Solana's structure to Ethereum in early 2021. On-chain inflows and developer activity continue to increase.

Meanwhile, the SEC hasaying decisions on five Solana ETF proposals until mid-2025. Despite this, SOL shows resilience, rising 2.7%.

Technically, SOL is maintaining support at $164. If this support holds, it could test $176.83 and $184.86. If. If $164, next supports are $159., $,154, and $$141.

Pi Network (PI)

Pi Network has faced several major issues since its mainnet launch in February 2025, becoming one of the most watched US-based coins. These include lack of Binance or Coinbase listing, poor price performance, and unfulfilled ecosystem promises. While 86% of the community supported a Binance listing, it has not occurred not.

Nevertheless, PI is showing short-term strength, rising nearly 10% in the past 24 hours and breaking $0.80. Market cap is approaching $6 billion again, and avera cross soon.

If momentum continues, PI could test resistance at $0.96. A breakout could lead to rallies to $1.30 and $1.67.

However, if the uptrend fades, PI could retrace to $0.66. If that level fails, the supports are $0and057 and below.

Uniswap (UNI)

Bancor has filed a patent infringement lawsuit against Uniswap, claiming it used its patented automated market maker (AMM) technology permission.

Bancor says it developed and patented the constant product AMM model in 2017, which Uuniswap later adopted in its protocol. The New York lawsuit seeks compensation from Uniswap Labs and the Uniswap Foundation, making UNI one of the notable US-based coins to watch next week.

Meanwhile, Uis near a5.94 major 94 support major.

If this level fails, hold it could to.649 and $5.43. If the uptrend recovtrersup, reUNI could retest $6.329. Breaking this level would see additional resistance at $6.52 and $7.36.

Worldcoin (WLD)

AI-related tokens have been attempting a broad recovery in recent recent weeks (has been gaining attention during this period, issues and efforts.

In Kenya, the High Court ruled that Worldcoin violated privacy protection laws,, ordering the deletion of biometric data collected from users.

During the same period, Indonesia suspended operations due to regulatory and certification issues. Despite these headwinds, Worldcoin has recently been launched in six major US cities and announced plans to deploy 7,500 biometric verification devices nationwide.

WLD has risen by 6.8% in the past 24 hours, showing signs of a short-term rebound. The exponential moving average (EMA) suggests that a golden cross may soon form, which is a bullish technical signal.

If momentum is maintained, WLD could rise to $1.19. If it breaks through this resistance, it could climb to $1.36. However, if it fails to maintain above $1.11, it could drop to $1.05, and if downward pressure accelerates, it could fall below $1.